FUNDAMENTALS OF COST ACCOUNTING W/CONNE

6th Edition

ISBN: 9781264199617

Author: LANEN/ANDERSON

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter A, Problem 14E

Present Value Analysis in Nonprofit Organizations

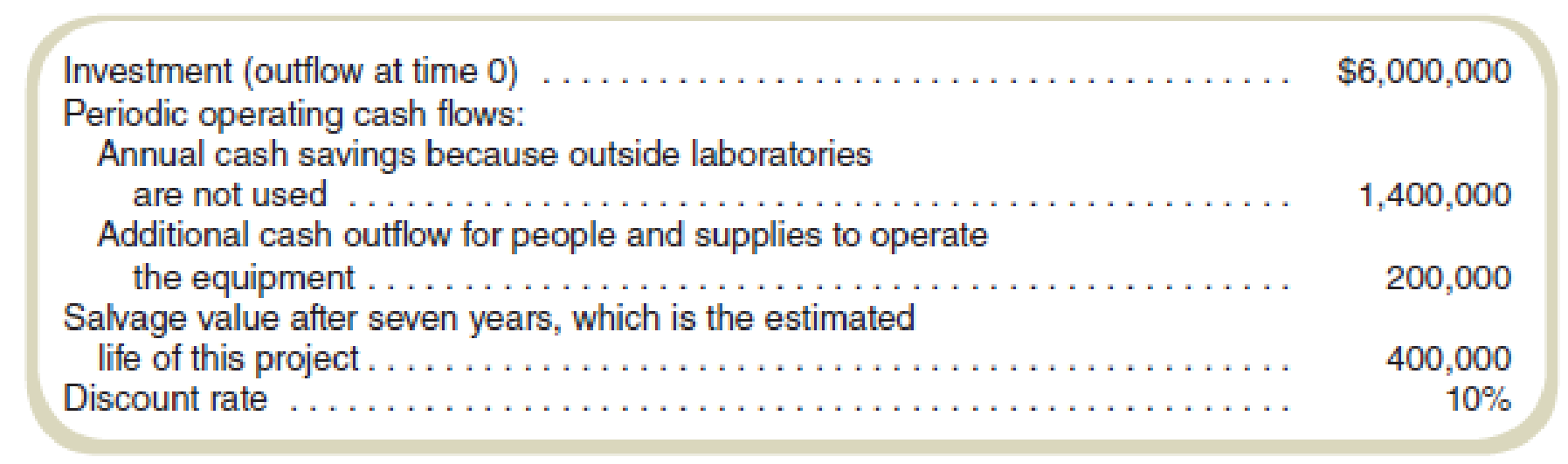

The Johnson Research Organization, a nonprofit organization that does not pay taxes, is considering buying laboratory equipment with an estimated life of seven years so it will not have to use outsiders’ laboratories for certain types of work. The following are all of the

Required

Calculate the

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

S

T

m

Computer Disk Duplicators, Inc. has been considering several capital investment proposals for the year beginning in 2022. For each investment proposal, the

relevant cash flows and other relevant financial data are summarized in the table below. New assets will be depreciated under the MACRS system rather than being

fully expensed right away. In the case of a replacement decision, the total installed cost of the equipment will be partially offset by the sale of existing equipment. The

firm is subject to a 40 percent tax rate on ordinary income and on long-term capital gains. The firm's cost of capital is 15 percent.

Type of Capital

Budgeting Decision

OA. $34,400

OB. $66,400

1

Expansion

OC. $80,000

OD. $13,600

Type of Project

Cost of new asset

Installation costs

MACRS (new asset)

Original cost of old asset

Purchase date (old asset)

Sale proceeds (old asset)

MACRS (old asset)

Annual net profits before

depreciation & taxes (old)

Annual net profits before

depreciation & taxes (new)…

A company has just purchased a new delivery van. Now it is trying to decide whether to sell its old delivery van or donate it to a non-profit organization that delivers meals to the elderly. In estimating the incremental free cash flows for this decision, for which of the following should we adjust? Do not include factors that are only indirectly used to calculate other factors – only choose factors that should be directly considered, for their own sake, in the cash flow calculations (rather than in the calculation of another factor). For this particular problem, circle the letters of all of the answers that apply (i.e., you may choose to circle more than just one answer).

a. The cost of the new van.

b. The interest expense on the loan to buy the new van.

c. Any reputation effect/goodwill resulting from donating the van to a worthy charity.

d. The price that the company originally paid for the old van.

e. The book value of the old van.

f. The tax effect of donating…

Q.The Kuhl Brothers ask you whether they should buy the new machine. To help in your analysis, calculate the following:

1. Difference in after-tax cash flow from terminal disposal of new machine and old machine

Chapter A Solutions

FUNDAMENTALS OF COST ACCOUNTING W/CONNE

Ch. A - What are the two most important factors an...Ch. A - Prob. 2RQCh. A - Prob. 3RQCh. A - Prob. 4RQCh. A - Prob. 5RQCh. A - Prob. 6CADQCh. A - What are the four types of cash flows related to a...Ch. A - Is depreciation included in the computation of net...Ch. A - The total tax deduction for depreciation is the...Ch. A - Prob. 10CADQ

Ch. A - In Chapter 14, we discussed performance...Ch. A - Present Value of Cash Flows Star City is...Ch. A - Prob. 13ECh. A - Present Value Analysis in Nonprofit Organizations...Ch. A - Prob. 15ECh. A - What is the net present value of the investment...Ch. A - Prob. 17PCh. A - Sensitivity Analysis in Capital Investment...Ch. A - Compute Net Present Value Dungan Corporation is...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Alexander Industries is considering purchasing an insurance policy for its new office building in St. Louis, Missouri. The policy has an annual cost of $10,000. If Alexander Industries doesn’t purchase the insurance and minor fire damage occurs, a cost of $100,000 is anticipated; the cost if major or total destruction occurs is $200,000. The costs, including the state-of-nature probabilities, are as follows: Using the expected value approach, what decision do you recommend? What lottery would you use to assess utilities? (Note: Because the data are costs, the best payoff is $0.) Assume that you found the following indifference probabilities for the lottery defined in part (b). What decision would you recommend? Do you favor using expected value or expected utility for this decision problem? Why?arrow_forwardYou own a construction company and have recently received a contract with the local school district to refurbish one of its elementary schools. You are given an up-front payment from the school district in the amount of $5 million. The contract terms extend from years 2018 to 2020. When would you recognize revenue for this payment? What method of accounting would you use for this construction project and why? What would be the benefits and challenges with your method selection? Give an example of your distribution selection and associated costs of the project (you may estimate based on other industry competitors). What might be some benefits and challenges associated with the other method of construction revenue recognition?arrow_forwardSan Lucas Corporation is considering investment in robotic machinery based upon the following estimates: a. Determine the net present value of the equipment, assuming a desired rate of return of 10% and annual net cash flows of 700,000. Use the present value tables appearing in Exhibits 2 and 5 of this chapter. b. Determine the net present value of the equipment, assuming a desired rate of return of 10% and annual net cash flows of 500,000, 700,000, and 900,000. Use the present value tables (Exhibits 2 and 5) provided in the chapter in determining your answer. c. Determine the minimum annual net cash flow necessary to generate a positive net present value, assuming a desired rate of return of 10%. Round to the nearest dollar. d. Interpret the results of parts (a), (b), and (c).arrow_forward

- Carla Vista Clinic is considering investing in new heart-monitoring equipment. It has two options. Option A would have an initial lower cost but would require a significant expenditure for rebuilding after 4 years. Option B would require no rebuilding expenditure, but its maintenance costs would be higher. Since the Option B machine is of initial higher quality, it is expected to have a salvage value at the end of its useful life. The following estimates were made of the cash flows. The company's cost of capital is 5%. Option A Option B Initial cost $194,000 $291,000 Annual cash inflows $72,600 $82,000 Annual cash outflows $28,100 $25,100 Cost to rebuild (end of year 4) $51,200 $0 Salvage value $0 $9,000 Estimated useful life 7 years 7 years Click here to view the factor table. (a) Your answer is partially correct. Compute the (1) net present value, (2) profitability index, and (3) internal rate of return for each option. (Hint: To solve for internal rate of return, experiment with…arrow_forwardCarla Vista Clinic is considering investing in new heart-monitoring equipment. It has two options. Option A would have an initial lower cost but would require a significant expenditure for rebuilding after 4 years. Option B would require no rebuilding expenditure, but its maintenance costs would be higher. Since the Option B machine is of initial higher quality, it is expected to have a salvage value at the end of its useful life. The following estimates were made of the cash flows. The company's cost of capital is 5%. Initial cost Annual cash inflows Annual cash outflows Cost to rebuild (end of year 4) Salvage value Estimated useful life Option A $194,000 $72,600 $28,100 $51,200 $0 7 years Option B $291,000 $82,000 $25,100 $0 $9,000 7 yearsarrow_forwardWhich of the following would not be considered in capital budgeting cash flow analysis? Question 6 options: You are considering running your business out of your home. You own your home (i.e. no mortgage) and the value of the house is $200,000. You have paid a consultant $10,000 for a marketing analysis related to a capital budgeting project that you are analyzing. This fee has been paid and cannot be recovered if you do not go ahead with the project. Coke is considering a new line of lite beverages. If Coke goes ahead with this investment, it will cannibalize sales of Coke's existing drink lines.arrow_forward

- Net Present Value and Competing Projects Spiro Hospital is investigating the possibility of investing in new dialysis equipment. Two local manufacturers of this equipment are being considered as sources of the equipment. After-tax cash inflows for the two competing projects are as follows: Year Puro Equipment Briggs Equipment 1 $320,000 $120,000 2 280,000 120,000 3 240,000 320,000 4 160,000 400,000 5 120,000 440,000 Both projects require an initial investment of $560,000. In both cases, assume that the equipment has a life of 5 years with no salvage value. Required: Round present value calculations and your final answers to the nearest dollar. 1. Assuming a discount rate of 16%, compute the net present value of each piece of equipment. Puro equipment: $fill in the blank Briggs equipment: $fill in the blank 2. A third option has surfaced for equipment purchased from an out-of-state supplier. The cost is also $560,000, but this…arrow_forwardRuba Nasser SAOG is planning to invest in project as part of the organization's growth strategy to enhance the financial sustainability of the organization. The organization has two options available. Option 1– Project A – Increase the capacity in Division A Option 2 – Project B – Increase the capacity in Division B. Both projects are mutually exclusive. The available capital investment for the Project is RO 250,000. Due to the limited funds the organization needs to decide on a suitable investment project which will be part of the sustainable growth strategy. Below are the details for both Projects Project A - Increase in machine capacity in Division A Cost of Investment – RO 250,000 Useful Life – 4 Years Year Operating Profit Before Depreciation (RO) 55,000 65,000 80,000 80,000 1 2 3 4 The project has a scrap value of OMR 75,000. Project B – Increase in Machine Capacity in Division B Cost of Investment – RO 250,000 Operating Profit Before Depreciation (RO) 75,000 75,000 78,000 82.000…arrow_forwardA company manufacturing high precision polycarbonate plastic lenses wants to expand its manufacturing operations. The company is financially reasonably sound and has sufficient funds for the expansion. For purchase of machinery, the management has two options Option 1: Purchase new machinery by taking a bank loan Option 2: Purchase second-hand used machinery by utilizing its own funds Is it advisable for the company to purchase used equipment / machinery? What are the sources of used equipment / machinery?arrow_forward

- Assuming that you would like to buy an equipment for your small business. Using the information below, calculate the Rate of Return and the Pay Back Period for the investment. After presenting your calculations, explain why you think this will (or will not) be a good investment. Here are the numbers: Cost of the investment is $100,000 Estimated depreciable life of investment is 5 years Annual depreciated charge is $15,000 Estimated average profit over depreciable life is $10,000.arrow_forwardThe Johnson Research Organization, a nonprofit organization that does not pay taxes, is considering buying laboratory equipment with an estimated life of seven years so it will not have to use outsiders' laboratories for certain types of work. The following are all of the cash flows affected by the decision: Use Exhibit A.8. Investment (outflow at time 0) Periodic operating cash flows: Annual cash savings because outside laboratories are not used $6,430,000 Additional cash outflow for people and supplies to operate the equipment Salvage value after seven years, which is the estimated life of this project 1,410,000 210,000 410,000 Discount rate 8% Required: Calculate the net present value of this decision. (Round PV factor to 3 decimal places.) Net present value Should the organization buy the equipment? Yes O Noarrow_forwardCryptocurrency Finder is buying the first computer for their new server farm. Suppose the company paid $5,000for this computer, which it expects to last for three years. Describe how the company would account for the $5,000 expenditure under (a) the cash basis and (b) the accrual basis. State in your own words why the accrual basis is more realistic for this situation.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning  Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License