FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

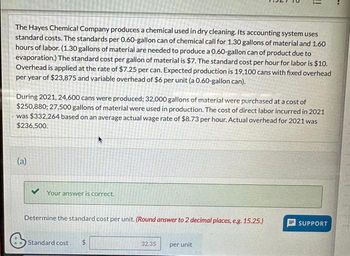

Transcribed Image Text:The Hayes Chemical Company produces a chemical used in dry cleaning. Its accounting system uses

standard costs. The standards per 0.60-gallon can of chemical call for 1.30 gallons of material and 1.60

hours of labor. (1.30 gallons of material are needed to produce a 0.60-gallon can of product due to

evaporation.) The standard cost per gallon of material is $7. The standard cost per hour for labor is $10.

Overhead is applied at the rate of $7.25 per can. Expected production is 19,100 cans with fixed overhead

per year of $23,875 and variable overhead of $6 per unit (a 0.60-gallon can).

During 2021, 24,600 cans were produced; 32,000 gallons of material were purchased at a cost of

$250,880; 27,500 gallons of material were used in production. The cost of direct labor incurred in 2021

was $332,264 based on an average actual wage rate of $8.73 per hour. Actual overhead for 2021 was

$236,500.

(a)

Your answer is correct.

Determine the standard cost per unit. (Round answer to 2 decimal places, e.g. 15.25.)

Standard cost

!!

32.35

per unit

SUPPORT

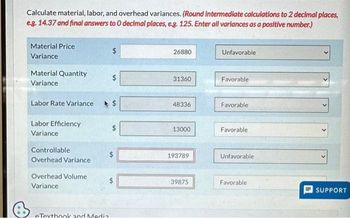

Transcribed Image Text:Calculate material, labor, and overhead variances. (Round intermediate calculations to 2 decimal places,

eg. 14.37 and final answers to O decimal places, e.g. 125. Enter all variances as a positive number.)

Material Price

Variance

Material Quantity

Variance

Labor Efficiency

Variance

Labor Rate Variance A $

Controllable

Overhead Variance

Overhead Volume

Variance

$

eTexthook and Media

$

$

$

26880

31360

48336

13000

193789

39875

Unfavorable

Favorable

Favorable

Favorable

Unfavorable

Favorable.

SUPPORT

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step 1: Define overhead rate

VIEW Step 2: a) Determining the standard cost per unit

VIEW Step 3: 2a) Calculation of material price variance and material quantity variance

VIEW Step 4: 2b) Calculation of Labor rate variance and labor efficiency variance

VIEW Step 5: 2c) Computation of Overhead controllable variance and overhead volume variance

VIEW Solution

VIEW Step by stepSolved in 6 steps with 7 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Rand Company produces dry fertilizer. At the beginning of the year, Rand had the following standard cost sheet: Direct materials (8 lbs. @ $1.25) $10.00 Direct labor (0.15 hr. @ $18.00) 2.70 Fixed overhead (0.20 hr. @ $3.00) 0.60 Variable overhead (0.20 hr. @ $1.70) 0.34 Standard cost per unit $13.64 Overhead rates are computed using practical volume, which is 49,000 units. The actual results for the year are as follows: Units produced: 53,000 Direct materials purchased: 408,000 pounds at $1.32 per pound Direct materials used: 406,800 pounds Direct labor: 10,500 hours at $17.95 per hour Fixed overhead: $36,570 Variable overhead: $18,000 MPV=28,560 UNFAV MUV=21,500 FAV LRV=525 FAV LEV=45,900 UNFAV FIXED SPENDING VARIANCE= 7,170 UNFAV FIXED VOLUME VARIANCE= 2,400 FAV VARIABLE SPENDING= 150 UNFAV VARIABLE EFFICIENCY= 4,335 UNFAV Prepare journal entries for the following: The purchase of direct materials The issuance…arrow_forwardGelb Company currently makes a key part for its main product. Making this part incurs per unit variable costs of $1.80 for direct materials and $1.35 for direct labor. Incremental overhead to make this part is $1.64 per unit. The company can buy the part for $5.06 per unit. (a) Prepare a make or buy analysis of costs for this part. (Enter your answers rounded to 2 decimal places.) (b) Should Gelb make or buy the part? (a) Make or Buy Analysis Direct materials Direct labor Overhead Cost to buy Cost per unit Cost difference (b) Company should: Make Buyarrow_forwardABC company manufactures rivets in an automated factory. The company uses standard costing system to control costs & to assign costs to its inventory. Price Standard Quantity Standard Direct material $3/ unit 16 meters/rivet Direct labour $11 per hour 3 hours per rivet Variable overheads are estimated at $5.50 per rivet. Fixed overheads are $26,000 per month. The standard fixed overhead rate is based on an estimated production of 1,000 per month. Required: a. Prepare a production budget for the coming year based on a planned production of 12,000 rivets. b. Compare the budget prepared in a) with a flexible budget based on actual production of 15,000 rivets.arrow_forward

- Carlise Corp., which manufactures ceiling fans, currently has two product lines, the Indoor and the Outdoor. Carlise has to overhead of $132,720. Carlise has identified the following information about its overhead activity cost pools and the two product lines: Quantity/Amount Consumed by Indoor Line Quantity/Amount Consumed by Outdoor Line Activity Cost Pools Cost Driver Materials handling Number of moves Quality control Number of inspections Machine maintenance Number of machine hours Required: 1. Suppose Carlise used a traditional costing system with machine hours as the cost driver. Determine the amount of overhead assigned to each product line. (Do not round intermediate calculations and round your final answers to the nearest whole dollar amount.) Indoor Model Outdoor Model Total Cost Assigned to Pool $21, 120 $71,760 4,600 inspections $39,840 29,000 machine hours 19,000 machine hours 600 moves 500 moves 5,800 inspections Overhead Assignedarrow_forwardMaxey & Sons manufactures two types of storage cabinets—Type A and Type B—and applies manufacturing overhead to all units at the rate of $120 per machine hour. Production information follows. Type A Type BAnticipated volume (units) 24,000 45,000 Direct-material cost per unit $ 28 $ 42 Direct-labor cost per unit 33 33 The controller, who is studying the use of activity-based costing, has determined that the firm’s overhead can be identified with three activities: manufacturing setups, machine processing, and product shipping. Data on the number of setups, machine hours, and outgoing shipments, which are the activities’ three respective cost drivers, follow. Type A Type B TotalSetups 140 100 240 Machine hours 48,000 67,500 115,500 Outgoing shipments 200 150 350 The firm’s total…arrow_forwardI need help with cost accounting. Thanks.arrow_forward

- Bramble's standard quantities for 1 unit of product include 3 pounds of materials and 1.0 labor hours. The standard rates are $3 per pound and $5 per hour. The standard overhead rate is $10 per direct labor hour. The total standard cost per unit of Bramble's product is O $24.00. O $18.00. O $15.00. O $14.00.arrow_forwardBrannon Company manufactures ceiling fans and uses an activity-based costing system. Each ceiling fan consists of 20 separate parts totaling $95 in direct materials, and requires 2.5 hours of machine time to produce. Additional information follows: Cost Pool Allocation Base Overhead Rate Materials handling Number of parts $.08 Machining Machine hours $7.20 Assembling Number of parts $.35 Packaging Number of finished units $2.70 What is the cost of machining per ceiling fan? Brannon Company manufactures ceiling fans and uses an activity-based costing system. Each ceiling fan consists of 20 separate parts totaling $95 in direct materials, and requires 2.5 hours of machine time to produce. Additional information follows: Cost Pool Allocation Base Overhead Rate Materials handling Number of parts $.08 Machining Machine hours $7.20 Assembling Number of parts $.35 Packaging Number of finished units $2.70 What is the cost of machining per ceiling fan? $144.00 $18.00 $180.00 $30.00arrow_forwardFountain Water Products (FWP) manufacturers water bottles. They have historically used a traditional system that allocated the manufacturing overhead costs based on machine hours. FWP is looking at switching to an ABC system in order to ensure more accurate product costing. They first want to compare the traditional and ABC costing systems to determine if it is worth the effort and costs to implement and maintain. They estimate a total overhead cost of $459,000. Under the traditional system they identified machine hours as the cost driver, and estimated a total of 51,000 machine hours. They actually incurred 48,700 machine hours in production. The total applied MOH calculated under the more precise ABC system was $320,000. The ABC costing system will cost $50,000 to implement. FWP has determined that a benefit of more accurate costing by $80,000 is worth the $50,000 implementation cost. What is the difference between the ABC costing and traditional system? Enter your number as a…arrow_forward

- Haggstrom, Inc., manufactures steel fittings. Each fitting requires both steel and an alloy that allows the fitting to be used under extreme conditions. The following data apply to the production of the fittings. Direct materials per unit 3 pounds of steel at $0.55 per pound 0.5 pounds of alloy at $1.90 per pound Direct labor per unit 0.02 hours at $30 per hour Overhead per unit Indirect materials Indirect labor Utilities Plant and equipment depreciation Miscellaneous $0.60 0.75 0.55 0.90 0.70 Total overhead per unit $3.50 The plant and equipment depreciation and miscellaneous costs are fixed and are based on production of 250,000 units annually. All other costs are variable. Plant capacity is 300,000 units annually. All other overhead costs are variable. The following are forecast for year 2. Contract negotiations with the union are expected to lead to an increase in hourly direct labor costs of 4 percent, mostly in the form of additional benefits. Commodity prices, including steel,…arrow_forwardAarrow_forwardGibson Company produces commercial gardening equipment. Since production is highly automated, the company allocates its overhead costs to product lines using activity-based costing. The costs and cost drivers associated with the four overhead activity cost pools follow: Cost Cost driver Unit Level $50,600 Req A and B 2,300 labor hours. Production of 890 sets of cutting shears, one of the company's 20 products, took 210 labor hours and 9 setups and consumed 10 percent of the product-sustaining activities. Complete this question by entering your answers in the tabs below. Req C a. Allocated cost b. Allocated cost Activities Batch Level $ 21,160 46 setups Required a. Had the company used labor hours as a companywide allocation base, how much overhead would it have allocated to the cutting shears? b. How much overhead is allocated to the cutting shears using activity-based costing? c. Compute the overhead cost per unit for cutting shears first using activity-based costing and then using…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education