FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

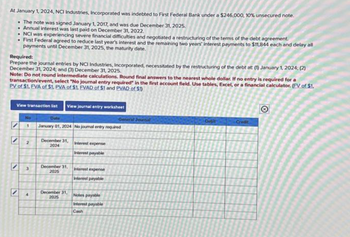

Transcribed Image Text:At January 1, 2024, NCI Industries, Incorporated was indebted to First Federal Bank under a $246,000, 10% unsecured note.

. The note was signed January 1, 2017, and was due December 31, 2025.

Annual interest was last paid on December 31, 2022.

• NCI was experiencing severe financial difficulties and negotiated a restructuring of the terms of the debt agreement.

• First Federal agreed to reduce last year's interest and the remaining two years' interest payments to $11,844 each and delay all

payments until December 31, 2025, the maturity date.

Required:

Prepare the journal entries by NCI Industries, Incorporated, necessitated by the restructuring of the debt at (1) January 1, 2024; (2)

December 31, 2024; and (3) December 31, 2025.

Note: Do not round intermediate calculations. Round final answers to the nearest whole dollar. If no entry is required for a

transaction/event, select "No journal entry required in the first account field. Use tables, Excel, or a financial calculator. (FV of $1.

PV of $1. EVA of $1. PVA of $1. EVAD of $1 and PVAD of $1)

View transaction list View journal entry worksheet

'

No

1

4

Date

January 01, 2024 No joumal entry required

December 31, Interest expense

2024

Interest payable

December 31,

2025

Interest expense

Interest payable

December 31, Notes payable

2025

Interest payable

Cash

General Journal

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On January 1, 2025, Tamarisk Corporation redeemed $460,000 of bands at 98. At the time of redemption, the unamortized premium was $13,800. Prepare the corporation's journal entry to record the reacquisition of the bonds. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.) Account Titles and Explanation Debit Creditarrow_forwardRothschild Chair Company, Incorporated, was indebted to First Lincoln Bank under a $40 million, 10% unsecured note. The note was signed January 1, 2014, and was due December 31, 2027. Annual interest was last paid on December 31, 2022. At January 1, 2024, Rothschild Chair Company was experiencing severe financial difficulties and negotiated a restructuring of the terms of the debt agreement. Note: Use appropriate factor(s) from the tables provided. (FV of $1. PV of $1. EVA of $1. PVA of $1. EVAD of $1 and PVAD of $.1) Required: Prepare all journal entries by First Lincoln Bank to record the restructuring and any remaining transactions, for current and future years, relating to the debt under each of the independent circumstances below: 1. First Lincoln Bank agreed to settle the debt in exchange for land having a fair value of $36 million but carried on Rothschild Chair Company's books at $33 million. 2. First Lincoln Bank agreed to (a) forgive the interest accrued from last year, (b)…arrow_forwardOn December 31 , 2018 Nicholas Co. is in financial difficulty and cannot pay a note due that day . It is a $3,300,000 8% issued at par note, payable to Key Bank. Key Bank agrees to accept from Nicholas equipment that has a fair value of 1,450,000, originally costing $2,400,000, with accumulated depreciation of $1,250,000. Key Bank also extends the maturity date to December 31, 2021, reduces the face amount of the note to $1,250,000, and reduces the interest rate to 6%, with interest payable at the end of each year. a. Nicholas should recognize a gain or loss on the transfer of the equipment of: b. At the end of each of the next three years Nicholas records the $ 75,000 interest paid to Key Bank as a: c. In determining the carrying value of the note at December 31, 2018 Key Bank uses an effective interest rate equal to: d. Key Bank records a loss on restructuring of: e. In recording the loss on restructuring, Key bank:arrow_forward

- Excel Corporation is experiencing financial difficulty and has met with their creditor (BMO) to explore their options related to a $1.5 million, 6% note payable that is outstanding. The note was issued on September 1, 2020 when the market rate of interest was 6%. There are two years remaining on the note and the current market rate of interest is 8%. Excel and BMO prepare financial statements in accordance with IERS. For each of the following independent situations prepare the journal entry that both Excel and BMO would on their books. a. BMO agrees to accept Excel common shares valued at $1,000,000 as settlement of the debt. 5. BMO agrees to accept land as settlement of the debt. The land is on the books of Excel for $500,000 and has a market value of $1,250,000. c. BMO agrees to modify the terms so that Excel is not paying any interest on the note for the remaining two years. d. BMO agrees to reduce the principal balance to $1,000,000 and requires interest only payments for the next…arrow_forwardBhupatbhaiarrow_forward[The following information applies to the questions displayed below.] Agrico Inc. accepted a 10-month, 12.8% (annual rate), $9,000 note from one of its customers on May 15, 2019; interest is payable with the principal at maturity. b-1. Prepare the horizontal model to record collection of the note and interest at maturity. (Use amounts with + for increases and amounts with – for decreases.) Please don't provide solution image based thankuarrow_forward

- am. 113.arrow_forwardRothschild Chair Company, Incorporated, was indebted to First Lincoln Bank under a $20 million, 10% unsecured note. The note was signed January 1, 2014, and was due December 31, 2027. Annual interest was last paid on December 31, 2022. At January 1, 2024, Rothschild Chair Company was experiencing severe financial difficulties and negotiated a restructuring of the terms of the debt agreement. Note: Use appropriate factor(s) from the tables provided. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Required: Prepare all journal entries by First Lincoln Bank to record the restructuring and any remaining transactions, for current and future years, relating to the debt under each of the independent circumstances below: 1. First Lincoln Bank agreed to settle the debt in exchange for land having a fair value of $16 million but carried on Rothschild Chair Company's books at $13 million. 2. First Lincoln Bank agreed to (a) forgive the interest accrued from last year, (b)…arrow_forwardBlue Cells Can contain On December 31, 2017, Short Co. is in financial difficulty and cannot pay a note due that day. It is a $2,000,000 face value note with $200,000 accrued interest payable to Bryan, Inc. The original market rate of interest on the note was 12.58613%. Bryan agrees to forgive the accrued interest, extend the maturity date (two years) to December 31, 2019, and reduce the interest rate to 4%. The present value of the restructured cash flows is $1,712,000 (using the original market rate). Do NOT add rows to the spreadsheet! Discount Cash Premium Interest payable Par Interest expense Discount on bond payable Yes Bonds payable No Loss on redemption Gain on redemptin Cash Interest payable Interest receivable Notes payable Gain on restructuring Loss on restructuring Discount on Note payable Premium on Note payable…arrow_forward

- At January 1, 2018, Brainard Industries, Inc., owed Second BancCorp $12 million under a 10% note due December 31, 2020. Interest was paid last on December 31, 2016. Brainard was experiencing severe financial difficultiesand asked Second BancCorp to modify the terms of the debt agreement. After negotiation Second BancCorpagreed to:a. Forgive the interest accrued for the year just ended.b. Reduce the remaining two years’ interest payments to $1 million each and delay the first payment untilDecember 31, 2019.c. Reduce the unpaid principal amount to $11 million.Required:Prepare the journal entries by Brainard Industries, Inc., necessitated by the restructuring of the debt at (1) January1, 2018; (2) December 31, 2019; and (3) December 31, 2020.arrow_forwardAt January 1, 2024, Mahmoud Industries, Incorporated, owed Second BancCorp $12 million under a 10% note due December 31, 2026. Interest was paid last on December 31, 2022. Mahmoud was experiencing severe financial difficulties and asked Second BancCorp to modify the terms of the debt agreement. After negotiation Second BancCorp agreed to: Forgive the interest accrued for the year just ended. Reduce the remaining two years’ interest payments to $1 million each and delay the first payment until December 31, 2025. Reduce the unpaid principal amount to $11 million. Required: Prepare the journal entries by Mahmoud Industries, Incorporated, necessitated by the restructuring of the debt at (1) January 1, 2024; (2) December 31, 2025; and (3) December 31, 2026.arrow_forwardAt January 1, 2024, Clayton Hoists Incorporated owed Third BancCorp $20 million, under a 10% note due December 31, 2025. Interest was paid last on December 31, 2022. Clayton was experiencing severe financial difficulties and asked Third BancCorp to modify the terms of the debt agreement. After negotiation Third BancCorp agreed to do the following: Note: Use appropriate factor(s) from the tables provided. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) • Forgive the interest accrued for the year just ended. • Reduce the remaining two years' interest payments to $1 million each. • Reduce the principal amount to $19 million. Required: 1-3. Prepare the journal entries by Third BancCorp necessitated by the restructuring of the debt at January 1, 2024, December 31, 2024 and December 31, 2025. Note: Enter your answers in whole dollars. If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your final answers…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education