Introduction To Managerial Accounting

8th Edition

ISBN: 9781259917066

Author: BREWER, Peter C., Garrison, Ray H., Noreen, Eric W.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter IE, Problem 2IE

Absorption Costing, Variable Costing, Cost, Volume,Profit, Relationships

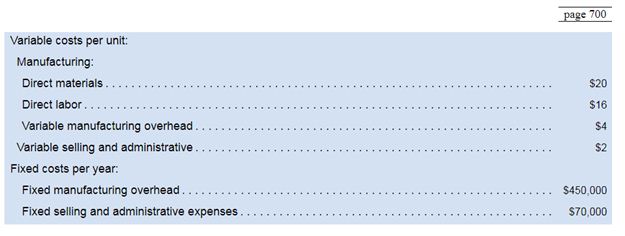

Newton Company manufactures and sells one product. The company assembled the following projections for its first year of operations:

During its first year of operations, Newton expects to produce 25,000 units and sell 20,000 units. The budgeted selling price of the company’s only product is S66 per unit.

Required (answer each question independently by referring to the original data):

- Assuming that Newton’s projections arc accurate,what will be its absorption costing net operating income in its first year of operations?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Chapter IE Solutions

Introduction To Managerial Accounting

Ch. IE - INTEGRATION EXERCISE I Different Costs for...Ch. IE - Absorption Costing, Variable Costing, Cost,...Ch. IE - Cash Budget, Income Statement, Balance Sheet,...Ch. IE - Prob. 4IECh. IE - Plantwide and Departmental Overhead Allocation;...Ch. IE - Normal Costing versus Actual Costing Darwin...Ch. IE - Prob. 7IECh. IE - Master Budgeting Endless Mountain Company...Ch. IE - Statement of Cash Flows Refer to the information...Ch. IE - Financial Statement Ratio Analysis Refer to the...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Scattergraph, High-Low Method, and Predicting Cost for a Different Time Period from the One Used to Develop a Cost Formula Refer to the information for Farnsworth Company on the previous page. Required: 1. Prepare a scattergraph based on the 10 months of data. Does the relationship appear to be linear? 2. Using the high-low method, prepare a cost formula for the receiving activity. Using this formula, what is the predicted cost of receiving for a month in which 1,450 receiving orders are processed? 3. Prepare a cost formula for the receiving activity for a quarter. Based on this formula, what is the predicted cost of receiving for a quarter in which 4,650 receiving orders are anticipated? Prepare a cost formula for the receiving activity for a year. Based on this formula, what is the predicted cost of receiving for a year in which 18,000 receiving orders are anticipated? Use the following information for Problems 3-60 and 3-61: Farnsworth Company has gathered data on its overhead activities and associated costs for the past 10 months. Tracy Heppler, a member of the controllers department, has convinced management that overhead costs can be better estimated and controlled if the fixed and variable components of each overhead activity are known. One such activity is receiving raw materials (unloading incoming goods, counting goods, and inspecting goods), which she believes is driven by the number of receiving orders. Ten months of data have been gathered for the receiving activity and are as follows:arrow_forwardUsing High-Low to Calculate Predicted Total Variable Cost and Total Cost for a Time Period That Differs from the Data Period Refer to the information for Pizza Vesuvio on the previous page. Assume that this information was used to construct the following formula for monthly labor cost. TotalLaborCost=5,237+(7.40EmployeeHours) Required: Assume that 4,000 employee hours are budgeted for the coming year. Use the total labor cost formula to make the following calculations: 1. Calculate total variable labor cost for the year. 2. Calculate total fixed labor cost for the year. 3. Calculate total labor cost for the coming year. Use the following information for Brief Exercises 3-17 through 3-20: Pizza Vesuvio makes specialty pizzas. Data for the past 8 months were collected:arrow_forwardLotts Company produces and sells one product. The selling price is 10, and the unit variable cost is 6. Total fixed cost is 10,000. Required: 1. Prepare a CVP graph with Units Sold as the horizontal axis and Dollars as the vertical axis. Label the break-even point on the horizontal axis. 2. Prepare CVP graphs for each of the following independent scenarios: (a) Fixed cost increases by 5,000, (b) Unit variable cost increases to 7, (c) Unit selling price increases to 12, and (d) Fixed cost increases by 5,000 and unit variable cost is 7.arrow_forward

- Sales Revenue Approach, Variable Cost Ratio, Contribution Margin Ratio Arberg Companys controller prepared the following budgeted income statement for the coming year: Required: 1. What is Arbergs variable cost ratio? What is its contribution margin ratio? 2. Suppose Arbergs actual revenues are 30,000 more than budgeted. By how much will operating income increase? Give the answer without preparing a new income statement 3. How much sales revenue must Arberg earn to break even? Prepare a contribution margin income statement to verify the accuracy of your answer. 4. What is Arbergs expected margin of safety? 5. What is Arbergs margin of safety if sales revenue is 380,000?arrow_forwardUsing Regression to Calculate Fixed Cost, Calculate the Variable Rate, Construct a Cost Formula, and Determine Budgeted Cost Refer to the information for Pizza Vesuvio on the previous page. Coefficients shown by a regression program for Pizza Vesuvios data are: Required: Use the results of regression to make the following calculations: 1. Calculate the fixed cost of labor and the variable rate per employee hour. 2. Construct the cost formula for total labor cost. 3. Calculate the budgeted cost for next month, assuming that 675 employee hours are budgeted. (Note: Round answers to the nearest dollar.) Use the following information for Brief Exercises 3-17 through 3-20: Pizza Vesuvio makes specialty pizzas. Data for the past 8 months were collected:arrow_forwardContribution margin, break-even sales, cost-volume-profit chart, margin of safety, and operating leverage Belmain Co. expects to maintain the same inventories at the end of 20Y7 as at the beginning of the year. The total of all production costs for the year is therefore assumed to be equal to the cost of goods sold. With this in mind, the various department heads were asked to submit estimates of the costs for their departments during the year. A summary report of these estimates is as follows: It is expected that 12,000 units will be sold at a price of 240 a unit. Maximum sales within the relevant range are 18,000 units. Instructions 1. Prepare an estimated income statement for 20Y7. 2. What is the expected contribution margin ratio? 3. Determine the break-even sales in units and dollars. 4. Construct a cost-volume-profit chart indicating the break-even sales. 5. What is the expected margin of safety in dollars and as a percentage of sales? (Round to one decimal place.) 6. Determine the operating leverage.arrow_forward

- Refer to Cornerstone Exercise 3.4 for data on Dohini Manufacturing Companys purchasing cost and number of purchase orders. The controller for Dohini Manufacturing ran regression on the data, and the coefficients shown by the regression program are: Required: 1. Construct the cost formula for the purchasing activity showing the fixed cost and the variable rate. 2. If Dohini Manufacturing Company estimates that next month will have 430 purchase orders, what is the total estimated purchasing cost for that month? (Round your answer to the nearest dollar.) 3. What if Dohini Manufacturing wants to estimate purchasing cost for the coming year and expects 5,340 purchase orders? What will estimated total purchasing cost be? (Round your answer to the nearest dollar.) What is the total fixed purchasing cost? Why doesnt it equal the fixed cost calculated in Requirement 1?arrow_forwardContribution margin, break-even sales, cost-volume-profit chart, margin of safety, and operating leverage Wolsey Industries Inc. expects to maintain the same inventories at the end of 20Y3 as at the beginning of the year. The total of all production costs for the year is therefore assumed to be equal to the cost of goods sold. With this in mind, the various department heads were asked to submit estimates of the costs for their departments during the year. A summary report of these estimates is as follows: It is expected that 21,875 units will be sold at a price of 160 a unit. Maximum sales within the relevant range are 27,000 units. Instructions Prepare an estimated income statement for 20Y3. What is the expected contribution margin ratio? Determine the break-even sales in units and dollars. Construct a cost-volume-profit chart indicating the break-even sales. What is the expected margin of safety in dollars and as a percentage of sales? Determine the operating leverage. It is expected that 12,000 units will be sold a price of 240 a unit. Maximum sales within the relevant range are 18,000 units. Instructions Prepare an estimated income statement for 20Y7. What is the expected contribution margin ratio? Determine the break-even sales in units and dollars. Construct a cost-volume-profit chart indicating the break-even sales. What is the expected margin of safety in dollars and as a percentage of sales? Determine the operating leverage.arrow_forwardVariable Cost Ratio, Contribution Margin Ratio Chillmax Company plans to sell 3,500 pairs of shoes at 60 each in the coming year. Unit variable cost is 21 (includes direct materials, direct labor, variable factory overhead, and variable selling expense). Fixed factory overhead is 30,000 and fixed selling and administrative expense is 48,000. Required: 1. Calculate the variable cost ratio. 2. Calculate the contribution margin ratio. 3. Prepare a contribution margin income statement based on the budgeted figures for next year. In a column next to the income statement, show the percentages based on sales for sales, total variable cost, and total contribution margin.arrow_forward

- Using Regression to Calculate Fixed Cost, Calculate the Variable Rate, Construct a Cost Formula, and Determine Budgeted Cost Refer to the information for Speedy Petes on the previous page. Coefficients shown by a regression program for Speedy Petes data are: Required: Use the results of regression to make the following calculations: 1. Calculate the fixed cost of deliveries and the variable rate per delivery. 2. Construct the cost formula for total delivery cost. 3. Calculate the budgeted cost for next month, assuming that 3,000 deliveries are budgeted. (Note: Round answers to the nearest dollar.) Use the following information for Brief Exercises 3-26 through 3-29: Speedy Petes is a small start-up company that delivers high-end coffee drinks to large metropolitan office buildings via a cutting-edge motorized coffee cart to compete with other premium coffee shops. Data for the past 8 months were collected as follows:arrow_forwardGrand Canyon Manufacturing Inc. produces and sells a product with a price of 100 per unit. The following cost data have been prepared for its estimated upper and lower limits of activity: Overhead: Selling and administrative expenses: Required: 1. Classify each cost element as either variable, fixed, or semi-variable. (Hint: Recall that variable expenses must go up in direct proportion to changes in the volume of activity.) 2. Calculate the break-even point in units and dollars. (Hint: First use the high-low method illustrated in Chapter 4 to separate costs into their fixed and variable components.) 3. Prepare a break-even chart. 4. Prepare a contribution income statement, similar in format to the statement appearing on page 540, assuming sales of 5,000 units. 5. Recompute the break-even point in units, assuming that variable costs increase by 20% and fixed costs are reduced by 50,000.arrow_forwardA company has prepared the following statistics regarding its production and sales at different capacity levels. Total costs: 1. At what point is break-even reached in sales dollars? In units? (Hint: Use the capacity level to determine the number of units.) 2. If the company is operating at 60% capacity, should it accept an offer from a customer to buy 10,000 units at 3 per unit?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Cost-Volume-Profit (CVP) Analysis and Break-Even Analysis Step-by-Step, by Mike Werner; Author: Accounting Step by Step;https://www.youtube.com/watch?v=D0MOfse9OWk;License: Standard Youtube License