International Accounting

5th Edition

ISBN: 9781259747984

Author: Doupnik, Timothy S., Finn, Mark T., Gotti, Giorgio

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 7, Problem 11EP

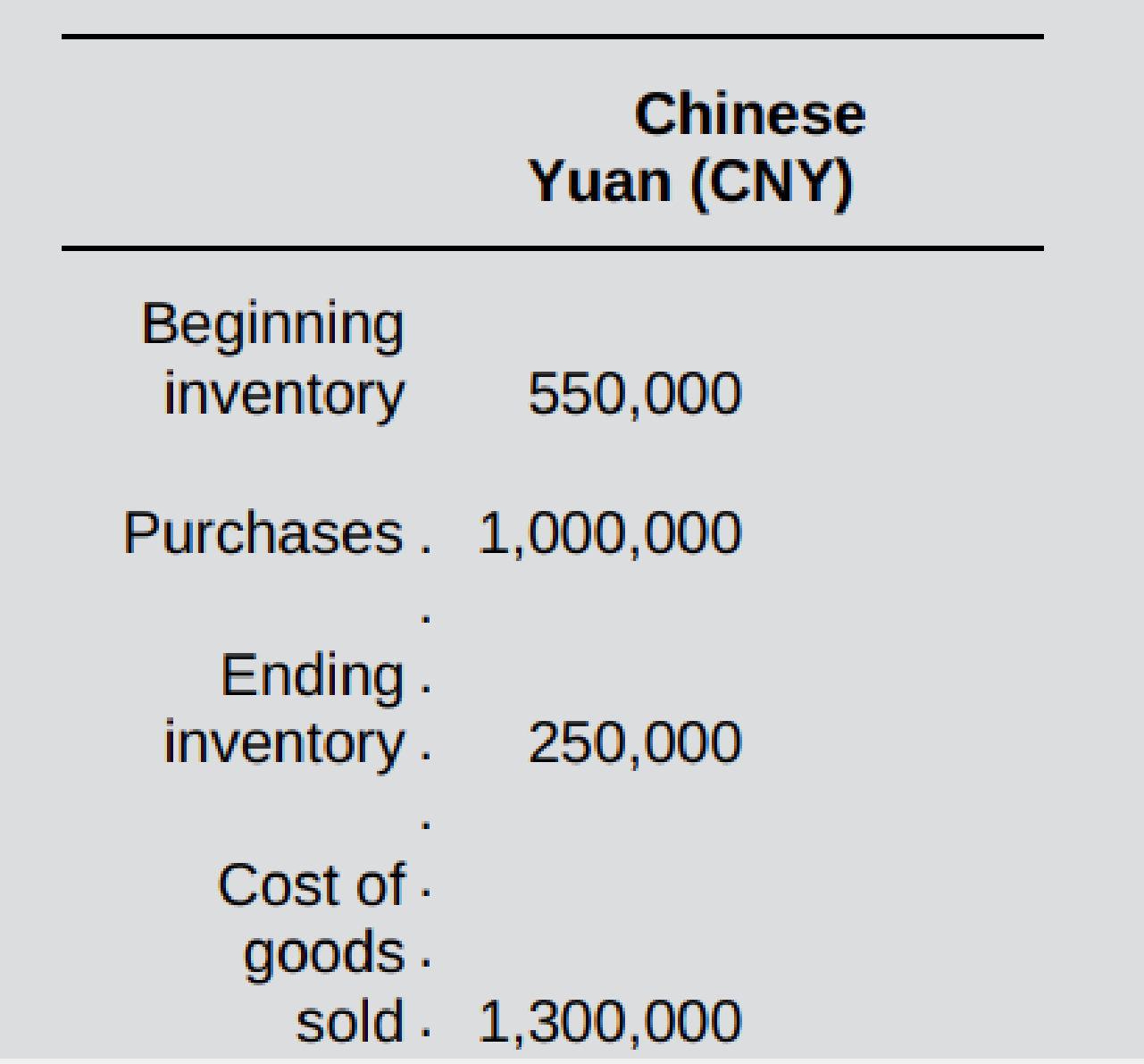

The Year 1 financial statements of the Chinese subsidiary of Singcom Limited (a Singapore-based company) revealed the following:

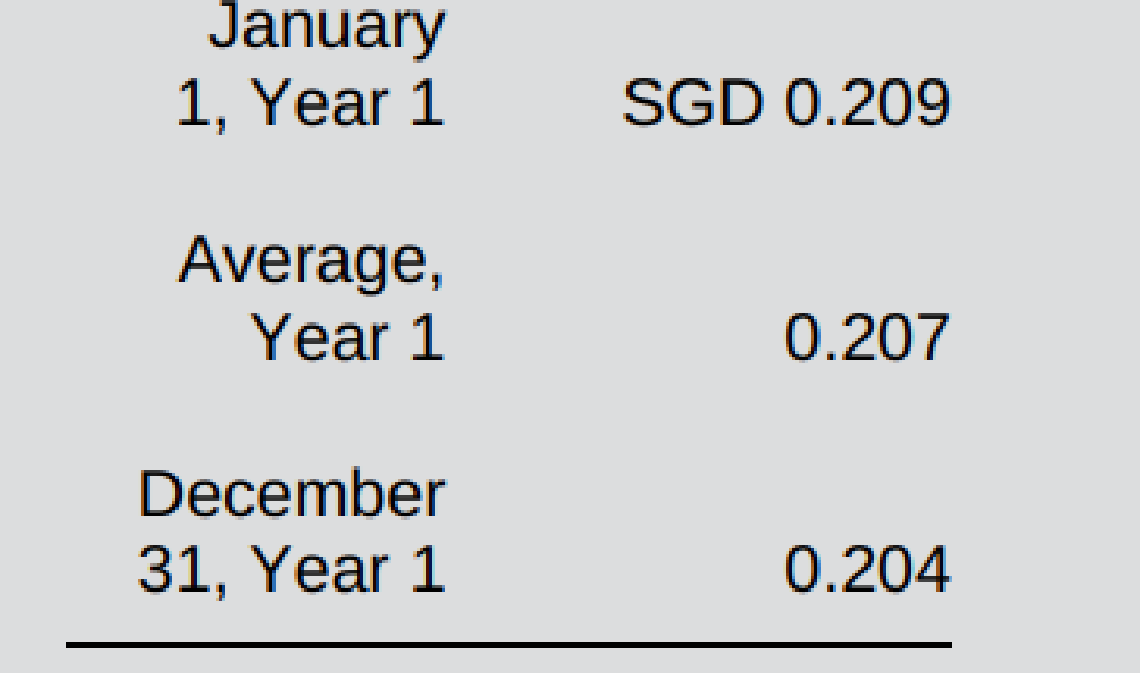

Singapore dollar (SGD) exchange rates for 1 CNY are as follows:

The beginning inventory was acquired in the last quarter of the previous year, when the exchange rate was SGD 0.210 = CNY 1; ending inventory was acquired in the last quarter of the current year, when the exchange rate was SGD 0.205 = CNY 1.

Required:

- a. Assuming that the current rate method is the appropriate method of translation, determine the amounts at which the Chinese subsidiary’s ending inventory and cost of goods sold should be included in Singcom’s Year 1 consolidated financial statements.

- b. Assuming that the temporal method is the appropriate method of translation, determine the amounts at which the Chinese subsidiary’s ending inventory and cost of goods sold should be included in Singcom’s Year 1 consolidated financial statements.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

A company has an account payable to a U.S. company, a supplier of inventory, in the amount of US$

170,000. The payable was incurred when the exchange rate was US$1 = Cdn$0.79. At year - end, the rate

is $0.75. Required: 1. What amount of inventory is recorded? 2. What amount of exchange gain or loss will

the company report for the year?

A company has an account payable to a U.S. company, a supplier of inventory, in the amount of US$250,000. The payable was

incurred when the exchange rate was US$1 = Cdn$0.82. At year-end, the rate is $0.79.

Required:

1. What amount of inventory is recorded?

Amount of inventory

2. What amount of exchange gain or loss will the company report for the year?

Amount of exchange gain or los

The Simpson Corporation is calculating their adjusted balance sheet into U.S. Dollars. The exchange rate at the beginning of the year was $1 Euro = $1 U.S. dollar. The current exchange rate is .80 Euros to $1.00. Net Income for the year was zero. How much is the accounting gain/loss due to the exchange rate change?

Beginning Balance Sheet:

Assets = 3,000 Euros

Equity = 1,500 Euros

Liabilities = 1,500 Euros

Chapter 7 Solutions

International Accounting

Ch. 7 - Prob. 1QCh. 7 - Prob. 2QCh. 7 - Prob. 3QCh. 7 - Prob. 4QCh. 7 - Prob. 5QCh. 7 - 6. What are the major differences between IFRS and...Ch. 7 - Prob. 7QCh. 7 - 8. Which translation method does U.S. GAAP require...Ch. 7 - Prob. 9QCh. 7 - 10. How are gains and losses on foreign currency...

Ch. 7 - Prob. 11QCh. 7 - Prob. 12QCh. 7 - Prob. 1EPCh. 7 - Prob. 2EPCh. 7 - Prob. 3EPCh. 7 - Prob. 4EPCh. 7 - 4. Which of the following best explains how a...Ch. 7 - In the translated financial statements, which...Ch. 7 - Prob. 7EPCh. 7 - Prob. 8EPCh. 7 - Prob. 9EPCh. 7 - Prob. 10EPCh. 7 - The Year 1 financial statements of the Chinese...Ch. 7 -

10. Simga Company's Turkish subsidiary repented...Ch. 7 - Prob. 13EPCh. 7 - Prob. 14EPCh. 7 - Prob. 15EPCh. 7 - Prob. 16EPCh. 7 - Prob. 17EPCh. 7 - Prob. 18EPCh. 7 - 16. Access the most recent annual report for a...Ch. 7 - Prob. 21EPCh. 7 - Prob. 22EPCh. 7 - Prob. 1CCh. 7 - Prob. 2C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The Simpson Corporation is calculating their adjusted balance sheet into U.S. Dollars. The exchange rate at the beginning of the year was $1 Euro = $1 U.S. dollar. The current exchange rate is .80 Euros to $1.00. Net Income for the year was zero. How much is the accounting gain/loss due to the exchange rate change? Beginning Balance Sheet: Assets = 3,000 Euros Equity = 1,500 Euros Liabilities = 1,500 Euros Multiple Choice $375, loss $375, gain $500, loss $125, gain $500, gainarrow_forwardThe Simpson Corporation is calculating their adjusted balance sheet into U.S. Dollars. The exchange rate at the beginning of the year was $1 Euro = $1 U.S. dollar. The current exchange rate is .80 Euros to $1.00. Net Income for the year was zero. How much is the accounting gain/loss due to the exchange rate change? Beginning Balance Sheet: Assets = 3,000 EurosEquity = 1,500 EurosLiabilities = 1,500 Euros $125, gain $375, loss $375, gain $500, loss $500, gainarrow_forwardClark Company, a U.S. corporation, sold inventory on December 1, 2022, with payment of 12,000 British pounds to be received in sixty days. The pertinent exchange rates were as follows: Date December 1 December 31 January 30 Spot Rate $ 1.831 $1.976 $1.768 What amount of foreign exchange gain or loss should be recorded on January 30? $2,496 loss $2,496 gain $1,740 loss $1,740 gain 7:11 PMarrow_forward

- A U.S. company's foreign subsidiary had the following amounts in stickles (5), the functional currency, in 2018: Cost of goods sold $12,000, e00 Ending inventory Beginning inventory 600,000 240,000 The average exchange rate during 2018 was 81 = $.96. The beginning inventory was acquired when the exchange rate was §1 = $1.20. The ending inventory was acquired when the exchange rate was §1 = $.90. The exchange rate at December 31, 2018 was §1= $.84. Assuming that the foreign nation for the subsidiary had a highly inflationary economy, at what amount should that foreign subsidiary's purchases have been reflected in the 2018 U.S. dollar income statement? Multiple Cholce $11,865,600. $11.577,600. $11.520.000. $11,613,600. $11,523,600.arrow_forwardA U.S. company’s foreign subsidiary had these amounts in local currency units (LCU) in 2020: Cost of goods sold LCU 5,590,000 Beginning inventory 548,000 Ending inventory 609,000 The average exchange rate during 2020 was $1.30 = LCU 1. The beginning inventory was acquired when the exchange rate was $1.10 = LCU 1. Ending inventory was acquired when the exchange rate was $1.40 = LCU 1. The exchange rate at December 31, 2020, was $1.45 = LCU 1. Assuming that the foreign country is highly inflationary, at what amount should the foreign subsidiary’s cost of goods sold be reflected in the U.S. dollar income statement?arrow_forwardClark Co., a U.S. corporation, sold inventory on December 1, 2021, with payment of 12,000 British pounds to be received in sixty days. The pertinent exchange rates were as follows: Spot rate: $1.831 Dec. 31 Spot rate: $1.976 Jan. 30 Spot rate: $1.768 Dec. 1 For what amount should Sales be credited on December 1? Multiple Choice $21,216. $21,972. $23,712. $19,760. $18,310.arrow_forward

- Suppose that Canton Co. is a U.S.-based MNC with a foreign subsidiary in Germany, which deals in euros. The local earnings of this German subsidia over a two-year period are shown in the following table, along with the weighted average exchange rate of the euro and the translated U.S. dollar earnings of the subsidiary. Period Year 1 Year 2 Local Earnings of German Subsidiary (Euros, Millions) 20 20 Translated U.S. Dollar Earnings of Weighted Average Exchange German Subsidiary Rate of Euro $1.20 $1.00 (Dollars, Millions) $24.00 $20.00 Suppose that Canton has no earnings from the U.S. and all of it's earnings come from the consolidated earnings from the German subsidiary. Also suppose that the price of Canton stock is approximately equal to the mean P/E ratio in the industry multiplied by Canton's EPS. With these assumptions, the Consolidated Earnings (Euros, Millions) Period EPS (based on 10 million shares) Mean P/E Ratio (Dollars, Valuation of Canton Stock Millions) Price Year 1 Year 2…arrow_forwardA U.S. company's foreign subsidiary had these amounts in local currency units (LCU) in 2024: Cost of goods sold Beginning inventory Ending inventory LCU 5,710,000 542,000 623,000 The average exchange rate during 2024 was $1.20=LCU 1. The beginning inventory was acquired when the exchange rate was $1.00=LCU 1. Ending inventory was acquired when the exchange rate was $1.30 = LCU 1. The exchange rate on December 31, 2024, was $1.35=LCU 1. Required: Assuming that the foreign country is highly inflationary, determine the amount at which the foreign subsidiary's cost of goods sold should be reflected in the U.S. dollar income statement. Cost of goods soldarrow_forwardOn January 1, Narnevik Corporation formed a subsidiary in a foreign country. On April 1, the subsidiary purchased inventory on account at a cost of 250,000 local currency units (LCU). One-fifth of this inventory remained unsold on December 31, while 30 percent of the account payable had not yet been paid. The U.S.dollar–per-LCU exchange rates were as follows: January 1 $ 0.60 April 1 0.58 Average for the current year 0.56 December 31 0.54 At what amounts should the December 31 balances in inventory and accounts payable be translated into U.S. dollars using the current rate method?arrow_forward

- On December 12, 20X5, Dahl Company entered into three forward exchange contracts, each to purchase 100,000 francs in 90 days. The relevant exchange rates are as follows: Spot Rate Forward Rate for March 12, 20X6 December 12, 20X5 $ 0.88 $ 0.90 December 31, 20X5 0.98 0.93 3. Dahl entered into the first forward contract to manage the foreign currency risk from a purchase of inventory in November 20X5, payable in March 20X6. The forward contract is not designated as a hedge. At December 31, 20X5, what amount of foreign currency transaction gain should Dahl include in income from this forward contract? multiple choice $10,000 $0 $5,000 $3,000 4. Dahl entered into the second forward contract to hedge a commitment to purchase equipment being manufactured to Dahl’s specifications. At December 31, 20X5, what amount of foreign currency transaction gain should Dahl include in income from this forward contract? multiple choice $10,000 $0 $5,000…arrow_forwardOn January 1, Narnevik Corporation formed a subsidiary in a foreign country. On April 1, the subsidiary purchased inventory on account at a cost of 250,000 local currency units (LCU). One-fifth of this inventory remained unsold on December 31, while 30 percent of the account payable had not yet been paid. The U.S. $ per LCU exchange rates were as follows:At what amounts should the December 31 balances in inventory and accounts payable be translated into U.S. dollars using the current rate method?arrow_forwardThe trial balance of Honesty Company at December 31, 2022, a foreign subsidiary of ABC Company, is presented below (denominated in US dollars) (see image below).T he translated amount of Retained Earnings is P325,000. Exchange rates were: Current Rate - P10; Historical Rate - P11; and Weighted Average Rate - P12. Answer the following subquestion(s): a. How much is the Cumulative Translation Adjustment at December 31, 2022? ______________ thanks!arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

The Exchange Rate and the Foreign Exchange Market [AP Macroeconomics Explained]; Author: Heimler's History;https://www.youtube.com/watch?v=JsKLBpy6cEc;License: Standard Youtube License