Concept explainers

(1)

Note receivable:

Note receivable refers to a written promise for the amounts to be received within a stipulated period of time. This written promise is issued by a debtor or borrower to lender or creditor. Notes receivable is an asset of a business.

To prepare:

(1)

Explanation of Solution

Journal entries of FL bank are as follows:

FL bank agreed to settle the debt in exchange for land worth $16 million.

| Date | Accounts title and explanation | Post Ref. | Debit ($) |

Credit ($) |

| Land | 16,000,000 | |||

| Loss on debt restructuring | 6,000,000 | |||

| Note receivable | 20,000,000 | |||

| Accrued interest receivable (1) | 2,000,000 | |||

| (To record the settlement of land for the debt) |

Table (1)

Working note:

(2)(a)

Interest accrued from last year.

(2)(a)

Explanation of Solution

| Date | Accounts title and explanation | Post Ref. | Debit ($) |

Credit ($) |

| January 1, 2018 | Loss on troubled debt restructuring | 8,584,980 | ||

| Accrued interest receivable (1) | 2,000,000 | |||

| Note receivable

|

6,584,980 | |||

| (To record accrued interest) |

Table (2)

Working note:

| $ | $ | |

| Previous value: | ||

| Interest Accrued 2017 (1) | 2,000,000 | |

| Principal | 20,000,000 | |

| Carrying amount of the receivables | 22,000,000 | |

| New value: | ||

| Interest

|

3,169,870 | |

| Principal

|

10,245,150 | |

| Present value of the receivable | (13,415,02) | |

| Loss | 8,584,980 |

Table (3)

- PV factor of 3.16987 (Present value of an ordinary annuity of $1: n = 4, i = 10%) is taken from the table value (Refer Table 4 in Appendix from textbook).

- PV factor of 0.68301 (Present value of $1: n = 4, i = 10%) is taken from the table value (Refer Table 2 in Appendix from textbook).

(b)

Reduce the interest payment to $1 Million each:

(b)

Explanation of Solution

| Date | Accounts title and explanation | Post Ref. | Debit ($) |

Credit ($) |

| December 31, 2018 | Cash (required by new agreement) | 1,000,000 | ||

| Note receivable (Balance) | 341,502 | |||

| Interest revenue

|

1,341,502 | |||

| (To record the interest revenue ) |

Table (4)

| Date | Accounts title and explanation | Post Ref. | Debit ($) |

Credit ($) |

| December 31, 2019 | Cash (required by new agreement) | 1,000,000 | ||

| Note receivable (Balance) | 375,652 | |||

| Interest revenue

|

1,375,652 | |||

| (To record the interest revenue ) |

Table (5)

| Date | Accounts title and explanation | Post Ref. | Debit ($) |

Credit ($) |

| December 31, 2020 | Cash (required by new agreement) | 1,000,000 | ||

| Note receivable (Balance) | 413,217 | |||

| Interest revenue

|

1,413,217 | |||

| (To record the interest revenue ) |

Table (6)

| Date | Accounts title and explanation | Post Ref. | Debit ($) |

Credit ($) |

| December 31, 2021 | Cash (required by new agreement) | 1,000,000 | ||

| Note receivable (Balance) | 454,609 | |||

| Interest revenue

|

1,454,609 | |||

| (To record the interest revenue ) |

Table (7)

(c)

Reduce the principal to $15 Million:

(c)

Explanation of Solution

| Date | Accounts title and explanation | Post Ref. | Debit ($) |

Credit ($) |

| December 31, 2021 | Cash (required by new agreement) | 15,000,000 | ||

| Note receivable (Balance) | 15,000,000 | |||

| (To record the principal ) |

Table (8)

Note:

- $15,000,000 is rounded to amortize the note.

Working note:

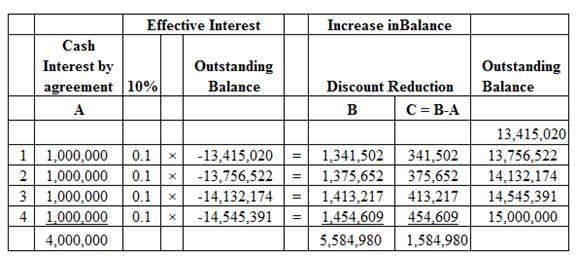

Amortization schedule:

Image (1)

(3)

To defer all payments until the maturity date:

(3)

Explanation of Solution

| Date | Accounts title and explanation | Post Ref. | Debit ($) |

Credit ($) |

| January 1, 2018 | Loss on troubled debt restructuring | 3,029,397 | ||

| Accrued interest receivable (1) | 2,000,000 | |||

| Note receivable

|

1,029,397 | |||

| (To record the loss on debt ) | ||||

| December 31, 2018 | Note receivable (Balance) | 1,897,060 | ||

| Interest revenue

|

1,897,060 | |||

| (To record the interest revenue ) | ||||

| December 31, 2019 | Note receivable (Balance) | 2,086,766 | ||

| Interest revenue

|

2,086,766 | |||

| (To record the interest revenue ) | ||||

| December 31, 2020 | Note receivable (Balance) | 2,295,443 | ||

| Interest revenue (Refer schedule) | 2,295,443 | |||

| To record the interest revenue ) | ||||

| December 31, 2021 | Note receivable (Balance) | 2,295,443 | ||

| Interest revenue (Refer schedule) | 2,295,443 | |||

| To record the interest revenue ) | ||||

| December 31, 2021 | Cash (required by new agreement) | 27,775,000 | ||

| Note receivable (Balance) | 27,775,000 | |||

| (To record the principal ) | ||||

Table (8)

Working notes:

| $ | |

| Previous value: | |

| Interest Accrued 2017 (1) | 2,000,000 |

| Principal | 20,000,000 |

| Carrying amount of the receivables | |

| New value: | |

| Principal

|

18,970,603 |

| Loss | 3,029,397 |

Table (9)

- PV factor of 0.68301 (Present value of $1: n = 4, i = 10%) is taken from the table value (Refer Table 2 in Appendix from textbook).

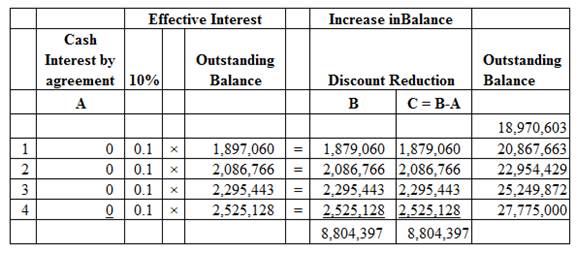

Amortization schedule:

Image (2)

Want to see more full solutions like this?

Chapter 7 Solutions

GEN COMBO INTERMEDIATE ACCOUNTING; CONNECT ACCESS CARD

- Problem 7-15 (Algo) Troubled debt restructuring [Appendix 7B] Rothschild Chair Company, Incorporated, was indebted to First Lincoln Bank under a $35 million, 10% unsecured note. The note was signed January 1, 2014, and was due December 31, 2027. Annual interest was last paid on December 31, 2022. At January 1, 2024, Rothschild Chair Company was experiencing severe financial difficulties and negotiated a restructuring of the terms of the debt agreement. Note: Use appropriate factor(s) from the tables provided. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Required: Prepare all journal entries by First Lincoln Bank to record the restructuring and any remaining transactions, for current and future years, relating to the debt under each of the independent circumstances below: 1. First Lincoln Bank agreed to settle the debt in exchange for land having a fair value of $31 million but carried on Rothschild Chair Company's books at $28 million. 2. First Lincoln Bank…arrow_forwardb. Forgave the accrued interest for one year amounting to P12,000. Case 5 Brewed entered into two restructuring agreement in 2021, Brewed is currently experiencing financial difficulties. The details of the restructuring of its note payable are as follows: Note payable- Café Company On December 31, 2021, Brewed Company entered into a debt restructunng agreement with Café Company. A note for P100,000 and one yea accrued interest was due on this date to Café Company. The termis restructuring are as follows: a. Reduced the principal obligation to P70,000. b. Forgave the accrued interest for one year amounting to P12,00. c. Extend the maturity date to December 31, 2024.arrow_forwardRestructuring (Debtor) Oakwood Corporation is delinquent on a 2,400,000, 10% note to Second National Bank that was due January 1, 2019. At that time, Oakwood owed the principal amount plus 34,031.82 of accrued interest. Oakwood enters into a debt restructuring agreement with the bank on January 2, 2019. Required: Prepare the journal entries for Oakwood to record the debt restructuring agreement and all subsequent interest payments assuming the following independent alternatives: 1. The bank extends the repayment date to December 31, 2022, forgives the accrued interest owed, reduces the principal by 200,000, and reduces the interest rate to 8%. 2. The bank extends the repayment date to December 31, 2022, forgives the accrued interest owed, reduces the principal by 200,000, and reduces the interest rate to 1%. 3. The bank accepts 160,000 shares of Oakwoods 55 par value common stock, which is currently selling for 14.50 per share, in full settlement of the debt. 4. The bank accepts land with a fair value of 2,300,000 in full settlement of the debt. The land is being carried on Oakwoods books at a cost of 2,200,000.arrow_forward

- On December 31, 2023, Green Bank enters into a debt restructuring agreement with Windsor Inc., which is now experiencing financial trouble. The bank agrees to restructure a $2.9-million, 10% note receivable issued at par by the following modifications: 1. Reducing the principal obligation from $2.9 million to $2.76 million 2. Extending the maturity date from December 31, 2023, to December 31, 2026 3. Reducing the interest rate from 10% to 8% Windsor pays interest at the end of each year. On January 1, 2027, Windsor pays $2.76 million in cash to Green Bank. Windsor prepares financial statements in accordance with IFRS 9. Assume instead that Windsor follows ASPE. Using (1) a financial calculator or (2) Excel function Rate, calculate the rate of interest that Windsor should use to calculate its interest expense in future periods. (Hint: Refer to Chapter 3 for tips on calculating.) (Round answer to 4 decimal places, e.g. 1.2246%.) Rate of interest %arrow_forwardOn December 31, 2023, Green Bank enters into a debt restructuring agreement with Teal Mountain Inc., which is now experiencing financial trouble. The bank agrees to restructure a $2.1-million, 10% note receivable issued at par by the following modifications: 1. Reducing the principal obligation from $2.1 million to $2.00 million Extending the maturity date from December 31, 2023, to December 31, 2026 3. Reducing the interest rate from 10% to 8% 2. Teal Mountain pays interest at the end of each year. On January 1, 2027, Teal Mountain pays $2.00 million in cash to Green Bank. Teal Mountain prepares financial statements in accordance with IFRS 9. (b) Prepare an entry at December 31, 2023, based on the results of your calculation. (Round answers to 0 decimal places, e.g. 5,275. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List debit entry…arrow_forwardOn December 31, 2023, Green Bank enters into a debt restructuring agreement with Windsor Inc., which is now experiencing financial trouble. The bank agrees to restructure a $2.9-million, 10% note receivable issued at par by the following modifications: 1. Reducing the principal obligation from $2.9 million to $2.76 million 2. Extending the maturity date from December 31, 2023, to December 31, 2026 3. Reducing the interest rate from 10% to 8% Windsor pays interest at the end of each year. On January 1, 2027, Windsor pays $2.76 million in cash to Green Bank. Windsor prepares financial statements in accordance with IFRS 9. Prepare the interest payment entry for Windsor on December 31, 2025, and the entry on January 1, 2027. (Round answer to O decimal places, e.g. 5,275. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries…arrow_forward

- Rothschild Chair Company, Incorporated, was indebted to First Lincoln Bank under a $40 million, 10% unsecured note. The note was signed January 1, 2014, and was due December 31, 2027. Annual interest was last paid on December 31, 2022. At January 1, 2024. Rothschild Chair Company was experiencing severe financial difficulties and negotiated a restructuring of the terms of the debt agreement Note: Use appropriate factor(s) from the tables provided. (FV of $1. PV of $1. FVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) Required: Prepare all journal entries by First Lincoln Bank to record the restructuring and any remaining transactions, for current and future years, relating to the debt under each of the independent circumstances below: 1. First Lincoln Bank agreed to settle the debt in exchange for land having a fair value of $36 million but carried on Rothschild Chair Company's books at $33 million. 2. First Lincoln Bank agreed to (a) forgive the interest accrued from last year, (b)…arrow_forward21 Details for one of the loan of BB Company that is probably impaired during the period is as follows: The company made a loan of P40,000,000 to a customer with similar credit risk to BB Company on January 1, 2021. Interest is receivable on this loan at the end of each year at 2% per annum for the next five years. The loan was properly recorded and classified as amortized cost. The company made and initial assessment of the loan and the total expected credit losses over the life of the loan was P1,000,000. The discount rate applicable was at 2%. On January 1, 2021, the probability of default over the next 12 months was 5%. At December 31, 2021, there was a significant increase in the credit risk on the loan made by BB Company, the expert assessed that the total expected credit losses over the life of the loan was increase to P2,200,000. The discount rate applicable was at 2%. How much is the balance of the allowance for credit losses as of December 31, 2021?arrow_forwardOn December 31, 2023, Crane Bank enters into a debt restructuring agreement with Troubled Inc., which is now experiencing financial trouble. The bank agrees to restructure a $1.0-million, 10% note receivable issued at par by the following modifications: 1. Reducing the principal obligation from $1.0 million to $0.80 million Extending the maturity date from December 31, 2023, to December 31, 2026 Reducing the interest rate from 10% to 9% 2. 3. Troubled pays interest at the end of each year. On January 1, 2027, Troubled Inc. pays $0.80 million in cash to Crane Bank for the principal. The market rate is currently 9%. Answer the following questions related to Crane Bank (the creditor). Click here to view the factor table PRESENT VALUE OF 1. Click here to view the factor table PRESENT VALUE OF AN ANNUITY OF 1. What interest rate should Crane Bank use to calculate the loss on the debt restructuring? Interest rate List of Accounts 10 % Using (1) factor tables, (2) a financial calculator, or…arrow_forward

- (Term Modification without Gain—Debtor’s Entries) On December 31, 2017, American Bank enters into a debt restructuring agreement with Barkley Company, which is now experiencing financial trouble. The bank agrees to restructure a 12%, issued at par, $3,000,000 note receivable by the following modifications:1. Reducing the principal obligation from $3,000,000 to $2,400,000.2. Extending the maturity date from December 31, 2017, to January 1, 2021.3. Reducing the interest rate from 12% to 10%.Barkley pays interest at the end of each year. On January 1, 2021, Barkley Company pays $2,400,000 in cash to American Bank.Instructions(a) Will the gain recorded by Barkley be equal to the loss recorded by American Bank under the debt restructuring?(b) Can Barkley Company record a gain under the term modification mentioned above? Explain.(c) Assuming that the interest rate Barkley should use to compute interest expense in future periods is 1.4276%, prepare the interest payment schedule of the note…arrow_forwardAt January 1, 2024, NCI Industries, Incorporated was indebted to First Federal Bank under a $246,000, 10% unsecured note. . The note was signed January 1, 2017, and was due December 31, 2025. Annual interest was last paid on December 31, 2022. • NCI was experiencing severe financial difficulties and negotiated a restructuring of the terms of the debt agreement. • First Federal agreed to reduce last year's interest and the remaining two years' interest payments to $11,844 each and delay all payments until December 31, 2025, the maturity date. Required: Prepare the journal entries by NCI Industries, Incorporated, necessitated by the restructuring of the debt at (1) January 1, 2024; (2) December 31, 2024; and (3) December 31, 2025. Note: Do not round intermediate calculations. Round final answers to the nearest whole dollar. If no entry is required for a transaction/event, select "No journal entry required in the first account field. Use tables, Excel, or a financial calculator. (FV of…arrow_forwardLO 10-2, 10-5 ne acor-10-assets-ratio 1. 2. 3. re is no assets ratio is less than 1.0.) PA10-2 Recording and Reporting Current Liabilities with Evaluation of Effects on the Debt-to- Assets Ratio Using data from PA10-1, complete the following requirements. Required: Prepare journal entries for each of the transactions through August 31. Prepare all adjusting entries required on December 31. Show how all of the liabilities arising from these items are reported on the balance sheet at December 31.arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning