Concept explainers

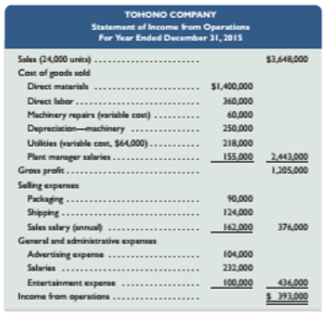

Refer to the information in Problem 8-1B. Tohono Company’s actual income statement for 2015 follows.

Required

- Prepare a flexible budget performance report for 2015.

Analysis Component

- Analyze and interpret both the (a) sales variance and (b) direct materials cost variance.

Concept introduction:

Flexible Budget:

A flexible budget, also known as variation budget adjusts to changes in volume or activity. Flexible budgets are prepared for comparing actual to budgeted performances at many levels of activity during the previous year. In order to accurately predict the changes in costs, management identifies them into fixed or variable costs.

Requirement 1:

Flexible budget performance report for 2015 of the company.

Answer to Problem 2PSB

Flexible budget performance report for the year ended December 31, 2015 (Amount in $):

| Particulars | Flexible budget | Actual Results | Variances | Favorable/ Unfavorable |

| Sales (24, 000 units) | 36, 00, 000 | 36, 48, 000 | 48, 000 | F |

| Variable costs: | ||||

| Direct materials | 14, 40, 000 | 14, 00, 000 | 40, 000 | F |

| Direct labor | 3, 12, 000 | 3, 60, 000 | 48, 000 | U |

| Machinery repairs | 68, 400 | 60, 000 | 8, 400 | F |

| Utilities | 60, 000 | 64, 000 | 4, 000 | U |

| Packaging | 96, 000 | 90, 000 | 6, 000 | F |

| Shipping | 1, 39, 200 | 1, 24, 000 | 15, 200 | F |

| Total variable costs | 21, 15, 600 | 20, 98, 000 | 17, 600 | F |

| Contribution margin | 14, 84, 400 | 15, 50, 000 | 65, 600 | F |

| Fixed costs: | ||||

| Depreciation- machinery | 2, 50, 000 | 2, 50, 000 | 0 | |

| Utilities | 1, 50, 000 | 1, 54, 000 | 4, 000 | U |

| Plant manager salaries | 1, 40, 000 | 1, 55, 000 | 15, 000 | U |

| Sales salary | 1, 60, 000 | 1, 62, 000 | 2, 000 | U |

| Advertising expense | 81, 000 | 1, 04, 000 | 23, 000 | U |

| Salaries | 2, 41, 000 | 2, 32, 000 | 9, 000 | F |

| Entertainment expense | 90, 000 | 1, 00, 000 | 10, 000 | U |

| Total fixed costs | 11, 12, 000 | 11, 57, 000 | 36, 000 | U |

| Income from operations | 3, 72, 400 | 3, 93, 000 | 20, 600 | F |

Explanation of Solution

For preparation of flexible budget of the company, following formulas would be used:

As per information in problem 8-1B, it is given that sales are $30, 00, 000 and sales volume is 20, 000 units. Flexible budget has to be prepared at sales volume of 24, 000 units. Now, required calculations have been made in the following manner:

| Particulars | Amount per unit | Amount |

| Sales (24, 000 units) | $30, 00, 000/ 20, 000 units = $150 | $150*24, 000 units = $36, 00, 000 |

| Variable costs: | ||

| Direct materials | $12, 00, 000/ 20, 000 units = $60 | $60*24, 000 units = $14, 40, 000 |

| Direct labor | $2, 60, 000/ 20, 000 units = $13 | $13*24, 000 units = $3, 12, 000 |

| Machinery repairs | $57, 000/ 20, 000 units = $2.85 | $2.85*24, 000 units = $68, 400 |

| Utilities | $50, 000/ 20, 000 units = $2.5 | $2.5*24, 000 units=$60, 000 |

| Packaging | $80, 000/ 20, 000 units = $4 | $4*24, 000 units = $96, 000 |

| Shipping | $1, 16, 000/ 20, 000 units = $5.8 | $5.8*24, 000 units = $1, 39, 200 |

| Total variable costs | $88.15 | 21, 15, 600 |

Further, contribution margin can be calculated using the below- mentioned formulas:

Thus, contribution margin would be:

Fixed costs would remain same irrespective of the changes in sales volume. Also, Income from operations can be computed using the following formula:

Further, variances can be calculated using the following formula:

Therefore, flexible budget performance report as asked in the given problem is given below:

Flexible budget performance report for the year ended December 31, 2015 (Amount in $):

| Particulars | Flexible budget | Actual Results | Variances | Favorable/ Unfavorable |

| Sales (24, 000 units) | 36, 00, 000 | 36, 48, 000 | 48, 000 | F |

| Variable costs: | ||||

| Direct materials | 14, 40, 000 | 14, 00, 000 | 40, 000 | F |

| Direct labor | 3, 12, 000 | 3, 60, 000 | 48, 000 | U |

| Machinery repairs | 68, 400 | 60, 000 | 8, 400 | F |

| Utilities | 60, 000 | 64, 000 | 4, 000 | U |

| Packaging | 96, 000 | 90, 000 | 6, 000 | F |

| Shipping | 1, 39, 200 | 1, 24, 000 | 15, 200 | F |

| Total variable costs | 21, 15, 600 | 20, 98, 000 | 17, 600 | F |

| Contribution margin | 14, 84, 400 | 15, 50, 000 | 65, 600 | F |

| Fixed costs: | ||||

| Depreciation- machinery | 2, 50, 000 | 2, 50, 000 | 0 | |

| Utilities | 1, 50, 000 | 1, 54, 000 | 4, 000 | U |

| Plant manager salaries | 1, 40, 000 | 1, 55, 000 | 15, 000 | U |

| Sales salary | 1, 60, 000 | 1, 62, 000 | 2, 000 | U |

| Advertising expense | 81, 000 | 1, 04, 000 | 23, 000 | U |

| Salaries | 2, 41, 000 | 2, 32, 000 | 9, 000 | F |

| Entertainment expense | 90, 000 | 1, 00, 000 | 10, 000 | U |

| Total fixed costs | 11, 12, 000 | 11, 57, 000 | 36, 000 | U |

| Income from operations | 3, 72, 400 | 3, 93, 000 | 20, 600 | F |

Thus, income from operations of the company at flexible budget is coming out to be $3, 72, 400.

Concept introduction:

Sales variance:

It is the monetary difference between actual and budgeted sales. It is used to analyze changes in sales level over time. It can be calculated using the following formula:

Direct material cost variance:

It is the difference between standard cost of direct materials specified for the output achieved and the actual cost of direct materials used and can be calculated as under:

Requirement 2:

Analyze and interpret (a) sales variance and (b) direct materials cost variance.

Answer to Problem 2PSB

Sales variance of the company is favorable because the budgeted sales figure is less than that of actual sales during the period.

Direct material cost variance of the company is favorable due to the reason that the actual materials used were less than that of budgeted materials.

Explanation of Solution

Sales variance can be calculated using the following formula:

The calculation for same has been tabulated below:

| Particulars | Amount (In $) | Amount per unit (In $) |

| Budgeted sales (A) | 36, 00, 000 | 150 |

| Actual sales (B) | 36, 48, 000 | $36, 48, 000/ 24, 000 units = $152 |

| Sales variance (B-A) (Favorable) | 48, 000 | 2 |

Also, direct material cost variance can be computed using the below- mentioned formula:

The calculation for same has been tabulated below:

| Particulars | Amount (In $) | Amount per unit (In $) |

| Budgeted materials (A) | 14, 40, 000 | 60 |

| Actual materials used (B) | 14, 00, 000 | $14, 00, 000/ 24, 000 units = $58.33 |

| Direct materials cost variance (A-B) (Favorable) | 40, 000 | 1.67 |

Analysis of sales and direct materials cost variance:

Sales variance of the company is favorable because the budgeted sales figure is less than that of actual sales during the period. Also, per unit cost of actual sales is higher than that of budgeted sales.

Further, direct material cost variance of the company is favorable due to the reason that the actual materials used were less than that of budgeted materials. Also, per unit cost of actual materials is paid less than that estimated for budgeted materials.

Want to see more full solutions like this?

Chapter 8 Solutions

MANAGERIAL ACCOUNTING FUND. W/CONNECT

- The May 2018 revenue and cost information for Boise Outfitters, Inc. follows: (Click the icon to view the revenue and cost information.) Prepare a standard cost income statement for management through gross profit. Report all standard cost variances for management's use. Has management done a good or poor job of controlling costs? Explain. (Use a minus sign or parentheses to enter any contra expenses. Enter all other amounts as positive numbers.) Boise Outfitters, Inc. - X Data table Standard Cost Income Statement For the Month Ended May 31, 2018 Sales Revenue (at standard) Cost of Goods Sold (at standard) Direct Materials Cost Variance Direct Materials Efficiency Variance Direct Labor Cost Variance Direct Labor Efficiency Variance Variable Overhead Cost Variance Variable Overhead Efficiency Variance Fixed Overhead Cost Variance Fixed Overhead Volume Variance Print Done Gross Profit $ 560,000 344,000 700 F 6,000 F 4,700 U 2,300 F 3,000 U 750 U 1,500 U 8,700 Farrow_forwardThe following data were drawn from the records of Fanning Corporation. Planned volume for year (static budget) Standard direct materials cost per unit Standard direct labor cost per unit Total expected fixed overhead costs. Actual volume for the year (flexible budget) Actual direct materials cost per unit Actual direct labor cost per unit Total actual fixed overhead costs Required a. Prepare a materials variance information table showing the standard price, the actual price, the standard quantity, and the actual quantity. b. Calculate the materials price and usage variances. Indicate whether the variances are favorable (F) or unfavorable (U). c. Prepare a labor variance information table showing the standard price, the actual price, the standard hours, and the actual hours. d. Calculate the labor price and usage variances. Indicate whether the variances are favorable (F) or unfavorable (U). e. Calculate the predetermined overhead rate, assuming that Fanning uses the number of units as…arrow_forwardUsing a flexible budgeting approach how do I prepare a performance report for the current department for September 2016, comparing actual overhead cost with budgeted overhead cost for 5700 hours. Separate overhead costs into variable and fix components and show the amounts of any variances between actual and budget in amounts.arrow_forward

- A company that wants to report both spending and efficiency variances for 1 point overhead must compute budget allowances for both the actual amount of activity that occurred and the standard level of activity allowed for the level of output achieved. True O Falsearrow_forward1. Prepare a performance report that compares static budget and actual costs for the period just ended (i.e., the report that Kellerman likely used when assessing his performancearrow_forwardRequired:(i) Prepare a standard costing profit statement, and a profit statement based on actual figures for the month of May. (ii) Prepare a statement of the variances which reconciles the actual with the standard profit or loss figure.arrow_forward

- Overhead variance, missing information. Consider the following two situations—cases A and B— independently. Data refer to operations for April 2017. For each situation, assume standard costing. Also assume the use of a flexible budget for control of variable and fixed manufacturing overhead based on machine-hours.arrow_forwardOverhead variance, missing information. Consider the following two situations—cases A and B— independently. Data refer to operations for April 2017. For each situation, assume standard costing. Also assume the use of a exible budget for control of variable and xed manufacturing overhead based on machine-hours.arrow_forwardPLEASE ANSWER THE FOLLOWING QUESTIONS: Requirements 1. Compute the total sales-volume variance, the total sales-mix variance, and the total sales-quantity variance. (Calculate all variances in terms of contribution margin.) Show results for each product in your computations. 2. What inferences can you draw from the variances computed in requirement 1? Data table Budget for 2020 Selling Variable Cost Cartons Product Price per Carton Sold Kostor $11.00 $ Limba $ 23.00 $ 6.40 16.15 Actual for 2020 Selling Variable Cost Cartons Price per Carton Sold 7.40 138,600 16.35 59,400 132,000 $11.60 S 88,000 $ 24.40 $arrow_forward

- Match the definition the term. Terms: Cost variance Overhead cost variance Price variance Quantity variance Standard costs Sales budget Production Budget Balanced scorecard Profit center Cost center Definitions: 1. A plan showing the units of goods to be sold and sales to be derived; usually starting pointing the budgeting process. 2. A system of performance measures, including the nonfinancial measures, used to asses manager performance. 3. A department that incurs cost and genrate revenues, such as a selling department 4. The difference between actual and budgeted sales or cost caused by the difference between the actual per unit and the budgeted price per unit. 5. The difference between actual cost and standard cost, made up of a price variance and a quantity variance. 6. The difference between the total overhead cost actually incurred and the total overhead cost applied to products 7. The difference between the actual budgeted cost caused by…arrow_forwardRequired: a) Using Activity Based Costing, calculate the rate for each cost driver. b) Using activity based budgeting, prepare a budgeted yearly operating statement for Aero3D Ltd. Show the following separately, within the statement. i. The budgeted output for each product per year; ii. The contribution to profits for each product and in total before charging activity based costs; iii. The profit for each product and in total after charging activity based costs but before charging core costs (non-activity based costs); iv. The total profit after charging core based costs.arrow_forwardProduction budgets are used as a basis for the preparation of which of the following budgets? a. Operating expensesb. Direct materials purchases, direct labour cost, and factory overhead cost c. Sales in poundsd. Sales in unitsarrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,