To calculate: The monthly savings of Person BB.

Introduction:

The series of payments that are made at equal intervals is an

Answer to Problem 57QP

The monthly savings of Person BB is $3,362.78.

Explanation of Solution

Given information:

Person BB wishes to save money to fulfill his three objectives. They are as follows:

- The first objective of Person BB is to retire at thirty years from now with a retirement amount of $20,000 for a month for every 25 years, the first payment will be expected at thirty years and a month from present

- The second objective of Person BB is to buy a cabin in the Place R within ten years at an projected cost of $375,000

- The third objective of Person B is to leave an inheritance of $2,000,000 to Person F after he passes on and at the last of the 25 years of withdrawal

Person BB can afford to save $25,000 for a month for the next ten years if he can earn the effective annual cost of 7% after his retirement and 10% before his retirement.

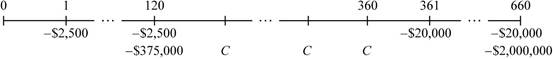

Time line of the cash flow:

Note: The cash flows from the given information takes place monthly basis, the given interest rate is an effective annual rate. As the cash flows take place on a monthly basis, it is essential to compute the effective monthly rate by finding the annual percentage rate through monthly compounding, and then dividing it by 12. The preretirement annual percentage rate is calculated as follows:

Formula to calculate the effective annual rate:

Compute the effective annual rate:

Compute the annual percentage rate with the effective annual rate:

Hence, the annual percentage rate is 0.0957 or 9.57%.

The annual percentage rate for the post-retirement is calculated as follows:

Formula to calculate the effective annual rate:

Compute the effective annual rate:

Compute the annual percentage rate with the effective annual rate:

Hence, the annual percentage rate is 0.067 or 6.78%.

First, it is essential to compute the retirement needs of Person BB. The amount that is essential for the retirement is the present value of the monthly spending plus the inheritance’s present value. The present value of the two cash flows is as follows:

Formula to calculate the present value

Note: C denotes the payments, r denotes the rate of exchange, and t denotes the period.

Compute the present value annuity for without fee:

Formula to calculate the present value:

Compute the present value:

Hence, the present value is $368,498.36.

Person BB will be saving $2,500 per month for the upcoming ten years until he buys the cabin. The value of his savings after ten years is calculated as follows:

Formula to calculate the

Note: C denotes the annual cash flow or the annuity payment, r denotes the rate of interest, and t denotes the number of payments.

Compute the future value annuity of Person BB:

Hence, the future value of the annuity is $499,659.64.

The amount that remains in the hands of Person BB after the purchase of the cabin is as follows:

Note: The amount that remains in the hands of Person BB is calculated by subtracting the cost of the cabin from the calculated future value of the annuity.

Hence, the amount that Person BB has in his hands is $124,659.64.

Person BB still has twenty years until the retirement and at the time when he is ready to retire, the amount he would receive is as follows:

Formula to compute the future value:

Note: C denotes the annual cash flow or the annuity payment, r denotes the rate of interest, and t denotes the number of payments.

Compute the future value:

Hence, the future value is $838,647.73.

Thus, when Person BB is ready for the retirement based on his present savings, he will be short of the below amount:

Thus, the above calculated amount is the future value of the monthly savings that Person BB has to make between ten to thirty years.

Hence, the future value of an annuity of Person BB is $2,415,347.07.

Compute the monthly savings of Person BB using the Formula of the future value of an annuity:

Hence, the monthly savings of Person BB is $3,362.78.

Want to see more full solutions like this?

Chapter 6 Solutions

Fundamentals of Corporate Finance

- You want to retire in 20 years. You currently have $200,000, and think you will need $1.5 million at retirement. What annual interest rate must you earn to reach your goal, assuming you don’t save any additional funds? What annual interest rate must you earn if you can contribute an additional $5,000 per year? What annual interest rate must you earn if you can contribute an additional $15,000 per year? You want to retire in 30 years. You currently have $500,000, and think you will need $2.5 million at retirement. What annual interest rate must you earn to reach your goal, assuming you don’t save any additional funds? What annual interest rate must you earn if you can contribute an additional $7,500 per year? What annual interest rate must you earn if you can contribute an additional $13,000 per year?arrow_forward27. A couple thinking about retirement decide to put aside $3,000 each year in a savings plan that earns 8% interest. In 5 years they will receive a gift of $10,000, which can also be invested. a. How much money will they have accumulated 30 years from now? (Round your answer to the nearest cent.) b. If their goal is to retire with $800,000 of savings, how much extra do they need to save every year? (Round your answer to the nearest cent.)arrow_forward14. You are saving for retirement. To live comfortably, you decide you will need to save $3 million by the time you are 65. Today is your 20th birthday, and you decide, starting today and continuing on every birthday up to and including your 65th birthday, that you will put the same amount into a savings account. If the interest rate is 10%, how much must you set aside each year to make sure that you will have $3 million in the account on your 65th birthday?\The amount to deposit each year is $______(Round to the nearest dollar.)arrow_forward

- Bilbo Baggins wants to save money to meet three objectives. First, he would like to be able to retire 30 years from now with retirement income of $24,000 per month for 20 years, with the first payment received 30 years and 1 month from now. Second, he would like to purchase a cabin in Rivendell in 20 years at an estimated cost of $1,322,000. Third, after he passes on at the end of the 20 years of withdrawals, he would like to leave an inheritance of $850,000 to his nephew Frodo. He can afford to save $2,300 per month for the next 20 years. If he can earn a 10 percent EAR before he retires and a 8 percent EAR after he retires, how much will he have to save each month in Years 21 through 30?arrow_forwardFinding the required interest rate Your parents will retire in 29 years. They currently have $400,000, and they think they will need $1,100,000 at retirement. What annual interest rate must they earn to reach their goal, assuming they don't save any additional funds? Round your answer to two decimal places.arrow_forwardBilbo Baggins wants to save money to meet three objectives. First, he would like to be able to retire 30 years from now with retirement income of $27,000 per month for 20 years, with the first payment received 30 years and 1 month from now. Second, he would like to purchase a cabin in Rivendell in 15 years at an estimated cost of $792,000. Third, after he passes on at the end of the 20 years of withdrawals, he would like to leave an inheritance of $800,000 to his nephew Frodo. He can afford to save $2,100 per month for the next 15 years. If he can earn a 12 percent EAR before he retires and a 8 percent EAR after he retires, how much will he have to save each month in Years 16 through 30? show all detailed equations , Financial Calculator not allowed.arrow_forward

- Final Question: You want to start saving for your retirement now. You plan on retiring at 60. Solve the following problems. How much do you need to set aside from your current birthday, till the age of 60, in order to have saved $1 million dollars in an RRSP. Assume you are setting aside an equal payment every two weeks, with a return of 8.5% on the investment. Now that you have retired, you are going to convert the RRSP to a RIF (registered income fund) that will pay out on a regular basis, replacing the pay cheque you no longer will receive. Assume your RIF gives you a monthly payment with the annual interest rate now at a conservative 5%. Assume you want your RIF to run out on your 95th birthday, the day you die... I know, morbid right! Show complete solutions. please provide full detailed answers and please dont use Alarrow_forwardPerpetuity: Your grandfather is retiring at the end of next year. He would like to ensure that his heirs receive payments of $10,000 a year forever, starting when he retires. If he can earn 6.5 percent annually, how much does your grandfather need to invest to produce the desired cash flow? Please use Excel to solvearrow_forwardYour uncle is about to retire, and he wants to buy an annuity that will provide him with $97,000 of income a year for 20 years, with the first payment coming immediately. The going rate on such annuities is 5.45%. How much would it cost him to buy the annuity today? a. $1,192,059.14 b. $1,164,011.03 c. $1,195,837.87 d. $1,261,011.03 e. $1,227,449.63arrow_forward

- You believe you will need to have saved $593,000 by the time you retire in 30 years in order to live comfortably. You also believe that you will inherit $113,000 in 5 years. 1) If the interest rate is 7% per year, what is the future value of your inheritance at retirement? 2) How much additional money must you save to meet your retirement goal, assuming you save your entire inheritance?arrow_forward1. Retirement Planning. A couple will retire in 50 years; they plan to spend about $30,000 a year in retirement, which should last about 25 years. They believe that they can earn 8 percent interest on retirement savings. a. If they make annual payments into a savings plan, how much will they need to save each year? Assume the first payment comes in 1 year.b. How would the answer to part (a) change if the couple also realizes that in 20 years, they will need to spend $60,000 on their child’s college education?arrow_forwardFunding a retirement goal. Austin Miller wishes to have 800,000 in a retirement fund 20 years from now. He can create the retirement fund by making a single lump-sum deposit today. a. If upon retirement in 20 years, Austin plans to invest 800,000 in a fund that earns 4 percent, what is the maximum annual withdrawal he can make over the following 15 years? b. How much would Austin need to have on deposit at retirement in order to withdraw 35,000 annually over the 15 years if the retirement fund earns 4 percent? c. To achieve his annual withdrawal goal of 35,000 calculated in part b, how much more than the amount calculated in part a must Austin deposit today in an investment earning 4 percent annual interest?arrow_forward

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning PFIN (with PFIN Online, 1 term (6 months) Printed...FinanceISBN:9781337117005Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed...FinanceISBN:9781337117005Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning