FUNDAMENTALS OF COST ACCOUNTING W/CONNE

6th Edition

ISBN: 9781264199617

Author: LANEN/ANDERSON

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter A, Problem 12E

Present Value of Cash Flows

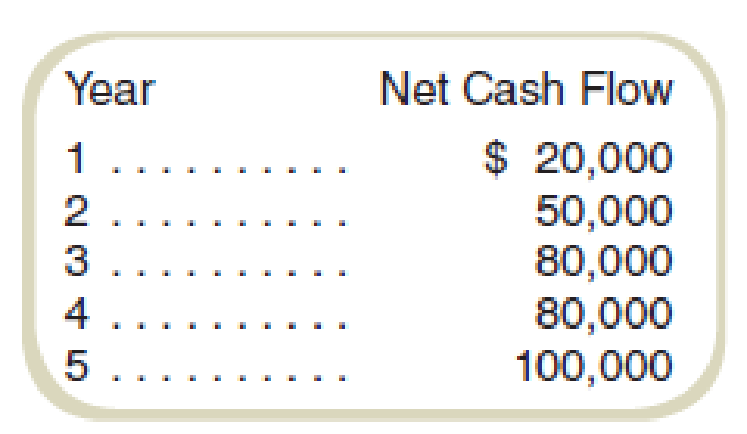

Star City is considering an investment in the community center that is expected to return the following cash flows:

This schedule includes all

Required

- a. What is the

net present value of the project if the appropriate discount rate is 20 percent? - b. What is the net present value of the project if the appropriate discount rate is 12 percent?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Star City is considering an investment in the community center that is expected to return the following cash flows: Use

Exhibit A.8.

Year Net Cash Flow

1234in

5

$ 28,000

58,000

88,000

88,000

108,000

This schedule includes all cash inflows from the project, which will also require an immediate $208,000 cash outlay.

The city is tax-exempt; therefore, taxes need not be considered.

Required:

a. What is the net present value of the project if the appropriate discount rate is 22 percent? (Round PV factor to 3

decimal places. Negative amount should be indicated by a minus sign.)

Net present value

2) Assume that you are considering a project. Its initial after-tax

cost is $1,500,000 and it is expected to provide after-tax

operating cash inflows of $1,800,000 in year 1, $2,900,000 in

year2, $2,700,000 in year 3 and $2,300,000 in year 4.

a. Roughly calculate the Internal Rate of Return (IRR) of

the project.

b. Discuss whether you accept the project or not.

A public project is being considered by a local government that will cost $10M at the start

and SSM at the end of years 1 through 5. The project is estimated to earn $20M at the end of

year 2, $30M at the end of years 3 and 4, and $20M at the end of year 5. Assuming i = 10%.

What is the benefit-to-cost ratio for this project? Draw a cash flow diagram for the costs

and benefits annually.

Chapter A Solutions

FUNDAMENTALS OF COST ACCOUNTING W/CONNE

Ch. A - What are the two most important factors an...Ch. A - Prob. 2RQCh. A - Prob. 3RQCh. A - Prob. 4RQCh. A - Prob. 5RQCh. A - Prob. 6CADQCh. A - What are the four types of cash flows related to a...Ch. A - Is depreciation included in the computation of net...Ch. A - The total tax deduction for depreciation is the...Ch. A - Prob. 10CADQ

Ch. A - In Chapter 14, we discussed performance...Ch. A - Present Value of Cash Flows Star City is...Ch. A - Prob. 13ECh. A - Present Value Analysis in Nonprofit Organizations...Ch. A - Prob. 15ECh. A - What is the net present value of the investment...Ch. A - Prob. 17PCh. A - Sensitivity Analysis in Capital Investment...Ch. A - Compute Net Present Value Dungan Corporation is...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The management of Ryland International Is considering Investing in a new facility and the following cash flows are expected to result from the investment: A. What Is the payback period of this uneven cash flow? B. Does your answer change if year 6s cash inflow changes to $920,000?arrow_forwardConsider how Rouse Valley Waterfall Park Lodge could use capital budgeting to decide whether the $12,000,000 Waterfall Park Lodge expansion would be a good investment. Assume Rouse Valley's managers developed the following estimates concerning the expansion: (Click the icon to view the estimates.) Read the requirements Requirement 1. Compute the average annual net cash inflow from the expansion. The average annual net cash inflow from the expansion is Requirement 2. Compute the average annual operating income from the expansion. The average annual operating income from the expansion is Data table Number of additional skiers per day Average number of days per year that weather conditions allow skiing at Rouse Valley Useful life of expansion (in years) Average cash spent by each skier per day Average variable cost of serving each skier per day Cost of expansion Discount rate Print $ Done 118 skiers 152 days 8 years 245 85 12,000,000 Assume that Rouse Valley uses the straight-ine…arrow_forwardAASBC is considering a project that has the following cash flow stream. Year 3 Cash Flows 0 -$10,000 1 $4,000 2 $3,500 $3,800 a. Calculate the project's IRR. b. What is the project's payback period? c. If the project's cost of capital is equal to 10%, should AASBC accept the project?arrow_forward

- Net Present Value and Competing Projects Follow the format shown in Exhibit 12B.1 and Exhibit 12B.2 as you complete the requirements below. Spiro Hospital is investigating the possibility of investing in new dialysis equipment. Two local manufacturers of this equipment are being considered as sources of the equipment. After-tax cash inflows for the two competing projects are as follows: Year Puro Equipment Briggs Equipment 1 $320,000 $120,000 2 280,000 120,000 3 240,000 320,000 4 160,000 400,000 5 120,000 440,000 Both projects require an initial investment of $560,000. In both cases, assume that the equipment has a life of 5 years with no salvage value. Required: Round present value calculations and your final answers to the nearest dollar. 1. Assuming a discount rate of 12%, compute the net present value of each piece of equipment. Puro equipment: $fill in the blank 1 Briggs equipment: $fill in the blank 2 2. A third option has…arrow_forwardA city is planning to invest in potential projects with the estimated cash flows below. Given that interest rate is 4.880884817% per semiannual, determine which option is preferable if options are mutually exclusive using PW analysis. show the steps: please don't use excelarrow_forwardConsider how Steinback Valley River Park Lodge could use capital budgeting to decide whether the $12,000,000 River Park Lodge expansion would be a good investment. Assume Steinback Valley's managers developed the following estimates concerning the expansion: 1(Click the icon to view the estimates.) Read the requirements2. Requirement 1. Compute the average annual net cash inflow from the expansion. The average annual net cash inflow from the expansion is Requirement 2. Compute the average annual operating income from the expansion. The average annual operating income from the expansion is 1: Data Table Number of additional skiers per day 119 skiers Average number of days per year that weather conditions allow skiing at Steinback Valley 151 days Useful life of expansion (in years) 8 years Average cash spent by each skier per day $244 Average variable cost of serving each skier per day 78 Cost…arrow_forward

- Nashville's Kitchen Corp. is considering a proposed project with the following cash flows. If both the discount rate and the reinvestment rate are 16 percent, what is the project’s modified internal rate of return (MIRR) using the combination approach? Solve using a Financial Calculator showing all calculator inputs. Year Cash Flow 0 –$375,000 1 133,500 2 -35,600 3 244,700 4 271,000arrow_forwardInvestment Criteria. Consider the following information. Expected Net Cash Flows Year Project X 0 ($10,000) 1 6,500 2 3,500 3 3,000 4 1,000 Assume the discount rate is 10 percent. Calculate Project X’s discounted payback period. Should the project be accepted Calculate the profitability index. Should the project be accepted? Calculate the accounting rate of return. Should the project be accepted?arrow_forwardInvestment Criteria. Consider the following information. (20 points) Expected Net Cash Flows Year Project X 0 ($10,000) 1 6,500 2 3,500 3 3,000 4 1,000 Assume the discount rate is 10 percent. Please show the work Calculate Project X’s discounted payback period. Should the project be accepted? Calculate the profitability index. Should the project be accepted? Calculate the accounting rate of return. Should the project be accepted?arrow_forward

- Toby Amberville’s Manhattan Café, Inc., is considering investment in two alternative capital budgeting projects. Project A is an investment of $75,000 to replace working but obsolete refrigeration equipment. Project B is an investment of $150,000 to expand dining roomfacilities.Relevant cash flowdata forthe two projects over their expected two-year lives are: Project A year 1 year 2 probability cash flow probability cash flow 0.18 0 $ 0.08 0 $ 0.64 50,000 $ 0.084 50,000 0.18 100,000 0.08 100,00 Project B year 1 year 2 probability cash flow probability cash flow 0.50 0 $ 0.125 0 $ 0.50 200,000 0.75 100,000 0.125 200,000 A. Calculate the expected value, standard deviation, and coefficient of variation for cash flows from each project. B. Calculate the risk-adjusted NPV for each project using a 15% cost of capital for the riskier project and a 12% cost of capital for the less risky one. Which project is preferred…arrow_forwardThe net present value (NPV) rule is considered one of the most common and preferred criteria that generally lead to good investment decisions. Consider this case: Suppose Happy Dog Soap Company is evaluating a proposed capital budgeting project (project Alpha) that will require an initial investment of $550,000. The project is expected to generate the following net cash flows: Year Cash Flow Year 1 $275,000 Year 2 $450,000 Year 3 $425,000 Year 4 $475,000 Happy Dog Soap Company’s weighted average cost of capital is 8%, and project Alpha has the same risk as the firm’s average project. Based on the cash flows, what is project Alpha’s net present value (NPV)? $1,226,950 $776,950 $893,492 $1,251,950 Making the accept or reject decision Happy Dog Soap Company’s decision to accept or reject project Alpha is independent of its decisions on other projects. If the firm follows the NPV method, it should project Alpha.…arrow_forwardDetermine the following: 1. Determine the initial investment required by the press. 2. Determine the annual after tax cash inflows attributable to the press from year 1 to 4 3. Determine the after tax cash flow on year 5. 4. ASSUMING the project’s IRR is 25%, the discount rate should be above 25% for the project to have a PW higher than zero (true or false) 5. Assuming that at the very last minute, you are able to sell the equipment for 200,000 (without altering the book value). What is the cash flow on year 5? PROBLEM: Wells Printing is considering expanding its business by purchasing a printing press. The cost of the press is $2 million. Installation costs amount to $200,000. As a result of acquisition of the press, sales in each of the next 5 years are expected to be $1.6 million from this new line of business, but product costs (excluding depreciation) will represent 50% of sales. The press will not affect the firm’s net working capital requirements. The press will be depreciated…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Profitability index; Author: The Finance Storyteller;https://www.youtube.com/watch?v=Md5ocNqKHq8;License: Standard Youtube License