Concept explainers

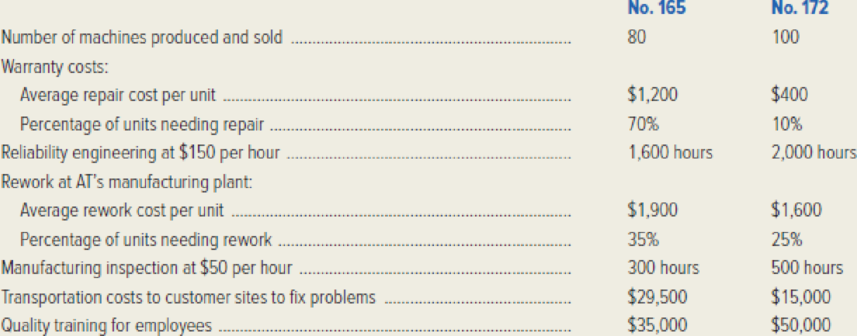

Advanced Technologies (AT) produces two compression machines that are popular with manufacturers of plastics: no. 165 and no. 172. Machine no. 165 has an average selling price of $60,000, whereas no. 172 typically sells for approximately $55,000. The company is very concerned about quality and has provided the following information:

Required:

- 1. Classify the preceding costs as prevention, appraisal, internal failure, or external failure.

- 2. Using the classifications in requirement (1), compute AT’s quality costs for machine no. 165 in dollars and as a percentage of sales revenues. Also calculate prevention, appraisal, internal failure, and external failure costs as a percentage of total quality costs.

- 3. Repeat requirement (2) for machine no. 172.

- 4. Comment on your findings, noting whether the company is “investing” its quality expenditures differently for the two machines.

- 5. Quality costs can be classified as observable or hidden. What are hidden quality costs, and how do these costs differ from observable costs?

1.

Classify the given costs of company A as prevention, appraisal, internal failure, or external failure.

Explanation of Solution

Absorption Costing: “Absorption costing is a method that allocates “direct labor, direct materials, fixed manufacturing overhead and variable manufacturing overhead” to products and it is required by GAAP for the purpose of external reporting”.

Variable Costing: Managers frequently use variable costing for internal purposes for taking decision making. The cost of goods manufactured includes direct materials, direct labor, and variable factory overhead. Fixed factory overhead treated as period (fixed) expense.

Classify the given costs of company A as prevention, appraisal, internal failure, or external failure as follows:

| Particular | Type of costs |

| Warranty costs | External failure |

| Reliability engineering | Prevention |

| Rework at AT’s manufacturing plant | Internal failure |

| Manufacturing inspection | Appraisal |

| Transportation costs to customer sites | External failure |

| Quality training for employees | Prevention |

Table (1)

Type of costs:

- A prevention cost is the cost that is used to prevent or minimize the defects. Example: Quality engineering, warranty costs.

- The appraisal cost is the costs that are used to determine whether any defects exist.

- The internal failure costs is the costs that helps to repair the defects (found any) prior to product delivery.

- The external failure cost is the costs that incurred after defective products have been delivered.

2.

Calculate the quality costs of company A for machine no. 165 in dollars and as a percentage of sales revenues, and also compute the percentage of total quality costs of prevention, internal failure, appraisal, and external failure costs.

Explanation of Solution

Calculate the quality costs of company A for machine no. 165 in dollars and as a percentage of sales revenues as follows:

| Company S | ||||

| Quality-Cost Report for Machine 165 | ||||

| For the Month of May | ||||

| Particulars | Units or hours (A) | Cost per unit (B) | Total cost | Percentage of Sales |

| Sales revenue: | 80 units | $60,000 | $4,800,000 | |

| Prevention: | ||||

| Reliability engineering | 1,600 hours | $150 | $ 240,000 | |

| Quality training | 35,000 | |||

| Total (a) | $ 275,000 | 5.73% | ||

| Appraisal (inspection): | 300 hours | $50 | $ 15,000 | 0.31% |

| Total (b) | $ 15,000 | 0.31% | ||

| Internal failure | 80 units | $665 (1) | $ 53,200 | 1.11% |

| Total (c) | $ 53,200 | 1.11% | ||

| External failure: | ||||

| Warranty costs: | 80 units | $840 (2) | $ 67,200 | |

| Transportation to customers | 29,500 | |||

| Total (d) | $ 96,700 | 2.01% | ||

| Total quality costs | $ 439,900 | 9.16% | ||

Table (2)

Compute the percentage of total quality costs of prevention, internal failure, appraisal, and external failure costs as follows:

| Company S | ||

| Quality-Cost Report for Machine 165 | ||

| For the Month of May | ||

| Particulars | Amounts in ($) (a) | Percentage of Total |

| Prevention | $275,000 | 62.51% |

| Appraisal | 15,000 | 3.41% |

| Internal failure | 53,200 | 12.09% |

| External failure | 96,700 | 21.98% |

| Total | $439,900 | |

Table (3)

Working note (1):

Compute the cost per unit of internal failure for machine 165 as follows:

Working note (2):

Compute the warranty cost per unit for machine 165 as follows:

3.

Calculate the quality costs of company A for machine no. 172 in dollars and as a percentage of sales revenues, and also compute the percentage of total quality costs of prevention, internal failure, appraisal, and external failure costs.

Explanation of Solution

Calculate the quality costs of company A for machine no. 172 in dollars and as a percentage of sales revenues as follows:

| Company S | ||||

| Quality-Cost Report for Machine 172 | ||||

| For the Month of May | ||||

| Particulars | Units or hours (A) | Cost per unit (B) | Total cost | Percentage of Sales |

| Sales revenue: | 100 units | $55,000 | $5,500,000 | |

| Prevention: | ||||

| Reliability engineering | 2,000 hours | $150 | $ 300,000 | |

| Quality training | 50,000 | |||

| Total (a) | $ 350,000 | 6.36% | ||

| Appraisal (inspection): | 500 hours | $50 | $ 25,000 | 0.45% |

| Total (b) | $ 25,000 | 0.45% | ||

| Internal failure | 100 units | $400 (3) | $ 40,000 | 0.73% |

| Total (c) | $ 40,000 | 0.73% | ||

| External failure: | ||||

| Warranty costs: | 100 units | $40(4) | $ 4,000 | |

| Transportation to customers | 15,000 | |||

| Total (d) | $ 19,000 | 0.35% | ||

| Total quality costs | $ 434,000 | 7.89% | ||

Table (2)

Compute the percentage of total quality costs of prevention, internal failure, appraisal, and external failure costs as follows:

| Company S | ||

| Quality-Cost Report for Machine 172 | ||

| For the Month of May | ||

| Particulars | Amounts in ($) (a) | Percentage of Total |

| Prevention | $350,000 | 80.65% |

| Appraisal | 25,000 | 5.76% |

| Internal failure | 40,000 | 9.22% |

| External failure | 19,000 | 4.38% |

| Total | $434,900 | |

Table (3)

Working note (3):

Compute the cost per unit of internal failure for machine 172 as follows:

Working note (4):

Compute the warranty cost per unit for machine 172 as follows:

4.

Describe whether the company is “investing” its quality expenditures differently for the two machines.

Explanation of Solution

Yes, the company is “investing” its quality expenditures differently for the two machines. With respect to prevention and appraisal the company spent almost over 86% of the total quality expenditures for machine 172. Whereas, the company spent only 66% (approximately) of the total quality expenditures for machine 165. Thus, the net result is lower internal and external failure costs and, perhaps more important, lower total quality costs as a percentage of sales (7.89% for no. 172 and 9.16% for no. 165). In this case, the company proves the essence of total quality management (TQM) systems when compared with conventional quality control procedures.

5.

Explain the meaning of hidden quality costs, and describe the manner in which the hidden quality costs differ from observable costs.

Explanation of Solution

Prevention, appraisal, internal failure, and external failure costs are the costs that are visible which could be measured and reported. If inferior products make it to the marketplace, it often creates customer dissatisfaction; as a result a loss would occur on the sales of the defective product and perhaps on other goods as well. Thus, the opportunity cost related with lost sales is a hidden quality cost to the company which is very difficult to measure.

Want to see more full solutions like this?

Chapter 8 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

- b) Paste Corporation has established new plant for the production of new product called “Diazinon”. There are two different manufacturing methods available to produce Diazinon. Either by using a process or an order base method. The assembling technique won't influence the quality or deals of the item. The evaluated manufacturing expenses of the two strategies are as per the following:Process base Order baseVariable manufacturing cost per unit..................... Rs14.00 Rs.17.60Fixed manufacturing cost per year ......................Rs. 2,440,000 Rs. 1,320,000 The organization's statistical surveying office has suggested an initial selling cost of Rs.35 per unit for Diazinon. The yearly fixed selling and admin costs of the Diazinon are Rs.500, 000. The variable selling and regulatory costs are Rs. 2 per unit. Required: I. CM ratio and variable expenses ratio. If Paste Corporation uses the:1. Process base manufacturing method.2. Order base manufacturing method.II. Break-even point in…arrow_forwardAbernathy, Inc., produces two different generators and is concerned about their quality. The company has identified the following quality activities and costs associated with the two products: Required: 1. Calculate the quality cost per unit for each product, and break this unit cost into quality cost categories. Which of the two seems to have the lowest quality? 2. How might a manager use the unit quality cost information?arrow_forwardLarsen, Inc., produces two types of electronic parts and has provided the following data: There are four activities: machining, setting up, testing, and purchasing. Required: 1. Calculate the activity consumption ratios for each product. 2. Calculate the consumption ratios for the plantwide rate (direct labor hours). When compared with the activity ratios, what can you say about the relative accuracy of a plantwide rate? Which product is undercosted? 3. What if the machine hours were used for the plantwide rate? Would this remove the cost distortion of a plantwide rate?arrow_forward

- Lelime Precision Tools makes cutting tools for metalworking operations. It makes two types of tools: A6, a regular cutting tool, and EX4, a high-precision cutting tool. A6 is manufactured on a regular machine, but EX4 must be manufactured on both the regular machine and a high-precision machine. The following information is available: (Click to view the information.) Read the requirements. Requirement 1. What product mix - that is, how many units of A6 and EX4 - will maximize Lelime's operating income? Show your calculations. (Enter an amount in each input cell including zero balances.) Begin by calculating the benefit from only selling A6 or EX4. Contribution margin per hour of the constrained resource Hours of constrained resource X Total contribution margin Less: Lease costs of the high-precision machine Net relevant benefit A6 10 50000 500000 500000 EX4 70 50000 3500000 350000 3150000arrow_forwardMozaic Inc. has decided to introduce a new product, which can be manufactured by either a computer-assisted manufacturing system (CAM) or a labor-intensive production system (LIP). The manufacturing method will not affect the quality of the product. The estimated manufacturing costs by the two methods are as follows: www CAM System LIP System Direct Material $5.00 $5.60 Direct Labor (DLH) 0.5 DLH x $12 $6.00 0.8 DLH x $9 $7.20 Variable Overhead 0.5 DLH x $6 $3.00 0.8 DLH x $6 $4.80 Fixed Overhead* $2,440,000 $1,320,000 * These costs are directly traceable to the new product line. They would not be incurred if the new product were not produced. The company's marketing research department has recommended an introductory unit sales price of $30. Selling expenses are estimated to be $500,000 annually plus $2 for each unit sold. (Ignore income taxes.) Required: 1. Describe the circumstances under which the firm should employ each of the two manufacturing methods. 2. Identify some business…arrow_forwardEthan Manufacturing Incorporated produces floor mats for automobiles. The owner, Joseph Ethan, has asked you to assist in estimating maintenance costs. Together, you and Joseph determine that the single best cost driver for maintenance costs is machine hours. These data are from the previous fiscal year for maintenance costs and machine hours: 1. What is the cost equation for maintenance costs using the high-low method? 2. Calculate the mean absolute percentage error (MAPE) for the cost equation you developed in requirement 1. Month Maintenance Costs Machine Hours 1 $ 2,660 1,750 2 2,820 1,830 3 2,970 1,910 4 3,080 1,930 5 3,160 1,960 6 3,130 1,940 7 3,070 1,920 8 2,910 1,900 9 2,680 1,760 10 2,280 1,160 11 2,290 1,360 12 2,510 1,650arrow_forward

- Required information [The following information applies to the questions displayed below.] Celestial Products, Inc., has decided to introduce a new product, which can be manufactured by either a computer- assisted manufacturing system or a labor-intensive production system. The manufacturing method will not affect the quality of the product. The estimated manufacturing costs by the two methods are as follows: Direct material Direct labor (DLH denotes direct-labor hours) Variable overhead Fixed overhead* Computer-Assisted Manufacturing System $ Volume 0.5DLH @ $25.50 0.5DLH @ $16.50 9.00 12.75 8.25 $4,410,000 units Labor-Intensive Production System $ 0.8DLH @ $21.00 0.8DLH @ $16.50 *These costs are directly traceable to the new product line. They would not be incurred if the new product were not produced. 9.90 16.80 13.20 $2,730,000 The company's marketing research department has recommended an introductory unit sales price of $75.00. Selling expenses are estimated to be $900,000…arrow_forwardLogicCO is a fast-growing manufacturer of computer chips. Direct materials are added at the start of the production process. Conversion costs are added evenly during the process. Some units of this product are spoiled as a result of defects not detectable before inspection of finished goods. Spoiled units are disposed of at zero net disposal value. uses the FIFO method of process costing. Summary data and weighted-average data for are as follows: Requirements : 1. For each cost category, compute equivalent units. Show physical units in the first column. 2. Summarize total costs to account for; calculate cost per equivalent unit for each cost category; and assign costs to units completed and transferred out (including normal spoilage), to abnormal spoilage, and to units in ending work in process. 3. Should 's managers choose the weighted-average method or the FIFO method? Explain.arrow_forwardCost Estimation; Machine Replacement; Ethics Hardison Inc. manufactures glass for officebuildings in Florida. As a result of age and wear, a critical machine in the production process hasbegun to produce quality defects. Hardison is considering replacing the old machine with a newmachine, either brand A or brand B. The manufacturer has provided Hardison with the following dataon the costs of operation of each machine brand at various levels of output:Output(square yards)Brand AEstimated Total CostsBrand BEstimated Total Costs2,000 $ 97,000 $ 120,0004,000 125,000 160,0008,000 180,000 200,00016,000 225,000 260,00032,000 280,000 300,00064,000 438,000 368,000Required1. Graph the data for the two brands of machines.2. Use the high-low method to determine the cost equation for each brand of machine and use the results tocalculate the costs of operating each machine if Hardison’s output is expected to be 25,000 square yardsarrow_forward

- Dacosta & Co. makes electronic components. Chris Dacosta, the president, recently instructed Vice President Jim Bruegger to develop a total quality control program "if we don't at least the quality improvements our competitors are he soon began by listing various "costs Dacosta incurs. The first six items that came to mind were (Click the icon to view the information) Classify each item as a prevention cost, an appraisal cost, an internal failure cost, or an external failure cost. Then, determine the total cost of quality by category. Begin by classifying each item as a prevention cost, an appraisal cost, an internal failure cost, or an external failure cost by entering each amount in the appropriate column, then, determine the total cost of quality by category. (If an input field is not used in the table leave the input field empty; do not enter a zero.) Prevention Cost Appraisal Cost Internal Failure Cost External Failure Cost 15000 More info 27500 Print 30000 a Costs incurred by…arrow_forwardPlanet Fit, Inc., produces two basic types of weight-lifting equipment, Model 9 and Model 14. Pertinent data are as follows: LOADING... (Click the icon to view the data.) The weight-lifting craze suggests that Planet Fit can sell enough of either Model 9 or Model 14 to keep the plant operating at full capacity. Both products are processed through the same production departments. Read the requirements LOADING... . Before determining which products to produce, let's calculate the contribution margin per unit and the contribution margin per machine hour for each machine. (Reduce the fixed manufacturing overhead to the lowest possible ratio of machine hours in order to calculate the contribution margin per machine hour. Example: 8:4 would be 2:1. Enter the amounts to the nearest cent.) Model 9 Model 14 - = Contribution margin per unit ÷ = Contribution margin…arrow_forwardIn a manufacturing company, overhead allocations are made for three reasons: (1) to determine the full cost of a product; (2) to encourage efficient resource usage; and (3) to compare alternative courses of action for management purposes. 1. Why must overhead be considered a product cost under generally accepted accounting principles? 2. Ayam Company makes plastic dog carriers. The manufacturing process is highly automated and the machine time needed to make any size crate is approximately the same. Ayam’s management decides to begin producing plastic lawn furniture and, to do so, two additional pieces of automated equipment are acquired. Annual depreciation on the new pieces of equipment is P38,000. Should the new overhead cost be allocated over all products manufactured by Ayam? Explain.arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning