Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 9, Problem 1CMA

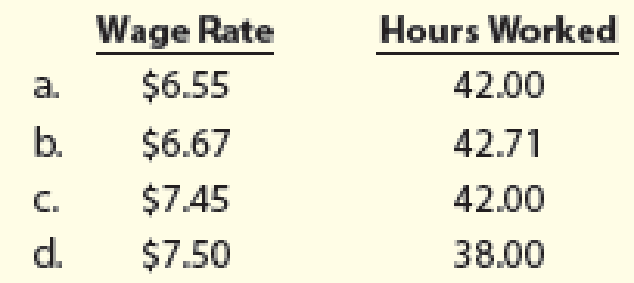

MinnOil performs oil changes and other minor maintenance services on cars and trucks. The company advertises that all services are performed within 15 minutes each. On a recent Saturday, 160 cars were serviced, resulting in the following labor variances: rate, $19 unfavorable; efficiency (time), $14 favorable. If MinnOil’s standard labor rate is $7 per hour, determine the actual wage rate per hour and the actual hours worked.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Monte Services, Inc. is trying to establish the standard labor cost of a typical brake repair. The following data have been collected from

time and motion studies conducted over the past month.

Actual time spent on the brake repairs

Hourly wage rate

Payroll taxes

Setup and downtime

Cleanup and rest periods

Fringe benefits

(a)

Your answer is correct.

5 hours

$12

20% of wage rate

11% of actual labor time

34% of actual labor time

25% of wage rate

Determine the standard direct labor hours per brake repairs. (Round answer to 2 decimal places, e.g. 1.25.)

Standard direct labor hours per brake repair

7.25

hours

Ackerman’s Garage uses standards to plan and control labor time and expense. The standard time for an engine tune-up is 3.5 hours, and the standard labor rate is $15 per hour. Last week, 24 tune-ups were completed. The labor efficiency variance was 6 hours unfavorable, and the labor rate variance totaled $81 favorable.

Required:

Calculate the actual direct labor hourly rate paid for tune-up work last week. (Round your answer to 1 decimal place.)

Calculate the dollar amount of the labor efficiency variance. (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance).)

Less skilled, lower paid workers took longer than standard to get the work done is the most likely explanation for these two variances

a. actual direct labor rate per hour

b. direct labor efficiency

c. less skilled workers took longer than standard time? True or False

Monte Services, Inc. is trying to establish the standard labor cost of a typical brake repair. The following data have been collected from

time and motion studies conducted over the past month.

Actual time spent on the brake repairs

Hourly wage rate

Payroll taxes

Setup and downtime

Cleanup and rest periods

Fringe benefits

(a)

5 hours

$12

20% of wage rate

11% of actual labor time

34% of actual labor time

25% of wage rate

Determine the standard direct labor hours per brake repairs. (Round answer to 2 decimal places, e.g. 1.25.)

Standard direct labor hours per brake repair

hours

Chapter 9 Solutions

Managerial Accounting

Ch. 9 - What are the basic objectives in the use of...Ch. 9 - What is meant by reporting by the principle of...Ch. 9 - What are the two variances between the actual cost...Ch. 9 - The materials cost variance report for Nickols...Ch. 9 - A. What are the two variances between the actual...Ch. 9 - Prob. 6DQCh. 9 - Would the use of standards be appropriate in a...Ch. 9 - A. Describe the two variances between the actual...Ch. 9 - At the end of the period, the factory overhead...Ch. 9 - If variances are recorded in the accounts at the...

Ch. 9 - Direct materials variances Bellingham Company...Ch. 9 - Direct labor variances Bellingham Company produces...Ch. 9 - Factory overhead controllable variance Bellingham...Ch. 9 - Factory overhead volume variance Bellingham...Ch. 9 - Standard cost journal entries Bellingham Company...Ch. 9 - Prob. 6BECh. 9 - Crazy Delicious Inc. produces chocolate bars. The...Ch. 9 - Prob. 2ECh. 9 - Salisbury Bottle Company manufactures plastic...Ch. 9 - The following data relate to the direct materials...Ch. 9 - De Soto Inc. produces tablet computers. The...Ch. 9 - Standard direct materials cost per unit from...Ch. 9 - H.J. Heinz Company uses standards to control its...Ch. 9 - Direct labor variances The following data relate...Ch. 9 - Glacier Bicycle Company manufactures commuter...Ch. 9 - Ada Clothes Company produced 40,000 units during...Ch. 9 - Prob. 11ECh. 9 - Direct materials and direct labor variances At the...Ch. 9 - Flexible overhead budget Leno Manufacturing...Ch. 9 - Prob. 14ECh. 9 - Factory overhead cost variances The following data...Ch. 9 - Thomas Textiles Corporation began November with a...Ch. 9 - Prob. 17ECh. 9 - Factory overhead cost variance report Tannin...Ch. 9 - Prob. 19ECh. 9 - Prob. 20ECh. 9 - Income statement indicating standard cost...Ch. 9 - Prob. 22ECh. 9 - Prob. 23ECh. 9 - Rosenberry Company computed the following revenue...Ch. 9 - Lowell Manufacturing Inc. has a normal selling...Ch. 9 - Shasta Fixture Company manufactures faucets in a...Ch. 9 - Flexible budgeting and variance analysis I Love My...Ch. 9 - Direct materials, direct labor, and factory...Ch. 9 - Factory overhead cost variance report Tiger...Ch. 9 - CodeHead Software Inc. does software development....Ch. 9 - Direct materials and direct labor variance...Ch. 9 - Flexible budgeting and variance analysis Im Really...Ch. 9 - Direct materials, direct labor, and factory...Ch. 9 - Factory overhead cost variance report Feeling...Ch. 9 - Prob. 5PBCh. 9 - Prob. 1COMPCh. 9 - Advent Software uses standards to manage the cost...Ch. 9 - Prob. 2MADCh. 9 - Prob. 3MADCh. 9 - Prob. 4MADCh. 9 - Ethics in action Dash Riprock is a cost analyst...Ch. 9 - Variance interpretation Vanadium Audio Inc. is a...Ch. 9 - MinnOil performs oil changes and other minor...Ch. 9 - Marten Company has a cost-benefit policy to...Ch. 9 - Prob. 3CMACh. 9 - JoyT Company manufactures Maxi Dolls for sale in...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Blossom Services, Inc. is trying to establish the standard labor cost of a typical brake repair. The following data have been collected from time and motion studies conducted over the past month. Actual time spent on the brake repairs Hourly wage rate Payroll taxes Setup and downtime Cleanup and rest periods Fringe benefits (a) 1 hour $11 10% of wage rate 5% of actual labor time 25% of actual labor time 20% of wage rate Determine the standard direct labor hours per brake repairs. (Round answer to 2 decimal places, e.g. 1.25.) Standard direct labor hours per brake repair hours 1 SUarrow_forwardBlossom Services, Inc. is trying to establish the standard labor cost of a typical brake repair. The following data have been collected from time and motion studies conducted over the past month. Actual time spent on the brake repairs Hourly wage rate Payroll taxes Setup and downtime Cleanup and rest periods Fringe benefits (a) 1 hour $11 10% of wage rate 5% of actual labor time 25% of actual labor time 20% of wage rate Determine the standard direct labor hours per brake repairs. (Round answer to 2 decimal places, eg. 1.25.) Standard direct labor hours per brake repair hours Farrow_forwardGadubhaiarrow_forward

- Dengararrow_forwardAirQual Test Corporation provides on-site air quality testing services. The company has provided the following cost formulas and actual results for the month of February: The company uses the number of jobs as its measure of activity. For example, mobile lab operating expenses should be $4,600 plus $31 per job, and the actual mobile lab operating expenses for February were $8,780. The company expected to work 140 jobs in February, but actually worked 146 jobs. Required: Prepare a flexible budget performance report showing AirQual Test Corporation's revenue and spending variances and activity variances for February.arrow_forwardBarkoff Enterprises, which uses the high-low method to analyze cost behavior, has determined that machine hours best explain the company's utilities cost. The company's relevant range of activity varies from a low of 600 machine hours to a high of 1,200 machine hours, with the following data being available for the first six months of the year: Month Utilities Machine Hours January 9,600 890 February 9,260 810 March 9,850 900 April 10,260 1,010 May 10,732 1,040 June 10,050 990 The fixed utilities cost per month for Barkoff is: Multiple Choice $3,440. $4,076. $4,436. • $4,776. None of the answers is correctarrow_forward

- An accountant has been monitoring the overall indirect service costs incurred at their company based on the number of labour hours worked. They accept that the costs follow a uniform, regular pattern so decide to use the High-Low method to calculate the Variable Costs and then the fixed costs. The have found the during the month when the lowest hours were worked ( 2083 hours) that the service costs in that low activity month was $14705. In the month when the highest hours were worked ( 4803 hours) the service costs were $18998. Calculate the Variable Cost using the high-low method. Note: Do not input the $ sign, just the decimal number to two decimal placesarrow_forwardThe manager of Mandaue LTO has determined that it typically takes 30 minutes for the department's employees to register a new car. In Mandaue, the fixed overhead rate computed on ah estimated 4,000 direct labor hours is P8 per direct labor hour, whereas the variable overhead rate is estimated at P3 per direct labor hour. During July, 7,600 cars were registered in Mandaue and 3,700 direct labor hours were worked in registering those vehicles. For the month, variable overhead was P10,730 and fixed overhead was P29,950 Required: a. Compute the overhead variances using a four-variance approach. b. Compute the overhead variances using a three-variance approach c. Compute the overhead variances using a two-variance approach d. Compute the overhead variances uUsing a one way approach.arrow_forwardplease help mearrow_forward

- AirQual Test Corporation provides on-site air quality testing services. The company has provided the following cost formulas and actual results for the month of February. Revenue Technician wages Mobile lab operating expenses office expenses Advertising expenses Insurance Miscellaneous expenses Jobs Revenue Expenses: Technician wages Mobile lab operating The company uses the number of jobs as its measure of activity. For example, mobile lab operating expenses should be $4,500 plus $35 per job, and the actual mobile lab operating expenses for February were $9,240. The company expected to work 140 jobs in February, but actually worked 146 jobs. expenses Required: Prepare a flexible budget performance report showing AirQual Test Corporation's revenue and spending variances and activity variances for February, (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values.)…arrow_forwardAlpesharrow_forwardAirQual Test Corporation provides on-site air quality testing services. The company has provided the following cost formulas and actual results for the month of February Revenue Technician wages Mobile lab operating expenses office expenses Advertising expenses Insurance Miscellaneous expenses Jobs Revenue Expenses: Technician wages Mobile lab operating expenses The company uses the number of jobs as its measure of activity. For example, mobile lab operating expenses should be $4,900 plus $34 per job, and the actual mobile lab operating expenses for February were $8,820. The company expected to work 120 jobs in February, but actually worked 128 jobs. Office expenses Fixed Component per Month Required: Prepare a flexible budget performance report showing AirQual Test Corporation's revenue and spending variances and activity variances for February (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance).…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

What is variance analysis?; Author: Corporate finance institute;https://www.youtube.com/watch?v=SMTa1lZu7Qw;License: Standard YouTube License, CC-BY