Concept explainers

Cost Accumulation: Service

Youth Athletic Services (YAS) provides adult supervision for organized youth athletics. It has a president, William Mayes, and five employees. He and one of the other five employees manage all marketing and administrative duties. The remaining four employees work directly on operations. YAS has four

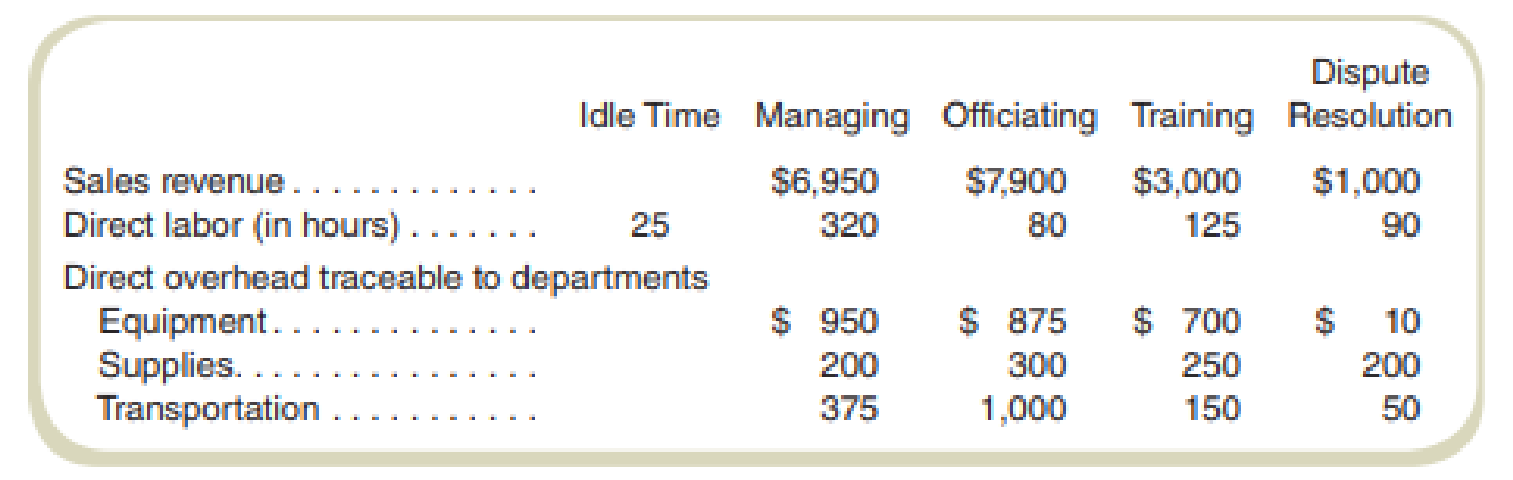

Some of the July operating data are as follows:

Other Data

- The four employees working in the operating departments all make $15 per hour.

- The fifth employee, who helps manage marketing and administrative duties, earns $2,250 per month, and William earns $3,000 per month.

- Indirect

overhead amounted to $768 and is assigned to departments based on the number of direct labor-hours used. Because there are idle hours, some overhead will not be assigned to a department. - In addition to salaries paid, marketing costs for items such as advertising and special promotions totaled $600.

- In addition to salaries paid, other administrative costs were $225.

- All revenue transactions are cash; all others are on account.

Required

Management wants to know whether each department is contributing to the company’s profit. Prepare an income statement for July that shows the revenue and cost of services for each department. Write a short report to management about departmental profitability. No inventories are kept.

Prepare an income statement for July that shows the revenue and cost of services for each department also write a short report to management about departmental profitability.

Explanation of Solution

Job costing: Job costing is a method of tracking and allocating costs to different jobs in the manufacturing process. This method of costing is used in entities where different jobs are incurred in each period.

Income statement for July that shows the revenue and cost of services:

| Income statement for the month ending July 31. | |||||

| Particulars | Managing | Officiating | Training | Dispute Resolution | Total |

| Revenue | $ 6,950 | $ 7,900 | $ 3,000 | $ 1,000 | $ 18,850 |

| Cost of services | |||||

| Labor | $ 4,800 (1) | $ 1,200 (2) | $ 1,875 (3) | $ 1,350 (4) | |

| Add: direct overhead | $ 1,525 (5) | $ 2,175 (6) | $ 1,100 (7) | $ 260 (8) | |

| Add: indirect overhead | $ 384 (9) | $ 96 (10) | $ 150 (11) | $ 108 (12) | |

| Total costs of services | $ 6,709 | $ 3,471 | $ 3,125 | $ 1,718 | $ 15,023 |

| Department margin | $ 241 | $ 4,429 | ($ 125) | ($ 718) | $ 3,827 |

| Less other costs | |||||

| Unassigned labor costs (idle time) | $ 375 (14) | ||||

| Unassigned overhead, indirect costs | $ 30 | ||||

| Marketing and administrative costs | $ 6,075 | ||||

| Operating profit | ($ 2,653) | ||||

Table: (1)

Managing and Officiating are the departments that are making any profits. Managing among the two is still making very less profit. For Training and Dispute Resolution the management should consider pricing policies of the two. The highest loss was earned by Dispute Resolution.

Thus, the value of operating loss is $2,653 for July.

Working note 1:

Compute the labor:

Working note 2:

Compute the labor:

Working note 3:

Compute the labor:

Working note 4:

Compute the labor:

Working note 5:

Compute the direct overhead:

Working note 6:

Compute the direct overhead:

Working note 7:

Compute the direct overhead:

Working note 8:

Compute the direct overhead:

Working note 9:

Compute the indirect overhead:

Working note 10:

Compute the indirect overhead:

Working note 11:

Compute the indirect overhead:

Working note 12:

Compute the indirect overhead:

Working note 13:

Compute the application rate:

Working note 14:

Compute the unassigned labor cost:

Working note 15:

Compute the indirect labor cost:

Want to see more full solutions like this?

Chapter 7 Solutions

Fundamentals of Cost Accounting

- Potta Corporation transferred property with a tax basis of $450 and a fair market value of $700 to a corporation in exchange for stock with a fair market value of $550 and $75 cash in a transaction that qualifies for deferral under Section 351. What is the corporation's tax basis in the property received in the exchange?arrow_forwardHiii, tutor give answerarrow_forwardAnswer please Solve thisarrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning