Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

4th Edition

ISBN: 9780134083278

Author: Jonathan Berk, Peter DeMarzo

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 6, Problem 25P

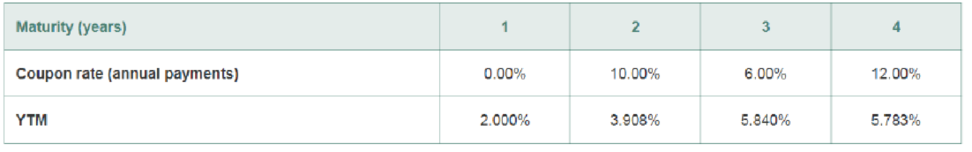

Suppose you are given the following information about the default-free, coupon-paying yield curve:

- a. Use arbitrage to determine the yield to maturity of a two-year. zero-coupon bond.

- b. What is the zero-coupon yield curve for years 1 through 4?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

For the yield-to-maturity (YTM) to qual the actual compound return an investor realizes on an investment in a coupon

bond, we must assume:

O A. cash flows will be paid as promised.

B. The bond will be held until maturity.

C. cash flows will be reinvested at the YTM rate.

D. All of the above.

After recently receiving a bonus, you have decided to add some bonds to your investment portfolio. You have narrowed your choice down to the following bonds (assume semiannual payments):

a. Using the PRICE function, calculate the intrinsic value of each bond. Is either bond currently undervalued? How much accrued interest would you have to pay for each bond? b. Using the YIELD function, calculate the yield to maturity of each bond using the current market prices. c. Calculate the duration and modified duration of each bond.d. Which bond would you rather own if you expect market rates to fall by 2% across the maturity spectrum? What if rates will rise by 2%? Why?

The yield to maturity on a bond with a price equal to its par value will

Select one:

a.

Will depend upon the required return.

b.

Will be lower than the coupon rate.

c.

Always be equal to the coupon rate.

d.

Will be more than the coupon rate

Chapter 6 Solutions

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

Ch. 6.1 - What is the relationship between a bonds price and...Ch. 6.1 - The risk-free interest rate for a maturity of...Ch. 6.2 - If a bonds yield to maturity does not change, how...Ch. 6.2 - Prob. 2CCCh. 6.2 - How does a bonds coupon rate affect its...Ch. 6.3 - How do you calculate the price of a coupon bond...Ch. 6.3 - How do you calculate the price of a coupon bond...Ch. 6.3 - Explain why two coupon bonds with the same...Ch. 6.4 - There are two reasons the yield of a defaultable...Ch. 6.4 - What is a bond rating?

Ch. 6.5 - Why do sovereign debt yields differ across...Ch. 6.5 - What options does a country have if it decides it...Ch. 6 - A 30-year bond with a face value of 1000 has a...Ch. 6 - Assume that a bond will make payments every six...Ch. 6 - The following table summarizes prices of various...Ch. 6 - Suppose the current zero-coupon yield curve for...Ch. 6 - Prob. 5PCh. 6 - Prob. 6PCh. 6 - Suppose a five-year, 1000 bond with annual coupons...Ch. 6 - Prob. 8PCh. 6 - Explain why the yield of a bond that trades at a...Ch. 6 - Prob. 10PCh. 6 - Prob. 11PCh. 6 - Consider the following bonds: Bond Coupon Rate...Ch. 6 - Prob. 14PCh. 6 - Prob. 17PCh. 6 - Prob. 18PCh. 6 - Prob. 19PCh. 6 - Prob. 20PCh. 6 - Prob. 22PCh. 6 - Prob. 23PCh. 6 - Suppose you are given the following information...Ch. 6 - Prob. 26PCh. 6 - Grumman Corporation has issued zero-coupon...Ch. 6 - The following table summarizes the yields to...Ch. 6 - Prob. 30PCh. 6 - Prob. 31PCh. 6 - A BBB-rated corporate bond has a yield to maturity...Ch. 6 - Prob. 33PCh. 6 - Prob. 34PCh. 6 - Prob. 35P

Additional Business Textbook Solutions

Find more solutions based on key concepts

The meaning for float and its three components.

Principles of Managerial Finance (14th Edition) (Pearson Series in Finance)

(Future value) Giancarlo Stanton hit 59 home runs in 2017. If his home-run output grew at a rate of 12 percent ...

Foundations Of Finance

The weaknesses of payback period method of calculation. Introduction: Every investment requires a time period t...

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

(Measuring growth) Septian, Inc.’s return on equity is 16 percent, and the management plans to retain 60 percen...

Foundations of Finance (9th Edition) (Pearson Series in Finance)

11-9. Identify a company with a product that interests you. Consider ways the company could use customer relati...

Business Essentials (12th Edition) (What's New in Intro to Business)

Why have P&G’s competitors not been able to duplicate its customer relationship strategy?

Principles Of Marketing

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Give typing answer with explanation and conclusion Consider a coupon bond with coupon payment=4.25, M=100, and n=2. Suppose ?1 = 4% and ?2 = 4.24%. Consider a forward contract for the delivery of the coupon bond in one period from today. Calculate the forward price using the following two approaches: 1) use the forward rate to price the forward contract; 2) use the cost of carry approach: spot-forward parity adjusted for the coupons.arrow_forwardWhich of the following statements regarding bonds and their terms is FALSE? *** OA. When we calculate a bond's yield to maturity by solving the formula, Coupon Coupon Coupon + Face Price of an n-period bond = (1 + )" + + + MA (1+)¹ (1+)² the yield we compute will be a rate per coupon interval. OB. The internal rate of return (IRR) of an investment in a zero-coupon bond is the rate of return that investors will earn on their money if they buy a default - free bond at its current price and hold it to maturity. OC. The yield to maturity of a bond is the discount rate that sets the future value (FV) of the promised bond payments equal to the current market price of the bond. OD. Financial professionals also use the term spot interest rates to refer to the default - free zero- coupon yields.arrow_forwardThe rate of return that you would earn if you bought a bond and held It to its maturity date is called the bond's yield to maturity (YTM). If Interest rates in the economy rise after a bond has been issued, what will happen to the bond's price and to Its YTM? Does the length of time to maturity affect the extent to which a given change in interest rates will affect the bond's price? Briefly explain with necessary numerical data.arrow_forward

- Suppose that x is the continuously compounded yield to maturity on a zero-coupon bond that pays off $1 at time T. Assume that x follows the process: dx = a (x₁ - x) dt + sx dz where a, x0, and s are positive constants and dz is a Wiener process. What is the process followed by the bond price? Solutions:arrow_forwardSuppose you are given the following information about the default-free, coupon-paying yield curve: Maturity (years) Coupon rate (annual payment) YTM 1 0.00% 2.587% a. Use arbitrage to determine the yield to maturity of a two-year zero-coupon bond. b. What is the zero-coupon yield curve for years 1 through 4? Note: Assume annual compounding. 2 11.00% 4.008% a. Use arbitrage to determine the yield to maturity of a two-year zero-coupon bond. The yield to maturity of a two-year, zero-coupon bond is %. (Round to two decimal places.) b. What is the zero-coupon yield curve for years 1 through 4? The yield to maturity for the three-year and four-year zero-coupon bond is found in the same manner as the two-year zero-coupon bond. The yield to maturity on the three-year, zero-coupon bond is %. (Round to two decimal places.) The yield to maturity on the four-year, zero-coupon bond is %. (Round to two decimal places.) Which graph best depicts the yield curve of the zero-coupon bonds? (Select the…arrow_forwardSuppose that y is the yield on a perpetual government bond that pays interest at the rate of $1 per annum. Assume that y is expressed with simply com- pounding, that interest is paid annually on the bond, and that y follows the process dy = a(y0 −y)dt + oydWt, where a, y0, and o are positive constants and dWt is a Wiener process. (a) What is the process followed by the bond price? (b) What is the expected instantaneous return (including interest and capital gains) to the holder of the bond?arrow_forward

- What is the current yield? (Hint: Refer to Footnote 6 for the definition of the current yield and to Table 7.1) Round your answer to two decimal places. % Is this yield affected by whether the bond is likely to be called? If the bond is called, the capital gains yield will remain the same but the current yield will be different. If the bond is called, the current yield and the capital gains yield will both be different. If the bond is called, the current yield and the capital gains yield will remain the same but the coupon rate will be different. If the bond is called, the current yield will remain the same but the capital gains yield will be different. If the bond is called, the current yield and the capital gains yield will remain the same.arrow_forwardWhich of the following is correct? O If you pay a price above its face value to buy a bond, your return will be higher than its coupon rate. O When market rate is greater than coupon rate, the bond has a price below its face value. O When determining the value of a bond that payments semi-annual payments, one need to use semi-annual coupon rate to determine the coupon payments and semi-annual market rate as discount rate.arrow_forwardd Required: a. Assuming that the expectations hypothesis is valid, compute the expected price of the four-year zero coupon bond shown below at the end of (i) the first year; (ii) the second year; (iii) the third year; (iv) the fourth year. b. What is the rate of return of the bond in years 1, 2, 3, and 4? Conclude that the expected return equals the forward rate for each year. Complete this question by entering your answers in the tabs below. Required A Required B Assuming that the expectations hypothesis is valid, compute the expected price of the four-year zero coupon bond shown below at the end of (i) the first year; (ii) the second year; (iii) the third year; (iv) the fourth year. Note: Do not round intermediate calculations. Round your answers to 2 decimal places. Beginning of Year 1 2 3 4 Price of Bond 948.40 921.47 832.62 781.99 $ $ GA $ $ Expected Price $ $ $ 1,150.22 X 1,144.95 X 965.60 x 937.47arrow_forward

- Which one of the following will decrease the current yield of a bond? changing the frequency of coupon payment from semi-annual to annual. increasing the face value. increasing the coupon rate. decreasing the yield to maturity. decreasing the bond price.arrow_forward13. Consider a coupon bond with coupon payment=4.25, M=100, and n=2. Suppose ?1 = 4% and ?2 = 4.24%. Consider a forward contract for the delivery of the coupon bond in one period from today. Calculate the forward price using the following two approaches: 1) use the forward rate to price the forward contract; 2) use the cost of carry approach: spot-forward parity adjusted for the coupons.arrow_forwardConsider the zero coupon Treasury bond yield curve. Suppose a 1 year bond has a yield of 2.13%. The yield curve slopes downwards between maturities of 1 year and 3 years, and then slopes upwards. Which of the following must be true? Group of answer choices A) The yield of a zero coupon bond with maturity 5 years is higher than 2.13%. B) A 1 year positive coupon bond must have a lower price than the zero coupon bond with the same maturity. C) Bond purchasers believe the Fed will decrease rates in the short run, and then increase them in the long run. D) The economy will be in a recession within 2 years. E) C and D.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education

The U.S. Treasury Markets Explained | Office Hours with Gary Gensler; Author: U.S. Securities and Exchange Commission;https://www.youtube.com/watch?v=uKXZSzY2ZbA;License: Standard Youtube License