FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

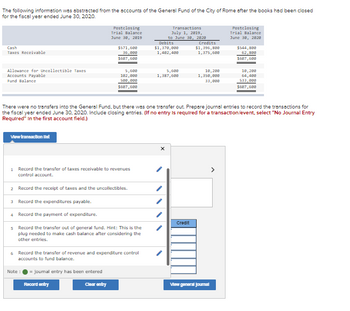

Transcribed Image Text:The following information was abstracted from the accounts of the General Fund of the City of Rome after the books had been closed

for the fiscal year ended June 30, 2020.

Cash

Taxes Receivable

Allowance for Uncollectible Taxes

Accounts Payable

Fund Balance

View transaction llest

Postclosing

Trial Balance

June 30, 2019

$571,600

36,000

$687,608

5,608

182,808

500,000

$607,608

Clear entry

1 Record the transfer of taxes receivable to revenues

control account.

2 Record the receipt of taxes and the uncollectibles.

3 Record the expenditures payable.

4 Record the payment of expenditure.

5 Record the transfer out of general fund. Hint: This is the

plug needed to make cash balance after considering the

other entries.

6 Record the transfer of revenue and expenditure control

accounts to fund balance.

Note: = journal entry has been entered

Record entry

Transactions

July 1, 2019,

to June 30, 2020

Debits

$1,370,000

1,482,488

5,600

1,387,600

X

There were no transfers into the General Fund, but there was one transfer out. Prepare journal entries to record the transactions for

the fiscal year ended June 30, 2020. Include closing entries. (If no entry is required for a transaction/event, select "No Journal Entry

Required" in the first account field.)

Credits

$1,396,800

1,375,608

Credit

10,200

1,350,000

33,000

Postclosing

Trial Balance

June 30, 2020

View general Journal

$544,800

62,800

$607,600

10,200

64,400

533,000

$607,600

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Effect of different measurement focuses and bases of accounting Following are some of Vista Village’s events during calendar year 2021. For each event, state (a) the amount the Village would report as expenditures if the event occurred in a governmental-type fund and (b) the amount it would report as expenses if the eventoccurred in an Enterprise Fund.1. The amount owed to employees for vacation and sick leave increased from $720,000to $765,000 during the year. Employees are permitted to receive payment for unusedvacation and sick leave days when they retire; at year-end, however, none of the employees had retired.2. At December 31, 2021 interest accrued on outstanding long-term debt amounted to $63,000. The interest was due to be paid on May 1, 2022.arrow_forwardP17-13 General Fund Entries [AICPA Adapted] The following information was abstracted from the accounts of the general fund of the City of Noble after the books had been closed for the fiscal year ended June 30, 20X2. Cash Taxes Receivable Total Allowance for Uncollectible Taxes Vouchers Payable Fund Balance: Assigned for Encumbrances Unassigned Total Postclosing Trial Balance, June 30, 20X1 $700,000 40,000 $740,000 $ 8,000 132,000 600,000 $740,000 Transactions July 1, 20X1-June 30, 20X2 Debit $1,820,000 1,870,000 8,000 1,852,000 70,000 Credit $1,852,000 1,828,000 10,000 1,840,000 70,000 20,000 Postclosing Trial Balance, June 30, 20X2 $668,000 82,000 $750,000 $ 10,000 120,000 70,000 550,000 $750,000 Additional Information The budget for the fiscal year ended June 30, 20X2, provided for estimated revenue of $2,000,000 and appropriations of $1,940,000. Encumbrances of $1,070,000 were made during the year. Required Prepare proper journal entries to record the budgeted and actual…arrow_forwardThe following transactions relate to the general fund of the city of Lost Angels for the year ending December 31, 2020. Prepare a statement of revenues, expenditures, and other changes in fund balance for the general fund for the period to be included in the fund financial statements. Assume that the fund balance at the beginning of the year was $180,000. Assume also that the city applies the purchases method to supplies. Receipt within 60 days serves as the definition of available resources. Collects property tax revenue of $700,000. A remaining assessment of $100,000 will be collected in the subsequent period. Half of that amount should be received within 30 days, and the remainder approximately five months after the end of the year. Spends $200,000 on three new police cars with 10-year lives. The anticipated price was $207,000 when the cars were ordered. The city calculates all depreciation using the straight-line method with no expected residual value. The city applies the…arrow_forward

- Required: The New City College reported deferred revenues of $493,000 as of July 1, 2023, the first day of its fiscal year. Record the following transactions related to student tuition and fees and related scholarship allowances for New City College for the year ended June 30, 2024. The deferred revenues related to unearned revenues for the summer session, which ended in August. During the fiscal year ended June 30, 2024, student tuition and fees were assessed in the amount of $12,100,000. Of that amount, $9,660,000 was collected in cash. Also, of that amount, $550,000 pertained to that portion of the summer session that took place after June 30, 2024. Student scholarships, for which no services were required, amounted to $821,000. These scholarships were applied to student tuition bills at the beginning of each semester. Student scholarships and fellowships for which services were required (graduate research assistantships) amounted to $741,000. These were applied to student tuition…arrow_forwardThe following information is provided about some of the Town of Truesdale’s General Fund operating statement and budgetary accounts for the fiscal year ended June 30. Estimated revenues $ 3,150,000 Revenues 3,190,000 Appropriations 3,185,000 Expenditures 3,175,000 Estimated other financing sources 400,000 Encumbrances 20,000 Encumbrances outstanding 20,000 Budgetary fund balance (calculate) The Town of Truesdale will honor all of its outstanding encumbrances in the next fiscal period. Prepare the journal entry(ies) to close budgetary accounts required to be closed at the fiscal year end using the information provided.arrow_forwardBen City maintains its books and records in a manner that facilitates the preparation of fund financial statements. Prepare all necessary journal entries to record the following events related to property tax revenues for the year ended December 31, 2017. The city has adopted the 60-day rule for property tax revenue recognition. a. On January 3, 2017 the city council levied property taxes of $2 million to support general government operations, due in two equal installments on June 20 and December 20, 2017. The property taxes were levied to finance the 2017 budget, which had been adopted on November 3, 2016. Historically 2 percent of property taxes are uncollectible. b. The city collected the following amounts related to property taxes Delinquent 2016 taxes collected in January 2017 $ 22,000 Delinquent 2016 taxes collected in March 2017 $ 25,000 2017 taxes collected in June 2017 $ 1,080 2017 taxes collected in December 2017 $ 800,000 Delinquent 2017 taxes collected in January 2018 $…arrow_forward

- Changes in mix of revenues and expenditures must be interpreted with care. The data that follow were drawn from the city of Boulder, Colorado’s CAFR. Dates have been changed. They are from two statistical-section schedules showing the mix of revenue and expenditures for a 10-year period. They include amounts only from the general fund, special revenue funds, and debt service funds. 2020 2021 (amounts in thousands) Revenues Sales and use taxes $ 97,397 $104,136 General property taxes 29,474 29,434 Other taxes 20,278 21,184 Charges for services 27,030 22,670 Intergovernmental 16,420 13,348 Proceeds from bonds and notes 54,830 Other 20,660 21,473 Total revenues $266,089 $212,245 Expenditures General government and administration $ 27,717 $ 30,185 Public safety 47,825 48,202 Public works 22,178 27,896 Housing and human services 13,384 20,226 Culture and recreation 25,677 28,089 Capital outlay 29,111 19,218 Debt service 13,574 16,375…arrow_forwardThe Foundation had the following preclosing trial balance at December 31, 2020, the end of its fiscal year: Trial Balance-December 31, 2020 Accounts payable Accounts receivable (net) Accrued interest receivable Accumulated depreciation Cash Contributed services Contributions-no restrictions Contributions-purpose restrictions Contributions-endowment Current pledges receivable Education program expenses Fund-raising expenses Investment revenue-purpose restrictions Training seminars expenses Land, buildings, and equipment Long-term investments Management and general expenses Net assets without donor restrictions Net assets with donor restrictions Net gains on endowments no restrictions Noncurrent pledges receivable Program service revenue - no restrictions Post-employment benefits payable (long-term) Reclassification-Satisfaction Reclassification-Satisfaction Reclassification-Satisfaction Reclassification-Satisfaction Research program expenses Short-term investments Supplies inventory…arrow_forwardplease assist need answer for all with full working please answer in text not image answer in detail with explanation , computation , formulation very thanksarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education