FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

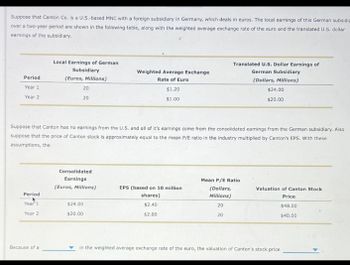

Transcribed Image Text:Suppose that Canton Co. is a U.S.-based MNC with a foreign subsidiary in Germany, which deals in euros. The local earnings of this German subsidia

over a two-year period are shown in the following table, along with the weighted average exchange rate of the euro and the translated U.S. dollar

earnings of the subsidiary.

Period

Year 1

Year 2

Local Earnings of German

Subsidiary

(Euros, Millions)

20

20

Translated U.S. Dollar Earnings of

Weighted Average Exchange

German Subsidiary

Rate of Euro

$1.20

$1.00

(Dollars, Millions)

$24.00

$20.00

Suppose that Canton has no earnings from the U.S. and all of it's earnings come from the consolidated earnings from the German subsidiary. Also

suppose that the price of Canton stock is approximately equal to the mean P/E ratio in the industry multiplied by Canton's EPS. With these

assumptions, the

Consolidated

Earnings

(Euros, Millions)

Period

EPS (based on 10 million

shares)

Mean P/E Ratio

(Dollars,

Valuation of Canton Stock

Millions)

Price

Year 1

Year 2

$24.00

$20.00

$2.40

20

$48.00

$2.00

20

$40.00

Because of a

in the weighted average exchange rate of the euro, the valuation of Canton's stock price.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Recording Import Transactions Pinnacle Foods imports a variety of items for resale to U.S. retail‑ ers. Following is a description of purchases and foreign‑currency‑denominated payments made in the last accounting period, plus the direct exchange rates for each date: Country Amount Currency Spot rate at purchase Spot rate at payment Australia . . . . . . . . . . . . . . . . . . 200,000 Australian dollar $0.7600 $0.7300 Thailand . . . . . . . . . . . . . . . . . . 800,000 Baht 0.0345 0.0365 Hong Kong . . . . . . . . . . . . . . . . 5,000,000 Hong Kong dollar 0.1319 0.1362 Jordan . . . . . . . . . . . . . . . . . . . 500,000 Dinar 1.4100 1.3900 Required Prepare the journal entries made by Pinnacle, a U.S. company, to record the above purchase and payment transaction.arrow_forwardLast year, the Mexican peso/U.S. dollar exchange rate was MXN13.3872/$. Today, the exchange rate is MXN16.5307/$. A U.S. firm has total assets worth MXN14,790,000 located in Mexico that did not change in value over the year. What was the change in the value of the assets in dollars on the company's U.S. balance sheet? Multiple Choice −$193,736.57 $210,087.71 −$210,087.71 $0 $193,736.57arrow_forward15.7Aarrow_forward

- Looking for help with these two questions. 1. Prepare financial statements (income statement, statement of retained earnings, and balance sheet) for the Canadian subsidiary in its functional currency, Canadian dollars.2. Translate the Canadian dollar functional currency financial statements into U.S. dollars so that Sendelbach can prepare consolidated financial statements.arrow_forwardA U.S. company's foreign subsidiary had these amounts in local currency units (LCU) in 2024: Cost of goods sold Beginning inventory Ending inventory LCU 5,230,000 536,000 622,000 The average exchange rate during 2024 was $1.30 = LCU 1. The beginning inventory was acquired when the exchange rate was $1.10 = LCU 1. Ending inventory was acquired when the exchange rate was $1.40 LCU 1. The exchange rate on December 31, 2024, was $1.45 = LCU 1. Required: Assuming that the foreign country is highly inflationary, determine the amount at which the foreign subsidiary's cost of goods sold should be reflected in the U.S. dollar income statement. Cost of goods soldarrow_forwardOn January 1, 2024, Trenten Systems, a U.S.-based company, purchased a controlling interest in Grant Management Consultants located in Zurich, Switzerland. The acquisition was treated as a purchase transaction. The 2024 financial statements stated in Swiss francs are given below. GRANT MANAGEMENT CONSULTANTS Comparative Balance Sheets January 1 and December 31, 2024 Direct exchange rates for Swiss franc are: Required: A. Translate the year-end balance sheet and income statement of foreign subsidiary using the current rate method of translation. B. Prepare a schedule to verify the translation adjustment. Cash and Receivables Net Property, Plant, and Equipment 40,000 37,000 60,000 92,000 30,000 32,000 20,000 20,000 10,000 40,000 60,000 92,000 Totals Accounts and Notes Payable Common Stock Retained Earnings Totals GRANT MANAGEMENT CONSULTANTS Consolidated Income and Retained Earnings Statement for the Year Ended December 31, 2024 Jan. 1 Dec. 31 20,000 55,000 Revenues 75,000 Operating…arrow_forward

- A U.S.-based multinational company has two subsidiaries, one in Mexico (local currency, Mexicanpeso, MP) and one in Japan (local currency, yen, ¥). Forecasts of business operations indicate the following short-term financing position for each subsidiary (in equivalent U.S. dollars): Mexico:$80 million excess cash to be invested (lent) Japan: $60 million funds to be raised (borrowed) Currency Item US $ MP ¥ Spot exchange rates MP11.60/US$ ¥108.25/US$ Forecast percentage change −3.00% +1.50% Interest rates Nominal Euromarket 4.00% 6.20% 2.00% Domestic 3.75% 5.90% 2.15% Effective Euromarket Domestic Euromarket and the domestic market; then indicate where the funds should be invested and raised.…arrow_forwardSuppose that Cleveland Co. engages in international business, with transactions denominated in four different foreign currencies: the euro, the Canadian dollar, the Australian dollar, and the Mexican peso. The company wishes to measure its cash flows in a single currency, the dollar, over the next quarter. The following table shows the total cash inflows and outflows for each currency, along with the expected exchange rate for that currency. For each row in the table, enter the net inflow or outflow in that currency for the MNC. Then, enter the dollar value of that inflow or outflow in the last column of the table. Total Inflow (Millions) 30 euros Note: Remember to enter a negative sign if a value is negative. Currency Euro Net Inflow or Outflow (Millions) Total Outflow Expected Exchange (Millions) Rate Net Inflow or Outflow, In Dollars (Millions) 15 euros euros $1.20 Canadian Dollar $C30 $C20 C$ $0.90 +A Australian Dollar $A10 $A20 A$ $0.50 Mexican peso 20 pesos 30 pesos peso $0.10 +A…arrow_forwardCertain balance sheet accounts of a foreign subsidiary of Roman, Inc., on December 31, 2010, have been translated into Philippine peso as follows: Translated at Current Rates P240,000 P200,000 85,000 80,000 150,000 170,000 P475,000 P450,000 The subsidiary's functional currency is the currency of the country in which it is located. What total amount should be included in Roman's December 31, 2010 consolidated balance sheet for the above accounts? Note receivable, long term. Prepaid rent Patent P450,000 P455,000 P475,000 P495,000 Historical Ratesarrow_forward

- 7. XYZ, a US company has a subsidiary in Korea. The Korean sub sells inventory to a Japanese company with the sale denominated in US dollars. Between the date of sale and the date the receivable is collected the Korean won strengthens 10% against the US dollar. Explain if there is a foreign exchange gain or loss or no FX impact and why Thank youarrow_forwardplease step by step solution.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education