Concept explainers

Comprehensive problem; ABC manufacturing, two products. Hazlett, Inc., operates at capacity and makes plastic combs and hairbrushes. Although the combs and brushes are a matching set, they are sold individually and so the sales mix is not 1:1. Hazlett’s management is planning its annual budget for fiscal year 2018. Here is information for 2018:

Input Prices

| Direct materials | |

| Plastic | $0.30 per ounce |

| Bristles | $0.75 per bunch |

| Direct manufacturing labor | $ 18 per direct manufacturing labor-hour |

Input Quantities per Unit of Output

| Combs | Brushes | |

| Direct materials | ||

| Plastic | 5 ounces | 8 ounces |

| Bristles | — | 16 bunches |

| Direct manufacturing labor | 0.05 hours | 0.2 hours |

| Machine-hours (MH) | 0.025 MH | 0.1 MH |

Inventory Information, Direct Materials

| Plastic | Bristles | |

| Beginning inventory | 1,600 ounces | 1,820 bunches |

| Target ending inventory | 1,766 ounces | 2,272 bunches |

| Cost of beginning inventory | $456 | $1,419 |

Hazlett accounts for direct materials using a FIFO cost flow.

Sales and Inventory Information, Finished Goods

| Combs | Brushes | |

| Expected sales in units | 12,000 | 14,000 |

| Selling price | $ 9 | $ 30 |

| Target ending inventory in units | 1,200 | 1,400 |

| Beginning inventory in units | 600 | 1,200 |

| Beginning inventory in dollars | $ 2,700 | $27,180 |

Hazlett uses a FIFO cost-flow assumption for finished-goods inventory.

Combs are manufactured in batches of 200, and brushes are manufactured in batches of 100. It takes 20 minutes to set up for a batch of combs and 1 hour to set up for a batch of brushes.

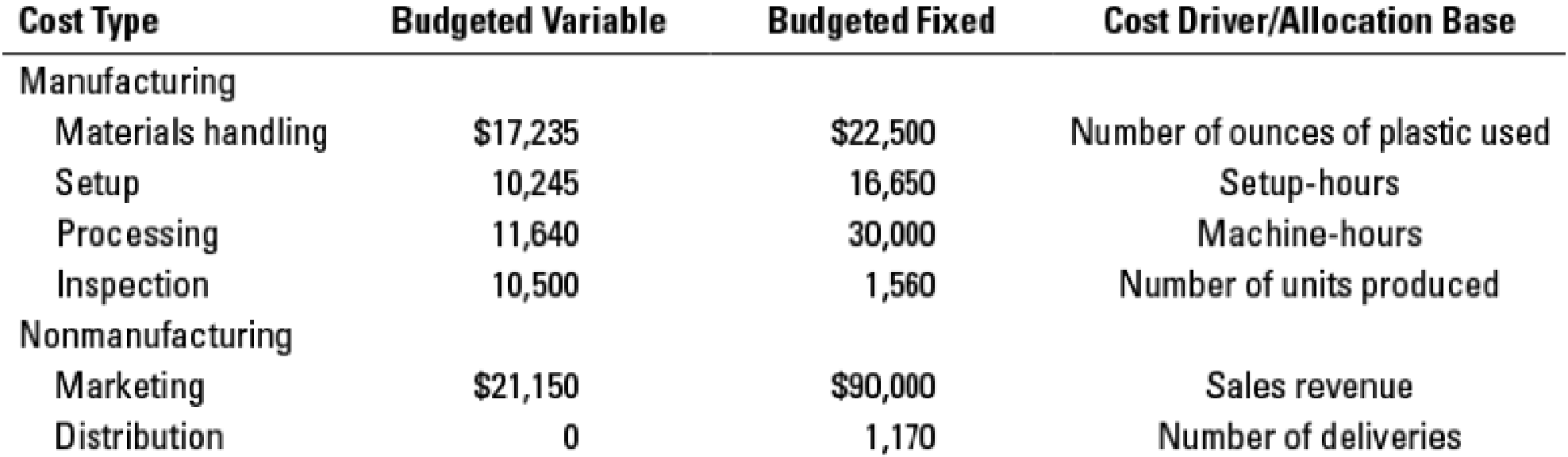

Hazlett uses activity-based costing and has classified all

Delivery trucks transport units sold in delivery sizes of 1,000 combs or 1,000 brushes.

Do the following for the year 2018:

- 1. Prepare the revenues budget.

- 2. Use the revenues budget to:

- a. Find the budgeted allocation rate for marketing costs.

- b. Find the budgeted number of deliveries and allocation rate for distribution costs.

- 3. Prepare the production budget in units.

- 4. Use the production budget to:

- a. Find the budgeted number of setups and setup-hours and the allocation rate for setup costs.

- b. Find the budgeted total machine-hours and the allocation rate for

processing costs. - c. Find the budgeted total units produced and the allocation rate for inspection costs.

- 5. Prepare the direct material usage budget and the direct material purchases budget in both units and dollars; round to whole dollars.

- 6. Use the direct material usage budget to find the budgeted allocation rate for materials-handling costs.

- 7. Prepare the direct

manufacturing labor cost budget. - 8. Prepare the manufacturing overhead cost budget for materials handling, setup, processing, and inspection costs.

- 9. Prepare the budgeted unit cost of ending finished-goods inventory and ending inventories budget.

- 10. Prepare the cost of goods sold budget.

- 11. Prepare the nonmanufacturing overhead costs budget for marketing and distribution.

- 12. Prepare a

budgeted income statement (ignore income taxes). - 13. How does preparing the budget help Hazlett's management team better manage the company?

Want to see the full answer?

Check out a sample textbook solution

Chapter 6 Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Additional Business Textbook Solutions

Principles of Accounting Volume 1

Managerial Accounting (5th Edition)

Managerial Accounting (4th Edition)

Financial Accounting: Tools for Business Decision Making, 8th Edition

Horngren's Accounting (12th Edition)

Auditing And Assurance Services

- 1. Zelmer Company manufactures tablecloths. Sales have grown rapidly over the past 2 years. As a result, the president has installed a budgetary control system for 2020. The following data were used in developing the master manufacturing overhead budget for the Ironing Department, which is based on an activity index of direct labor hours. Variable costs Rate per direct labor hour Annual fixed costs Indirect labor $ 0.42 Supervision $ 42600 Indirect material $ 0.50 depreciation $ 17280 Factory utilities $ 0.33 insurance $ 14640 Factory repairs $ 0.23 rent $ 30600 The master overhead budget was prepared on the expectation that 481,600 direct labor hours will be worked during the year. In June, 38,400 direct labor hours were worked. At that level of activity, actual costs were as shown below. Variable—per direct labor hour: indirect labor $0.46, indirect materials $0.48, factory utilities $0.37, and…arrow_forwardRadical Boards, Inc. manufactures and sells a single model of snowboard, the Vortex. In the summer of 2022, Iggy Sawdust, CPA, provided data for the 2022 budget: Direct Material Requirements (per snowboard) Wood Fiberglass Direct Labor Requirements Expected sales during 2022 - 1000 units at $450 per unit Expected inventory balances: Finished Goods Wood Raw Material Fiberglass Raw Material Other data: Wood Fiberglass Direct labor Variable Overhead Fixed Overhead Overhead Driver Variable marketing costs Expected sales visits in 2022 Fixed non-overhead costs 5 board feet (b.f.) 6 yards 5 hours 1/1/2022 100 2000 b.f. 1000 yards 12/31/2022 200 1500 b.f. 2000 yards Unit Prices $30.00 per b.f. $5.00 per yard $25.00 per hour $7.00 per dih $66,000 DL Hours $250 per sales visits 30 $30,000 The unit cost for ending FG inventory at 12/31/21 was $374.80. Ignore Work In Process The December 2022 Budget Includes the following selected balances: Cash Property, Plant, and Equipment Current Liabilities…arrow_forwardRequired information [The following information applies to the questions displayed below.] Black Diamond Company produces snowboards. Each snowboard requires 2 pounds of carbon fiber. Management reports that 6,000 snowboards and 7,000 pounds of carbon fiber are in inventory at the beginning of the third quarter, and that 160,000 snowboards are budgeted to be sold during the third quarter. Management wants to end the third quarter with 4,500 snowboards and 5,000 pounds of carbon fiber in inventory. Carbon fiber costs $25 per pound. Each snowboard requires 0.5 hour of direct labor at $30 per hour. Variable overhead is budgeted at the rate of $18 per direct labor hour. The company budgets fixed overhead of $1,792,000 for the quarter. 2. Prepare the direct materials budget for the third quarter. × Answer is not complete. BLACK DIAMOND COMPANY Direct Materials Budget Third Quarter 158,500 units 2 pounds Units to produce Materials required per unit (pounds) Materials needed for production…arrow_forward

- The AF PolyU Company manufactures two modular types of doors: one for the residential market, and the other for the office market. Budgeted and actual operating data for the year 2018 are: Static Budget Total 400,000 $26,000,000 $11,200,000 $37,200,000 Office 140,000 Residential Number of chairs sold 260,000 Contribution margin Actual Results Office 165,600 $22,356,000 $13,248,000 $35,604,000 Residential 248,400 Total 414,000 Number of chairs sold Contribution margin Required: Compute the following variances in terms of contribution margin: a. Compute the total static-budget variance, the total flexible-budget variance, and the total sales-volume variance. b. Compute the sale-mix variance and the sales-quantity variance by type of chair, and in total.arrow_forwardRequired information [The following information applies to the questions displayed below.] Black Diamond Company produces snowboards. Each snowboard requires 3 pounds of carbon fiber. Management reports that 5,300 snowboards and 6,300 pounds of carbon fiber are in inventory at the beginning of the third quarter, and that 153,000 snowboards are budgeted to be sold during the third quarter. Management wants to end the third quarter with 3,800 snowboards and 4,300 pounds of carbon fiber in inventory. Carbon fiber costs $18 per pound. Each snowboard requires 0.5 hour of direct labor at $23 per hour. Variable overhead is budgeted at the rate of $11 per direct labor hour. The company budgets fixed overhead of $1,785,000 for the quarter. 3. Prepare the direct labor budget for the third quarter. BLACK DIAMOND COMPANY Units to produce Direct labor hours needed Cost of direct labor Direct Labor Budget Third Quarterarrow_forwardRequired information [The following information applies to the questions displayed below] Black Diamond Company produces snowboards. Each snowboard requires 3 pounds of carbon fiber. Management reports that 5,100 snowboards and 6,100 pounds of carbon fiber are in inventory at the beginning of the third quarter, and that 151,000 snowboards are budgeted to be sold during the third quarter. Management wants to end the third quarter with 3.600 snowboards and 4,100 pounds of carbon fiber in inventory. Carbon fiber costs $16 per pound. Each snowboard requires 0.5 hour of direct labor at $21 per hour. Variable overhead is budgeted at the rate of $9 per direct labor hour. The company budgets fixed overhead of $1.783,000 for the quarter. Show Transcribed Text D 3. Prepare the direct labor budget for the third quarter. BLACK DIAMOND COMPANY Units to produce Direct labor hours needed Cost of direct labor Direct Labor Budget Third Quarterarrow_forward

- please answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image) Palermo Statuary manufactures bust statues of famous historical figures. All statues are the same size. Each unit requires the same amount of resources. The following information is from the static budget for 2020 . Expected production and sales 6,100 units Expected selling price per unit $755 Total fixed costs $1,600,000 Standard quantities, standard prices, and standard unit costs follow for direct materials and direct manufacturing labor. Data table Standard Quantity Standard Price Standard Unit Cost Direct materials 16 pounds $14 per pound $224 Direct manufacturing labor 3.8 hours $30 per hour $114 During 2020, actual number of units produced and sold was 5,100, at an average selling price of $790.Actual cost of direct materials used was…arrow_forward@ Gusteau's manufactures high-quality boxes of flavored seltzer which it sells for $14 per box. Below is some information related to Gusteau's capacity and budgeted fixed manufacturing costs for 2019: Budgeted Fixed Days of Hours of Denominator-Level W Capacity Concept Theoretical Capacity Practical Capacity Normal Capacity Master Budget Capacity $10,187,250 $10,194,980 # 3 E $ Help Center? Period 4 Manufacturing Overhead per $1,750,000 $1,750,000 $1,750,000 $1,750,000 R Production Production % 5 per Period T 362 310 310 310 Production during 2019 was 990,000 boxes of flavored seltzer, with 15,000 remaining in ending inventory at 12/31/19. Assume beginning inventory is zero. 22 Variable manufacturing costs were $1.78 per unit (there are no variable cost variances). Actual fixed manufacturing overhead costs were $1,750,000, the same as budgeted. Fixed manufacturing overhead cost variances are written off to cost of goods sold in the period in which they occur. (Note: Round interim…arrow_forwardOptimus Company manufactures a variety of tools and industrial equipment. The company operates through three divisions. Each division is an investment center. Operating data for the Home Division for the year ended December 31, 2020, and relevant budget data are as follows. Actual Comparison with Budget Sales $1,400,000 $100,000 favorable Variable cost of goods sold 680, 000 56,000 unfavorable Variable selling and administrative expenses 124,000 24,000 unfavorable Controllable fixed cost of goods sold 169,000 On target Controllable fixed selling and administrative expenses 83,000 On target Average operating assets for the year for the Home Division were $2,000,000 which was also the budgeted amount. Prepare a responsibility report for the Home Division. (List variable costs before fixed costs. Round ROI to 2 decimal places, e.g. 1.57% .) OPTIMUS COMPANY Home Division Responsibility Report For the Year Ended December 31, 2020arrow_forward

- Required information Use the following information for the Quick Study below. (Algo) Miami Solar manufactures solar panels for industrial use. The company budgets production of 5,600 units (solar panels) in July and 5,800 units in August. QS 20-9 (Algo) Manufacturing: Direct materials budget LO P1 Each unit requires 2 pounds of direct materials, which cost $6 per pound. The company's policy is to maintain direct materials inventory equal to 40% of the next month's direct materials requirement. As of June 30, the company has 4,480 pounds of direct materials in inventory. Prepare the direct materials budget for July. MIAMI SOLAR Direct Materials Budget Units to produce Materials required per unit (pounds) Materials needed for production (pounds) Add: Desired ending materials inventory Total materials required (pounds) Less: Beginning materials inventory (pounds) Materials to purchase (pounds); Materials cost per pound Cost of direct materials purchases $ July 5,600 2 11,200 4,640 15,840…arrow_forwardRequired information [The following information applies to the questions displayed below.) Black Diamond Company produces snowboards. Each snowboard requires 3 pounds of carbon fiber. Management reports that 6,800 snowboards and 7,800 pounds of carbon fiber are in inventory at the beginning of the third quarter, and that 168,000 snowboards are budgeted to be sold during the third quarter. Management wants to end the third quarter with 5,300 snowboards and 5,800 pounds of carbon fiber in inventory. Carbon fiber costs $17 per pound. Each snowboard requires 0.5 hour of direct labor at $22 per hour. Variable overhead is budgeted at the rate of $12 per direct labor hour. The company budgets fixed overhead of $1,800,000 for the quarter. Required: 1. Prepare the production budget for the third quarter. Hint: Desired ending inventory units are given. BLACK DIAMOND COMPANY Production Budget (in units) Third Quarter Total required units Units to producearrow_forwardThe Fortise Corporation manufactures two types of vacuum cleaners, the Victor for commercial building use and the House - Mate for residences. Budgeted and actual operating data for the year 2020 were as follows Static Budget Victor House-Mate Total 6,600 $1,560,000 27,000 $3,140,000 Number sold 33,600 $4,700,000 Contribution margin Actual Results Victor House-Mate Total Number sold Contribution margin 5,400 $1,400,000 38,000 $4,130,000 43,400 $5,530,000 What is the total flexible - budget variance in terms of the contribution margin? (Round intermediary calculations to the nearest dollar.) A. $4,408,000 unfavorable O B. $152,400 unfavorable O C. $1,274.400 favorable O D. $152,400 favorablearrow_forward

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub