Concept explainers

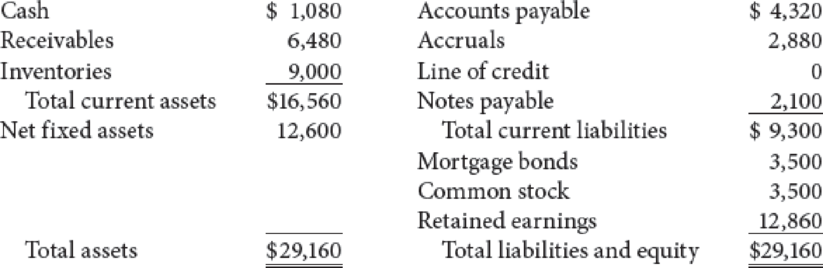

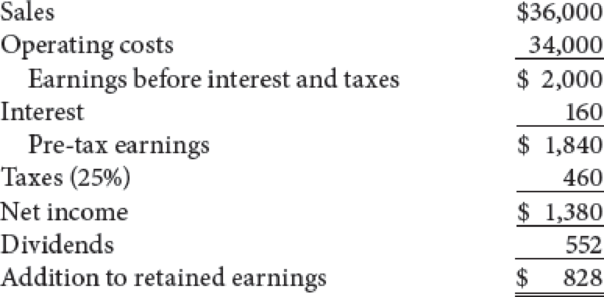

Stevens Textile Corporation’s 2019 financial statements are shown here. Stevens grew rapidly in 2019 and financed the growth with notes payable and long-term bonds. Stevens expects sales to grow by 15% in the next year but will finance the growth with a line of credit, not notes payable or long-term bonds. Use the

- a. What is the projected value for earnings before interest and taxes?

- b. What is the projected value for pre-tax earnings?

- c. What is the projected net income?

- d. What is the projected addition to retained earnings?

- e. What is the projected value of total current assets?

- f. What is the projected value of total assets?

- g. What is the projected sum of accounts payable, accruals, and notes payable?

- h. What is the forecasted line of credit?

Balance Sheet as of December 31, 2019 (Thousands of Dollars)

Income Statement for December 31, 2019 (Thousands of Dollars)

Trending nowThis is a popular solution!

Chapter 12 Solutions

Financial Management: Theory & Practice

- Use the information provided below to prepare the following for January and February 2023:Debtors Collection Schedule The following information was provided by Intel Enterprises:1. The bank balance on 31 December 2022 is expected to be R40 000 (unfavourable).2. Credit sales are expected to be as follows:December 2022 January 2023 February 2023R576 000 R540 000 R648 0003. Credit sales usually make up 40% of the total sales. Cash sales make up the balance. Cash customersreceive a 10% discount.4. Credit sales are normally collected as follows:* 30% in the month in which the transaction takes place, and these customers are entitled to a 5% discount.* 65% in the following monthThe rest is usually written off as bad debts.5. Budgeted purchases of inventory are as follows:December 2022 January 2023 February 2023R1 000 000 R800 000 R920 0004.26. Fifty percent (50%) of the purchases are for cash. The remainder is paid in the month after the purchase.7. The monthly salaries amount to R150 000.…arrow_forwardKestus Corporation's sales are expected to increase from $5 million in 2019 to $6 million in 2020, or by 20%. Its assets totaled $5 million at the end of 2019. Kestus is at full capacity, so its assets must grow in proportion to projected sales. At the end of 2019, current liabilities are $1 million, consisting of $250,000 of accounts payable, $500,000 of notes payable, and $250,000 of accrued liabilities. Its profit margin is forecasted to be 6%, and the forecasted retention ratio is 25%. Use the AFN equation to forecast Kestus additional funds needed for the coming year. Write out your answer completely. For example, 5 million should be entered as 5,000,000. Round your answer to the nearest dollar. Now assume the company's assets totaled $3 million at the end of 2019. Is the company's "capital intensity" the same or different comparing to initial situation?arrow_forwardWhat is the forecasted interest expense on Comfy Homes 2018 pro forma financial statements? When the $45000 current portion of the bank loan will be paid in December 31, 2018. Of the $255000 in long term debt, another $45000 comes due on December 31, 2019. Comfy home does not plan to obtain any additional loans in 2018. The interest rate for comfy homes borrowing has declined recently to 6%. It is expected to be the average rate of interest for comfy home short and long term borrowings in 2018. Use total beginning borrowers to estimate the interest expense for 2018arrow_forward

