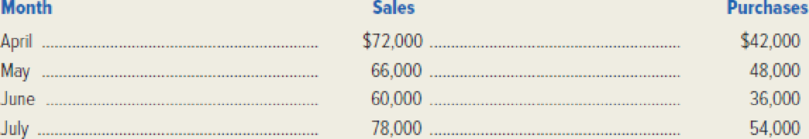

The following information is from Tejas WindowTint’s financial records.

Collections from customers are normally 70 percent in the month of sale, 20 percent in the month following the sale, and 9 percent in the second month following the sale. The balance is expected to be uncollectible. All purchases are on account. Management takes full advantage of the 2 percent discount allowed on purchases paid for by the tenth of the following month. Purchases for August are budgeted at $60,000, and sales for August are

Required: Prepare the following schedules.

- 1. Expected cash collections during August.

- 2. Expected cash disbursements during August.

- 3. Expected cash balance on August 31.

Want to see the full answer?

Check out a sample textbook solution

Chapter 9 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

Additional Business Textbook Solutions

Introduction To Managerial Accounting

Managerial Accounting (5th Edition)

Financial Accounting: Information for Decisions

Advanced Financial Accounting

Accounting for Governmental & Nonprofit Entities

Intermediate Accounting (2nd Edition)

- Sports Socks has a policy of always paying within the discount period and each of its suppliers provides a discount of 2% if paid within 10 days of purchase. Because of the purchase policy, 85% of its payments are made in the month of purchase and 15% are made the following month. The direct materials budget provides for purchases of $129,582 in November, $294,872 in December, $239,582 in January, and $234,837 in February. What is the balance in accounts payable for January 31, and February 28?arrow_forwardCash collections for Renew Lights found that 65% of sales were collected in the month of sale, 25% was collected the month after the sale, and 10% was collected the second month after the sale. Given the sales shown, how much cash will be collected in March and April?arrow_forwardMy Aunts Closet Store collects 60% of its accounts receivable in the month of sale and 35% in the month after the sale. Given the following sales, how much cash will be collected in March?arrow_forward

- Halifax Shoes has 30% of its sales in cash and the remainder on credit. Of the credit sales, 65% is collected in the month of sale, 25% is collected the month after the sale, and 5% is collected the second month after the sale. How much cash will be collected in August if sales are estimated as $75,000 in June, $65,000 in July, and $90,000 in August?arrow_forwardNonnas Re-Appliance Store collects 55% of its accounts receivable in the month of sale and 40% in the month after the sale. Given the following sales, how much cash will be collected in February?arrow_forwardEarthies Shoes has 55% of its sales in cash and the remainder on credit. Of the credit sales, 70% is collected in the month of sale, 15% is collected the month after the sale, and 10% is collected the second month after the sale. How much cash will be collected in June if sales are estimated as $75,000 in April, $65,000 in May, and $90,000 in June?arrow_forward

- Pilsner Inc. purchases raw materials on account for use in production. The direct materials purchases budget shows the following expected purchases on account: Pilsner typically pays 25% on account in the month of billing and 75% the next month. Required: 1. How much cash is required for payments on account in May? 2. How much cash is expected for payments on account in June?arrow_forwardThe following data were obtained from the financial records of Sonicbrush, Inc., for March: Sales are expected to increase each month by 15%. Prepare a budgeted income statement.arrow_forwardCash collections for Wax On Candles found that 60% of sales were collected in the month of the sale, 30% was collected the month after the sale, and 10% was collected the second month after the sale. Given the sales shown, how much cash will be collected in January and February?arrow_forward

- Palmgren Company produces consumer products. The sales budget for four months of the year is presented below. Company policy requires that ending inventories for each month be 25 percent of next months sales. At the beginning of July, the beginning inventory of consumer products met that policy. Required: Prepare a production budget for the third quarter of the year. Show the number of units that should be produced each month as well as for the quarter in total.arrow_forwardOne Device makes universal remote controls and expects to sell 500 units in January, 800 in February, 450 in March, 550 in April, and 600 in May. The required ending inventory is 20% of the next months sales. Prepare a production budget for the first four months of the year.arrow_forwardRehydrator makes a nutrition additive and expects to sell 3,000 units in January, 2,000 in February, 2,500 in March, 2,700 in April. and 2,900 in May. The required ending inventory is 20% of the next months sales, and the beginning inventory on January 1 was 600 units. Prepare a production budget for the first four months of the year.arrow_forward

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning