1.

Calculate cost per bag of chemicals transferred to finished goods using the FIFO method.

1.

Explanation of Solution

Calculate cost per bag of chemicals transferred out to finished goods.

Therefore, cost per bag of chemical transferred out to finished goods is $341.65.

Working notes:

Calculate physical flow schedule for baking department.

| Particulars | Units | Workings |

| Units to account for: | ||

| Beginning work in process | 10,000 | (5,000 × 2) |

| Units started | 100,000 | (50,000 ×2) |

| Total units to account for | 110,000 | |

| Units accounted for: | ||

| Units transferred out | 100,000 | (110,000 - 10,000) |

| Add: Normal spoilage | 5,000 | |

| Abnormal spoilage | 5,000 | |

| Total units accounted for | 110,000 |

Table (1)

Prepare equivalent units of production for baking department

| Particulars | Conversion costs | Transferred In |

| Units started and completed | 90,000 | 90,000 |

| Equivalent units in beginning work in process | 7,500 | 0 |

| Normal spoilage | 2,500 | 5,000 |

| Abnormal spoilage | 2,500 | 5,000 |

| Total equivalent units | 102,500 | 100,000 |

Table (2)

Prepare equivalent cost per unit for baking department.

| Particulars | Conversion | Transferred In |

| Cost (A) | $205,000 | $250,000 |

| Equivalent units of production (B) | 102,500 | 100,000 |

| Cost per unit (A ÷ B) | $2 | $2.50 |

Table (3)

Calculate cost of goods transferred out.

| Particulars | Amount | Amount |

| Started and completed (90,000 × ($2 + $2.50) | $405,000 | |

| Units from beginning work in process: | ||

| Prior period costs | $35,000 | |

| Cost to finished (7,500 × $2) | $15,000 | $50,000 |

| Normal spoilage (2,500 × $2)+ (2,500 × $2.50) | $17,500 | |

| Total | $472,500 |

Table (4)

Calculate abnormal spoilage loss for banking department.

Calculate physical flow schedule for grinding department.

| Particulars | Units | Workings |

| Units to account for: | ||

| Beginning work in process | 500 | (25,000 ÷50) |

| Units started | 2,000 | (100,000 ÷50) |

| Total units to account for | 2,500 | |

| Units accounted for: | ||

| Started and completed | 2,000 | (110,000 - 10,000) |

| Add: Beginning work in process | 500 | |

| Total units accounted for | 2,500 |

Table (5)

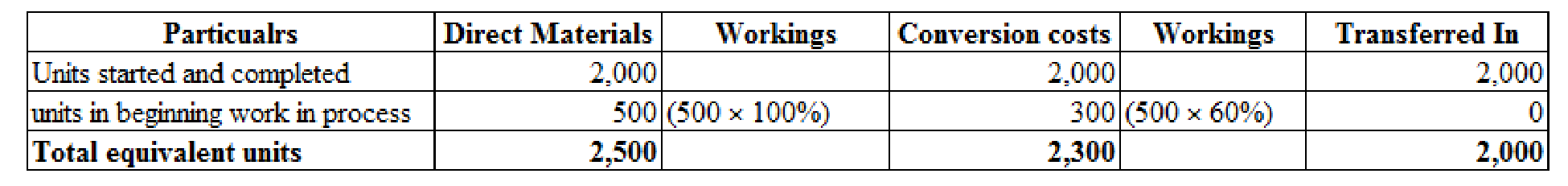

Prepare equivalent units of production for grinding

Figure (1)

Prepare equivalent cost per unit for grinding department.

| Particulars | Direct Materials | Conversion | Transferred In |

| Cost in beginning work in process | $0 | $15,000 | $132,500 |

| Add: Cost added (A) | $4,125 | $172,500 | $472,500 |

| Total costs | $4,125 | $187,500 | $605,000 |

| Equivalent units of production (B) | 2,500 | 2,300 | 2,000 |

| Cost per unit (A ÷ B) | $1.65 | $75 | $236.25 |

Table (6)

Calculate cost added for direct materials.

Calculate total prior costs for grinding department.

Calculate ending work in process inventory for direct materials.

Calculate ending work in process inventory for conversion cost.

2.

Prepare

2.

Explanation of Solution

Prepare journal entry to record to remove spoilage from the baking and grinding departments

| Date | Account titles and Explanation | Debit | Credit |

| Loss Due to spoilage | $17,500 | ||

| Work in process - Baking department | $17,500 | ||

| (To record remove spoilage for baking department) |

Table (7)

- Loss due to spoilage is a component of

stockholders’ equity , and it is decreased. Therefore, debit loss due to spoilage account for $17,500. - Work in process inventory- Baking department is a current asset, and it is decreased. Therefore, credit work in process inventory – Baking department account for $17,500.

Want to see more full solutions like this?

Chapter 6 Solutions

Cornerstones of Cost Management (Cornerstones Series)

- Healthway uses a process-costing system to compute the unit costs of the minerals that it produces. It has three departments: Mixing, Tableting, and Bottling. In Mixing, at the beginning of the process all materials are added and the ingredients for the minerals are measured, sifted, and blended together. The mix is transferred out in gallon containers. The Tableting Department takes the powdered mix and places it in capsules. One gallon of powdered mix converts to 1,600 capsules. After the capsules are filled and polished, they are transferred to Bottling where they are placed in bottles, which are then affixed with a safety seal and a lid and labeled. Each bottle receives 50 capsules. During July, the following results are available for the first two departments (direct materials are added at the beginning in both departments): Overhead in both departments is applied as a percentage of direct labor costs. In the Mixing Department, overhead is 200 percent of direct labor. In the Tableting Department, the overhead rate is 150 percent of direct labor. Required: 1. Prepare a production report for the Mixing Department using the weighted average method. Follow the five steps outlined in the chapter. Round unit cost to three decimal places. 2. Prepare a production report for the Tableting Department. Materials are added at the beginning of the process. Follow the five steps outlined in the chapter. Round unit cost to four decimal places.arrow_forwardBenson Pharmaceuticals uses a process-costing system to compute the unit costs of the over-the-counter cold remedies that it produces. It has three departments: mixing, encapsulating, and bottling. In mixing, the ingredients for the cold capsules are measured, sifted, and blended (with materials assumed to be uniformly added throughout the process). The mix is transferred out in gallon containers. The encapsulating department takes the powdered mix and places it in capsules (which are necessarily added at the beginning of the process). One gallon of powdered mix converts into 1,500 capsules. After the capsules are filled and polished, they are transferred to bottling, where they are placed in bottles that are then affixed with a safety seal, lid, and label. Each bottle receives 50 capsules. During March, the following results are available for the first two departments: Overhead in both departments is applied as a percentage of direct labor costs. In the mixing department, overhead is 200% of direct labor. In the encapsulating department, the overhead rate is 150% of direct labor. Required: 1. Prepare a production report for the mixing department using the weighted average method. Follow the five steps outlined in the chapter. (Note: Round to two decimal places for the unit cost.) 2. Prepare a production report for the encapsulating department using the weighted average method. Follow the five steps outlined in the chapter. (Note: Round to four decimal places for the unit cost.) 3. CONCEPTUAL CONNECTION Explain why the weighted average method is easier to use than FIFO. Explain when weighted average will give about the same results as FIFO.arrow_forwardThe Hayes Chemical Company produces a chemical used in dry cleaning. Its accounting system uses standard costs. The standards per 0.60-gallon can of chemical call for 1.30 gallons of material and 1.60 hours of labor. (1.30 gallons of material are needed to produce a 0.60-gallon can of product due to evaporation.) The standard cost per gallon of material is $7. The standard cost per hour for labor is $10. Overhead is applied at the rate of $7.25 per can. Expected production is 19,100 cans with fixed overhead per year of $23,875 and variable overhead of $6 per unit (a 0.60-gallon can). During 2021, 24,600 cans were produced; 32,000 gallons of material were purchased at a cost of $250,880; 27,500 gallons of material were used in production. The cost of direct labor incurred in 2021 was $332,264 based on an average actual wage rate of $8.73 per hour. Actual overhead for 2021 was $236,500. (a) Your answer is correct. Determine the standard cost per unit. (Round answer to 2 decimal places,…arrow_forward

- Scribners Corporation produces fine papers in three production departments—Pulping, Drying, and Finishing. In the Pulping Department, raw materials such as wood fiber and rag cotton are mechanically and chemically treated to separate their fibers. The result is a thick slurry of fibers. In the Drying Department, the wet fibers transferred from the Pulping Department are laid down on porous webs, pressed to remove excess liquid, and dried in ovens. In the Finishing Department, the dried paper is coated, cut, and spooled onto reels. The company uses the weighted-average method in its process costing system. Data for March for the Drying Department follow: Percent Completed Units Pulping Conversion Work in process inventory, March 1 3,800 100 % 80 % Work in process inventory, March 31 5,000 100 % 75 % Pulping cost in work in process inventory, March 1 $ 1,349 Conversion cost in work in process inventory, March 1 $ 684 Units transferred to the…arrow_forwardMedinc produces disinfectants by mixing 2 chemical solutions in a machine to become a disinfectant solution (solution 1 and solution 2). Solution 1 is the first process which is carried out at workstation A for 0.5 minutes per solution then continued at workstation B for 0.2 minutes per solution. Then together solution 1 is mixed with solution 2 at workstation C for 0.8 minutes per solution. Workstations B and C are processed at workstation D for mixing together where the process is 10 minutes per solution until it becomes a disinfectant solution for sale to customers. a. Which workstations are the bottleneck? Explain with a picture of the workstation.b. What is the resulting time (throughput time) of the entire work system above?c. How much disinfectant solution can a company produce per hour?arrow_forwardScribners Corporation produces fine papers in three production departments—Pulping, Drying, and Finishing. In the Pulping Department, raw materials such as wood fiber and rag cotton are mechanically and chemically treated to separate their fibers. The result is a thick slurry of fibers. In the Drying Department, the wet fibers transferred from the Pulping Department are laid down on porous webs, pressed to remove excess liquid, and dried in ovens. In the Finishing Department, the dried paper is coated, cut, and spooled onto reels. The company uses the weighted-average method in its process costing system. Data for March for the Drying Department follow: Percent Completed Units Pulping Conversion Work in process inventory, March 1 3,500 100 % 80 % Work in process inventory, March 31 7,500 100 % 60 % Pulping cost in work in process inventory, March 1 $ 1,085 Conversion cost in work in process inventory, March 1 $ 350 Units transferred to the…arrow_forward

- Scribners Corporation produces fine papers in three production departments—Pulping, Drying, and Finishing. In the Pulping Department, raw materials such as wood fiber and rag cotton are mechanically and chemically treated to separate their fibers. The result is a thick slurry of fibers. In the Drying Department, the wet fibers transferred from the Pulping Department are laid down on porous webs, pressed to remove excess liquid, and dried in ovens. In the Finishing Department, the dried paper is coated, cut, and spooled onto reels. The company uses the weighted-average method in its process costing system. Data for March for the Drying Department follow: Units Percent Completed Pulping Conversion Work in process inventory, March 1 4,000 100% 80% Work in process inventory, March 31 8,000 100% 75% Pulping cost in work in process inventory, March 1 $ 2,860 Conversion cost in work in process inventory, March 1 $ 800 Units transferred to the next production…arrow_forwardScribners Corporation produces fine papers in three production departments—Pulping, Drying, and Finishing. In the Pulping Department, raw materials such as wood fiber and rag cotton are mechanically and chemically treated to separate their fibers. The result is a thick slurry of fibers. In the Drying Department, the wet fibers transferred from the Pulping Department are laid down on porous webs, pressed to remove excess liquid, and dried in ovens. In the Finishing Department, thedried paper is coated, cut, and spooled onto reels. The company uses the weighted-average method in its process costing system. Data for March for the Drying Department follow: No materials are added in the Drying Department. Pulping cost represents the costs of the wet fibers transferred in from the Pulping Department. Wet fiber is processed in the Drying Department in batches; each unit in the above table is a batch and one batch of wet fibers produces a setamount of dried paper that is passed on to the…arrow_forwardScribners Corporation produces fine papers in three production departments-Pulping, Drying, and Finishing. In the Pulping Department, raw materials such as wood fiber and rag cotton are mechanically and chemically treated to separate their fibers. The result is a thick slurry of fibers. In the Drying Department, the wet fibers transferred from the Pulping Department are laid down on porous webs, pressed to remove excess liquid, and dried in ovens. In the Finishing Department, the dried paper is coated, cut, and spooled onto reels. The company uses the weighted-average method in its process costing system. Data for March for the Drying Department follow: Percent Completed Pulping 100% Units Conversion Work in process inventory, March 1 Work in process inventory, March 31 Pulping cost in work in process inventory, March 1 Conversion cost in work in process inventory, March 1 Units transferred to the next production department Pulping cost added during March Conversion cost added during…arrow_forward

- Scribners Corporation produces fine papers in three production departments-Pulping, Drying, and Finishing. In the Pulping Department, raw materials such as wood fiber and rag cotton are mechanically and chemically treated to separate their fibers. The result is a thick slurry of fibers. In the Drying Department, the wet fibers transferred from the Pulping Department are laid down on porous webs, pressed to remove excess liquid, and dried in ovens. In the Finishing Department, the dried paper is coated, cut, and spooled onto reels. The company uses the weighted-average method in its process costing system. Data for March for the Drying Department follow: Percent Completed Units Pulping Conversion 20% Work in process inventory, March 1 Work in process inventory, March 31 5,000 100% 8,000 100% 25% $4,800 $500 Pulping cost in work in process inventory, March 1 Conversion cost in work in process inventory, March 1 Units transferred to the next production department Pulping cost added during…arrow_forwardScribners Corporation produces fine papers in three production departments-Pulping, Drying, and Finishing. In the Pulping Department, raw materials such as wood fiber and rag cotton are mechanically and chemically treated to separate their fibers. The result is a thick slurry of fibers. In the Drying Department, the wet fibers transferred from the Pulping Department are laid down on porous webs, pressed to remove excess liquid, and dried in ovens. In the Finishing Department, the dried paper is coated, cut, and spooled onto reels. The company uses the weighted-average method in its process costing system. Data for March for the Drying Department follow: Work in process inventory, March 1 Work in process inventory, March 31 Pulping cost in work in process inventory, March 1 Conversion cost in work in process inventory, March 1 Units transferred to the next production department Pulping cost added during March Conversion cost added during March Complete this question by entering your…arrow_forwardScribners Corporation produces fine papers in three production departments-Pulping, Drying, and Finishing. In the Pulping Department, raw materials such as wood fiber and rag cotton are mechanically and chemically treated to separate their fibers. The result is a thick slurry of fibers. In the Drying Department, the wet fibers transferred from the Pulping Department are laid down on porous webs, pressed to remove excess liquid, and dried in ovens. In the Finishing Department, the dried paper is coated, cut, and spooled onto reels. The company uses the weighted-average method in its process costing system. Data for March for the Drying Department follow: Work in process inventory, March 1 Work in process inventory, March 31 Pulping cost in work in process inventory, March 1 Conversion cost in work in process inventory, March 1 Units transferred to the next production department Pulping cost added during March Conversion cost added during March Units Percent Completed Pulping Conversion…arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning