Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 6, Problem 15PB

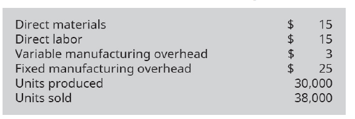

Trail Outfitters has this information for its manufacturing:

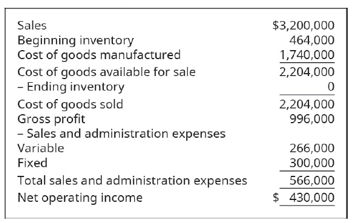

Its income statement under absorption costing is as follows:

Prepare an income statement with variable costing and a

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Hello tutor please provide answer accounting questions

Answer?? Financial accounting

Accounting question

Chapter 6 Solutions

Principles of Accounting Volume 2

Ch. 6 - Active Frame, Inc., manufactures clear and tinted...Ch. 6 - TyeDye Lights makes two products: Party and...Ch. 6 - Which is not a step in analyzing the cost driver...Ch. 6 - Overhead costs are assigned to each product based...Ch. 6 - Which of the following is a reason a company would...Ch. 6 - Which is the correct formula for computing the...Ch. 6 - A company anticipates the cost to heat the...Ch. 6 - A company calculated the predetermined overhead...Ch. 6 - Which is not a step In activity-based costing? A....Ch. 6 - What is the proper order of tasks In an ABC...

Ch. 6 - Which is not a task typically associated with ABC...Ch. 6 - Which statement is correct? A. Activity-based cost...Ch. 6 - Activity-based costing systems: A. use a single...Ch. 6 - Activity-based costing is preferable in a system:...Ch. 6 - Absorption costing is also referred to as: A....Ch. 6 - Under variable costing, a unit of product includes...Ch. 6 - Under absorption costing, a unit of product...Ch. 6 - A downside to absorption casting is: not including...Ch. 6 - When the number of units in ending inventory...Ch. 6 - Product costs under variable costing are...Ch. 6 - What is the predetermined overhead rate, and when...Ch. 6 - When is an activity-based costing system better...Ch. 6 - What is the advantage of labeling activities as...Ch. 6 - What conditions are necessary to designate an...Ch. 6 - For each cost pool, identify an appropriate cost...Ch. 6 - How is the primary focus of activity-based costing...Ch. 6 - What are the primary differences between...Ch. 6 - How are service companies similar or different...Ch. 6 - How are costs allocated in an ABC system?Ch. 6 - In production, what has changed to allow ABC...Ch. 6 - Why is it important to know the true cost for a...Ch. 6 - What is the primary difference between variable...Ch. 6 - Why would managers prefer variable costing over...Ch. 6 - Why is absorption costing the method allowable for...Ch. 6 - Can a company gather information for both variable...Ch. 6 - Steeler Towel Company estimates its overhead to be...Ch. 6 - Crystal Pools estimates overhead will utilize...Ch. 6 - A company estimated 100,000 direct labor hours and...Ch. 6 - Cozy, Inc., manufactures small and large blankets....Ch. 6 - Identify appropriate cost drivers for these cost...Ch. 6 - Match the activity with the most appropriate cost...Ch. 6 - Rex Industries has two products. They manufactured...Ch. 6 - Rex Industries has identified three different...Ch. 6 - Customs makes two types of hats: polyester (poly)...Ch. 6 - Customs has three cost pools and an associated...Ch. 6 - Potterii sells its products to large box stores...Ch. 6 - Assign each of the following expenses to either...Ch. 6 - Tri-bikes manufactures two different levels of...Ch. 6 - Cool Pool has these costs associated with...Ch. 6 - Using this information from Planters. Inc., what...Ch. 6 - Green Bay Cheese Company estimates its overhead to...Ch. 6 - Boarders estimates overhead will utilize 160,000...Ch. 6 - A company estimated 50,000 direct labor hours and...Ch. 6 - Cozy, Inc., manufactures small and large blankets....Ch. 6 - Identify appropriate cost drivers for these cost...Ch. 6 - Match the activity with the most appropriate cost...Ch. 6 - Rocks Industries has two products. They...Ch. 6 - Rocks Industries has identified three different...Ch. 6 - Frenchys makes two types of scarves: polyester...Ch. 6 - Frenchys has three cost pools and an associated...Ch. 6 - Carboni recently added a carbon line in addition...Ch. 6 - Assign each of the following expenses to either...Ch. 6 - Stacks manufactures two different levels of hockey...Ch. 6 - Crafts 4 All has these costs associated with...Ch. 6 - Using this information from Outdoor Grills, what...Ch. 6 - Colonels uses a traditional cost system and...Ch. 6 - Five Card Draw manufactures and sells 24,000 units...Ch. 6 - A local picnic table manufacturer has budgeted...Ch. 6 - Explain how each activity in this list can be...Ch. 6 - Medical Tape makes two products: Generic and...Ch. 6 - Box Springs, Inc., makes two sizes of box springs:...Ch. 6 - Please use the information from this problem for...Ch. 6 - A company has traditionally allocated its overhead...Ch. 6 - Carltons Kitchens makes two types of pasta makers:...Ch. 6 - Carltons Kitchens three cost pools and overhead...Ch. 6 - Lampierre makes brass and gold frames. The company...Ch. 6 - Portable Seats makes two chairs: folding and...Ch. 6 - Grainger Company produces only one product and...Ch. 6 - Summarized data for Walrus Co. for its first year...Ch. 6 - Happy Trails has this information for its...Ch. 6 - Appliance Apps has the following costs associated...Ch. 6 - This information was collected for the first year...Ch. 6 - Bobcat uses a traditional cost system and...Ch. 6 - Five Card Draw manufactures and sells 10,000 units...Ch. 6 - A local picnic table manufacturer has budgeted the...Ch. 6 - Explain how each activity in this list can be...Ch. 6 - Wrappers Tape makes two products: Simple and...Ch. 6 - Box Springs. Inc., makes two sizes of box springs:...Ch. 6 - Please use the information from this problem for...Ch. 6 - A company has traditionally allocated its overhead...Ch. 6 - Caseys Kitchens makes two types of food smokers:...Ch. 6 - Caseys Kitchens three cost pools and overhead...Ch. 6 - Lampierre makes silver and gold candlesticks. The...Ch. 6 - Portable Seats makes two chairs: folding and...Ch. 6 - Submarine Company produces only one product and...Ch. 6 - Summarized data for Backdraft Co. for its first...Ch. 6 - Trail Outfitters has this information for its...Ch. 6 - Wifi Apps has these costs associated with its...Ch. 6 - This information was collected for the first year...Ch. 6 - What conditions are optimal for using traditional...Ch. 6 - College Cases sells cases for electronic devices...Ch. 6 - How would a service industry apply activity-based...Ch. 6 - Cape Cod Adventures makes foam noodles with sales...Ch. 6 - In designing a bonus structure to reward your...

Additional Business Textbook Solutions

Find more solutions based on key concepts

Which of the following is a primary activity in the value chain?

purchasing

accounting

post-sales service

human...

Accounting Information Systems (14th Edition)

Why is the capital-budgeting process so important?

Foundations Of Finance

Determine the price elasticity of demand if, in response to an increase in price of 10 percent, quantity demand...

Microeconomics

11-13. Discuss how your team is going to identify the existing competitors in your chosen market. Based on the ...

Business Essentials (12th Edition) (What's New in Intro to Business)

S3-5 Identifying types of adjusting entries

Learning Objective 3

A select list of transactions for Anuradh...

Horngren's Accounting (12th Edition)

An experimental composite engine block for an automobile will trim 20 pounds of weight compared with a traditio...

Engineering Economy (17th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

IAS 29 Financial Reporting in Hyperinflationary Economies: Summary 2021; Author: Silvia of CPDbox;https://www.youtube.com/watch?v=55luVuTYLY8;License: Standard Youtube License