Accounting: What the Numbers Mean

11th Edition

ISBN: 9781259535314

Author: David Marshall, Wayne William McManus, Daniel Viele

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 9, Problem 9.28P

Problem 9.28

LO 10. 11

Complete

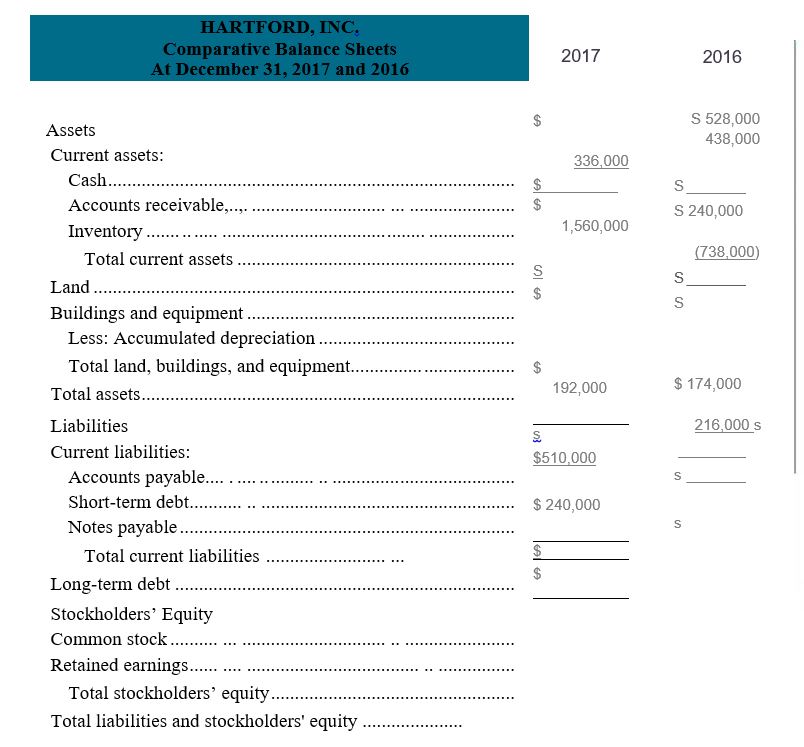

| HARTFORD, INC. |

Statement of Cash Flows

For the Year Ended December 31, 2017

30,000

Required:

- Complete the December 31, 2017 and 2016 balance sheets.

- Prepare a statement of changes in retained earnings for the year ended December 31, 2017.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Problem 9-28 (Algo) Complete balance sheet and prepare a statement of changes in retained earnings LO 10, 11

Following is a statement of cash flows (indirect method) for Hartford Inc. for the year ended December 31, 2020. Also shown is a partially completed comparative balance sheet as of December 31, 2020 and 2019:

HARTFORD INC.

Statement of Cash Flows

For the year Ended December 31, 2020

Cash Flows from Operating Activities:

Net income

$

13,500

Add (deduct) items not affecting cash:

Depreciation expense

67,500

Decrease in accounts receivable

34,500

Increase in Inventory

(10,500

)

Increase in notes payable

18,000

Decrease in accounts payable

(9,000

)

Net cash provided by operating activities

$

114,000

Cash Flows from Investing Activities:

Purchase of equipment

$

(75,000

)

Purchase of buildings

(72,000

)

Net cash used by investing activities

$

(147,000

)

Cash Flows from Financing Activities:

Proceeds…

GIVE THE COMPARATIVE BALANCE SHEET HORIZONTAL AND VERTICAL ANALYSIS FROM THE GIVEN BALANCE SHEET BELOW

JOLLIBEE BALANCE SHEET

ASSETS

ITEM

2016

2017

2018

2019

2020

Cash & Short Term Investments

17.46B

22.52B

24.17B

23.02B

57.46B

Cash & Short Term Investments Growth

-

28.99%

7.32%

-4.75%

149.59%

Cash Only

16.73B

21.11B

23.29B

20.89B

21.36B

Short-Term Investments

726M

1.41B

883.2M

2.13B

36.1B

Cash & ST Investments / Total Assets

23.96%

25.08%

16.06%

12.28%

27.26%

Total Accounts Receivable

3.59B

4.02B

4.86B

5.91B

7.05B

Total Accounts Receivable Growth

-

11.86%

21.04%

21.46%

19.36%

Accounts Receivables, Net

3.03B

3.39B

4.41B

5.37B

5.8B

Accounts Receivables, Gross

3.61B

4.08B

5.09B

5.76B

6.46B

Bad Debt/Doubtful Accounts

(579.79M)

(690.12M)

(676.91M)

(392.36M)

(658.63M)

Other Receivable

562.75M

630.06M

451.73M…

REQUIRED

Study the statement of cash flows of Mantis Limited for the year ended 31 December 2021 and answer the following questions:

Comment on the following:

1.3.1

Cash flows from operating activities (R181 800)

1.3.2. Increase in inventory (R808 000)

1.3.3 Increase in receivables (R606 000)

1.3.4 Interest paid (R80 800)

1.3.5 Cash flows from investing activities (R2 343 200)

INFORMATION

MANTIS LIMITED

STATEMENT OF CASH FLOWS FOR THE YEAR ENDED 31 DECEMBER 2021

R

Cash flows from operating activities

(181 800)

Operating profit

979 700

Depreciation

?

Profit before working capital changes

?

Working capital changes

(808 000)

Increase in inventory

(808 000)

Increase in receivables

(606 000)

Increase in payables

606 000

Cash generated from operations

494 900

Interest paid

(80 800)

Dividends paid

?

Income tax paid

(272 700)

Cash flows from investing activities

(2…

Chapter 9 Solutions

Accounting: What the Numbers Mean

Ch. 9 - Prob. 9.1MECh. 9 - Mini-Exercise 9.2 LO 5 Calculate operating income...Ch. 9 - Mini-Exercise 9.3 LO 6 Calculate basic EPS Net...Ch. 9 - Mini-Exercise 9.4

LO 10

Calculate cash flows from...Ch. 9 - Exercise 9.5

LO 1

Calculate earned revenues Big...Ch. 9 - Exercise 9.6 LO 1 Calculate earned revenues...Ch. 9 - Exercise 9.7 LO 2 Effects of inventory error If...Ch. 9 - Exercise 9.8 LO 2 Effects of inventory error...Ch. 9 - Prob. 9.9ECh. 9 - Prob. 9.10E

Ch. 9 - Exercise 9.11 LO 5 Operating income versus net...Ch. 9 - Prob. 9.12ECh. 9 - Prob. 9.13ECh. 9 - Prob. 9.14ECh. 9 - Prob. 9.15ECh. 9 - Prob. 9.16ECh. 9 - Prob. 9.17ECh. 9 - Prob. 9.18ECh. 9 - Problem 9.19 LO 5 Calculate operating income and...Ch. 9 - Prob. 9.20PCh. 9 - Problem 9.21

LO 3

Use gross profit ratio to...Ch. 9 - Prob. 9.22PCh. 9 - Prob. 9.23PCh. 9 - Problem 9.24

LO 10

Prepare a statement of cash...Ch. 9 - Problem 9.25

LO 10

Cash flows from operating,...Ch. 9 - Prob. 9.26PCh. 9 - Prob. 9.27PCh. 9 - Problem 9.28 LO 10. 11 Complete balance sheet and...Ch. 9 - Prob. 9.29PCh. 9 - Prob. 9.30PCh. 9 - Prob. 9.31CCh. 9 - Prob. 9.32CCh. 9 - Prob. 9.33C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- RITTER CORPORATION Income Statement Revenue Expenses Depreciation Net income Dividends 2019 Assets Cash Other current assets Net fixed assets Total assets Liabilities and Equity Accounts payable Long-term debt Stockholders' equity C. RITTER CORPORATION Balance Sheets December 31 Total liabilities and equity $780 580 93 $ 107 $ 87 2018 $ 58 168 373 $599 $ 118 143 338 $599 a. Change in cash b. Change in net working capital Cash flow from assets 2019 $ 71 176 393 $640 $ 131 151 358 a. What is the change in cash during 2019? b. Determine the change in net working capital in 2019. c. Determine the cash flow generated by the firm's assets during 2019. $640 $ $ 13 8arrow_forwardQUESTION REQUIRED Use the information provided below to prepare the Cash Flow Statement of Jonah Ltd for the year ended 31 December 2022. (Some of the figures have already been entered in the answer book.) INFORMATION The Statement of Comprehensive Income of Jonah Ltd for the year ended 31 December 2022 and Statement of Financial Position as at 31 December 2021 and 2022 are as follows: STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR ENDED 31 DECEMBER 2022 Sales Cost of sales Gross profit Other operating income Gross income Distribution expenses Administrative expenses Earnings before interest and tax Interest income Interest expense Esmings before tax Company tax Earnings after interest and tax STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER: ASSETS Non-current assets Land and buildings Plant and machinery Current assets Inventories Accounts receivable Total assets EQUITY AND LIABILITIES Equity Ordinary share capital Retained earnings Non-current liabilities Long-term borrowings…arrow_forwardGIVE THE COMPARATIVE BALANCE SHEET VERTICAL ANALYSIS FROM THE GIVEN BALANCE SHEET BELOW JOLLIBEE BALANCE SHEET ASSETS ITEM 2016 2017 2018 2019 2020 Cash & Short Term Investments 17.46B 22.52B 24.17B 23.02B 57.46B Cash & Short Term Investments Growth - 28.99% 7.32% -4.75% 149.59% Cash Only 16.73B 21.11B 23.29B 20.89B 21.36B Short-Term Investments 726M 1.41B 883.2M 2.13B 36.1B Cash & ST Investments / Total Assets 23.96% 25.08% 16.06% 12.28% 27.26% Total Accounts Receivable 3.59B 4.02B 4.86B 5.91B 7.05B Total Accounts Receivable Growth - 11.86% 21.04% 21.46% 19.36% Accounts Receivables, Net 3.03B 3.39B 4.41B 5.37B 5.8B Accounts Receivables, Gross 3.61B 4.08B 5.09B 5.76B 6.46B Bad Debt/Doubtful Accounts (579.79M) (690.12M) (676.91M) (392.36M) (658.63M) Other Receivable 562.75M 630.06M 451.73M 536.62M 1.25B…arrow_forward

- REQUIRED Study the statement of cash flows of Mantis Limited for the year ended 31 December 2021 and answer the following questions: Calculate the following for the year ended 31 December 2021: Depreciation Dividends paid Of what significance is this statement of cash flows to the shareholders of Mantis Limited? Comment on the following: Cash flows from operating activities (R181 800) 1.3.2. Increase in inventory (R808 000) Increase in receivables (R606 000) Interest paid (R80 800) Cash flows from investing activities (R2 343 200) INFORMATION MANTIS LIMITED STATEMENT OF CASH FLOWS FOR THE YEAR ENDED 31 DECEMBER 2021 R Cash flows from operating activities (181 800) Operating profit 979 700 Depreciation ? Profit before working capital changes ? Working capital changes (808 000) Increase in inventory (808 000) Increase in receivables…arrow_forwardQuestion 6Alco Company uses the indirect method to prepare its statement of cash flows. Please refer to the following information for the year 2014:Long-term notes payable, beginning balance $90,000Long-term notes payable, ending balance 84,000Common stock, beginning balance 2,000Common stock, ending balance 30,000Retained earnings, beginning balance 74,000Retained earnings, ending balance 113,000Treasury stock, beginning balance 5,000Treasury stock, ending balance 8,000• No stock was retired.• No treasury stock was sold.• During 2014, the company repaid $40,000 of long-term notes payable.• During 2014, the company borrowed $34,000 on a new note payable.• Net income for the year was $49,000.Required:Prepare financing activities section of the company’s statement of cash flows for the year ended 2014, using the indirect method?arrow_forwardUnit 8 Discussion QuestionHagag Company uses the indirect method to prepare its statement of cash flows.Please refer to the following sections of the company’s comparative balance sheet andcomplete the fourth column to show the increase or decrease for each item listed.Please use the correct sign for each item to gain the full mark assigned (for example ifthe figure is negative, this must be clearly stated with brackets or with the minus sign): 2014 2013 Increase/decrease Accounts payable $ 4,000 $ 6,000 Accrued liabilities 2,000 1,000 Long-term notes payable 84,000 90,000 Total liabilities $ 90,000 $ 97,000 Common stock 30,000 2,000 Retained earnings 113,000 74,000 Treasury stock (8,000) (5,000) Total equity $135,000 $ 71,000 Total liabilities and equity $225,000 $168,000arrow_forward

- GIVE THE COMPARATIVE BALANCE SHEET HORIZONTAL ANALYSIS FROM THE GIVEN BALANCE SHEET BELOW JOLLIBEE BALANCE SHEET ASSETS ITEM 2016 2017 2018 2019 2020 Cash & Short Term Investments 17.46B 22.52B 24.17B 23.02B 57.46B Cash & Short Term Investments Growth - 28.99% 7.32% -4.75% 149.59% Cash Only 16.73B 21.11B 23.29B 20.89B 21.36B Short-Term Investments 726M 1.41B 883.2M 2.13B 36.1B Cash & ST Investments / Total Assets 23.96% 25.08% 16.06% 12.28% 27.26% Total Accounts Receivable 3.59B 4.02B 4.86B 5.91B 7.05B Total Accounts Receivable Growth - 11.86% 21.04% 21.46% 19.36% Accounts Receivables, Net 3.03B 3.39B 4.41B 5.37B 5.8B Accounts Receivables, Gross 3.61B 4.08B 5.09B 5.76B 6.46B Bad Debt/Doubtful Accounts (579.79M) (690.12M) (676.91M) (392.36M) (658.63M) Other Receivable 562.75M 630.06M 451.73M 536.62M 1.25B…arrow_forwardParagraph Styles Section V: SCF Question 4 Identify the most significant cash outflow and inflow activity from Investing activities for the current year. Description of Activity Amount Click here to enter Cash outflow: (Hint: an outflow represents investing to support the long-term success of a compány.) text. 21 ${Student Frist Name} Olson Fall Arnica Mulder Click here to enter Cash inflow: text.arrow_forwardPart AReview the existing literature to critically examine the relative information content of theincome statement and the statement of cash flows. Why do investors find both incomestatement and statement of cash flows useful? Part BDownload the annual financial reports of BHP Ltd, Santos Ltd, and Funtastic Ltd for the year2019, 2018 and 2017. Examine the consolidated Cash Flow Statements for each companiesacross three years. Answer the following questions about each of the three cash-flowstatements.1. For each companies [except mentioned otherwise as in c), g) and i) below], across threeyears on the Statement of Cash Flows discuss:a) What are the major sources of cash for each firm? What are the major uses ofcash for each firm?b) What was the trend in cash flow from (continuing) operations for each firm?c) Compare and contrast the cash flow from operations with the net profit after taxin income statement. Explain in detail the major reasons for the differencebetween these two figures.…arrow_forward

- 11 Compute Cash Flow from Operating Activities from the following details: Particulars Trade Receivables: Debtors CA Bills Receivable CA Trade Payables: Creditors CL Bills Payable CL L Expenses Outstanding Accrued Income CAT Depreciation on Fixed Assets No + Surplus, i.e., Balance in Statement of Profit & Loss 31st March, 2023 (R) 50,000 23,000 28,000 22,000 4,500 9,000 5,000 90,000 31st March 2022 ) 60,000 25,000 32,000 35,000 3,500 8,000 4,000 80,000arrow_forwardAssessment task:Part AReview the existing literature to critically examine the relative information content of theincome statement and the statement of cash flows. Why do investors find both incomestatement and statement of cash flows useful?Part BDownload the annual financial reports of BHP Ltd, Santos Ltd, and Funtastic Ltd for the year2019, 2018 and 2017. Examine the consolidated Cash Flow Statements for each companiesacross three years. Answer the following questions about each of the three cash-flowstatements.1. For each companies [except mentioned otherwise as in c), g) and i) below], across threeyears on the Statement of Cash Flows discuss:a) What are the major sources of cash for each firm? What are the major uses ofcash for each firm?b) What was the trend in cash flow from (continuing) operations for each firm?c) Compare and contrast the cash flow from operations with the net profit after taxin income statement. Explain in detail the major reasons for the differencebetween…arrow_forwardTable 1 Jones Company Financial Information Net income Accounts receivable Accumulated depreciation Common stock Paid-in capital Retained earnings Accounts payable 2) $3,375 3) $3,900 December 2008 4) $2,980 $1,500 750 1,125 4,500 7,500 1,500 750 December 2009 $3,000 750 1,500 5,250 8,250 Based on the information in Table 1, calculate the after tax cash flow from operations for 2009 (no assets were disposed of during the year, and there was no change in interest payable or taxes payable) 1) $4,500 2,250 750arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License