Concept explainers

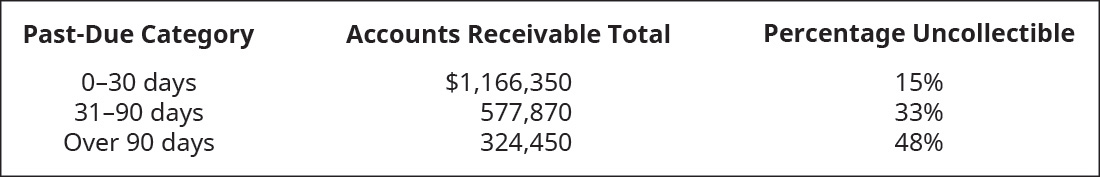

The following

A. Determine the estimated uncollectible

B. Record the year-end 2018

C. Assume there was a previous debit balance in Allowance for Doubtful Accounts of $187,450; record the year-end entry for bad debt, taking this into consideration.

D. Assume there was a previous credit balance in Allowance for Doubtful Accounts of $206,770; record the year-end entry for bad debt, taking this into consideration.

E. On January 24, 2019, Luxury Cruises identifies Landon Walker’s account as uncollectible in the amount of $4,650. Record the entry for identification.

Want to see the full answer?

Check out a sample textbook solution

Chapter 9 Solutions

Principles of Accounting Volume 1

Additional Business Textbook Solutions

Principles of Management

Principles of Accounting Volume 2

Cost Accounting (15th Edition)

Managerial Accounting (5th Edition)

Managerial Accounting (4th Edition)

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

- The following accounts receivable information pertains to Select Distributors. A. Determine the estimated uncollectible bad debt for Select Distributors in 2018 using the balance sheet aging of receivables method. B. Record the year-end 2018 adjusting journal entry for bad debt. C. Assume there was a previous debit balance in Allowance for Doubtful Accounts of $233,180; record the year-end entry for bad debt, taking this into consideration. D. Assume there was a previous credit balance in Allowance for Doubtful Accounts of $199,440; record the year-end entry for bad debt, taking this into consideration. E. On March 21, 2019, Select Distributors identifies Aida Normans account as uncollectible in the amount of $10,890. Record the entry for identification.arrow_forwardThe following accounts receivable information pertains to Marshall Inc. Determine the estimated uncollectible bad debt from Marshall Inc. using the balance sheet aging of receivables method, and record the year-end adjusting journal entry for bad debt.arrow_forwardThe following accounts receivable information pertains to Envelope Experts. Determine the estimated uncollectible bad debt from Envelope Experts using the balance sheet aging of receivables method, and record the year-end adjusting journal entry for bad debt.arrow_forward

- a. Determine the amount of the adjusting entry for uncollectible accounts. b. Determine the adjusted balances of Accounts Receivable, Allowance for Doubtful Accounts, and Bad Debt Expense. c. Determine the net realizable value of accounts receivable.arrow_forwardWhat is the adjusted balance of the Accounts Receivable account as of December 31, 2016?arrow_forwardWhat is the adjusted balance of the Allowance for Bad Debts account as of December 31, 2016?arrow_forward

- CAN SOMEONE HELP ME FILL OUT THIS CHART ? (b) Prepare the year-end adjusting journal entry to record the bad debts using the aged uncollectible accounts receivable determined in (a).Assume the current balance in Allowance for Doubtful Accounts is a $8,500 debit. (c) Of the above accounts, $4,700 is determined to be specifically uncollectible.Prepare the journal entry to write off the uncollectible account. (d) The company collects $4,700 subsequently on a specific account that had previously been determined to be uncollectible in (c).Prepare the journal entries necessary to restore the account and record the cash collection.arrow_forwardWhat is the carrying value of accounts receivable as of December 31, 2016?arrow_forwardThe following information is available for Sheridan Company: Allowance for Expected Credit Losses at December 31, 2023 Credit Sales during 2024 Accounts Receivable deemed worthless and written off during 2024 $7980 O $4788 $3762 $8550 O $84360 307800 3192 As a result of a review and aging of Accounts Receivable in early January 2025, it was determined that an Allowance for Expected Credit Losses balance of $8550 is required at December 31, 2024. What amount should Sheridan record as loss on impairment for calendar 2024?arrow_forward

- On the year end of July 31, 2020, Rainbow Appliances had the following account balances before adjustments for bad debt was made. Net Credit Sales for the period $1,028,000 CR Accounts Receivable $656,000 DR AFDA $1,900 DR Do not enter dollar signs or commas in the input boxes. a) Use the year-end balances reported on the balance sheet and the aging schedule shown below to calculate the allowance for doubtful accounts. Aging Category Bad Debt % Balance Estimated Bad Debt Less than 30 days 2% $422,000 31-60 days 4% $105,000 61-90 days 11% $75,000 91-120 days 28% $37,000 Over 120 days 52% $17,000 Total $656,000 Prepare the journal entry to record bad debt expense for the year: Date Account Title and Explanation Debit Credit Jul 31 To record bad debt expense b) Assume instead that Rainbow Appliances used the income statement approach for estimating bad debt. If historical data indicates that approximately 2% of net credit sales are uncollectible, what amount is expected to be…arrow_forwardJohnson Company uses the allowance method to account for uncollectible accounts receivable. Bad debt expenseis established as a percentage of credit sales. For 2018, net credit sales totaled $4,500,000, and the estimated baddebt percentage is 1.5%. The allowance for uncollectible accounts had a credit balance of $42,000 at the beginningof 2018 and $40,000, after adjusting entries, at the end of 2018.Required:1. What is bad debt expense for 2018 as a percent of net credit sales?2. Assume Johnson makes no other adjustment of bad debt expense during 2018. Determine the amount ofaccounts receivable written off during 2018.3. If the company uses the direct write-off method, what would bad debt expense be for 2018?arrow_forwardEdsel Inc. has the following unadjusted year end trial balance information available for 2018: Credit sales Ending accounts receivable balance. Ending allowance for uncollectibles Estimated uncollectibles Multiple Choice If Edsel uses the gross accounts receivable approach for estimating the bad debt provision, the allowance for uncollectibles account, afte accounts are recorded, should show a balance of. O $2,600 O $3,600 $600,000 $180,000 $1,500 O $5,600 2%arrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning