Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 9, Problem 8P

Financing Deficit

Stevens Textile Corporation’s 2018 financial statements are shown here:

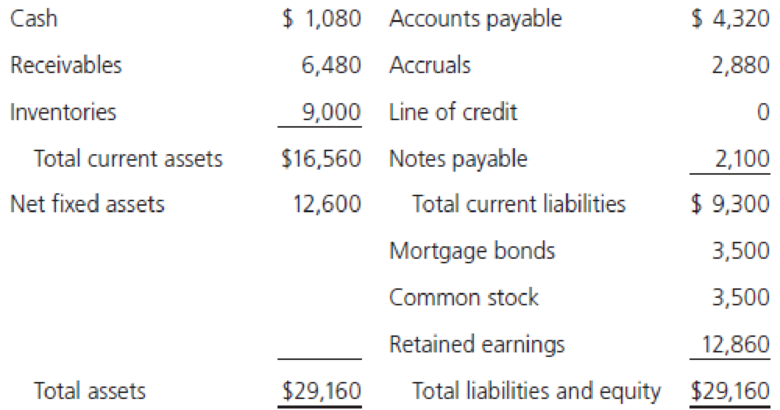

Balance Sheet as of December 31, 2018 (Thousands of Dollars)

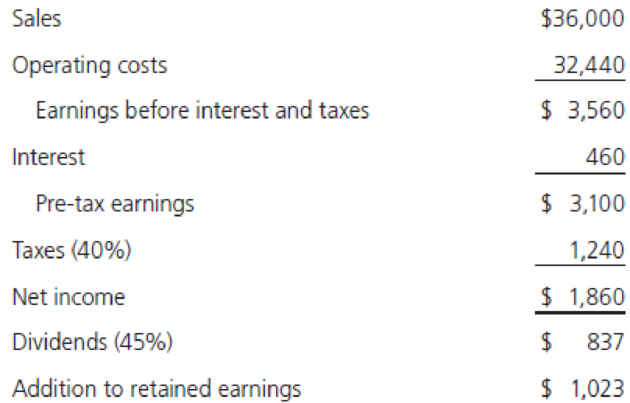

Income Statement for December 31, 2018 (Thousands of Dollars)

- a. Suppose 2019 sales are projected to increase by 15% over 2018 sales. Use the

forecasted financial statement method to forecast a balance sheet and income statement for December 31, 2019. The interest rate on all debt is 10%, and cash earns no interest income. Assume that all additional debt in the form of a line of credit is added at the end of the year, which means that you should base the forecasted interest expense on the balance of debt at the beginning of the year. Use theforecasted income statement to determine the addition toretained earnings . Assume that the company was operating at full capacity in 2018, that it cannot sell off any of its fixed assets, and that any required financing will be borrowed as notes payable. Also, assume that assets, spontaneous liabilities, and operating costs are expected to increase by the same percentage as sales. Determine the additional funds needed. - b. What is the resulting total forecasted amount of the line of credit?

- c. In your answers to parts a and b, you should not have charged any interest on the additional debt added during 2019 because it was assumed that the new debt was added at the end of the year. But now suppose that the new debt is added throughout the year. Don’t do any calculations, but how would this change the answers to parts a and b?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Pro forma balance sheet Peabody & Peabody has 2019 sales of $10 million. It wishes to analyze expected performance and financing needs for 2021, which is 2 years ahead. Given the following information, respond to parts a and b.

(1) The percent of sales for items that vary directly with sales are as follows: Accounts receivable, 12% Inventory, 18% Accounts payable, 14% Net profit margin, 3%

(2) Marketable securities and other current liabilities are expected to remain unchanged.

(3) A minimum cash balance of $480,000 is desired.

(4) A new machine costing $650,000 will be acquired in 2020, and equipment costing $850,000 will be purchased in 2021. Total depreciation in 2020 is forecast as $290,000, and in 2021 $390,000 of depreciation will be taken.

(5) Accruals are expected to rise to $500,000 by the end of 2021.

(6) No sale or retirement of long-term debt is expected.

(7) No sale or repurchase of common stock is expected.

(8) The dividend payout of 50% of net profits is expected to…

Use the information provided below to prepare the following for January and February 2023:Debtors Collection Schedule

The following information was provided by Intel Enterprises:1. The bank balance on 31 December 2022 is expected to be R40 000 (unfavourable).2. Credit sales are expected to be as follows:December 2022 January 2023 February 2023R576 000 R540 000 R648 0003. Credit sales usually make up 40% of the total sales. Cash sales make up the balance. Cash customersreceive a 10% discount.4. Credit sales are normally collected as follows:* 30% in the month in which the transaction takes place, and these customers are entitled to a 5% discount.* 65% in the following monthThe rest is usually written off as bad debts.5. Budgeted purchases of inventory are as follows:December 2022 January 2023 February 2023R1 000 000 R800 000 R920 0004.26. Fifty percent (50%) of the purchases are for cash. The remainder is paid in the month after the purchase.7. The monthly salaries amount to R150 000.…

Use the information provided below to prepare the following for January and February 2023:4.1 Debtors Collection Schedule

