Principles of Accounting

12th Edition

ISBN: 9781133626985

Author: Belverd E. Needles, Marian Powers, Susan V. Crosson

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 6, Problem 1P

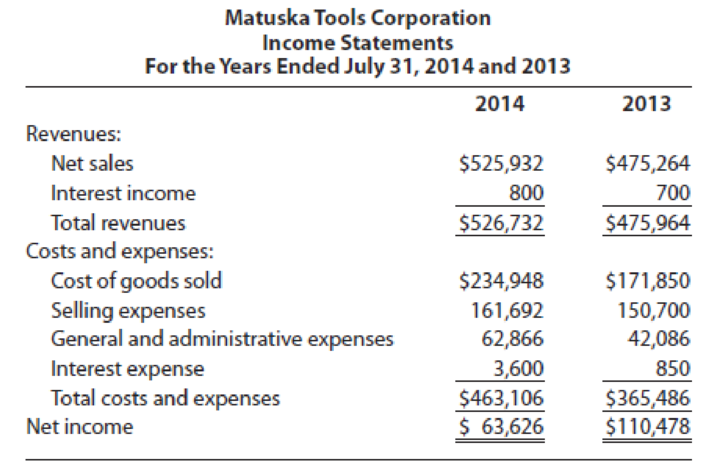

Matuska Tools Corporation’s income statements follow.

Required

- 1. Prepare a multistep income statement for 2013 and 2014 showing percentages of net sales for each component (e.g., cost of goods sold divided by net sales). (Round percentages to one decimal place.)

- 2. Accounting Connection ▶ Did income from operations increase or decrease between 2013 and 2014? Write a short explanation of why this change occurred.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Complete this question by entering your answers in the tabs below.

Analysis Analysis

Bal Sheet Inc Stmt

Prepare a vertical analysis of an income statements for Year 4 and Year 3. (Percentages

may not add exactly due to rounding. Round your answers to 2 decimal places. (i.e., .2345

should be entered as 23.45).)

Revenues

Sales (net)

Other revenues

Total revenues

Expenses

Cost of goods sold

FANNING COMPANY

Vertical Analysis of Income Statements

Year 4

Selling, general, and

administrative expense

Interest expense

Income tax expense

Total expenses

Net income

Amount

$

231,900

9,300

241,200

118,800

54,200

6,800

22,800

202,600

$

38,600

Percentage

of Total

Analysis Bal Sheet

%

%

Year 3

Amount

$

211,200

6,400

217,600

102,100

49,100

6,000

21,800

179,000

$

Percentage

of Total

%

%

38,600

Analysis Inc Stmt >

Show less

Comparative income statement for Deep Sea Company for 2016 and 2015 are given below:

Prepare the common size income statement of Deep Sea Company for 2016 and 2015. Enter the numbers without decimals. Do not round off the numbers. Add % sign after the numbers.

Revenue

unanswered

unanswered

Cost Of goods sold

unanswered

unanswered

Gross profit

unanswered

unanswered

Selling and general expenses

unanswered

unanswered

Operating profit

unanswered

unanswered

Interest expense

unanswered

unanswered

Income before tax

unanswered

unanswered

Income tax expenses

unanswered

unanswered

Net Profit

unanswered

unanswered

VII. Direction: Compute and interpret.

The following comparative financial statements are provided by Avatar Industries. You were asked

to compute the different financial ratios and provide your interpretations with regards to

profitability, efficiency, liquidity and solvency of the company. Use the Answer Sheet template

below to input your answer and solution.

AVATAR INDUSTRIES

AVATAR INDUSTRIES

Comparative Statement of Financial Position

For the years 2019 and 2018

Comparative Income Statement

For the years 2019 and 2018

2019

2018

2019

2018

ASSETS

Current Assets:

Sales

P200,000

P210,000

Cash & Cash Equivalent

P65,000

P70,000

Sales Returns and Allowances

40,000

25,000

Accounts Receivable

40,000

35,000

Net Sales

160,000

185,000

Marketable Secuities

40,000

35,000

Cost of Goods Sold

100,000

115,625

Inventory

100,000

80,000

Gross Profit

60,000

69,375

Total Current Assets

220,000

200,000 160,000

P445,000 P380,000

245,000

Operating Expenses:

Fixed Assets

Selling Expenses

22,000

25,000

Total…

Chapter 6 Solutions

Principles of Accounting

Ch. 6 - Prob. 1DQCh. 6 - Prob. 2DQCh. 6 - Prob. 3DQCh. 6 - Assume a large shipment of uninsured merchandise...Ch. 6 - Prob. 5DQCh. 6 - Prob. 6DQCh. 6 - Prob. 7DQCh. 6 - Indicate whether each of the statements that...Ch. 6 - Prob. 2SECh. 6 - Prob. 3SE

Ch. 6 - Prob. 4SECh. 6 - Prob. 5SECh. 6 - Prob. 6SECh. 6 - Prob. 7SECh. 6 - Prob. 8SECh. 6 - Record the following transactions using T...Ch. 6 - Prob. 10SECh. 6 - Prob. 11SECh. 6 - Sutton Hills Companys management made the...Ch. 6 - Prob. 2EACh. 6 - A company has the following data: net sales,...Ch. 6 - Prob. 4EACh. 6 - Prob. 5EACh. 6 - Linear Company engaged in the following...Ch. 6 - Prob. 7EACh. 6 - Prob. 8EACh. 6 - Prob. 9EACh. 6 - Prob. 10EACh. 6 - Prob. 11EACh. 6 - Prob. 12EACh. 6 - Prob. 13EACh. 6 - Prob. 14EACh. 6 - Prob. 15EACh. 6 - Matuska Tools Corporations income statements...Ch. 6 - Selected accounts from Murrays Furniture Stores...Ch. 6 - Prob. 3PCh. 6 - Selected accounts from Dences Gourmet Shops...Ch. 6 - Prob. 5PCh. 6 - Teague Company engaged in the following...Ch. 6 - Prob. 7APCh. 6 - Prob. 8APCh. 6 - Prob. 9APCh. 6 - Prob. 10APCh. 6 - Prob. 11APCh. 6 - Prob. 12APCh. 6 - Prob. 1CCh. 6 - Prob. 2CCh. 6 - Prob. 3CCh. 6 - Prob. 4CCh. 6 - Prob. 5CCh. 6 - Prob. 6C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- VII. Direction: Compute and interpret. The following comparative financial statements are provided by Avatar Industries. You were asked to compute the different financial ratios and provide your interpretations with regards to profitability, efficiency, liquidity and solvency of the company. Use the Answer Sheet template below to input your answer and solution. AVATAR INDUSTRIES AVATAR INDUSTRIES Comparative Statement of Financial Position For the years 2019 and 2018 Comparative Income Statement For the years 2019 and 2018 2019 2018 2019 2018 ASSETS Current Assets: Sales P200,000 P210,000 Cash & Cash Equivalent P65,000 P70,000 Sales Returns and Allowances 40,000 25,000 Accounts Receivable 40,000 35,000 Net Sales 160,000 185,000 Marketable Securities 40,000 35,000 Cost of Goods Sold 100,000 115,625 Inventory 100,000 80,000 Gross Profit 60,000 69,375 Total Current Assets 245,000 220,000 Operating Expenses: Fixed Assets 200,000 160,000 Selling Expenses 22,000 25,000 Total Assets P445,000…arrow_forwardUse the following tables to answer the question: LOGIC COMPANY Income Statement For years ended December 31, 2016 and 2017 (values in $) 2016 2017 Gross sales 19,800 15,600 Sales returns and allowances 900 100 Net sales 18,900 15,500 COGS 11,800 8,800 Gross profit 7,100 6,700 Depreciation 780 640 Selling and administrative expenses 2,800 2,400 Research 630 540 Miscellaneous 440 340 Total operating expenses 4,650 3,920 Income before interest and taxes 2,450 2,780 Interest expense 640 540 Income before taxes 1,810 2,240 Provision for taxes 724 896 LOGIC COMPANY Balance Sheet For years ended December 31, 2016 and 2017 (values in $) 2016 2017 Current assets 12,300 9,400 Accounts receivable 16,900 12,900 Merchandise inventory 8,900 14,400 Prepaid expenses 24,400 10,400 Total current assets 62,500 47,100 Building (net) 14,900 11,400 Land 13,900 9,400 Total plant and equipment 28,800 20,800 Total assets 91,300 67,900 Accounts payable 13,400 7,400 Salaries payable 7,500 5,400 Total current…arrow_forward3. Using the data provided in Table 1, prepare common size income statements using revenues and cost-of-goods-sold in the original S-1 and amended S-1. Analyze trends of expenses as a percentage of revenue for 2009 and 2010. Compare and contrast the following ratios: a. Gross Margin Percentage; b. Asset Turnover Ratio.arrow_forward

- Given the income statement for the MLC (Table 4–7) and balance sheet(Table 4–4), answer the following:a. Calculate the following ratios for 2012: operating profit margin, net profitmargin, operating return on assets, net return on assets, and return onequity.b. In a written explanation, describe what each ratio means.c. In a brief paragraph, describe the overall profitability of the MLC.arrow_forwardRequired: Use an Excel file to answer the following questions. Compute the following ratios for the companies’ 2014 fiscal years. (Use formulas): Current ratio Average days to sell inventory. (Use average inventory.) Debt to assets ratio. Return on investment. (Use average assets and use “earnings from continuing operations” rather than “net earnings.”) Gross margin percentage. Asset turnover. (Use average assets.) Net margin. (Use “earnings from continuing operations” rather than “net earnings.”) Plant assets to long-term debt ratio. Which company appears to be more profitable? Explain your answer and identify which ratio(s) from Requirement a you used to reach your conclusion. Which company appears to have the higher level of financial risk? Explain your answer and identify which ratio(s) from Requirement a you used to reach your conclusion. Which company appears to be charging higher prices for its goods? Explain your answer and identify which ratio(s) from Requirement a you…arrow_forwardRequired information Use the following information for the Problems below. (Algo) [The following information applies to the questions displayed below.] Lansing Company's current-year income statement and selected balance sheet data at December 31 of the current and prior years follow. LANSING COMPANY Income Statement For Current Year Ended December 31 Sales revenue Expenses Cost of goods sold Depreciation expense Salaries expense Rent expense Insurance expense Interest expense Utilities expense Net income $ 124,200 At December 31 Accounts receivable Inventory Accounts payable Salaries payable Utilities payable Prepaid insurance Prepaid rent 51,000 16,500 27,000 9,900 4,700 4,500 3,700 $ 6,900 LANSING COMPANY Selected Balance Sheet Accounts Current Year $ 6,500 2,880 5,300 1,060 400 350 400 Prior Year $ 7,600 1,990 6,400 790 250 460 270arrow_forward

- A condensed income statement for Weber Associates and a partially completed vertical analysis follow. Required: 1. Complete the vertical analysis by computing each missing line item as a percentage of net revenues. TIP: In the prior year, Cost of Goods Sold was 31 percent of Net Revenues, computed as ($1,397 ÷ $4,571). 2. Does Cost of Goods Sold, as a percentage of Net Revenues, represent better or worse performance in 2019 as compared to 2018? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Complete the vertical analysis by computing each missing line item as a percentage of net revenues. TIP: In the prior year, Cost of Goods Sold was 31 percent of Net Revenues, computed as ($1,397 ÷ $4,571). (Decreases should be indicated by a minus sign. Round your answers to the nearest whole percent.) Net Revenues Cost of Goods Sold Research and Development Expense Sales and Marketing Expense General and Administrative Expense Income from Operations Other…arrow_forwardPrepare a vertical analysis of the balance sheets for Year 4 and Year 3. (Percentages may not add exactly due to rounding. Round your percentage answers to 2 decimal places. (i.e., 0.2345 should be entered as 23.45).) Revenues Sales (net) Other revenues Total revenues Expenses Cost of goods sold WALTON COMPANY Vertical Analysis of Income Statements Year 4 Selling, general, and administrative expense Interest expense Income tax expense Total expenses Net income Amount $ 230,600 9,000 239,600 119,200 53,500 7,100 22,700 202,500 $ 37,100arrow_forwardAlex is currently considering to invest his money in one of the companies betweenCompany A and Company B. The summarized final accounts of the companies for theirlast completed financial year are as follows: (refer to the images) Required:a. Calculate the following ratios for Company A and Company B. State clearly theformulae used for each ratio:i. Gross Profit Marginii. Net Profit Marginiii. Inventory Turnover Period (days)iv. Receivables Collection Period (days)v. Payables Payment Period (days)vi. Current Ratiovii. Quick Ratiob. Comment on each of the ratios calculated in part (a) above.arrow_forward

- Top executive officers of Tildon Company, a merchandising firm, are preparing the next year's budget. The controller has provided everyone with the current year's projected income statement. Current Year $1,600,000 1,120,000 480,000 190,000 Sales revenue Cost of goods sold Gross profit Selling & administrative expenses Net income 290,000 Cost of goods sold is usually 70 percent of sales revenue, and selling and administrative expenses are usually 10 percent of sales plus a fixed cost of $30,000. The president has announced that the company's goal is to increase net income by 15 percent. Required The following items are independent of each other: a. Prepare a pro forma income statement. What percentage increase in sales would enable the company to reach its goal? b. The market may become stagnant next year, and the company does not expect an increase in sales revenue. The production manager believes that an improved production procedure can cut cost of goods sold by 2 percent. Prepare a…arrow_forwardSolve and perform the different financial ratios using the financial statements of XYZ Company for the year 2021. 1. Current Ratio 2. Quick Ratio 3. Receivables Turnover 4. Inventory Turnover 5. Debt Ratio 6. Equity Ratio 7. Times Interest Earned 8. Gross Profit Margin 9. Operating Profit Margin 10. Net Profit Marginarrow_forwardThe following select account data is taken from the records of Reese Industries for 2019. A. Use the data provided to compute net sales for 2019.B. Prepare a simple income statement for the year ended December 31, 2019.C. Compute the gross margin for 2019.D. Prepare a multi-step income statement for the year ended December 31, 2019.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License