Financial Accounting

3rd Edition

ISBN: 9780133791129

Author: Jane L. Reimers

Publisher: Pearson Higher Ed

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 5B, Problem 4EB

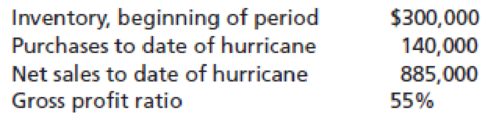

Estimate inventory. (LO 9). The records of Florida Tool Shop revealed the following information related to inventory destroyed in Hurricane Frances:

The company needs to file a claim for lost inventory with its insurance company. What is the estimated value of the lost inventory?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Vanity Corporation sells different types of paint. Due to the low demand, it would be testing its inventory for impairment. It acquired the following data:

What amount should be reported by Vanity Corporation as loss from inventory write-down?

In reviewing of subsequent events, you learned of heavy damage to the client’s warehouse due to a fire occurred after year-end. The loss will partly be reimbursed by insurance. The newspaper described the event in detail. The client made adjustment to related inventories and buildings to reflect the loss.

All facts are the same as situation 1, but the client did not make adjustment to year end figure of inventory.

During the course of examination on your audit client, you suspect that a material amount of assets has been misappropriated through fraud. Management refuses to allow you to investigate further to confirm the suspicions.

The client’s financing arrangements expired and the amount outstanding was past due. The client cannot renegotiate or obtain refinancing and is considering filing bankruptcy. Financial statements were prepared using the going concern basis and this fact is not disclosed.

An equipment which was used by the client for more than 5 years is considered to…

1. On which of the following instances is cost estimation not permitted?

A. Estimating the cost of inventory destroyed by fire or other natural calamities.

B. Presenting the value of inventory in an interim financial statement.

C. Reporting of inventory at the Statement of Financial Position at year-end.

D. Estimating the value of inventory missing because of theft.

2. Under the gross profit method, if the gross profit rate is based on cost, the cost of sales is computed as

A. Gross sales times cost ratio

B. Net sales divided by sales ratio

C. Net sales times cost ratio

D. Gross sales divided by sales ratio

3. In computing cost ratio, the conservative/conventional retail method should

A. Exclude mark-up but not markdown

B. Include mark-up and markdown

C. Exclude mark-up and markdown

D. Include mark-up but not markdown

Chapter 5B Solutions

Financial Accounting

Ch. 5B - Suppose Base Company began May with inventory of...Ch. 5B - Estimate inventory. (LO 9). Fantasy Games, Inc.,...Ch. 5B - (Estimate inventory. (LO 9). Knick-Knacks wants to...Ch. 5B - Estimate inventory. (LO 9). The following...Ch. 5B - Estimate inventory. (LO 9). The records of Florida...Ch. 5B - Estimate inventory. (LO 9). Hines Fruit Corp....Ch. 5B - Estimate inventory. (LO 9). Carries Cotton Candy...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- You are requested by a client on September 28 to prepare an insurance claim for a theft loss that occurred on that day. You immediately take an inventory and obtain the following data: 1. Compute the inventory lost during the theft. Round the gross profit percentage to 3 decimal places. 2. Next Level What concerns might you lhave about the inventory estimation under the gross profit method?arrow_forwardRequired: How much is the inventory loss due to fire?arrow_forwardAUDITING PROBLEM - AUDIT OF INVENTORIES 1. What is the estimated inventory on May 2, 2014 immediately prior to the fire? 2. How much should be recognized as inventory loss?arrow_forward

- After looking at the attachment below, if the physical ending inventory were valued at 325,000, how much is the estimated loss from inventory theft?arrow_forwardHow do I find the value of the inventory of october 31? I tried solving for it but did not get the correct valuearrow_forward1, how can assets and liabilities be classified for a more informative balance sheet? 2, what are reversing entries and how do we record them? 3, are there different methods used to account for perpetual inventory? 4, what are the effects of two of the different methods? 5, what happens if inventory declines in value? 6, how can we estimate inventory if there is a fire? 7, what are some guidelines for accounting and why do we need them? 8, how do business transactions affect the accounting records of a company?arrow_forward

- For companies that use a perpetual inventory system, all of the following are reasons for taking a physical inventory except to determine losses due to employee theft. to determine ownership of the goods. to check the accuracy of the records. to determine the amount of wasted raw materials.arrow_forwardAccounts receivable, December 31 Cost of goods sold Accounts payable, January 1 Accounts payable, December 31 Finished-goods inventory, December 31 Gross margin Work-in-process inventory, January 1 Work-in-process inventory, December 31 Finished-goods inventory, January 1 Direct materials used Direct manufacturing labor Manufacturing overhead costs Purchases of direct materials Revenues Accounts receivable, January 1 $ Case 2 Case 1 (in thousands) 7,000 $4,210 A 33,000 4,300 2,590 2,400 4,050 B 8,200 18,500 4,000 0 4,000 10,000 $5,000 7,200 14,800 46,000 3,400 с 700 4,200 10,000 23,000 7,800 D 14,500 54,900 2,500arrow_forwardPerfect Co. discovered the following errors in 2022. Identify the error that Perfect will not need to make a correcting entry. Goods on consignment at a third-party store was excluded from 12/31/2021 inventory. 2022 beginning inventory is overstated as a result of overstated 2021 ending inventory. 2022 beginning inventory is understated as a result of understated 2021 ending inventory. 2021 beginning inventory is overstated as a result of overstated 2020 ending inventory.arrow_forward

- Explain inventory overstatement. A merchandising company has asked you to advise it on how to detect fraudulent financial reporting. Management wants your help in detecting inventory overstatement. Further, management wants to know how to find evidence of inventory overstatement. Using your own numbers, make up an example to show management the effect of overstating inventory. Show how inventory overstatement at the end of Year 1 carries through to the beginning inventory overstatement in Year 2. Prepare a brief report to management suggesting ways management could detect inventory overstatement.arrow_forwardA company suffers an inventory loss from water damage due to a broken pipe. The company has never incurred a loss of this type and does not expect this type of damage to occur again. The loss would be reported as a. A reduction of sales revenue.b. Part of income from continuing operations.c. Part of income from discontinued operations.d. Not reported.arrow_forwardThe company just took a physical count of inventory and found $75 worth of inventory was unaccounted for. It was either stolen or damaged. Which journal would the company use to record the correction of the error in inventory? Group of answer choices 1.sales journal 2.purchases journal 3.general journal 4.cash disbursements journalarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

IAS 10 Events After the Reporting Period; Author: Silvia of CPDbox;https://www.youtube.com/watch?v=ijYZlb1_ZyQ;License: Standard Youtube License