INFORMATIONThe following information was provided by Intel Enterprises:1. The bank balance on 31 December 2022 is expected to be R40 000 (unfavourable).2. Credit sales are expected to be as follows:December 2022 January 2023 February 2023R576 000 R540 000 R648 0003. Credit sales usually make up 40% of the total sales. Cash sales make up the balance. Cash customersreceive a 10% discount.4. Credit sales are normally collected as follows:* 30% in the month in which the transaction takes place, and these customers are entitled to a 5% discount.* 65% in the following monthThe rest is usually written off as bad debts.5. Budgeted purchases of inventory are as follows:December 2022 January 2023 February 2023R1 000 000 R800 000 R920 000

6. Fifty percent (50%) of the purchases are…

Chapter 9 Solutions

Intermediate Financial Management (MindTap Course List)

Ch. 9 - Define each of the following terms:

Operating...Ch. 9 - Prob. 2QCh. 9 - Prob. 3QCh. 9 - Prob. 4QCh. 9 - Prob. 5QCh. 9 - Prob. 6QCh. 9 - Broussard Skateboard’s sales are expected to...Ch. 9 - AFN Equation Refer to Problem 9-1. What would be...Ch. 9 - AFN Equation Refer to Problem 9-1. Return to the...Ch. 9 - Sales Increase Maggies Muffins Bakery generated 5...

Ch. 9 - Long-Term Financing Needed At year-end 2018,...Ch. 9 - Additional Funds Needed

The Booth Company’s sales...Ch. 9 - Forecasted Statements and Ratios Upton Computers...Ch. 9 - Financing Deficit

Stevens Textile Corporation’s...Ch. 9 - Prob. 9PCh. 9 - Hatfield Medical Supplys stock price had been...Ch. 9 - Prob. 2MCCh. 9 - Define the term capital intensity. Explain how a...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Stevens Textile Corporations 2019 financial statements are shown here. Stevens grew rapidly in 2019 and financed the growth with notes payable and long-term bonds. Stevens expects sales to grow by 15% in the next year but will finance the growth with a line of credit, not notes payable or long-term bonds. Use the forecasted financial statement method to forecast a balance sheet and income statement for December 31, 2020. The interest rate on all debt is 10%, and cash earns no interest income. The line of credit is added at the end of the year, which means that you should base the forecasted interest expense on the balance of debt at the beginning of the year. Use the forecasted income statement to determine the addition to retained earnings. Assume that the company was operating at full capacity in 2019, that it cannot sell off any of its fixed assets, and that assets, spontaneous liabilities, and operating costs are expected to increase by the same percentage as sales. a. What is the projected value for earnings before interest and taxes? b. What is the projected value for pre-tax earnings? c. What is the projected net income? d. What is the projected addition to retained earnings? e. What is the projected value of total current assets? f. What is the projected value of total assets? g. What is the projected sum of accounts payable, accruals, and notes payable? h. What is the forecasted line of credit? Balance Sheet as of December 31, 2019 (Thousands of Dollars) Income Statement for December 31, 2019 (Thousands of Dollars)arrow_forwardDortmund Stockyard reports $896,000 in credit sales for 2018 and $802,670 in 2019. It has a $675,000 accounts receivable balance at the end of 2018, and $682,000 at the end of 2019. Dortmund uses the balance sheet method to record bad debt estimation at 8% during 2018. To manage earnings more favorably, Dortmund changes bad debt estimation to the income statement method at 6% during 2019. A. Determine the bad debt estimation for 2018. B. Determine the bad debt estimation for 2019. C. Describe a benefit to Dortmund Stockyard in 2019 as a result of its earnings management.arrow_forwardLONG-TERM FINANCING NEEDED At year-end 2019, total assets for Arrington Inc. were 1.8 million and accounts payable were 450,000. Sales, which in 2019 were 3.0 million, are expected to increase by 25% in 2020. Total assets and accounts payable are proportional to sales, and that relationship will be maintained; that is, they will grow at the same rate as sales. Arrington typically uses no current liabilities other than accounts payable. Common stock amounted to 500,000 in 2019, and retained earnings were 475,000. Arrington plans to sell new common stock in the amount of 130,000. The firms profit margin on sates is 5%; 35% of earnings will be retained. a. What were Arringtons total liabilities in 2019? b. How much new long-term debt financing will be needed in 2020? (Hint: AFN - New stock = New long-term debt.)arrow_forward

- Fortune Accounting reports $1,455,000 in credit sales for 2018 and $1,678,430 in 2019. It has an $825,000 accounts receivable balance at the end of 2018 and $756,000 at the end of 2019. Fortune uses the balance sheet method to record bad debt estimation at 7.5% during 2018. To manage earnings more favorably, Fortune changes bad debt estimation to the income statement method at 5.5% during 2019. A. Determine the bad debt estimation for 2018. B. Determine the bad debt estimation for 2019. C. Describe a benefit to Fortune in 2019 as a result of its earnings management.arrow_forwardPrepare the income statement for 2020 TPR had one major creditor at the beginning of 2020. One of the major banks loaned TPR $500,000 for ongoing operating costs. The outstanding portion of the loan was $400,000 at the beginning of the vear. The bank requires TPR to maintain a current ratio of 1.8:1 or the loan may become immediately repayable. It also requires TPR to have a debt to total asset ratio of no greater than 55%. Information required for adjusting journal entries: 1. There is no interest accrual required for the mortgage loan on the building because payment was made on December 31. The loan for the balloon machine carries an interest rate of 5% and has been outstanding for 15 days. 2. Depreciation of $800 on the cash register machines and $15,000 on the other equipment has not yet been recorded. 3. A dividend of $2,000 was declared but has not been recorded. It will be paid in March 2021. 4. The monthly electricity bill of $2,000 was received in early January 2021. This…arrow_forwardBelow are some of Facebook's financial ratios for fiscal 2020 and fiscal 2019. 2020 2019 Quick Ratio 1.0 1.5 Days Receivable 8 days 6 days Return on Assets 16% 18% Gross Margin % 80% 60% Debt-to-Equity Ratio 1.3 1.1 1. Is Facebook's Quick Ratio more favorable in 2020 or 2019? 2. Does Facebook's Days Receivable ratio suggest that the company is collecting receivables faster in 2020 or 2019? 3. Is Facebook's Return on Assets more favorable in 2020 or 2019? 4. Is Facebook's Gross Margin percentage more favorable in 2020 or 2019? 5. Does Facebook's Debt-to-Equity ratio suggest that the company carrying more debt per unit of equity in 2020 or 2019?arrow_forward

- Xanax Inc expects the following transaction in 2020. Their first year of operations.· Allowance for bad debts, end of year is 80,000· Sales (some receivables are collectible in 2021) 1,500,000· Bad debt written offs during the year 10,000· Disbursements of costs and expenses 1,200,000· Disbursements for income taxes 90,000· Accounts receivable, end of year, net- 70,000· Purchases of fixed assets for cash 400,000· Proceeds from issuance of ordinary shares 580,000· Proceed from short-term borrowings 100,000· Payments on short-term borrowings 60,000· Depreciation on fixed assets 80,000· Loss on sale of fixed assets (book value 100,000) 10,000What is the cash balance at December 31, 2020?arrow_forwardX Corporation expects the following transaction in 2020. Their first year of operations.· Allowance for bad debts, end of year is 80,000· Sales (some receivables are collectible in 2021) 1,500,000· Bad debt written offs during the year 10,000· Disbursements of costs and expenses 1,200,000· Disbursements for income taxes 90,000· Accounts receivable, end of year, net- 70,000· Purchases of fixed assets for cash 400,000· Proceeds from issuance of ordinary shares 580,000· Proceed from short-term borrowings 100,000· Payments on short-term borrowings 60,000· Depreciation on fixed assets 80,000· Loss on sale of fixed assets (book value 100,000) 10,000What is the cash balance at December 31, 2020? • 470,000 • 300,000 • 390,000 • 370,000 • None of the abovearrow_forwardX Corporation expects the following transaction in 2020. Their first year of operations.· Allowance for bad debts, end of year is 80,000· Sales (some receivables are collectible in 2021) 1,500,000· Bad debt written offs during the year 10,000· Disbursements of costs and expenses 1,200,000· Disbursements for income taxes 90,000· Accounts receivable, end of year, net- 70,000· Purchases of fixed assets for cash 400,000· Proceeds from issuance of ordinary shares 580,000· Proceed from short-term borrowings 100,000· Payments on short-term borrowings 60,000· Depreciation on fixed assets 80,000· Loss on sale of fixed assets (book value 100,000) 10,000What is the cash balance at December 31, 2020? a. 470,000 b. 300,000 c. 390,000 d. 370,000 e. None of the abovearrow_forward

- McKinney Co. estimates its uncollectible accounts as a percentage of credit sales. McKinney made credit sales of 1,500,000 in 2019. McKinney estimates 2.5% of its sales will be uncollectible. Prepare the journal entry to record bad debt expense for McKinney at the end of 2019.arrow_forwardAerospace Electronics reports $567,000 in credit sales for 2018 and $632,500 in 2019. They have a $499,000 accounts receivable balance at the end of 2018, and $600,000 at the end of 2019. Aerospace uses the income statement method to record bad debt estimation at 5% during 2018. To manage earnings more favorably, Aerospace changes bad debt estimation to the balance sheet method at 7% during 2019. A. Determine the bad debt estimation for 2018. B. Determine the bad debt estimation for 2019. C. Describe a benefit to Aerospace Electronics in 2019 as a result of its earnings management.arrow_forwardAngelos Outlet used to report bad debt using the balance sheet method and is now switching to the income statement method. The percentage uncollectible will remain constant at 5%. Credit sales figures for 2019 were $866,000, and accounts receivable was $732,000. How much will Angelos Outlet report for 2019 bad debt estimation under the income statement method?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Fundamentals Of Financial Management, Concise Edi...

Finance

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

What is Budgeting? | Budgetary control | Advantages & Limitations of Budgeting; Author: Educationleaves;https://www.youtube.com/watch?v=INnPo0QPXf4;License: Standard youtube license