- Carston Corporation's sales are expected to increase from $5 million in 2019 to $6 million in 2020, or by 20%. Its assets totaled $4 million at the end of 2019. Carston is at full capacity, so its assets must grow in proportion to projected sales. At the end of 2019, current liabilities are $1 million, consisting of $250,000 of accounts payable, $500,000 of notes payable, and $250,000 of accrued liabilities. Its profit margin is forecasted to be 5%, and the forecasted retention ratio is 40%. Use the AFN equation to forecast the additional funds Carston will need for the coming year. Write out your answer completely. For example, 5 million should be entered as 5,000,000. Round your answer to the nearest dollar.arrow_forwardMayor company sales are expected to increase by 20% from $5 million in 2018 to $6 million in 2019. Its assets totaled $7 million at the end of 2018. Mayor is already at full capacity, so its assets must grow at the same rate as projected sales. At the end of 2018, current liabilities were $1.2 million, consisting of $500,000 of accounts payable, $300,000 of notes payable, and $400,000 of accruals. The after-tax profit margin is forecasted to be 5%, and the forecasted payout ratio is 60%. a. Use the AFN equation to forecast Mayor’s additional funds needed for the coming year.arrow_forwardUse the information provided below to prepare the following for January and February 2023:4.1 Debtors Collection Schedule INFORMATIONThe following information was provided by Intel Enterprises:1. The bank balance on 31 December 2022 is expected to be R40 000 (unfavourable).2. Credit sales are expected to be as follows:December 2022 January 2023 February 2023R576 000 R540 000 R648 0003. Credit sales usually make up 40% of the total sales. Cash sales make up the balance. Cash customersreceive a 10% discount.4. Credit sales are normally collected as follows:* 30% in the month in which the transaction takes place, and these customers are entitled to a 5% discount.* 65% in the following monthThe rest is usually written off as bad debts.5. Budgeted purchases of inventory are as follows:December 2022 January 2023 February 2023R1 000 000 R800 000 R920 000 6. Fifty percent (50%) of the purchases are…arrow_forward

- Beasley Industries' sales are expected to increase from $5 million in 2019 to $6 million in 2020, or by 20%. Its assets totaled $2 million at the end of 2019. Beasley is at full capacity, so its assets must grow in proportion to projected sales. At the end of 2019, current liabilities are $700,000, consisting of $120,000 of accounts payable, $350,000 of notes payable, and $230,000 of accrued liabilities. Its profit margin is forecasted to be 4%, and its dividend payout ratio is 50%. Using the AFN equation, forecast the additional funds Beasley will need for the coming year. Do not round intermediate calculations. Round your answer to the nearest dollar.arrow_forwardBulawayo Products Company anticipates reaching a sales level of Sh.6 million in one year.The company expects earnings after taxes during the next year to equal Sh.400,000. During thepast several years, the company has been paying Sh.50,000 in dividends to its stockholders. Thecompany expects to continue this policy for at least the next year. The actual balance sheet andincome statement for Baldwin during 2019 follow.Bulawayo Products Company Balance Sheet as of December 31, 2019Cash Sh. 200,000 Accounts payable Sh. 600,000Accounts receivable 400,000 Notes payable 500,000Inventories 1,200,000 Long-term debt 200,000Fixed assets, net 500,000 Stockholders’ equity 1,000,000Total assets Sh.2,300,000 Total liabilities and equity Sh. 2,300,000Income Statement for the year Ending December 31, 2019Sales Sh. 4,000,000Expenses, including interest and taxes Sh.3,700,000Earnings after taxes Sh. 300,000Required:a) Using the percentage of sales method, calculate the additional financing…arrow_forwardCarlsbad Corporation’s sales are expected to increase from $5 millionin 2018 to $6 million in 2019, or by 20%. Its assets totaled $3 million at the end of 2018.Carlsbad is at full capacity, so its assets must grow in proportion to projected sales. At theend of 2018, current liabilities are $1 million, consisting of $250,000 of accounts payable,$500,000 of notes payable, and $250,000 of accrued liabilities. Its profit margin is forecastedto be 3%, and the forecasted retention ratio is 30%. Use the AFN equation to forecast theadditional funds Carlsbad will need for the coming year.arrow_forward

- Wally has provided the information below – and asked you to create an Income Statement and Balance Sheet for AndrewCo for the year ended December 31, 2019. Sales were $1,200,000 Gross profit margin was 50% Operating margins were 10% The Bank of Toronto provided a loan on Jan 1, 2019 worth $300,000. The annual interest is 8% and is compounded annually. Interest only payments are needed – until the loan is due in 10 years, where a balloon payment for the full balance must be paid. The combined federal and provincial tax rates is 25% Wally knows that the ending cash balance in his company is 200,000. Accounts Receivables is 12% of sales Inventory is 15% of sales Accounts Payable is 5% of sales Accrued expenses payable is 5.5% of sales Capital equipment purchases were made at the start of the year. These total $50,000. These depreciate at 10% per year The owner will provide all other capital in the form of equity financing Wally has asked you to figure out his Selling General and…arrow_forwardThe 2Ball's Co's sales are forecasted to double from P1,000,000 in 2020 to P2,000,000 in 2021. The figures in the Dec. 31,2020, balance sheet (in thousands) follows: Current Assets, P500; Net Fixed Assets, P500; Accounts Payable and Accruals, P100; Notes Payable, P150; Long-term debt, P400; Common Stock, P100; Retained Earnings, P250. The 2Balls fixed assets were used to only 50% of capacity in 2020, but its current assets were at their proper level in relation to sales. All assets except fixed assets must increase in the same rate as sales and fixed assets would also have to increase at the same rate if the current excess capacity did not exist. 2Balls' after tax profit margin is forecasted to be 5% and its payout ratio to be 60%. What is 2Balls Co.'s additional fund needed (AFN) for the coming year?arrow_forwardThe following relates to financial projections of ABC Co. for 2019: Suppose that, in 2024, ABC’s sales are expected to increase by 15%. By what percentage is the operating income expected to increase?arrow_forward

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning