Principles of Cost Accounting

17th Edition

ISBN: 9781305087408

Author: Edward J. Vanderbeck, Maria R. Mitchell

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 7, Problem 7E

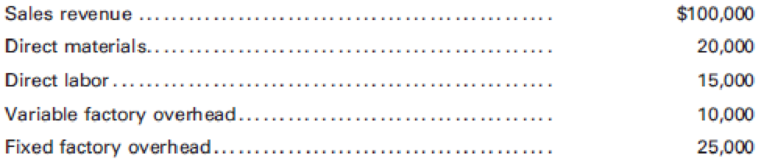

Starburst Inc. has the following items and amounts as part of its

Determine the total dollar amounts for the above items that would appear in a flexible budget at the following volume levels, assuming that both levels are within the relevant range:

- a. 8,000-unit level of sales and production

- b. 12,000-unit level of sales and production (Hint: You must first determine the unit selling price and certain unit costs.)

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Damerly Company (a Utah employer) wants to give a holiday bonus check of $375 to each employee. As it wants the check amount to be $375, it will need to gross-up the amount of the bonus. Calculate the withholding taxes and the gross amount of the bonus to be made to John Rolen if his cumulative earnings for the year are $46,910. Besides being subject to social security taxes and federal income tax (supplemental rate), a 4.95% Utah income tax must be withheld on supplemental payments.

Please given correct answer general Accounting

Hii ticher please given correct answer general Accounting

Chapter 7 Solutions

Principles of Cost Accounting

Ch. 7 - Prob. 1QCh. 7 - Prob. 2QCh. 7 - Prob. 3QCh. 7 - Prob. 4QCh. 7 - Explain zero-based budgeting and how it differs...Ch. 7 - Prob. 6QCh. 7 - Which operating budget must be prepared before the...Ch. 7 - Prob. 8QCh. 7 - Why is it important to have front-line managers...Ch. 7 - If the sales forecast estimates that 50,000 units...

Ch. 7 - What are the advantages and disadvantages of each...Ch. 7 - What three operating budgets can be prepared...Ch. 7 - Prob. 13QCh. 7 - What are the three budgets that are needed in...Ch. 7 - Why might Web-based budgeting be more useful than...Ch. 7 - What is a flexible budget?Ch. 7 - Why is a flexible budget better than a master...Ch. 7 - Why is it important to distinguish between...Ch. 7 - Why is the concept of relevant range important...Ch. 7 - In comparing actual sales revenue to flexible...Ch. 7 - How would you define the following? a. Theoretical...Ch. 7 - Is it possible for a factory to operate at more...Ch. 7 - If a factory operates at 100% of capacity one...Ch. 7 - How is the standard cost per unit for factory...Ch. 7 - When allocating service department costs to...Ch. 7 - The sales department of Macro Manufacturing Co....Ch. 7 - The sales department of F. Pollard Manufacturing...Ch. 7 - Barnes Manufacturing Co. forecast October sales to...Ch. 7 - Prepare a cost of goods sold budget for the Crest...Ch. 7 - Prepare a cost of goods sold budget for MacLaren...Ch. 7 - Roman Inc. has the following totals from its...Ch. 7 - Starburst Inc. has the following items and amounts...Ch. 7 - Using the following per-unit and total amounts,...Ch. 7 - Cortez Manufacturing, Inc. has the following...Ch. 7 - Prob. 10ECh. 7 - Prob. 11ECh. 7 - Prob. 12ECh. 7 - Prob. 13ECh. 7 - Calculating factory overhead The normal capacity...Ch. 7 - The Sales Department of Minimus Inc. has forecast...Ch. 7 - Sales, production, direct materials, direct labor,...Ch. 7 - Budgeted selling and administrative expenses for...Ch. 7 - Prob. 4PCh. 7 - Selling and administrative expense budget and...Ch. 7 - Preparing a flexible budget Use the information in...Ch. 7 - Preparing a performance report Use the flexible...Ch. 7 - Preparing a performance report Use the flexible...Ch. 7 - Flexible budget for factory overhead Presented...Ch. 7 - Prob. 10PCh. 7 - Overhead application rate Creole Manufacturing...Ch. 7 - Overhead application rate Roll Tide Manufacturing...Ch. 7 - Flexible budgeting, performance measurement, and...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On a particular date, FedEx has a stock price of $89.27 and an EPS of $7.11. Its competitor, UPS, had an EPS of $0.38. What would be the expected price of UPS stock on this date, if estimated using the method of comparables? A) $4.77 B) $7.16 C) $9.54 D) $10.50arrow_forwardHow much will you accumulated after 35 year? General accountingarrow_forwardGiven correct answer general Accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Responsibility Accounting| Responsibility Centers and Segments| US CMA Part 1| US CMA course; Master Budget and Responsibility Accounting-Intro to Managerial Accounting- Su. 2013-Prof. Gershberg; Author: Mera Skill; Rutgers Accounting Web;https://www.youtube.com/watch?v=SYQ4u1BP24g;License: Standard YouTube License, CC-BY