Accounting For Governmental & Nonprofit Entities

18th Edition

ISBN: 9781259917059

Author: RECK, Jacqueline L., Lowensohn, Suzanne L., NEELY, Daniel G.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 9, Problem 13C

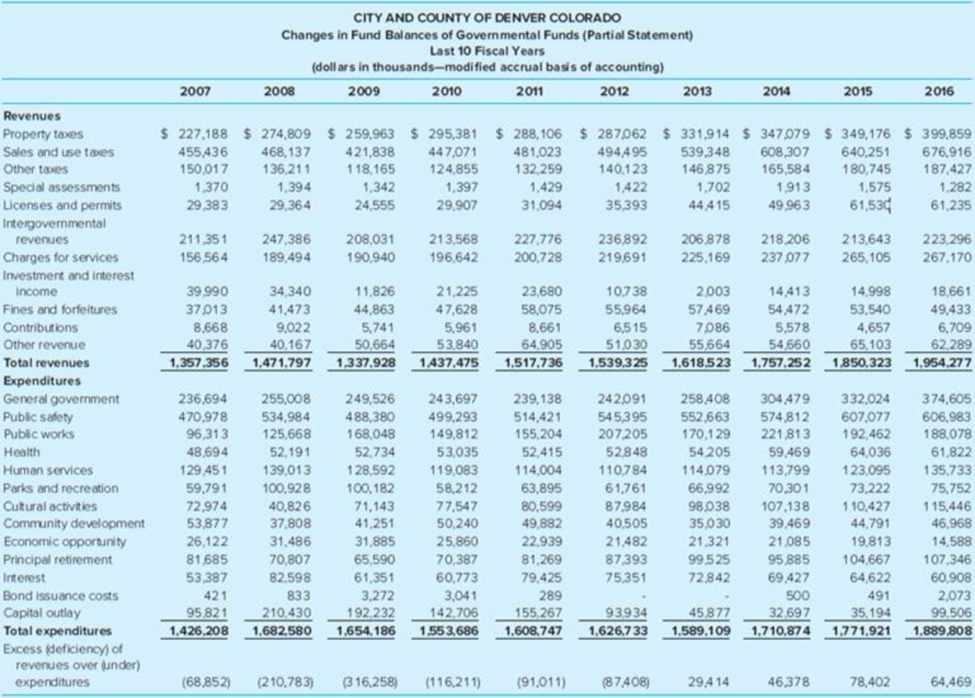

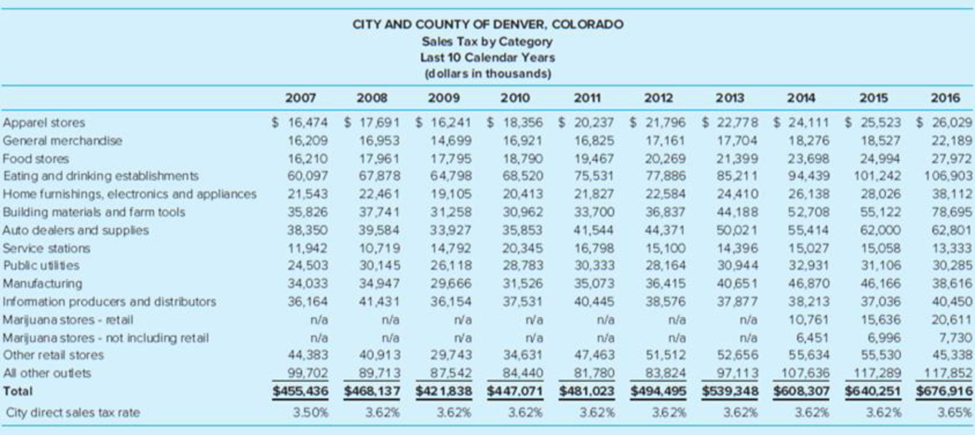

The MD&A for the 2016 City and County of Denver CAFR is included as Appendix B in this chapter. Following are two tables that have been adapted from the statistical section of the CAFR. Use the MD&A and the provided statistical tables to complete this case.

Required

- a. What are the three largest sources of governmental funds revenue? What percentage of the governmental funds revenue is from each of these sources?

- b. Sales tax is a large part of Denver’s tax revenue. Using information from the MD&A and trend information from both statistical tables provided, discuss trends in Denver’s sales tax revenues and your projection for sales tax revenues over the next two to three years.

- c. What are the three largest sources of governmental funds expenditures? What percentage of the governmental funds expenditures does each of the three sources represent and what has been the trend for each over the past few years?

- d. Compare the growth in revenue to the growth in expenditures over the past 10 years. Discuss any changes in the overall expenditure growth patterns you have seen and would expect to see over the next two to three years.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Required information

[The following information applies to the questions displayed below.]

The county collector of Sun County is responsible for collecting all property taxes levied by funds and governments within

the boundaries of the county. To reimburse the county for estimated administrative expenses of operating the tax

custodial fund, the custodial fund deducts 2 percent from the collections for the town, the school district, and the other

towns. The total amount deducted is added to the collections for the county and remitted to the Sun County General

Fund.

The following events occurred during the year:

1. Current-year tax levies to be collected by the custodial fund were

County General Fund

Town of Bayshore

Sun County Consolidated School District

Total

$ 7,664,480

5,508,845

10,778,175

$23,951,500

2. During the year, $20,358,000 of the current year's taxes was collected.

3. The 2 percent administrative collection fee was recorded. A schedule of amounts collected for each…

1) Determine whether each of the following elements should be classified as taxes, licenses, permits, intergovernmental revenues, service fees, fines, forfeiture, or miscellaneous income in a government fund.

A) Government sales and usage taxes. B) Citizen payments for the use of the city pool.

C) Building permits to build a roof in a house

2) Explain income, expenses, receipts, and payment? Draw the figure with an example? What is the difference between the two statements? 15 degrees.

1) Determine whether each of the following elements should be classified as taxes, licenses, permits, intergovernmental revenues, service fees, fines, forfeiture, or miscellaneous income in a government fund.

A) Government sales and usage taxes.

B) Citizen payments for the use of the city pool.

C) Building permits to build a roof in a house

2) Explain income, expenses, receipts, and payment? Draw the figure with an example? What is the difference between the two statements?

Chapter 9 Solutions

Accounting For Governmental & Nonprofit Entities

Ch. 9 - Prob. 1QCh. 9 - Prob. 2QCh. 9 - Prob. 3QCh. 9 - What is a component unit?Ch. 9 - Explain the difference between a blended and a...Ch. 9 - Prob. 6QCh. 9 - Prob. 7QCh. 9 - Prob. 8QCh. 9 - Give examples of items (transactions) that would...Ch. 9 - Prob. 10Q

Ch. 9 - Prob. 11QCh. 9 - Prob. 12CCh. 9 - The MDA for the 2016 City and County of Denver...Ch. 9 - Prob. 14CCh. 9 - Prob. 17.1EPCh. 9 - Prob. 17.2EPCh. 9 - Prob. 17.3EPCh. 9 - Interim government financial reports a. Are not...Ch. 9 - The comprehensive annual financial report (CAFR)...Ch. 9 - Prob. 17.6EPCh. 9 - The city council of Lake Jefferson wants to...Ch. 9 - Prob. 17.8EPCh. 9 - Prob. 17.9EPCh. 9 - Prob. 17.10EPCh. 9 - A positive unassigned fund balance can be found in...Ch. 9 - A city established a special revenue fund for gas...Ch. 9 - The county commission passed into law through an...Ch. 9 - Prob. 17.14EPCh. 9 - Prob. 17.15EPCh. 9 - Prob. 18EPCh. 9 - Prob. 19EPCh. 9 - The City of Lynnwood was recently incorporated and...Ch. 9 - Prob. 21EPCh. 9 - Prob. 22EPCh. 9 - Prob. 23EPCh. 9 - Prob. 24EPCh. 9 - You have recently started working as the...Ch. 9 - Prob. 26EPCh. 9 - Prob. 27EP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- In recording its property tax assessment for the year, a county government estimates the amount of uncollectible taxes. How is this estimate reflected in the financial statements: An expenditure under General Government Operations. A credit to Taxes Receivable. A reduction in Property Tax Revenue. A debit to Estimated Uncollectible Taxes.arrow_forwardRequired Information [The following information applies to the questions displayed below.] The county collector of Sun County is responsible for collecting all property taxes levied by funds and governments within the boundaries of the county. To reimburse the county for estimated administrative expenses of operating the tax custodial fund, the custodial fund deducts 4 percent from the collections for the town, the school district, and the other towns. The total amount deducted is added to the collections for the county and remitted to the Sun County General Fund. The following events occurred during the year: 1. Current-year tax levies to be collected by the custodial fund were County General Fund Town of Bay Sun County Consolidated School District Total $10,373,000 4,860,000 6,570,000 $21,803,000 2. During the year, $13,740,000 of the current year's taxes was collected. 3. The 4 percent administrative collection fee was recorded. A schedule of amounts collected for each participant,…arrow_forwardRequired information [The following information applies to the questions displayed below.] The county collector of Sun County is responsible for collecting all property taxes levied by funds and governments within the boundaries of the county. To reimburse the county for estimated administrative expenses of operating the tax custodial fund, the custodial fund deducts 4 percent from the collections for the town, the school district, and the other towns. The total amount deducted is added to the collections for the county and remitted to the Sun County General Fund. The following events occurred during the year: 1. Current-year tax levies to be collected by the custodial fund were County General Fund Town of Bayshore Sun County Consolidated School District Total $10,473,000 4,910,000 6,620,000 $22,003,000 2. During the year, $13,840,000 of the current year's taxes was collected. 3. The 4 percent administrative collection fee was recorded. A schedule of amounts collected for each…arrow_forward

- Required information [The following information applies to the questions displayed below.] The county collector of Sun County is responsible for collecting all property taxes levied by funds and governments within the boundaries of the county. To reimburse the county for estimated administrative expenses of operating the tax custodial fund, the custodial fund deducts 4 percent from the collections for the town, the school district, and the other towns. The total amount deducted is added to the collections for the county and remitted to the Sun County General Fund. The following events occurred during the year: 1. Current-year tax levies to be collected by the custodial fund were County General Fund Town of Bayshore Sun County Consolidated School District Total $10,473,000 4,910,000 6,620,000 $22,003,000 2. During the year, $13,840,000 of the current year's taxes was collected. 3. The 4 percent administrative collection fee was recorded. A schedule of amounts collected for each…arrow_forward3. The following information is available for the preparation of the government-wide financial statements for the City of Northern Pines for the year ended June 30, 2024: Expenses: General government $ 10,712,000 Public safety 22,500,000 Public works 11,290,000 Health and sanitation 6,010,000 Culture and recreation 4,198,000 Interest on long-term debt, governmental type 450,000 Water and sewer system 10,710,000 Parking system 412,000 Revenues: Charges for services, general government 1,206,000 Charges for services, public safety 210,000 Operating grant, public safety 800,000 Charges for services, health, and sanitation 2,580,000 Operating grant, health, and sanitation 1,210,000 Charges for services, culture, and recreation 1,998,000 Charges for services, water, and sewer 11,588,000 Charges for services, parking system 388,000 Property taxes 27,900,000 Sales taxes 17,600,000 Investment earnings, business-type 325,000 Special item—gain on…arrow_forwardWhat are the main sources of revenues for the City of Phoenix, including both governmental and business-type activities?arrow_forward

- Which of the following should not be included in the introductory section of a city's CAFR? A.) Management discussion and analysis B.) Letter of transmittal C.) Government Finance Officer's certificate of achievement for excellence in financial reporting D.) Photos of city officialsarrow_forwardRequired information Skip to question [The following information applies to the questions displayed below.] The county collector of Sun County is responsible for collecting all property taxes levied by funds and governments within the boundaries of the county. To reimburse the county for estimated administrative expenses of operating the tax custodial fund, the custodial fund deducts 5 percent from the collections for the town, the school district, and the other towns. The total amount deducted is added to the collections for the county and remitted to the Sun County General Fund. The following events occurred during the year: Current-year tax levies to be collected by the custodial fund were County General Fund $ 10,383,000 Town of Bayshore 4,865,000 Sun County Consolidated School District 6,575,000 Total $ 21,823,000 During the year, $13,750,000 of the current year's taxes was collected. The 5 percent administrative…arrow_forwardCalculate the government-wide financial position ratio, the quick ratio, and the debt per capita ratio (assuming a population of 250,000) for the City of Cottonwood using the financial statements on the previous page. 1. Enter the government-wide financial position ratio for the City of Cottonwood, along with the calculation you used to arrive at your answer. 2. Enter the quick ratio for the City of Cottonwood, along with the calculation you used to arrive at your answer. 3. Enter the debt per capita ratio for the City of Cottonwood, along with the calculation you used to arrive at your answer. Assume a population of 250,000.arrow_forward

- Major sources of revenue for the local government units (LGUs) are the taxescollected under the Local Government Code of 1991 or what Republic Act? a. Republic Act No. 7160 b. Republic Act No. 7260 c. Republic Act No. 7150arrow_forward1) State whether each of the following items should be classified as taxes, licences and permits, intergovernmental revenues, charges for services, fines and forfeits or miscellaneous revenue in a governmental fund. g) Charges to a local university for extra city police protection during sporting events. h) Barbers and hairdressers’ registration fees. i) Donation to government due to coronovirus. j) Parkingarrow_forwardProperty taxes levied on the citizens of the Hill County would most appropriately be budgeted in which of the following budgets? Select one :- a. expenditures budget b. Capital budget. c. Flexible budget. d. Operating budget. Unreserved Fund Balance in Governmental entities is equal to which of the following in commercial entities: Select one : a. Capital Stock b. Bond sinking Fund c. Unearned revenue d. Retained earningsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

What is Fund Accounting?; Author: Aplos;https://www.youtube.com/watch?v=W5D5Dr0j9j4;License: Standard Youtube License