FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

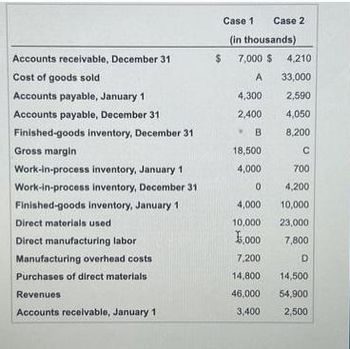

Transcribed Image Text:Accounts receivable, December 31

Cost of goods sold

Accounts payable, January 1

Accounts payable, December 31

Finished-goods inventory, December 31

Gross margin

Work-in-process inventory, January 1

Work-in-process inventory, December 31

Finished-goods inventory, January 1

Direct materials used

Direct manufacturing labor

Manufacturing overhead costs

Purchases of direct materials

Revenues

Accounts receivable, January 1

$

Case 2

Case 1

(in thousands)

7,000 $4,210

A

33,000

4,300

2,590

2,400

4,050

B

8,200

18,500

4,000

0

4,000

10,000

$5,000

7,200

14,800

46,000

3,400

с

700

4,200

10,000

23,000

7,800

D

14,500

54,900

2,500

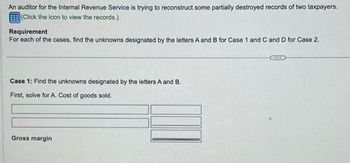

Transcribed Image Text:An auditor for the Internal Revenue Service is trying to reconstruct some partially destroyed records of two taxpayers.

(Click the icon to view the records.)

Requirement

For each of the cases, find the unknowns designated by the letters A and B for Case 1 and C and D for Case 2.

Case 1: Find the unknowns designated by the letters A and B.

First, solve for A. Cost of goods sold.

Gross margin

GETTID

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Cost of Goods Manufactured, Cost of Goods Sold Hayward Company,a manufacturing firm, has supplied the following information from its accounting records for the month of May: Required: Prepare a statement of cost of goods manufactured . 2.Prepare a statement of cost of goods sold.arrow_forwardInventory of work in process Inventory of finished goods Direct materials used Direct labor Manufacturing overhead Selling expenses December 31 $ 40,000 60,000 a. Work in process inventory b. Cost of finished goods manufactured c. Cost of goods sold d. Total manufacturing costs 250,000 120,000 145,000 135,000 January 1 $ 18,000 68,000 Required: a. Find the amount debited to the Work In Process Inventory account during the year. b. What is the cost of finished goods manufactured for the year? c. What is the cost of goods sold for the year? d. What are the total manufacturing costs for the year?arrow_forwardCost of Goods Manufactured for a Manufacturing Company Two items are omitted from each of the following three lists of cost of goods manufactured statement data. Determine the amounts of the missing items, identifying them by letter. Work in process inventory, August 1 Total manufacturing costs incurred during August Total manufacturing costs Work in process inventory, August 31 Cost of goods manufactured a. b. C. d. $2,000 13,600 $16,600 (c) (a) $194,200 40,800 (d) 3,000 (b) (e) 97,100 $105,400 (1) $88,500arrow_forward

- The following information is available for Windsor Company. Raw materials inventory Work in process inventory Finished goods inventory Materials purchased Direct labor Manufacturing overhead Sales revenue (a) Jan, 1 led Dec 31 V V V > > January 1, 2022 $25,200 << < 17,100 33,150 Compute cost of goods manufactured. (Assume that all raw materials used were direct materials.) 2022 $183,000 268,400 219,600 $ 1,110,200 WINDSOR COMPANY Cost of Goods Manufactured Schedule December 31, 2022 183000 171600 $36,600 $ 21.150 25,620 268400 219600 659.600 $ 0000 $ 21 670 21 655arrow_forwardharrow_forwardDon't provide answer in image formatarrow_forward

- Inventories Raw materials, beginning Work in process, beginning Finished goods, beginning Cost of goods manufactured Cost of goods sold (not considering over- or underapplied overhead) Sales Predetermined overhead rate based on direct materials used $ 39,000 13,400 Required 2 9,750 96,290 0 84,200 101,000 Finished Goods Inventory 90% 1. Complete the T-accounts for each of the three Inventory accounts using the data provided in the above table. 2. Compute overapplied or underapplied overhead. Complete this question by entering your answers in the tabs below. Costs incurred for the period Raw materials purchases Direct materials used Direct labor used. Factory overhead (actual) Required 1 Complete the T-accounts for each of the three inventory accounts using the data provided in the above table. Raw Materials Inventory Indirect materials used Indirect labor used Other overhead costs Work in Process Inventory 0 $19,460 45,250 23,800 10,300 17,400 5,300arrow_forwardIndicate missing amount for case 1arrow_forwardAnswerarrow_forward

- Product Cost Flows Complete the following T-accounts: Materials Inventory 1,120 Answer Answer 18,120 250 Wages Payable 9,000 1,050 Finished Goods Inventory 1,500 Answer Answer 1,200 Manufactured Overhead 175 Answer Answer 18,000 4,500 0 Work in Process Inventory 3,500 Answer Answer 9,000 Answer 500 Cost of Goods Sold Answer Save AnswersNextarrow_forwardRequired:11. Cost of goods sold.12. Cost of goods manufactured.13. Raw materials inventory August 31.arrow_forwardS Raw materials Work in process Finished goods Beginning Inventory $ 28,100 22,200 79,400 Raw materials purchases Indirect materials used Direct labor Additional information for the month of March follows: Manufacturing overhead applied Selling, general, and administrative expenses Sales revenue Required 1 Required 2 Inventory Required: 1. Based on the above information, prepare a cost of goods manufactured report. 2. Based on the above information, prepare an income statement for the month of March. Complete this question by entering your answers in the tabs below. $ 25,300 45,600 68,900 Sales Revenue Less: Cost of Goods Sold Beginning Finished Goods Inventory Less: Ending Finished Goods Inventory Cost of Goods Sold Gross Profit Based on the above information, prepare an income statement for the month of March. Stor Smart Company Income Statement For the Month of March Net Income (Loss) from Operations $ 41,300 1,800 63,900 36,000 24,900 237,600arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education