Concept explainers

Cost Accumulation: Service

Youth Athletic Services (YAS) provides adult supervision for organized youth athletics. It has a president, William Mayes, and five employees. He and one of the other five employees manage all marketing and administrative duties. The remaining four employees work directly on operations. YAS has four

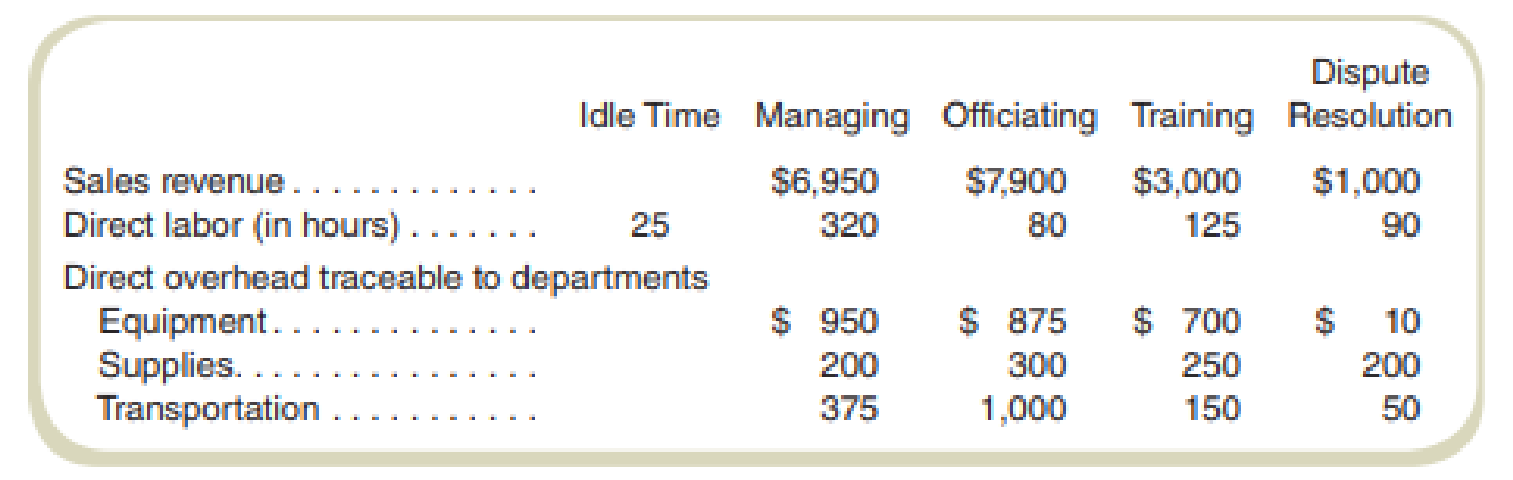

Some of the July operating data are as follows:

Other Data

- The four employees working in the operating departments all make $15 per hour.

- The fifth employee, who helps manage marketing and administrative duties, earns $2,250 per month, and William earns $3,000 per month.

- Indirect overhead amounted to $768 and is assigned to departments based on the number of direct labor-hours used. Because there are idle hours, some overhead will not be assigned to a department.

- In addition to salaries paid, marketing costs for items such as advertising and special promotions totaled $600.

- In addition to salaries paid, other administrative costs were $225.

- All revenue transactions are cash; all others are on account.

Required

Management wants to know whether each department is contributing to the company’s profit. Prepare an income statement for July that shows the revenue and cost of services for each department. Write a short report to management about departmental profitability. No inventories are kept.

Prepare an income statement for July that shows the revenue and cost of services for each department also write a short report to management about departmental profitability.

Explanation of Solution

Job costing: Job costing is a method of tracking and allocating costs to different jobs in the manufacturing process. This method of costing is used in entities where different jobs are incurred in each period.

Income statement for July that shows the revenue and cost of services:

| Income statement for the month ending July 31. | |||||

| Particulars | Managing | Officiating | Training | Dispute Resolution | Total |

| Revenue | $ 6,950 | $ 7,900 | $ 3,000 | $ 1,000 | $ 18,850 |

| Cost of services | |||||

| Labor | $ 4,800 (1) | $ 1,200 (2) | $ 1,875 (3) | $ 1,350 (4) | |

| Add: direct overhead | $ 1,525 (5) | $ 2,175 (6) | $ 1,100 (7) | $ 260 (8) | |

| Add: indirect overhead | $ 384 (9) | $ 96 (10) | $ 150 (11) | $ 108 (12) | |

| Total costs of services | $ 6,709 | $ 3,471 | $ 3,125 | $ 1,718 | $ 15,023 |

| Department margin | $ 241 | $ 4,429 | ($ 125) | ($ 718) | $ 3,827 |

| Less other costs | |||||

| Unassigned labor costs (idle time) | $ 375 (14) | ||||

| Unassigned overhead, indirect costs | $ 30 | ||||

| Marketing and administrative costs | $ 6,075 | ||||

| Operating profit | ($ 2,653) | ||||

Table: (1)

Managing and Officiating are the departments that are making any profits. Managing among the two is still making very less profit. For Training and Dispute Resolution the management should consider pricing policies of the two. The highest loss was earned by Dispute Resolution.

