Contemporary Engineering Economics (6th Edition)

6th Edition

ISBN: 9780134105598

Author: Chan S. Park

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 6, Problem 10P

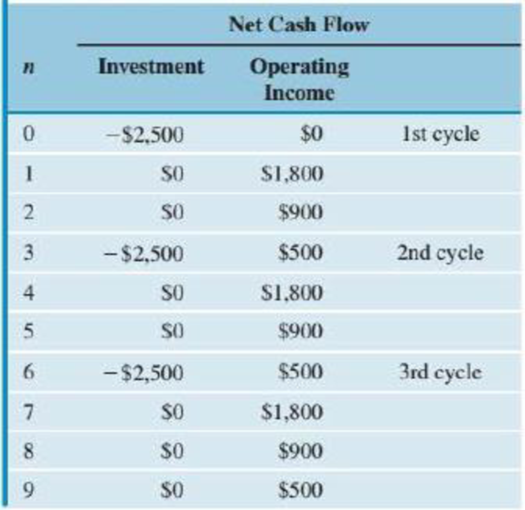

The repeating cash flows for a certain project are as given in Table P6.10. Find the equivalent annual worth for this project at i = 10%, and determine the acceptability of the project.

TABLE P6.10

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The initial cost of a pickup truck is $12,748 and will have a salvage value of $4,360 after five years. Maintenance is estimated to be a uniform gradient amount of $121 per year, with zero dollar for first year maintenance. The operation cost is estimated to be $0.3 per mile for 351 miles per month. If the interest rate is 12%, what is the annual equivalent cost (AEC) for the truck?

A company is considering constructing a plant to manufacture a proposed new product. The land costs $250,000, the building costs $650,000, the equipment costs $300,000,

and $80,000 additional working capital is required. It is expected that the product will result in sales of $700,000 per year for 11 years, at which time the land can be sold for

$350,000, the building for $400,000, and the equipment for $50,000. All of the working capital would-be recovered at the EOY 11. The annual expenses for labor, materials,

and all other items are estimated to total $500,000. If the company requires a MARR of 14% per year on projects of comparable risk, determine if it should invest in the new

product line. Use the AW method.

Click the icon to view the interest and annuity table for discrete compounding when the MARR is 14% per year.

A computerized wood lathe, costing P25,000, will be used to make ornamental parts for sale. Receipts are estimated at P60,000 per year with costs running P55,000 per year. The salvage value is P9,000 at the end of 10 years. If the MARR is 12%, what is the present worth of this investment?

a) P 7,877.89

b) P 6,148.87

c) P 50,353.36

d) P 56,148.87

Chapter 6 Solutions

Contemporary Engineering Economics (6th Edition)

Ch. 6 - Prob. 1PCh. 6 - Prob. 2PCh. 6 - Prob. 3PCh. 6 - Prob. 4PCh. 6 - Prob. 5PCh. 6 - Prob. 6PCh. 6 - Consider the cash flows in Table P6.7 for the...Ch. 6 - Prob. 8PCh. 6 - Prob. 9PCh. 6 - The repeating cash flows for a certain project are...

Ch. 6 - Beginning next year, a foundation will support an...Ch. 6 - Prob. 12PCh. 6 - Prob. 13PCh. 6 - Prob. 14PCh. 6 - Prob. 15PCh. 6 - Prob. 16PCh. 6 - Prob. 17PCh. 6 - Prob. 18PCh. 6 - The Geo-Star Manufacturing Company is considering...Ch. 6 - Prob. 20PCh. 6 - Prob. 21PCh. 6 - Prob. 22PCh. 6 - Prob. 23PCh. 6 - Prob. 24PCh. 6 - Prob. 25PCh. 6 - Prob. 26PCh. 6 - Prob. 27PCh. 6 - Prob. 28PCh. 6 - Prob. 29PCh. 6 - Prob. 30PCh. 6 - Prob. 31PCh. 6 - Prob. 32PCh. 6 - Prob. 33PCh. 6 - Prob. 34PCh. 6 - Prob. 35PCh. 6 - Prob. 36PCh. 6 - Prob. 37PCh. 6 - Prob. 38PCh. 6 - Prob. 39PCh. 6 - Prob. 40PCh. 6 - Prob. 41PCh. 6 - Prob. 42PCh. 6 - Prob. 43PCh. 6 - Prob. 44PCh. 6 - Prob. 45PCh. 6 - Prob. 46PCh. 6 - Prob. 47PCh. 6 - Prob. 48PCh. 6 - Prob. 49PCh. 6 - Prob. 50PCh. 6 - Prob. 51PCh. 6 - Prob. 52PCh. 6 - Prob. 53PCh. 6 - Prob. 1STCh. 6 - Prob. 2STCh. 6 - Prob. 3STCh. 6 - Prob. 4ST

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- A COMPANY IS CONSIDERING CONSTRUCTING A PLANT TO MANUFACTURE A PROPOSED NEW PRODUCT. THE LAND COSTS P300,000, AND THE BUILDING COSTS P600,000, THE EQUIPMENT COSTS P250,000 AND P100,000 ADDITIONAL WORKING CAPITAL IS REQUIRED. IT IS EXPECTED THAT THE PRODUCT WILL RESULT IN SALES OF P750,000 PER YEAR FOR 10 YEARS, AT WHICH TIME THE LAND CAN BE SOLD FOR P400,000, THE BUILDING FOR P350,000 AND THE EQUIPMENT FOR P50,000. ALL OF THE WORKING CAPITAL WOULD BE RECOVERED AT THE END OF YEAR 10. THE ANNUAL EXPENSES FOR LABOR, MATERIALS, AND ALL OTHER ITEMS ARE ESTIMATED TO TOTAL P475,000. IF THE COMPANY REQUIRESS MARR OF 15% PER YEAR ON PROJECTS OF COMPARABLE RISK, DETERMINE IF IT SHOULD INVEST IN THE NEW PRODUCT LINE. EVALUATE USING ALL METHODS: A. RATE OF RETURN METHOD (RR) B. ANNUAL COST METHOD C. ANNUAL WORTH METHODarrow_forwardAn integrated, combined cycle power plant produces 295 MW of electricity by gasifying coal. The capital investment for the plant is $450 million, spread evenly over two years. The operating life of the plant is expected to be 15 years. Additionally, the plant will operate at full capacity 72% of the time (downtime is 28% of any given year). The MARR is 8% per year. a. If this plant will make a profit of two cents per kilowatt-hour of electricity sold to the power grid, what is the simple payback period of the plant? Is it a low-risk venture? b. What is the IRR for the plant? Is it profitable? a. The simple payback period of the plant is 12.1 years. (Round up to one decimal place.) It's a high-risk venture. b. The IRR for the plant is %. (Round to one decimal place.)arrow_forwardAn integrated, combined cycle power plant produces 285 MW of electricity by gasifying coal. The capital investment for the plant is $530 million, spread evenly over two years. The operating life of the plant is expected to be 18 years. Additionally, the plant will operate at full capacity 76% of the time (downtime is 24% of any given year). The MARR is 7% per year. a. If this plant will make a profit of two cents per kilowatt-hour of electricity sold to the power grid, what is the simple payback period of the plant? Is it a low-risk venture? b. What is the IRR for the plant? Is it profitable? a. The simple payback period of the plant is 14 years. (Round up to one decimal place.) It's a high-risk venture. b. The IRR for the plant is %. (Round to one decimal place.) CHEarrow_forward

- An integrated, combined cycle power plant produces 290 MW of electricity by gasifying coal. The capital investment for the plant is $530 million, spread evenly over two years. The operating life of the plant is expected to be 15 years. Additionally, the plant will operate at full capacity 74% of the time (downtime is 26% of any given year). The MARR is 5% per year. a. If this plant will make a profit of three cents per kilowatt-hour of electricity sold to the power grid, what is the simple payback period of the plant? Is it a low-risk venture? b. What is the IRR for the plant? Is it profitable?arrow_forwardConsider a proposal to enhance production of tortillas en a taqueria. The new machine is estimated to cost $20 million and will incur an additional $1 million per year in maintenance costs. The machine will produce annual savings of $7 million each year. The Minimum acceptable rate of return (MARR) is 10% per year, and the study period is five years at which time the machine will be obsolete (worthless). What is the maximum (minimum) percentage of maintenance cost can change that reverse your decision? (write upto 4 decimals.)arrow_forwardA company is considering investing $17,500 in a heat exchanger. The heat exchanger will last five vears, at which time it will be sold for $2.000, The maintenance cost at the end of the first vear is estimated to be $1.500. Maintenance costs for the exchanger are estimated to increase by $1,000 per year over its life. As an alternative, the company may lease the equipment for $X per year, including maintenance, with the annual payments to made at the end of each year. a. Choose cash flow diagrams of both alternatives b. For what value of X should the company lease the heat exchanger? The company expects to earn 8% on its investments. Assume end-of-year lease payments. Click the icon to view the interest and annuity table for discrete compounding when i= 8% per year. EOY EOY $2,000 2 3 4 5 2 $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 $2,500 $3.500 $4,500 $5,500 $17,500 $17,500 OD. C. EOY $2,000 EOY $2,000 1 2 3 5 2. $1,500 $2,500 $3,500 $4,500 $5.500 $4.500 $3.500 $2,500 $1,500 $5,500…arrow_forward

- An integrated, combined cycle power plant produces 285 MW of electricity by gasifying coal. The capital investment for the plant is $450 million, spread evenly over two years. The operating life of the plant is expected to be 18 years. Additionally, the plant will operate at full capacity 76% of the time (downtime is 24% of any given year). The MARR is 10% per year. a. If this plant will make a profit of two cents per kilowatt-hour of electricity sold to the power grid, what is the simple payback period of the plant? Is it a low-risk venture? b. What is the IRR for the plant? Is it profitable? a. The simple payback period of the plant is years. (Round up to one decimal place.) It's a venture. b. The IRR for the plant is%. (Round to one decimal place.) The plant isarrow_forwardA new municipal refuse-collection truck can be purchased for $84,000. Its expected useful life is six years, at which time its market value will be zero. Annual receipts less expenses will be approximately $18,000 per year over the six-year study period. At MARR of 19%, calculate the return on investment of the project.arrow_forwardA company is considering constructing a plant to manufacture a proposed new product. The land costs $300,000, the building cost $600,000, the equipment costs $250,000, and $100,000 additional working capital is required. It is expected that the product will result in sales of $750,000 per year for 10 years ,at which the land can be sold for $400,000, the building for $350,000, and the equipment for $50,000 and all of the working capital would be recovered at EOY10. The annual expense for labor, materials, and all other items are estimated to total $500,000 and will decrease by 20,000 per year until year 10. If the company requires a MARR of 12% per year on projects of comparable risk, determine if it should invest in the new product line. a) Use IRR and AW method. b) Determine the simple and payback period (Upload the picture of your complete solutions including the correct cash flow diagram and your conclusion.)arrow_forward

- A company is considering constructing a plant to manufacture a proposed new product. The land costs $300,000, the building cost $600,000, the equipment costs $250,000, and $100,000 additional working capital is required. It is expected that the product will result in sales of $750,000 per year for 10 years ,at which the land can be sold for $400,000, the building for $350,000, and the equipment for $50,000 and all of the working capital would be recovered at EOY10. The annual expense for labor, materials, and all other items are estimated to total $500,000 and will decrease by 20,000 per year until year 10. If the company requires a MARR of 12% per year on projects of comparable risk, determine if it should invest in the new product line. a) Use IRR and AW method. b) Determine the simple and payback period draw the cash flow diagram and write a conclusionarrow_forwardDelaware Chemicals is considering the installation of a computer process con- trol system in one of its processing plants. This plant is used about 40% of the time, or 3,500 operating hours per year, to produce a proprietary demulsifica- tion chemical; during the remaining 60% of the time, it is used to produce other specialty chemicals. The annual production of the demulsification chemical amounts to 30,000 kilograms per year, and it sells for $15 per kilogram. The proposed computer process control system will cost $65,000 and is expected to provide specific benefits in the production of the demulsification chemical as follows: First, the selling price of the product could be increased by $2 per kilogram because the product would be of higher purity, which translates into better demulsification performance. Second, production volumes would increase by 4,000 kilograms per year as a result of higher reaction yields, without any increase in requirements for raw material quantities or…arrow_forwardConsider a new machine at a bottling plant that has a first cost of $250000, operating and maintenance costs of $15100 per year, and an estimated net salvage value of $25000 at the end of 30 years. Assume an interest rate of 7%. What is the annual equivalent cost of the investment if the planning horizon is 30 years?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education

Break Even Analysis (BEP); Author: Tutorials Point (India) Ltd.;https://www.youtube.com/watch?v=wOEkc3O_Q_Y;License: Standard YouTube License, CC-BY

Cost Volume Profit Analysis (CVP): calculating the Break Even Point; Author: Edspira;https://www.youtube.com/watch?v=Nw2IioaF6Lc;License: Standard Youtube License