Principles of Accounting

12th Edition

ISBN: 9781133626985

Author: Belverd E. Needles, Marian Powers, Susan V. Crosson

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 6, Problem 6P

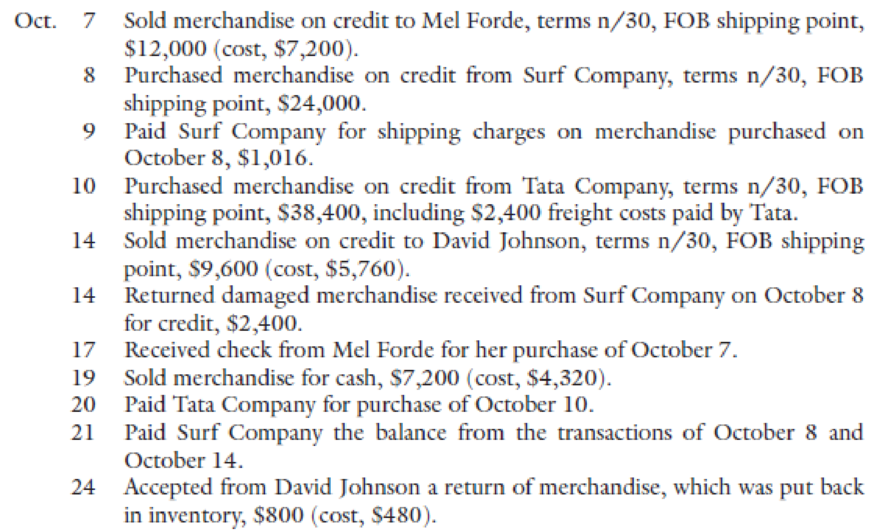

Teague Company engaged in the following transactions in October 2014:

REQUIRED

- 1. Prepare

journal entries to record the transactions, assuming use of the perpetual inventory system. (Hint: Refer to the TriLevel Problem feature.) - 2. ACCOUNTING CONNECTION ▶ Receiving cash rebates from suppliers based on the past year’s purchases is a common practice in some industries. If, at the end of the year, Teague receives rebates in cash from a supplier, should these cash rebates be reported as revenue? Why or why not?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

A "bill and hold" scheme is most likely to include:

a) Shipment of items to a customer beyond what the customer has ordered

b) Selling itms at substantial discounts near year end

c) Billing items that are held by the customer in future revenue production purposes

d) Recording items that the company retaines as of year end as sales chegg

Alpha company is a trading company that purchases and sales fruits and vegetables. During the year 2020, the company shows the following transactions and events:

1) The company uses the perpetual inventory system to account for its inventory at December 31, 2020 and its financial statements are disclosed without delay.

2) The company records sales when cash is received from customers and delay expenses for the next year.

3) For credit purchase transactions, the accountant debit (merchandise inventory) and credit (accounts receivable).

4) The company assumes the freight charges to its customers. The accountant debit (freight in expenses) and credit (merchandise inventory).

5) One customer returned fruits to Alpha that were damaged. The accountant of the company debit (purchase returns) and credit (accounts payable).

6) The cost of goods sold is determined after each sale asfollow: beginning inventory – purchases + ending inventory.

7) Net profit is computed by…

Evergreen Company sells lawn and garden products to wholesalers. The company's fiscal year-end is December 31. During 2024, the following transactions related to receivables occurred:

Prepare the necessary journal entries for Evergreen for each of the above dates. For transactions involving the sale of merchandise, ignore the entry for the cost of goods sold.

February 28

Sold merchandise to Lennox, Incorporated, for $30,000 and accepted a 6%, 7-month note. 6% is an appropriate rate for this type of note.

March 31

Sold merchandise to Maddox Company that had a fair value of $23,500, and accepted a noninterest-bearing note for which $25,000 payment is due on March 31, 2025.

April 3

Sold merchandise to Carr Company for $22,000 with terms 3/10, n/30. Evergreen uses the gross method to account for cash discounts.

April 11

Collected the entire amount due from Carr Company

April 17

A customer returned merchandise costing $4,200. Evergreen reduced the customer’s receivable balance…

Chapter 6 Solutions

Principles of Accounting

Ch. 6 - Prob. 1DQCh. 6 - Prob. 2DQCh. 6 - Prob. 3DQCh. 6 - Assume a large shipment of uninsured merchandise...Ch. 6 - Prob. 5DQCh. 6 - Prob. 6DQCh. 6 - Prob. 7DQCh. 6 - Indicate whether each of the statements that...Ch. 6 - Prob. 2SECh. 6 - Prob. 3SE

Ch. 6 - Prob. 4SECh. 6 - Prob. 5SECh. 6 - Prob. 6SECh. 6 - Prob. 7SECh. 6 - Prob. 8SECh. 6 - Record the following transactions using T...Ch. 6 - Prob. 10SECh. 6 - Prob. 11SECh. 6 - Sutton Hills Companys management made the...Ch. 6 - Prob. 2EACh. 6 - A company has the following data: net sales,...Ch. 6 - Prob. 4EACh. 6 - Prob. 5EACh. 6 - Linear Company engaged in the following...Ch. 6 - Prob. 7EACh. 6 - Prob. 8EACh. 6 - Prob. 9EACh. 6 - Prob. 10EACh. 6 - Prob. 11EACh. 6 - Prob. 12EACh. 6 - Prob. 13EACh. 6 - Prob. 14EACh. 6 - Prob. 15EACh. 6 - Matuska Tools Corporations income statements...Ch. 6 - Selected accounts from Murrays Furniture Stores...Ch. 6 - Prob. 3PCh. 6 - Selected accounts from Dences Gourmet Shops...Ch. 6 - Prob. 5PCh. 6 - Teague Company engaged in the following...Ch. 6 - Prob. 7APCh. 6 - Prob. 8APCh. 6 - Prob. 9APCh. 6 - Prob. 10APCh. 6 - Prob. 11APCh. 6 - Prob. 12APCh. 6 - Prob. 1CCh. 6 - Prob. 2CCh. 6 - Prob. 3CCh. 6 - Prob. 4CCh. 6 - Prob. 5CCh. 6 - Prob. 6C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The Lawrence Company records its trade accounts payable net of any cash discounts. At the end of 2016, Lawrence had a balance of $300,000 in its trade accounts payable account before any adjustments related to the following items: 1. Goods shipped to Lawrence FOB shipping point were in transit on December 31. The invoice price of the goods was $50,000, with a 2% discount allowed for prompt payment. 2. Goods shipped to Lawrence FOB destination on December 29 arrived on January 2, 2017. The invoice price of the goods was $9,000, with a 4% discount allowed for payment within 20 days. 3. On December 10, Lawrence had recorded a shipment received. The recorded invoice price was $24,750, net, with a 1% discount allowed for payment within 14 days. At the end of the year, payment had not been made. At what amount should Lawrence report trade accounts payable on its December 31, 2016 balance sheet? a. $349,000 b. $357,930 c. $357,680 d. $349,250arrow_forwardThe following is sample list of the Speiran Company's transactions completed during 2019. The company's fiscal year ends on December 31. Jan. 8 Purchased merchandise for resale on account. The invoice amount was $14,720; assume a perpetual inventory system. 17 Paid January 8 invoice. Apr. 1 Borrowed $72,000 from Lowell Bank for general use; signed a 12-month, 8% annual interest-bearing note for the money. May 1 Rented office space in one of Speiran Company's buildings to another company and collected six months' rent in advance amounting to $27,000. Required: 1. Prepare journal entries for each of these transactions. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)arrow_forwardDuring August 2024, Lima Company recorded the following: Requirements • Sales of $133,300 ($122,000 on account; $11,300 for cash). Ignore Cost of 1. Journalize Lima's transactions during August 2024, assuming Lima uses the direct write-off method. Goods Sold. • Collections on account, $106,400. 2. Journalize Lima's transactions during August 2024, assuming Lima uses the allowance method. • Write-offs of uncollectible receivables, $990. • Recovery of receivable previously written off, $800. Requirement 1. Journalize Lima's transactions during August 2024, assuming Lima uses the direct write-off method. Sales of $133,300 ($122,000 on account, $11,300 for cash). Ignore Cost of Goods Sold. (Record debits first, then credits. Select the explanation on the last line of the journal entratable. Prepare a single compound journal entry.) Accounts and Explanation Debit Credit Date Augarrow_forward

- Please answer asap. answer both 1 and 2 . The Appomatix Company sells fertilizer and pesticides to wholesalers. The company’s fiscal year-end is December 31. During 2018, the following transactions related to receivables occurred: March 31 Sold merchandise to the Misthos Co. and accepted a noninterest-bearing note with a discount rate of 10%. The $12,000 payment is due on March 31, 2019. May 30 Transferred receivables of $100,000 to a factor without recourse. The factor charged Appomatix a 2% finance charge on the receivables transferred. The sale criteria are met. July 31 Sold merchandise to Favre Corporation for $15,000 and accepted an 8%, 6-month note. 8% is an appropriate rate for this type of note. Sept. 30 Sold the Favre Corporation note to a local bank. The bank’s discount rate is 12%. The note was sold without recourse. Required: 1. Prepare the necessary journal entries for Appomatix for each of the above dates. For transactions involving the sale of…arrow_forwardGovender Wholesalers entered into the following transactions during February 2016 (IGNORE VAT).They make use of the perpetual inventory system.DateDetailsThe owner made a capital contribution of R640 000 to his business. This was done bymeans of an electronic transfer from his personal account into the business' bank account.Purchase trading inventory on credit for R153 500.1215Sell trading inventory for R32 160 cash. Goods were sold at a mark-up of 20% on cost.Purchase a computer for R15 000 on credit for use in the business.18Services rendered by Govender Wholesalers on credit for R36 000.2425The business paid back R50 000 of the inventory purchased on credit on 8 February.The debtor made full payment for the services rendered on credit on the 18t of February.27The owner takes inventory for his personal use with a selling price of R3 000. (Mark-up 50%on cost price.)28Pay staff salaries of R27 500,Required:Show the effect of each individual transaction on the accounting equation…arrow_forwardLloyd Gurango Co. completed the following sales transactions during the month of June 2019. All credit sales have terms of 3/10, n/30 and all invoices are dates as at the transaction date. June 1 Sold merchandise on account to KRA Company, P32 000. Invoice number 377 Sold merchandise on account to LRM Trading, P54 000. Invoice number 378. Sold P46 000 of merchandise for cash. Received payment from KRA Company, less discounts. Received payment from LRM Trading, less discounts. Sold merchandise to JPT Store on account, P62 000. Invoice number 379. 6. Borrowed P30 000 from the Unlad Bank issuing a 10% note payable due in 3 JPT Store returned P11 000 of merchandise from the June 13 sale. Sold merchandise to NOV Convenience Store on account, P17 000. Invoice months number 380. Collected amount due from JPT Store less returns and discounts. 16 Received P6 000 from NOV Convenience Store. Sold goods on account to LPR Co, P34 000. Invoice number 381 347935arrow_forward

- Vigeland Company completed the following transactions during Year 1. Vigeland’s fiscal year ends on December 31. January 15 Purchased and paid for merchandise. The invoice amount was $15,200; assume a perpetual inventory system. April 1 Borrowed $774,000 from Summit Bank for general use; signed a 10-month, 9% annual interest-bearing note for the money. June 14 Received a $24,000 customer deposit for services to be performed in the future. July 15 Performed $3,450 of the services paid for on June 14. December 12 Received electric bill for $26,160. Vigeland plans to pay the bill in early January. December 31 Determined wages of $15,000 were earned but not yet paid on December 31 (disregard payroll taxes). Required: Prepare journal entries for each of these transactions. Prepare the adjusting entries required on December 31.arrow_forwardAssuming that a Retail Merchandise business purchased 500 numbers of HP three in one printer for OMR 40 each on 1st December 2020 under the credit terms of 5/20, n/60. On 3rd December 2020 the business discovers that 100 numbers of HP three in one Printer are HP two in one. Therefore, the business returned the goods to supplier. On 5th December 2020, the business settles full cash. Which of the following journal entry is correct on 3rd December 2020 assumes that the business uses periodic inventory system? a. Debit Accounts payable OMR 16,000 Credit Cash OMR 15,200 Credit Discount OMR 800 b. Debit Purchase OMR 20,000 Credit Accounts payable OMR 20,000 c. Debit Accounts payable OMR 4000 Credit Purchase return and allowances OMR 4000 d. Debit Accounts payable OMR 20,000 Credit Merchandise Inventory OMR 20,000arrow_forwardBlossom Co. uses the gross method to record sales made on credit. On June 1, 2025, it made sales of $62,000 with terms 3/15, n/45. On June 12, 2025, Blossom received full payment for the June 1 sale. Prepare the required journal entries for Blossom Co. (If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit 10 Creditarrow_forward

- 2. ABC Company left the sales journal open after year end for two extra days and included the January 1 & 2 sales in the December 31 totals. The company uses perpetual inventory system. What effect would this have on the 2018 financial statements? Assume that the client made the following actual credit sales and received cash receipts as follows after 12/29/20: Cash Receipts (Besixakles Only) 7,500.00 SALES COGS 12/30/2020 11,250.00 6,000.00 12/31/2020 7,750.00 3,500.00 6,750.00 1/1/2021 6,000.00 2,000.00 1/2/2021 5,700.00 1,500.00 4,500.00 3,700.00 ABC Company has the following balances at 12/29/20: a. Cash $115,000 b. Accounts Receivable $55,000 c. Sales $150,000 d. Cost of Goods Sold $61,000 e. Inventory $75,000 Determine the overstatements and understatements that would result from the following situations. Assume that each situation is independent of one another. In the case of a perpetual inventory, assume that the year-end inventory count did not identify and correct the…arrow_forwardHart Company sells subscription to a specialized directory that is published semiannually and shipped to subscribers on April 15 and October 15. Subscriptions received after the March 31 and September 30 cut-off dates are held for the next publication. Cash from subscribers is received evenly during the year and is credited to deferred revenue from subscriptions. Data relating to 2021 are as follows: Deferred revenue from subscriptions – January 1 Cash receipts from subscribers In its December 31, 2022 balance sheet, Hart should report deferred revenue from subscription of 1,800,000 3,300,000 3,600,000 5,400,000 1,500,000 7,200,000 a. b. C. d.arrow_forwardMain Corporation has operated a branch in Cavite for one year. Shipments are billed to the branch at cost. The branch carries its own accounts receivable, makes its own collections, and pays its own expenses. The branch reported an inventory on December 31, 2021: Outsiders, P3,391; Home office, P7,625 The transactions for the year are given effect to in the trial balance below: (see image) QUESTION: Determine the net profit of the Cavite Branch for 2021.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY