Healthful Foods Inc., a manufacturer of breakfast cereals and snack bars, has experienced several years of steady growth in sales, profits, and dividends while maintaining a relatively low level of debt. The board of directors has adopted a long-run strategy to maximize the value of the shareholders’ investment. In order to achieve this goal, the board of directors established the following five-year financial objectives.

- Increase sales by 12 percent per year.

- Increase income before taxes by 15 percent per year.

- Maintain long-term debt at a maximum of 16 percent of assets.

These financial objectives have been attained for the past three years. At the beginning of last year, the president of Healthful Foods, Andrea Donis, added a fourth financial objective of maintaining cost of goods sold at a maximum of 70 percent of sales. This goal also was attained last year.

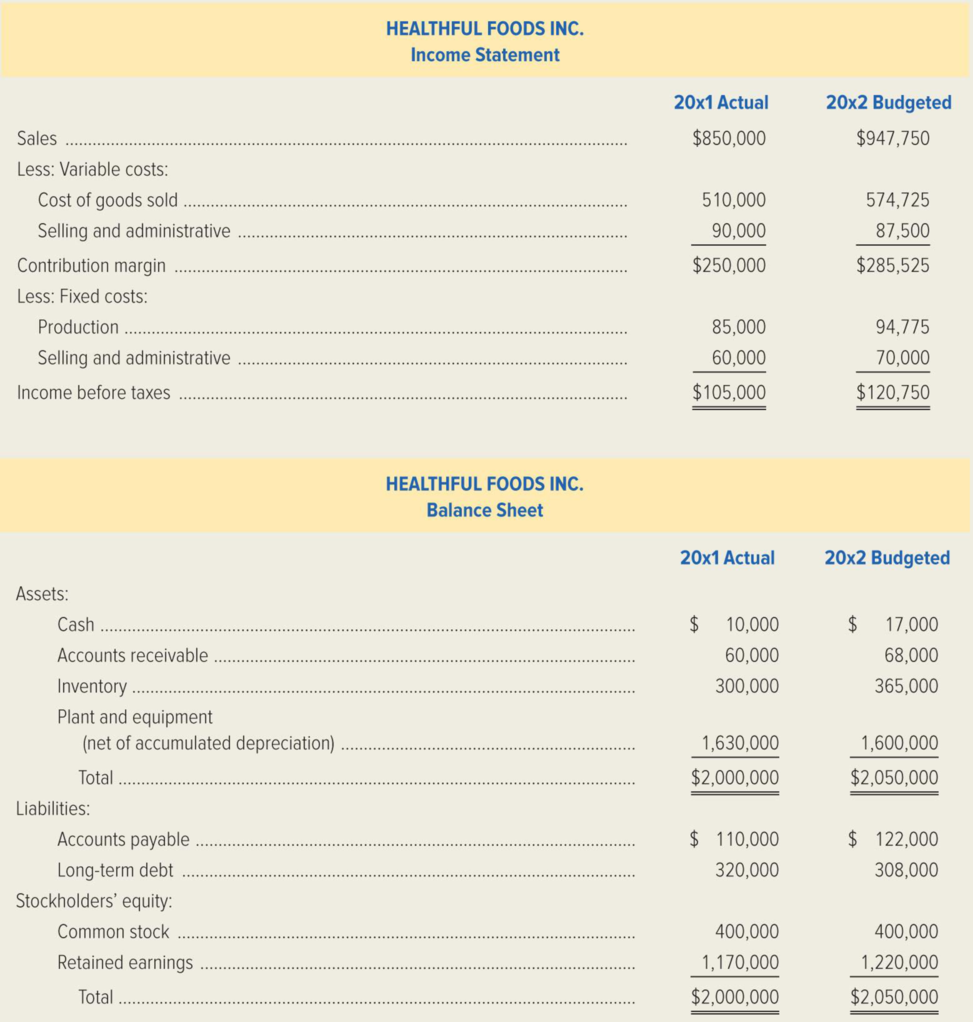

The budgeting process at Healthful Foods is to be directed toward attaining these goals for the forthcoming year, a difficult task with the economy in a prolonged recession. In addition, the increased emphasis on eating healthful foods has driven up the price of ingredients used by the company significantly faster than the expected rate of inflation. John Winslow, cost accountant at Healthful Foods, has responsibility for preparation of the profit plan for next year. Winslow assured Donis that he could present a budget that achieved all of the financial objectives. Winslow believed that he could overestimate the ending inventory and reclassify fruit and grain inspection costs as administrative rather than production costs to attain the desired objective. The actual statements for 20x1 and the budgeted statements for 20x2 that Winslow prepared are as follows:

The company paid dividends of $27,720 in 20x1, and the expected tax rate for 20x2 is 34 percent.

Required:

- 1. Describe the role of budgeting in a firm’s strategic planning.

- 2. For each of the financial objectives established by the board of directors and the president of Healthful Foods Inc., determine whether John Winslow’s budget attains these objectives. Support your conclusion in each case by presenting appropriate calculations, and use the following format for your answer.

- 3. Explain why the adjustments contemplated by John Winslow are unethical, citing specific standards of ethical professional practice for

management accountants.

Want to see the full answer?

Check out a sample textbook solution

Chapter 9 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

- Gardial GreenLights, a manufacturer of energy-efficient lighting solutions, has had such success with its new products that it is planning to substantially expand its manufacturing capacity with a $15 million investment in new machinery. Gardial plans to maintain its current 30% debt-to-total-assets ratio for its capital structure and to maintain its dividend policy in which at the end of each year it distributes 55% of the year’s net income. This year’s net income was $8 million. How much external equity must Gardial seek now to expand as planned?arrow_forwardA closely- held plastic manufacturing company has been following a dividend policy which can maximize the market value of the firm as per Walter's model. Accordingly, each year at dividend time the capital budget is reviewed in conjunction with the earnings for the period and alternative investment opportunities for the shareholders. In the current year, the firm reports net earnings of Rs. 5,00,000. It is estimated that the firm can earn Rs. 1,00,000 if the amounts are retained. The investors have alternative investment opportunities that will yield them 10 per cent. The firm has 50,000 shares outstanding.What should be the D/P ratio of the company if it wishes to maximize the wealth of the shareholders?arrow_forwardA closely held plastic manufacturing company has been following a dividend policy which can be maximize the market value of the firm as per walter's model. Accordingly,each year at dividend time the capital budget is reviewed in conjunction with the earnings for the period and alternative investment opportunities for the shareholders.in the current year, the firm reports net earnings of rs.5,00,000. It is estimated that the firm can earn rs.1,00,000 if the amounts are retained. The investors have alternative investment opportunities that will yield them 10 per cent. The firm has 50,000 shares outstanding. What should be the D/P ratio of the company of it wishes to maximize the wealth of the shareholders?arrow_forward

- The financial manager for "ERR" industrial Company would extend the credit terms from "net 30" to "net 45" in order to stimulate credit sales. 'ERR' Company also benefits from relaxing of terms from its suppliers from "net 30" to "net 35". The manager is wondering how to estimate the financial impact of these alternatives would have on the shareholder's wealth. The financial manager estimates that the daily sales increase at a growth rate equals 10% following the extension of DSO. You gathered the following information:Purchase amount = 40% of sales amount Annual sales amount = $31,025,000 The annual cost of capital = 10% Inventory turnover =18.25 1- Calculate the daily NPV of the current terms. 2- Calculate the daily NPV of the proposed terms. 3- Based on your own calculations, what is your recommendation? Why? 4- Calculate the NPVCCP of the present terms. Interpret. 5- Calculate the ANPVCCP-aggregate of the Company. Interpret.arrow_forwardGardial GreenLights, a manufacturer of energy-efficient lighting solutions,has had such success with its new products that it is planning to substantially expand its manufacturing capacity with a $15 million investment innew machinery. Gardial plans to maintain its current 30% debt-to-totalassets ratio for its capital structure and to maintain its dividend policy inwhich at the end of each year it distributes 55% of the year’s net income.This year’s net income was $8 million. How much external equity mustGardial seek now to expand as planned?arrow_forwardThe managers of the XYZ clubs, who have the authority to make investments as needed, are evaluated based largely on return on investment (ROI). The company's X Club reported the following results for the past year: Sales Net operating income Average operating assets $ 730,000 $ 13, 140 $ 100,000 The following questions are to be considered independently. 2. Assume that the manager of the club is able to increase sales by $73,000 and that, as a result, net operating income increases by $5,329. Further assume that this is possible without any increase in average operating assets. What would be the club's return on investment (ROI)? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Return on investment (ROI) %arrow_forward

- Northwest Utility Company faces Increasing needs for capital. Fortunately. It has an Aa3 credit rating. The corporate tax rate is 30 percent. Northwest's treasurer is trying to determine the corporation's current weighted average cost of capital in order to assess the profitability of capital budgeting projects. Historically, the corporation's earnings and dividends per share have Increased about 9.6 percent annually and this should continue in the future. Northwest's common stock is selling at $71 per share, and the company will pay a $8.20 per share dividend (D₁); The company's $110 preferred stock has been yielding 8 percent in the current market. Flotation costs for the company have been estimated by its investment banker to be $6.00 for preferred stock. The company's optimum capital structure is 50 percent debt, 25 percent preferred stock, and 25 percent common equity in the form of retained earnings. Refer to the following table on bond Issues for comparative yields on bonds of…arrow_forwardNorthwest Utility Company faces increasing needs for capital. Fortunately, it has an Aa3 credit rating. The corporate tax rate is 40 percent. Northwest's treasurer is trying to determine the corporation's current weighted average cost of capital in order to assess the profitability of capital budgeting projects. Historically, the corporation's earnings and dividends per share have increased about 9.4 percent annually and this should continue in the future. Northwest's common stock is selling at $76 per share, and the company will pay a $9.60 per share dividend (D₁) The company's $120 preferred stock has been yielding 9 percent in the current market. Flotation costs for the company have been estimated by its investment banker to be $4.00 for preferred stock. The company's optimum capital structure is 40 percent debt, 20 percent preferred stock, and 40 percent common equity in the form of retained earnings. Refer to the following table on bond issues for comparative yields on bonds of…arrow_forwardYou have been asked to value Brilliant Enterprises, a publicly traded IT services firm, and have collected the following information: After-tax operating income last year = $100 million Net income last year = $82.5 million Book value of equity at start of this year = $750 million Book value of debt at start of this year = $250 million Capital expenditure last year = $80 million Depreciation last year = $30 million Increase in non-cash working capital last year = $10 million a) Assuming that Brilliant Enterprises will maintain its return on capital and reinvestment rate from last year for the next 3 years, estimate the free cash flow for the company for each of the next 3 years. b) After year 3, Brilliant expects its growth rate to decline to 3% and the return on capital to be 9% in perpetuity. Assuming that its cost of capital is 8%, estimate the terminal value at the end of the third year. c) Assuming that Brilliant has a cost of capital of 10% for the next 3…arrow_forward

- Mr. Ang is a member of the board of directors. He will be given a bonus if he can increase the share price by 20% at the end of the fiscal year. Which of the following would LEAST LIKELY BE be a manifestation of bias by Mr. Ang?a. Management letter to the stockholders stating the qualitative improvements on the businessb. Increase in operating cash inflowc. Increase in accrued income and accounts receivablesd. Increased media coverage to paint a better picture of the entityarrow_forwardHarte Textiles, Inc., a maker of custom upholstery fabrics, is concerned about preserving the wealth of its stockholders during a cyclic downturn in the home furnishings business. The company has maintained a constant dividend payout of $2.00 tied to a target payout ratio of 30%. Management is preparing a share repurchase recommendation to present to the firm's board of directors. The following data have been gathered from the last two years: LOADING... 2021 2022 Earnings available for common stockholders $1,995,000 $1,900,000 Number of shares outstanding 356,250 356,250 Earnings per share $5.60 $5.33 Market price per share $29.12 $24.52 Price/earnings ratio 5.2 4.6 a) How many shares should the company have outstanding in 2022 if its earnings available for common stockholders in that year are $1,900,000 and it pays a dividend of $2.00, given that its desired payout ratio is…arrow_forwardEthics and the Manager M. K. Gallant is president of Kranbrack Corporation, a company whose stock is traded on a national exchange. In a meeting with investment analysts at the beginning of the year, Gallant had predicted that the company’s earnings would grow by 20% this year. Unfortunately, sales have been less than expected for the year, and Gallant concluded within two weeks of the end of the fiscal year that it would be impossible to report an increase in earnings as large as predicted unless some drastic action was taken. Accordingly, Gallant has ordered that wherever possible, expenditures should be postponed to the new year—including canceling or postponing orders with suppliers, delaying planned maintenance and training, and cutting back on end-of-year advertising and travel. Additionally, Gallant ordered the company’s controller to carefully scrutinize all costs that are currently classified as period costs and reclassify as many as possible as product costs that are…arrow_forward

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT