Concept explainers

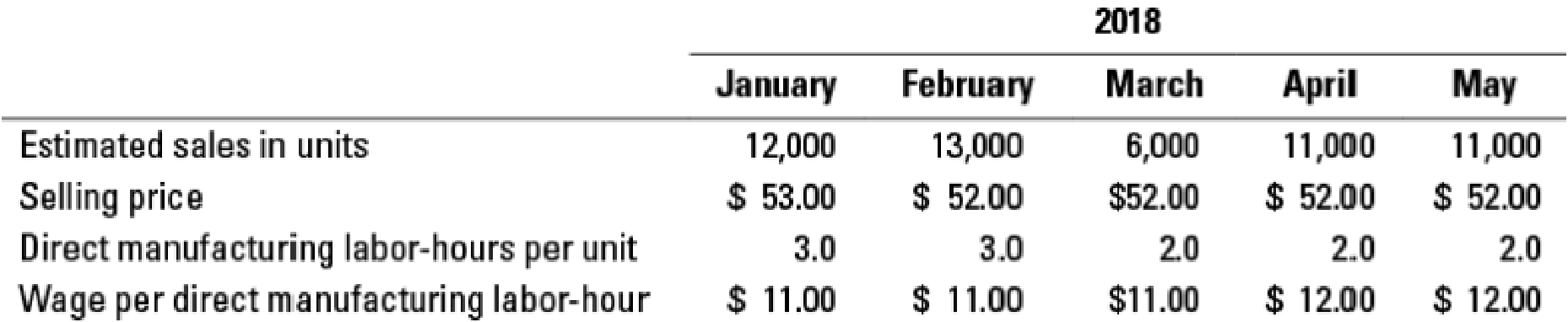

Budgets for production and direct manufacturing labor. (CMA, adapted) DeWitt Company makes and sells artistic frames for pictures of weddings, graduations, and other special events. Ron Bahar, the controller, is responsible for preparing DeWitt’s

In addition to wages, direct manufacturing labor-related costs include pension contributions of $0.40 per hour, worker’s compensation insurance of $0.10 per hour, employee medical insurance of $0.50 per hour, and Social Security taxes. Assume that as of January 1, 2018, the Social Security tax rates are 7.5% for employers and 7.5% for employees. The cost of employee benefits paid by DeWitt on its direct manufacturing employees is treated as a direct

DeWitt has a labor contract that calls for a wage increase to $12 per hour on April 1, 2018. New labor-saving machinery has been installed and will be fully operational by March 1, 2018. DeWitt expects to have 16,000 frames on hand at December 31, 2017, and it has a policy of carrying an end-of-month inventory of 100% of the following month’s sales plus 50% of the second following month’s sales.

- 1. Prepare a production budget and a direct manufacturing labor cost budget for DeWitt Company by month and for the first quarter of 2018. You may combine both budgets in one schedule. The direct manufacturing labor cost budget should include labor-hours and show the details for each labor cost category.

Required

- 2. What actions has the budget process prompted DeWitt’s management to take?

- 3. How might DeWitt’s managers use the budget developed in requirement 1 to better manage the company?

Trending nowThis is a popular solution!

Chapter 6 Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

- Don Johnson is the management accountant for Cari-Blocks (CB), which manufacturesspecialty blocks. CB uses two direct cost categories: direct materials and directmanufacturing labour. Johnson feels that manufacturing overhead is most closely related tomaterial usage. Therefore, CB allocates manufacturing overhead to production based uponpounds of materials used.At the beginning of 2021, CB budgeted annual production of 200,000 blocks and adopted thefollowing standards for each block: Input Cost/BlockDirect materials 0.5 lb. @ $12/lb. $ 6.00Direct manufacturing labour 1.4 hours @ $20/hour 28.00Manufacturing overhead:Variable $6/lb. 0.5 lb. 3.00Fixed $15/lb. 0.3 lb. 4.50Standard cost per block $41.50Actual results for April 2021 were as follows:Production 24,000 blocksDirect materials purchased 12,000 lb. at $13/lb.Direct materials used 11,450 lb.Direct manufacturing labour 38,000 hours for $798000Variable manufacturing overhead $68,150Fixed manufacturing overhead $155,000 1) Prepare a…arrow_forwardDon Johnson is the management accountant for Cari-Blocks (CB), which manufacturesspecialty blocks. CB uses two direct cost categories: direct materials and directmanufacturing labour. Johnson feels that manufacturing overhead is most closely related tomaterial usage. Therefore, CB allocates manufacturing overhead to production based uponpounds of materials used.At the beginning of 2021, CB budgeted annual production of 200,000 blocks and adopted thefollowing standards for each block:Direct materials 0.5 lb. @ $12/lb. $ 6.00Direct manufacturing labour 1.4 hours @ $20/hour 28.00Manufacturing overhead:Variable $6/lb. 0.5 lb. 3.00Fixed $15/lb. 0.3 lb. 4.50Standard cost per block $41.50Actual results for April 2021 were as follows:Production 24,000 blocksDirect materials purchased 12,000 lb. at $13/lb.Direct materials used 11,450 lb.Direct manufacturing labour 38,000 hours for $798000Variable manufacturing overhead $68,150Fixed manufacturing overhead $155,000 CALCULATE: .a. Direct…arrow_forwardSheridan Corporation manufactures safes-large mobile safes, and large walk-in stationary bank safes. As part of its annual budgeting process, Sheridan is analyzing the profitability of its two products. Part of this analysis involves estimating the amount of overhead to be assigned to each product line. The following information relates to overhead. Units planned for production Material moves per product line Purchase orders per product line Direct labor hours per product line Manufacturing overhead $ eTextbook and Media Material handling costs $ Purchasing activity costs $ (c) Mobile Safes Mobile Safe The total estimated manufacturing overhead was $270,000. Under traditional costing (which assigns overhead on the basis of direct labor hours), what amount of manufacturing overhead costs are assigned to: (Round answers to 2 decimal places, e.g. 15.25.) Well, in fata 200 $ 350 ९ 500 900 Walk-In Safes 1. One mobile safe 2. What amount of purchasing activity costs are assigned to:…arrow_forward

- Buller Company uses normal costing. It allocates manufacturing overhead costs using a budgeted rate per machine-hour. The following data are available for 2019:Budgeted manufacturing overhead costs Budgeted machine-hoursActual manufacturing overhead costs Actual machine-hoursRequired:$4,800,000 180,000 $3,990,000150,0001. Calculate the budgeted manufacturing overhead rate.2. Calculate the manufacturing overhead allocated during 2019.3. Calculate the amount of under- or overallocated manufacturing overhead. Whydo Buller’s managers need to calculate this amount?arrow_forwardDon Johnson is the management accountant for Cari-Blocks (CB), which manufactures specialty blocks. CB uses two direct cost categories: direct materials and direct manufacturing labour. Johnson feels that manufacturing overhead is most closely related tomaterial usage. Therefore, CB allocates manufacturing overhead to production based upon pounds of materials used.At the beginning of 2021, CB budgeted annual production of 200,000 blocks and adopted the following standards for each block: Input Cost/BlockDirect materials 0.5 lb. @ $12/lb. $ 6.00Direct manufacturing labour 1.4 hours @ $20/hour 28.00Manufacturing overhead:Variable $6/lb. 0.5 lb. 3.00Fixed $15/lb. 0.3 lb. 4.50Standard cost per block $41.50Actual results for April 2021 were as follows:Production 24,000 blocksDirect materials purchased 12,000 lb. at $13/lb.Direct materials used 11,450 lb.Direct manufacturing labour 38,000 hours for $798000Variable manufacturing overhead $68,150Fixed manufacturing overhead $155,000…arrow_forwardWest Glass (WG), which manufactures specialty windows, recently hired Derek Smith as the management accountant . Direct materials and direct manufacturing labour are the two direct cost categories used by WG. Smith feels that manufacturing overhead is most closely related to material usage. Therefore, WG allocates manufacturing overhead to production based upon pounds of materials used. At the beginning of 2021, WG budgeted annual production of 200,000 windows and adopted the following standards for each window: Input Cost/window Direct materials 0.5 lb. @ $12/lb. $ 6.00 Direct manufacturing labour 1.4 hours @ $20/hour 28.00 Manufacturing overhead: Variable $6/lb. 0.5 lb.…arrow_forward

- Don Johnson is the management accountant for Cari-Blocks (CB), which manufactures specialty blocks. CB uses two direct cost categories: direct materials and direct manufacturing labour. Johnson feels that manufacturing overhead is most closely related tomaterial usage. Therefore, CB allocates manufacturing overhead to production based upon pounds of materials used.At the beginning of 2021, CB budgeted annual production of 200,000 blocks and adopted the following standards for each block: Input Cost/BlockDirect materials 0.5 lb. @ $12/lb. $ 6.00Direct manufacturing labour 1.4 hours @ $20/hour 28.00Manufacturing overhead:Variable $6/lb. 0.5 lb. 3.00Fixed $15/lb. 0.3 lb. 4.50Standard cost per block $41.50Actual results for April 2021 were as follows:Production 24,000 blocksDirect materials purchased 12,000 lb. at $13/lb.Direct materials used 11,450 lb.Direct manufacturing labour 38,000 hours for $798000Variable manufacturing overhead $68,150Fixed manufacturing overhead $155,000…arrow_forwardDon Johnson is the management accountant for Cari-Blocks (CB), which manufactures specialty blocks. CB uses two direct cost categories: direct materials and direct manufacturing labour. Johnson feels that manufacturing overhead is most closely related tomaterial usage. Therefore, CB allocates manufacturing overhead to production based upon pounds of materials used.At the beginning of 2021, CB budgeted annual production of 200,000 blocks and adopted the following standards for each block: Input Cost/BlockDirect materials 0.5 lb. @ $12/lb. $ 6.00Direct manufacturing labour 1.4 hours @ $20/hour 28.00Manufacturing overhead:Variable $6/lb. 0.5 lb. 3.00Fixed $15/lb. 0.3 lb. 4.50Standard cost per block $41.50Actual results for April 2021 were as follows:Production 24,000 blocksDirect materials purchased 12,000 lb. at $13/lb.Direct materials used 11,450 lb.Direct manufacturing labour 38,000 hours for $798000Variable manufacturing overhead $68,150Fixed manufacturing overhead $155,000…arrow_forwardDon Johnson is the management accountant for Cari-Blocks (CB), which manufactures specialty blocks. CB uses two direct cost categories: direct materials and direct manufacturing labor. Johnson feels that manufacturing overhead is most closely related to material usage. Therefore, CB allocates manufacturing overhead to production based upon pounds of materials used. At the beginning of 2021, CB budgeted annual production of 200,000 blocks and adopted the following standards for each block: Input Cost/Block Direct materials 0.5 lb. @ $12/lb. $ 6.00 Direct manufacturing labour 1.4 hours @ $20/hour 28.00 Manufacturing overhead: Variable $6/lb. 0.5 lb. 3.00 Fixed $15/lb. 0.3 lb. 4.50 Standard cost per block $41.50 Actual results for April 2021 were as follows: Production 24,000 blocks Direct materials purchased…arrow_forward

- Don Johnson is the management accountant for Cari-Blocks (CB), which manufactures specialty blocks. CB uses two direct cost categories: direct materials and direct manufacturing labor. Johnson feels that manufacturing overhead is most closely related to material usage. Therefore, CB allocates manufacturing overhead to production based upon pounds of materials used. At the beginning of 2021, CB budgeted annual production of 200,000 blocks and adopted the following standards for each block: Input Cost/Block Direct materials 0.5 lb. @ $12/lb. $ 6.00 Direct manufacturing labour 1.4 hours @ $20/hour 28.00 Manufacturing overhead: Variable $6/lb. 0.5 lb. 3.00 Fixed $15/lb. 0.3 lb. 4.50 Standard cost per block $41.50 Actual results for April 2021 were as follows: Production 24,000 blocks Direct materials purchased…arrow_forwardDon Johnson is the management accountant for Cari-Blocks (CB), which manufactures specialty blocks. CB uses two direct cost categories: direct materials and direct manufacturing labor. Johnson feels that manufacturing overhead is most closely related to material usage. Therefore, CB allocates manufacturing overhead to production based upon pounds of materials used. At the beginning of 2021, CB budgeted annual production of 200,000 blocks and adopted the following standards for each block: Input Cost/Block Direct materials 0.5 lb. @ $12/lb. $ 6.00 Direct manufacturing labour 1.4 hours @ $20/hour 28.00 Manufacturing overhead: Variable $6/lb. 0.5 lb. 3.00 Fixed $15/lb. 0.3 lb. 4.50 Standard cost per block $41.50 Actual results for April 2021 were as follows: Production 24,000 blocks Direct materials purchased…arrow_forwardDon Johnson is the management accountant for Cari-Blocks (CB), which manufactures specialty blocks. CB uses two direct cost categories: direct materials and direct manufacturing labor. Johnson feels that manufacturing overhead is most closely related to material usage. Therefore, CB allocates manufacturing overhead to production based upon pounds of materials used. At the beginning of 2021, CB budgeted annual production of 200,000 blocks and adopted the following standards for each block: Input Cost/Block Direct materials 0.5 lb. @ $12/lb. $ 6.00 Direct manufacturing labour 1.4 hours @ $20/hour 28.00 Manufacturing overhead: Variable $6/lb. 0.5 lb. 3.00 Fixed $15/lb. 0.3 lb. 4.50 Standard cost per block $41.50 Actual results for April 2021 were as follows: Production 24,000 blocks Direct materials purchased…arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning