Concept explainers

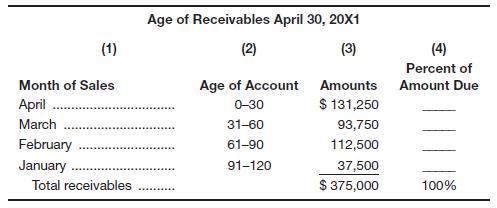

Route Canal Shipping Company has the following schedule for aging of accounts receivable:

a. Fill in column (4) for each month.

b. If the firm had

c. If the firm likes to see its bills collected in 35 days, should it be satisfied with the average collection period?

d. Disregarding your answer to part c and considering the aging schedule for accounts receivable, should the company be satisfied?

e. What additional information does the aging schedule bring to the company that the average collection period may not show?

Want to see the full answer?

Check out a sample textbook solution

Chapter 7 Solutions

Loose Leaf for Foundations of Financial Management Format: Loose-leaf

- ABCD Corporation has credit sales of $10,290,000 and receivables of $1,560,000. Assume there are 365 days in a year. What is the receivables turnover? Round your answer to two decimal places. What is the average collection period (days sales outstanding)? Round your answer to the nearest whole number. days If the company offers credit terms of 45 days, are its receivables past due? Round your answer to the nearest whole number. Enter zero if the receivables are not past due. , it is days overdue.arrow_forwardDome Metals has credit sales of $342,000 yearly with credit terms of net 45 days, which is also the average collection period. Dome does not offer a discount for early payment, so its customers take the full 45 days to pay. a. What is the average receivables balance? (Use a 360-day year.)b. What is the receivables turnover? (Use a 360-day year.)arrow_forwardTo increase its sales, a company decides to increase its credit terms from 15 to 30 days. What effect will this change in policy have on receivables turnover and days' sales uncollected?arrow_forward

- ABCD Corporation has credit sales of $10,960,000 and receivables of $1,260,000. Assume there are 365 days in a year. What is the receivables turnover? Round your answer to two decimal places. What is the average collection period (days sales outstanding)? Round your answer to the nearest whole number. days If the company offers credit terms of 30 days, are its receivables past due? Round your answer to the nearest whole number. Enter zero if the receivables are not past due. -Select-YesNoItem 3 , it is days overdue.arrow_forwardMcGriff Dog Food Company normally takes 30 days to pay for average daily credit purchases of $9,730. Its average daily sales are $10,010, and it collects accounts in 32 days. a. What is its net credit position? Net credit position b-1. If the firm extends its average payment period from 30 days to 37 days (and all else remains the same), what is the firm's new net credit position? (Negative amount should be indicated by a minus sign.) Net credit position b-2. Has the firm improved its cash flow? Yes Noarrow_forwardALei Industries has credit sales of $146 million a year. ALei's management reviewed its credit policy and decided that it wants to maintain an average collection period of 35 days. a. What is the maximum level of accounts receivable that ALei can carry and have a 35-day average collection period? b. If ALei's current accounts receivable collection period is 55 days, how much would it have to reduce its level of accounts receivable in order to achieve its goal of 35 days?arrow_forward

- A company computes its accounts receivable turnover to be 20. Based onthis information, find the average collection period. If the company has a credit collection period of 30 days, explain the relationship between thecredit collection period and the average collection period.arrow_forwardCalculating the Average Collection Period Trout Lumber Yard has a current accounts receivable balance of $527,164. Credit sales for the year just ended were $6,787,626. What is the receivables turnover? The days’ sales in receivables? How long did it take, on average, for credit customers to pay off their accounts during the past year?arrow_forwardThe Moncton Corporation has annual sales of $31 million. The average collection period is 27 days. What is the average investment in accounts receivable as shown on the balance sheet? Assume 365 days per year. (Enter the answer In dollars. Do not round Intermediate calculations. Round the final answer to nearest whole dollar amount. Omit "$" sign In your response.) Average receivables $arrow_forward

- If you are told that LSJ Company turns its accounts receivable over every 33 days…this would represent an example of what type of analysis: a. Vertical Analysis b. Horizontal Analysis c. Ratio Analysisarrow_forwardA firm has total annual sales (all credit) of P1,200,000 and accounts receivable of P500,000. How rapidly (in how many days) must accounts receivable be collected if management wants to reduce the accounts receivable to P300,000? choose the letter of the correct answera. 51.3 daysb. 61.3 daysc. 71.3 daysd. 81.3 dayse. 91.3 daysarrow_forwardMcGriff Dog Food Company normally takes 28 days to pay for average daily credit purchases of $9,540. Its average daily sales are $10,710, and it collects accounts in 32 days.a. What is its net credit position? b-1. If the firm extends its average payment period from 28 days to 38 days (and all else remains the same), what is the firm's new net credit position? (Negative amount should be indicated by a minus sign.)arrow_forward

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT