(Capital Outlay; Inventory–Purchases Method) (a) Record the following transactions in the General Fund General Ledger of a school district that uses the purchases method to account for materials, supplies, and prepayments. Record both the budgetary and actual entries. Assume that materials and supplies costing $37,000 were on hand at the beginning of the year. (b) What amount of nonspendable fund balance should be reported at year end?

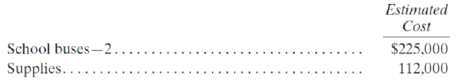

1. The school district ordered the following:

2. The school received one of the buses at an actual cost of $120,000, which equaled the estimated amount.

3. The school received most of the supplies ordered (estimated cost, $95,000). The actual cost was $95,800.

4. The school paid $93,000 of the vouchers payable for the supplies.

5. At year end, the school had supplies on hand costing $22,000.

Want to see the full answer?

Check out a sample textbook solution

Chapter 6 Solutions

Governmental and Nonprofit Accounting (11th Edition)

- Prepare a preclosing trial balance for the General Fund as of December 31, 2021.arrow_forwardPrepare entries in general journal form to record the following transactions in the Roadway Fund general ledger accounts for City of Kettering for the fiscal year 2018. Use modified accrual accounting. At the beginning of the fiscal year, the fund $1,360,000 was offset by the assigned fund balance in the same amount. The city was awarded $4,200,000 for road inspections and repairs during the year. The award requires reimbursement for expenditures, not an allotment upfront. Work contracted for the year amounted to $4,175,000. Invoices received for the work performed totaled $4,150,000. $3,980,000 of that amount was paid in cash as of year-end. The state reimbursed the city $4,000,000 for the completed work before year-end. Prepare a statement of Revenues, Expenditures, and Changes in Fund Balance for the Roadway Fund.arrow_forwardThe General Fund and Special Revenue Funds P4-2 (General Fund-Typical Transactions) Prepare all general journal entries required in the General Fund of Washington County for each of the following transactions. Also, use transaction analysis to show any effects on the GCA-GLTL accounts. The county levied property taxes of $5,000,000. It is estimated that 2% will be uncollectible. The rest of the taxes are expected to be collected by year end or soon enough thereafter to be considered available at year end. The county collected $4,300,000 of the taxes receivable before the due date and the balance of taxes became delinquent. The county collected another $540,000 of the taxes receivable by the end of the fiscal year. The county paid salariesarrow_forward

- The following information was abstracted from the accounts of the General Fund of the City of Rome after the books had been closed for the fiscal year ended June 30, 2020. Cash Taxes Receivable Allowance for Uncollectible Taxes Accounts Payable Fund Balance View transaction llest Postclosing Trial Balance June 30, 2019 $571,600 36,000 $687,608 5,608 182,808 500,000 $607,608 Clear entry 1 Record the transfer of taxes receivable to revenues control account. 2 Record the receipt of taxes and the uncollectibles. 3 Record the expenditures payable. 4 Record the payment of expenditure. 5 Record the transfer out of general fund. Hint: This is the plug needed to make cash balance after considering the other entries. 6 Record the transfer of revenue and expenditure control accounts to fund balance. Note: = journal entry has been entered Record entry Transactions July 1, 2019, to June 30, 2020 Debits $1,370,000 1,482,488 5,600 1,387,600 X There were no transfers into the General Fund, but there…arrow_forward! Required information [The following information applies to the questions displayed below.] The Village of Seaside Pines prepared the following enterprise fund Trial Balance as of December 31, 2020, the last day of its fiscal year. The enterprise fund was established this year through a transfer from the General Fund. Accounts payable Accounts receivable Accrued interest payable Accumulated depreciation Administrative and selling expenses Allowance for uncollectible accounts Capital assets Cash Charges for sales and services Cost of sales and services Depreciation expense Due from General Fund Debits $ Credits 96,000 $ 32,000 28,000 45,000 47,000 12,000 712,000 89,000 550,000 479,000 45,000 17,000 Interest expense Interest revenue Transfer in from General Fund Bank note payable Supplies inventory Totals 40,000 18,000 4,000 119,000 625,000 $1,479,000 $1,479,000 Prepare the reconciliation of operating income to net cash provided by operating activities that would appear at the bottom of…arrow_forwardDo not give answer in imagearrow_forward

- Accounting Questionarrow_forwardRequired: For each of the summarized transactions for the Village of Sycamore General Fund, prepare the general ledger journal entries. The budget was formally adopted, providing for estimated revenues of $1,076,000 and appropriations of $1,006,000. Revenues were received, all in cash, in the amount of $1,019,000. Purchase orders were issued in the amount of $486,000. Of the $486,000 in (c), purchase orders were filled in the amount of $479,500; the invoice amount was $478,000 (not yet paid). Expenditures for payroll not encumbered amounted to $518,000 (not yet paid). Amounts from (d) and (e) are paid in cash. Note: If no entry is required for a transaction or event, select "No Journal Entry Required" in the first account field.arrow_forwardces Following are transactions and events of the General Fund of the City of Springfield for the fiscal year ended December 31, 2020. 1. Estimated revenues (legally budgeted) Property taxes Sales taxes Licenses and permits Miscellaneous 2. Appropriations: General government Culture and recreation Health and welfare. 3. Revenues received (cash) Property taxes Sales taxes Licenses and permits General government Culture and recreation Health and welfare. 5. Goods and services received (paid in cash) General government culture and recreation Health and welfare Miscellaneous 4. Encumbrances issued (includes salaries and other recurring items) Estimated $5,275,000 4,630,000 995,000 6. Budget revisions Estimated Revenues Appropriations Increase appropriations: General government $ 140,000 110,000 Culture and recreation. 7. Fund balance on January 1, 2020, was $753,000. There were no outstanding encumbrances at that date. a. Record the transactions using appropriate journal entries, b. Prepare…arrow_forward

- 3. Which of the following accounts appears on both the interim and year-end balance sheets of the General Fund? a) Revenues. b) Reserve for encumbrances. c) Encumbrances. d) Appropriations. 4. Which of the following would be considered a general capital asset? a) A vehicle purchased from general fund revenues. b) A vehicle purchased and maintained by an enterprise fund. c) A computer purchased from revenues of an internal service fund and used by the supplies department. d) Real estate purchased with the assets of a pension trust fund. 5. A machine is sold for $500. It had originally been purchased for $8,000 using GF It is fully depreciated. Gain on sale of equipment account revenues. should be recorded in the General fund journal as: a) Debit in 500S. b) Credit in 500$. c) Credit in 7500S. d) Gain on sale of equipment account will not recorded in general fund journal. Question Three: mini casesarrow_forwardThe following transactions relate to the General Fund of the city of Lost Angels for the year ending December 31, 2017. Prepare a statement of revenues, expenditures, and other changes in fund balance for the general fund for the period to be included in the fund financial statements. Assume that the fund balance at the beginning of the year was $180,000. Assume also that the purchases method is applied to the supplies and that receipt within 60 days is used as the definition of available resources. Collected property tax revenue of $700,000. A remaining assessment of $100,000 will be collected in the subsequent period. Half of that amount should be collected within 30 days, and the remainder will be received in about five months after the end of the year. Spent $200,000 on four new police cars with 10-year lives. A price of $207,000 had been anticipated when the cars were ordered. The city calculates all depreciation using the straight-line method with no salvage value. The half-year…arrow_forward! Required information [The following information applies to the questions displayed below.] The Village of Seaside Pines prepared the following enterprise fund Trial Balance as of December 31, 2024, the last day of its fiscal year. The enterprise fund was established this year through a transfer from the General Fund. Accounts payable Accounts receivable Accrued interest payable Accumulated depreciation Administrative and selling expenses Allowance for uncollectible accounts Capital assets Cash Charges for sales and services Cost of sales and services Depreciation expense Due from General Fund Interest expense Interest revenue Transfer in from General Fund Bank note payable Supplies inventory Totals Required A Required B Complete this question by entering your answers in the tabs below. Required C VILLAGE OF SEASIDE PINES ENTERPRISE FUND Statement of Net Position December 31, 2024 Net Position: Net Investment in Capital Assets Unrestricted Total Net Position Debits Required: a.…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education