Advanced Accounting

12th Edition

ISBN: 9781305084858

Author: Paul M. Fischer, William J. Tayler, Rita H. Cheng

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 7, Problem 7.2E

Exercise 7 (LO 4) Equity adjustments with

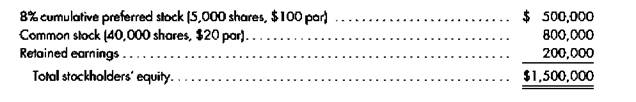

Brian Construction Company did not pay preferred dividends in 2014.

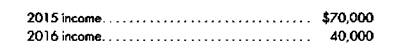

Assume Ace Construction has me following net income (loss) for 2015 and 2016 and does not pay any dividends:

Roller maintains its investment account under the cost method. Prepare the cost-to-equity conversion entries necessary on Roller Company's books to adjust its investment account to the simple equity balance as of January 1, 2017.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Please solve this question financial accounting

General Accounting Problem solve

I won't to this question answer general Accounting

Chapter 7 Solutions

Advanced Accounting

Ch. 7 - Prob. 1UTICh. 7 - Prob. 2UTICh. 7 - Prob. 3UTICh. 7 - Prob. 4UTICh. 7 - Exercise 1 (LO 1) Purchase of shares directly from...Ch. 7 - Prob. 2ECh. 7 - Prob. 3ECh. 7 - Prob. 4ECh. 7 - Prob. 5ECh. 7 - Prob. 6E

Ch. 7 - Prob. 7.1ECh. 7 - Exercise 7 (LO 4) Equity adjustments with...Ch. 7 - Prob. 8.1ECh. 7 - Prob. 8.2ECh. 7 - Prob. 8.3ECh. 7 - Prob. 7.1.1PCh. 7 - Prob. 7.1.2PCh. 7 - Prob. 7.2.1PCh. 7 - Prob. 7.2.2PCh. 7 - Prob. 7.2.3PCh. 7 - Prob. 7.2.4PCh. 7 - Problem 7-4 (LO 3) Sale of partial, then balance...Ch. 7 - Prob. 7.5PCh. 7 - Prob. 7.7.1PCh. 7 - Prob. 7.8.2PCh. 7 - Prob. 7A.1APCh. 7 - Prob. 7A.2.1APCh. 7 - Prob. 7A.2.2AP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Financial instruments products; Author: fi-compass;https://www.youtube.com/watch?v=gvxozM3TUIg;License: Standard Youtube License