Thus, the value of operating loss is $2,653 for July.

Working note 1:

Compute the labor:

Working note 2:

Compute the labor:

Working note 3:

Compute the labor:

Working note 4:

Compute the labor:

Working note 5:

Compute the direct overhead:

Working note 6:

Compute the direct overhead:

Working note 7:

Compute the direct overhead:

Working note 8:

Compute the direct overhead:

Working note 9:

Compute the indirect overhead:

Working note 10:

Compute the indirect overhead:

Working note 11:

Compute the indirect overhead:

Working note 12:

Compute the indirect overhead:

Working note 13:

Compute the application rate:

Working note 14:

Compute the unassigned labor cost:

Working note 15:

Compute the indirect labor cost:

Want to see more full solutions like this?

Chapter 7 Solutions

Gen Combo Fundamentals Of Cost Accounting; Connect Access Card

- A manufacturing company has two service and two production departments. Human Resources and Machine Repair are the service departments. The production departments are Grinding and Polishing. The following data have been estimated for next years operations: The direct charges identified with each of the departments are as follows: The human resources department services all departments of the company, and its costs are allocated using the numbers of employees within each department, while machine repair costs are allocable to Grinding and Polishing on the basis of machine hours. 1. Distribute the service department costs, using the direct method. 2. Distribute the service department costs, using the sequential distribution method, with the department servicing the greatest number of other departments distributed first.arrow_forwardWoodstock Binding has two service departments, IT (Information Technology) and HR (Human Resources), and two operating departments, Publishing and Binding. Management has decided to allocate IT costs on the basis of IT Tickets (issued with each IT request) in each department and HR costs on the basis of employees in each department. The following data appear in the company records for the current period: IT tickets Employees Department direct costs a. The order of allocation starts with IT. b. The order of allocation starts with HR. IT Required A HR 1,200 0 0 16 $ 152,000 $ 249,600 Required: Use the step method to allocate the service costs, using the following: Required B Publishing 1,200 24 $430,000 Complete this question by entering your answers in the tabs below. X Answer is not complete. Use the step method to allocate the service costs, using the following: Binding Return to question 3,600 40 $ 390,000arrow_forwardWoodstock Binding has two service departments, IT (Information Technology) and HR (Human Resources), and two operating departments, Publishing and Binding. Management has decided to allocate IT costs on the basis of IT Tickets (issued with each IT request) in each department and HR costs on the basis of employees in each department. The following data appear in the company records for the current period: IT HR Publishing Binding IT tickets 0 1,500 2,400 2,100 Employees 16 0 24 40 Department direct costs $150,000 $247,500 $430,000 $390,000 Required: Use the direct method to allocate these service department costs to the operating departments. Note: Amounts to be deducted should be indicated by a minus sign. Do not round intermediate calculations. Round "Publishing" and "Binding" answers to 2 decimal places. IT HR Publishing Binding Service Department Costs IT Allocation HR Allocation Total Costs Allocated $ $ $ $arrow_forward

- Woodstock Binding has two service departments, IT (Information Technology) and HR (Human Resources), and two operating departments, Publishing and Binding. Management has decided to allocate IT costs on the basis of IT Tickets (issued with each IT request) in each department and HR costs on the basis of employees in each department. The following data appear in the company records for the current period: IT HR Publishing Binding IT tickets 0 1,500 2,400 2,100 Employees 16 0 24 40 Department direct costs $ 150,000 $ 247,500 $ 430,000 $ 390,000 Required: Use the step method to allocate the service costs, using the following:The order of allocation starts with HR.Note: Amounts to be deducted should be indicated by a minus sign. Do not round intermediate calculations. Cost Allocation To: Cost Allocation To: Cost Allocation To: Cost Allocation To: From: HR IT Publishing Binding Service department costs HR IT Total costs $ $ $ $arrow_forwardWoodstock Binding has two service departments, IT (Information Technology) and HR (Human Resources), and two operating departments, Publishing and Binding. Management has decided to allocate IT costs on the basis of IT Tickets (issued with each IT request) in each department and HR costs on the basis of employees in each department. The following data appear in the company records for the current period: IT HR Publishing Binding IT tickets 0 1,700 1,700 5,100 Employees 16 0 24 40 Department direct costs $ 156,000 $ 266,200 $ 430,000 $ 390,000 Required: Use the step method to allocate the service costs, using the following: The order of allocation starts with IT. The order of allocation starts with HR.arrow_forwardWoodstock Binding has two service departments, IT (Information Technology) and HR (Human Resources), and two operating departments, Publishing and Binding. Management has decided to allocate IT costs on the basis of IT Tickets (issued with each IT request) in each department and HR costs on the basis of employees in each department. The following data appear in the company records for the current period: IT tickets Employees Department direct costs Service department costs IT allocation HR allocation Total costs allocated IT IT 0 33 $ 157,000 HR HR 1,500 0 $ 247,500 Publishing 1,500 41 $ 430,000 Required: Use the direct method to allocate these service department costs to the operating departments. Note: Amounts to be deducted should be Indicated by a minus sign. Do not round Intermediate calculations. Round "Publishing" and "Binding" answers to 2 decimal places. Binding Publishing 4,500 57 $ 390,000 AL Bindingarrow_forward

- Golding Bank is in the process of implementing an activity-based costing system. A copy of an interview with the manager of Golding's Credit Card Department follows: QUESTION I: How many employees are in your department? RESPONSE: There are eight employees, including me. QUESTION 2: What do they do (please describe)? RESPONSE: There are four major activities: supervising employees, processing credit card transactions, issuing customer statements, and answering customer questions. QUESTION 3: Do customers outside your department use any equipment? RESPONSE: Yes. Automatic bank tellers service customers who require cash advances. QUESTION 4: What resources are used by each activity (equipment, materials, energy)? RESPONSE: We each have our own computer, printer, and desk. Paper and other supplies are needed to operate the printers. Of course, we each have a telephone as well. QUESTION 5: What are the outputs of each activity? RESPONSE: Well, for supervising, I manage employees' needs…arrow_forwardJose Ruiz manages a car dealer’s service department. His department is organized as a cost center. Costs for a recent quarter are shown below. List the costs that would appear on a responsibility accounting report for the service department.arrow_forwardWoodstock Binding has two service departments, IT (Information Technology) and HR (Human Resources), and two operating departments, Publishing and Binding. Management has decided to allocate IT costs on the basis of IT Tickets (issued with each IT request) in each department and HR costs on the basis of employees in each department. The following data appear in the company records for the current period: IT tickets Employees Department direct costs. IT HR 0 16 1,525 0 Publishing 2,440 24 $ 152,000 $ 247,950 $ 431,000 Binding 2,135 40 $ 392,500 Woodstock Binding estimates that the variable costs in the IT Department total $112,500, and in the HR Department variable costs to $142,500. Avoidable fixed costs in the IT Department are $18,250. Required: If Woodstock Binding outsources the IT Department functions, what is the maximum it can pay an outside vendor without increasing total costs? Note: Do not round intermediate calculations. × Answer is complete but not entirely correct. Maximum…arrow_forward

- The manager of the Personnel Department at City Enterprises has been reading about time-driven ABC and wants to apply it to her department. She has identified four basic activities her employees spend most of the their time on: Interviewing, Hiring, Assessment, and Separation Processing. The department employs 8 staff who perform these activities. The manager provides the following estimates for the amount of time it takes to complete each of these activities: Interviewing: 95 minutes. • Hiring: 85 minutes. • Assessment: 125 minutes. • Separation Processing: 115 minutes. Employees in Personnel work 34-hour weeks with four weeks for vacation. Of the 34 hours, five are reserved for administrative tasks, training, and so on. The costs of the Personnel Department, including any allocated costs from other staff functions, are $1,503,360. During the year, Personnel conducted 1,250 Interviews, made 400 hires, made 4,000 assessments, and had 350 separations. The manager of the Personnel…arrow_forwardSolomon Information Services, Incorporated, has two service departments: human resources and billing. Solomon's operating departments, organized according to the special Industry each department serves, are health care, retall, and legal services. The billing department supports only the three operating departments, but the human resources department supports all operating departments and the billing department. Other relevant information follows. Number of employees Annual cost* Annual revenue Req A1 Department Human Resources Billing Health Care Retail Req A2 Legal Services Total 20 $ 900,000 Complete this question by entering your answers in the tabs below. Allocation Rate Req B1 *This is the operating cost before allocating service department costs. Required a. Allocate service department costs to operating departments, assuming that Solomon adopts the step method. The company uses the number of employees as the base for allocating human resources department costs and department…arrow_forwardFollowing items belong to the revenue, expenditure, human resources/payroll, production, or financing cycle. Classify each item based on the cycle it belongs to. a. Pay pay-as-you-earn (PAYE) payroll taxes b. Send material requisition to inventory c. Issue stock to investors d. Borrow money from the bank to purchase a new factory e. Complete receiving report f. Appoint replacement purchasing clerk g. Measure employee performance using a performance management system h. Choose suitable supplier of raw materials i. Ensure employees are up to date with the latest tax provisions j. Record personal and tax information for new employeesarrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub