Fundamentals of Cost Accounting

5th Edition

ISBN: 9781259565403

Author: William N. Lanen Professor, Shannon Anderson Associate Professor, Michael W Maher

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 8, Problem 41E

Prepare a Production Cost Report: Weighted-Average Method

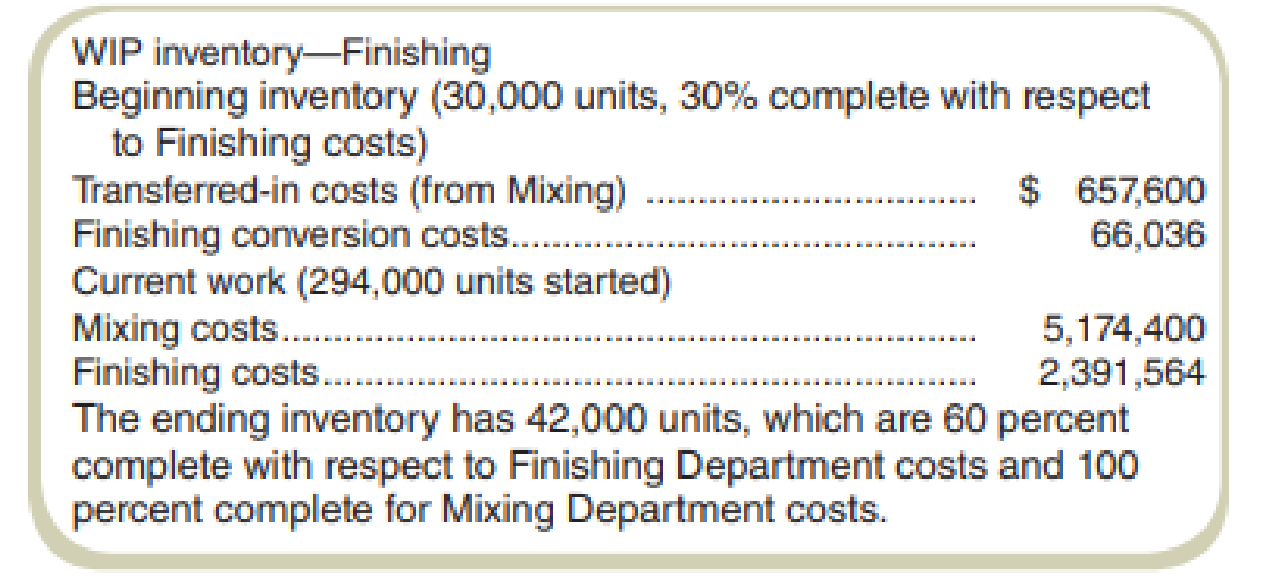

Yarmouth Company produces a liquid solvent in two departments: Mixing and Finishing. Accounting records at Yarmouth show the following information for Finishing operations for February (no new material is added in the Finishing Department):

Required

Prepare a production cost report using the weighted-average method.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Question

None

Tech Zone Store offers volume discounts: 0-100 units at $50 each, 101-200 units at $45 each, over 200 units at $40 each. If a customer orders 250 units, their total purchase cost is?

Chapter 8 Solutions

Fundamentals of Cost Accounting

Ch. 8 - What are the characteristics of industries most...Ch. 8 - A manufacturing company has records of its...Ch. 8 - If costs increase from one period to another, will...Ch. 8 - What are the five steps to follow when computing...Ch. 8 - What is the distinction between equivalent units...Ch. 8 - Which method, weighted-average or FIFO, better...Ch. 8 - It has been said that a prior departments costs...Ch. 8 - The more important individual unit costs are for...Ch. 8 - Assume that the number of units transferred out of...Ch. 8 - The management of a liquid cleaning product...

Ch. 8 - We have discussed two methods for process costing,...Ch. 8 - A friend owns and operates a consulting firm that...Ch. 8 - The controller of a local firm that uses a...Ch. 8 - Throughout the chapter, we treated conversion...Ch. 8 - Consider a manufacturing firm with multiple...Ch. 8 - Prob. 16CADQCh. 8 - Would process costing work well for a service...Ch. 8 - Compute Equivalent Units: Weighted-Average Method...Ch. 8 - Compute Equivalent Units: FIFO Method Refer to the...Ch. 8 - Compute Equivalent Units: Weighted-Average Method...Ch. 8 - Compute Equivalent Units: FIFO Method Refer to the...Ch. 8 - Compute Equivalent Units Magic Company adds...Ch. 8 - Equivalent Units: Weighted-Average Process Costing...Ch. 8 - Compute Equivalent Units: Ethical Issues Aaron...Ch. 8 - Equivalent Units and Cost of Production By...Ch. 8 - Compute Costs per Equivalent Unit:...Ch. 8 - Prob. 27ECh. 8 - Compute Equivalent Units: FIFO Method Materials...Ch. 8 - Compute Equivalent Units and Cost per Equivalent...Ch. 8 - Cost Per Equivalent Unit: Weighted-Average Method...Ch. 8 - Compute Costs per Equivalent Unit:...Ch. 8 - Prob. 32ECh. 8 - Compute Costs per Equivalent Unit: FIFO Method...Ch. 8 - Prob. 34ECh. 8 - Compute Costs per Equivalent Unit:...Ch. 8 - Assign Costs to Goods Transferred Out and Ending...Ch. 8 - Prob. 37ECh. 8 - Assign Costs to Goods Transferred Out and Ending...Ch. 8 - Prepare a Production Cost Report: FIFO Method...Ch. 8 - Prepare a Production Cost Report: Weighted-Average...Ch. 8 - Prepare a Production Cost Report: Weighted-Average...Ch. 8 - Prepare a Production Cost Report: FIFO Method...Ch. 8 - Cost of Production: Weighted-Average and FIFO...Ch. 8 - Operation Costing: Ethical Issues Brokia...Ch. 8 - Prob. 45ECh. 8 - Prob. 46PCh. 8 - Prob. 47PCh. 8 - Prob. 48PCh. 8 - Prob. 49PCh. 8 - Prob. 50PCh. 8 - Prob. 51PCh. 8 - Prepare a Production Cost Report and Show Cost...Ch. 8 - Prob. 53PCh. 8 - Prob. 54PCh. 8 - Prepare a Production Cost Report: Weighted-Average...Ch. 8 - Prob. 56PCh. 8 - Prob. 57PCh. 8 - Prob. 58PCh. 8 - Prob. 59PCh. 8 - Process Costing and Ethics: Increasing Production...

Additional Business Textbook Solutions

Find more solutions based on key concepts

Mary Williams, owner of Williams Products, is evaluating whether to introduce a new product line. After thinkin...

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

11-9. Identify a company with a product that interests you. Consider ways the company could use customer relati...

Business Essentials (12th Edition) (What's New in Intro to Business)

1-1. Define marketing and outline the steps in the marketing process. (AASCB: Communication)

Marketing: An Introduction (13th Edition)

There is a huge demand in the United States and elsewhere for affordable women’s clothing. Low-cost clothing re...

Operations Management

Fundamental and Enhancing Characteristics. Identify whether the following items are fundamental characteristics...

Intermediate Accounting (2nd Edition)

The Warm and Toasty Heating Oil Company used to deliver heating oil by sending trucks that printed out a ticket...

Essentials of MIS (13th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY