Concept explainers

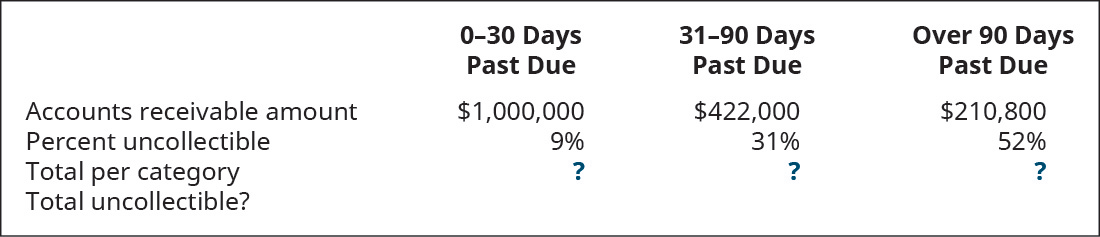

Goods for Less uses the

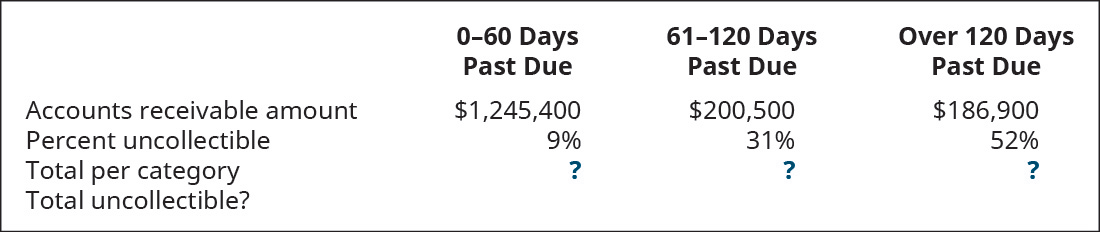

To manage earnings more favorably, Goods for Less considers changing the past-due categories as follows.

A. Complete each table by filling in the blanks.

B. Determine the difference between totals uncollectible.

C. Describe the categories change effect on net income and

Want to see the full answer?

Check out a sample textbook solution

Chapter 9 Solutions

Principles of Accounting Volume 1

Additional Business Textbook Solutions

Principles of Management

Cost Accounting (15th Edition)

Construction Accounting And Financial Management (4th Edition)

Managerial Accounting (4th Edition)

Principles of Accounting Volume 2

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

- Mirror Mart uses the balance sheet aging method to account for uncollectible debt on receivables. The following is the past-due category information for outstanding receivable debt for 2019. To manage earnings more efficiently, Mirror Mart decided to change past-due categories as follows. Complete the following. A. Complete each table by filling in the blanks. B. Determine the difference between total uncollectible. C. Explain how the new total uncollectible amount affects net income and accounts receivable.arrow_forwardElegant Linens uses the balance sheet aging method to account for uncollectible debt on receivables. The following is the past-due category information for outstanding receivable debt for 2019. To manage earnings more favorably, Elegant Linens considers changing the past-due categories as follows. A. Complete each table by filling in the blanks. B. Determine the difference between total uncollectible. C. Complete the following 2019 comparative income statements for 2019, showing net income changes as a result of the changes to the balance sheet aging method categories. D. Describe the categories change effect on net income and accounts receivable.arrow_forwardOutpost Designs uses the balance sheet aging method to account for uncollectible debt on receivables. The following is the past-due category information for outstanding receivable debt for 2019. To manage earnings more favorably, Outpost Designs decided to change past-due categories as follows. Complete the following. A. Complete each table by filling in the blanks. B. Determine the difference between total uncollectible. C. Explain how the new total uncollectible amount affects net income and accounts receivable.arrow_forward

- Noren Company uses the balance sheet aging method to account for uncollectible debt on receivables. The following is the past-due category information for outstanding receivable debt for 2019. To manage earnings more favorably, Noren Company considers changing the past-due categories as follows. A. Complete each table by filling in the blanks. B. Determine the difference between totals uncollectible. C. Complete the following 2019 comparative income statements for 2019, showing net income changes as a result of the changes to the balance sheet aging method categories. D. Describe the categories change effect on net income and accounts receivable.arrow_forwardWhich of the following estimation methods considers the amount of time past due when computing bad debt? A. balance sheet method B. direct write-off method C. income statement method D. balance sheet aging of receivables methodarrow_forwardPlease Solve all parts and Do not give Image formatarrow_forward

- Determine the amount of receivables that may not be collectible in the future as on June 30, 2020.arrow_forward1. Prepare the entry to record the write-off ofuncollectible accounts during 2019. 2. Prepare the entries to record the recovery ofthe uncollectible account during 2019 3. Prepare the entry to record bad debt expense(BDE) at the end of 2019. Ending balance ofAFDA was Rp18,200 (Cr.) 4. Determine the ending balance of AccountsReceivable as of December 31, 2019. 5. What is the net realizable value of thereceivables at the end of 2019? 6. The company has a notes receivable ofRp24,000 at January 15, 2019 for 3 months at10% interest rate. Prepare journal entry as ofApril 15, 2019, on its due date.arrow_forwardSagararrow_forward

- When would you consider a customer debt an uncollectible receivable? A. The debt is older than one year. B. You've been unable to contact them to collect. C. The debt is associated with a non-inventory item. D. You need to match income with expenses.arrow_forwardMirror Mart uses the balance sheet aging method to account for uncollectible debt on receivables. The following is the past-due category information for outstanding receivable debt for 2019. 0-30 dayspast due 31-90 dayspast due Over 90 dayspast due Accounts receivable amount $52,000 $31,000 $17,000 Percent uncollectible 8% 15% 30% Total per category ? ? ? Total uncollectible ? To manage earnings more efficiently, Mirror Mart decided to change past-due categories as follows. 0-60 dayspast due 61-120 dayspast due Over 120 dayspast due Accounts receivable Amount $82,000 $15,000 $8,000 Percent uncollectible 8% 15% 30% Total per category ? ? ? Total uncollectible ? Complete the following. A. Complete each table by filling in the blanks. 0-30 dayspast due 31-90 dayspast due Over 90 dayspast due Accounts receivable amount $52,000…arrow_forwardOceanside Company uses the balance sheet approach in estimating uncollectible accounts expense. It has just completed an aging analysis of accounts receivable at December 31, 2019. This analysis disclosed the following information: Age Group Total Percentage Considered Uncollectible Not Yet Due 1 - 30 days past due $52,000 $32,000 $13,000 1% 2% 8% 31 - 60 days past due What is the appropriate balance for Oceanside's Allowance for Impairment at December 31, 2019 O A. $1,560 O B. $2,160 O C, 2% of credit sales in 2019 O D. $95,000arrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning