Financial Accounting

15th Edition

ISBN: 9781337272124

Author: Carl Warren, James M. Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 5, Problem 9E

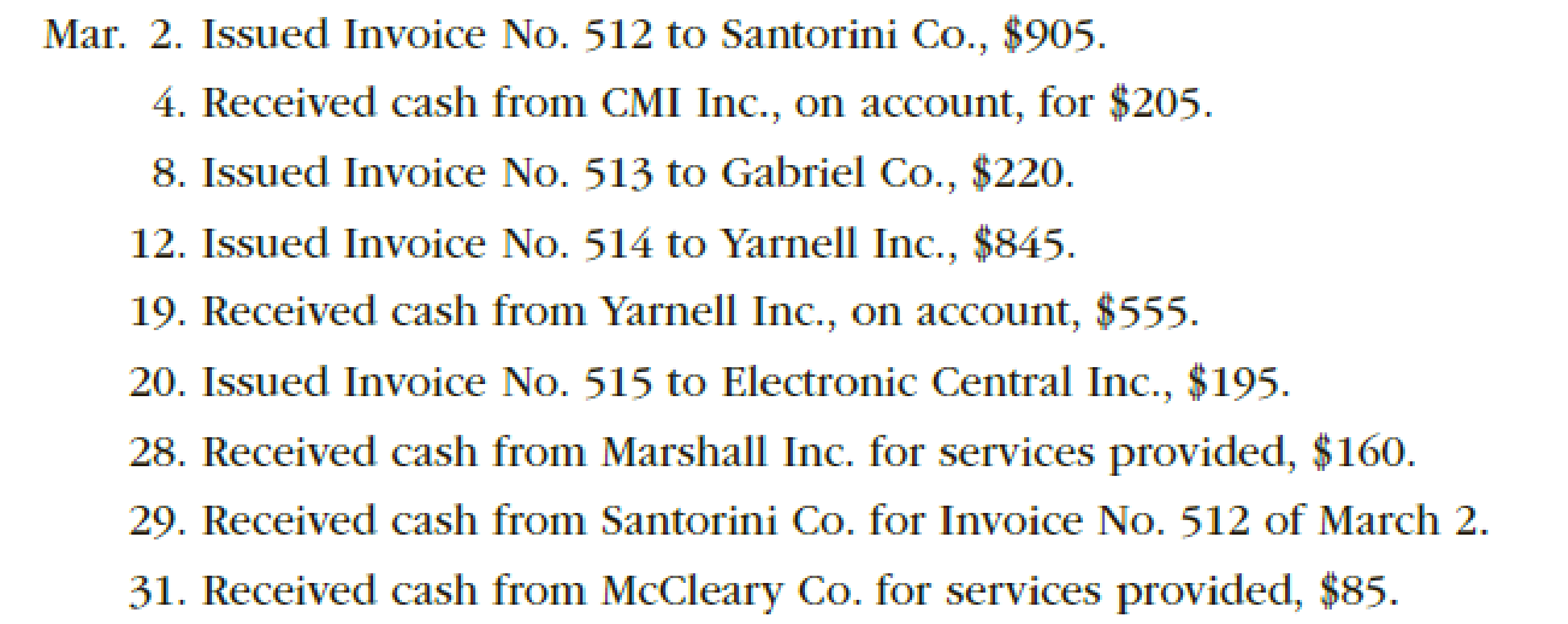

Transactions related to revenue and cash receipts completed by Sycamore Inc. during the month of March 20Y8 are as follows:

Prepare a single-column revenue journal and a cash receipts journal to record these transactions. Use the following column headings for the cash receipts journal: Fees Earned Cr.,

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Building from the Module 2 Critical Thinking assignment about your company’s water purification product and target country market, research the components needed to build the product.

Use the following questions to guide your decisions about production and components, respond to the following topics for this week’s critical thinking assignment.

What does the target country produce and export?

What does the target country import; what are the imports used for?

To what degree does the target country have relevant and cost-effective component manufacturing capabilities?

Does the target country have relevant and cost-effective manufacturing/assembly capabilities to create products of acceptable quality?

If the target country does not have relevant component and manufacturing skills, where will the water purification components/devices be sourced from given the target country’s trade agreements?

How do trade profiles and trade relationships enter into your decision about manufacturing…

What is the variable overhead efficiency variance for the month?

MCQ

Chapter 5 Solutions

Financial Accounting

Ch. 5 - Why would a company maintain separate accounts...Ch. 5 - What are the major advantages of the use of...Ch. 5 - In recording 400 fees earned on account during a...Ch. 5 - How many postings to Fees Earned for the month...Ch. 5 - During the current month, the following errors...Ch. 5 - Assuming the use of a two-column general journal,...Ch. 5 - What is an electronic form, and how is it used in...Ch. 5 - When are transactions posted in a computerized...Ch. 5 - What happens to the special journal in a...Ch. 5 - Prob. 10DQ

Ch. 5 - The following revenue transactions occurred during...Ch. 5 - Prob. 1PEBCh. 5 - The debits and credits from two transactions are...Ch. 5 - The debits and credits from two transactions are...Ch. 5 - The following purchase transactions occurred...Ch. 5 - The following purchase transactions occurred...Ch. 5 - The debits and credits from two transactions are...Ch. 5 - Prob. 4PEBCh. 5 - McHale Company does business in two customer...Ch. 5 - Prob. 5PEBCh. 5 - Using the following revenue journal for Bowman...Ch. 5 - Based on the data presented in Exercise 5-1,...Ch. 5 - Assuming the use of a two-column (all-purpose)...Ch. 5 - Assuming the use of a two-column (all-purpose)...Ch. 5 - The debits and credits from three related...Ch. 5 - Horizon Consulting Company had the following...Ch. 5 - The revenue journal for Sapling Consulting Inc....Ch. 5 - Prob. 8ECh. 5 - Transactions related to revenue and cash receipts...Ch. 5 - Lasting Summer Inc. has 2,510 in the October 1...Ch. 5 - Using the following purchases journal, identify...Ch. 5 - Prob. 12ECh. 5 - Prob. 13ECh. 5 - Guardian Services Inc. had the following...Ch. 5 - Prob. 15ECh. 5 - The cash payments and purchases journals for...Ch. 5 - Transactions related to purchases and cash...Ch. 5 - Happy Tails Inc. has a September 1, 20Y4, accounts...Ch. 5 - After Bunker Hill Assay Services Inc. had...Ch. 5 - Prob. 20ECh. 5 - Prob. 21ECh. 5 - Most computerized accounting systems use...Ch. 5 - Prob. 23ECh. 5 - For each of the following companies, determine...Ch. 5 - Prob. 25ECh. 5 - Prob. 26ECh. 5 - Prob. 27ECh. 5 - Sage Learning Centers was established on July 20...Ch. 5 - Transactions related to revenue and cash receipts...Ch. 5 - Sterling Forest Landscaping designs and installs...Ch. 5 - Prob. 4PACh. 5 - The transactions completed by Revere Courier...Ch. 5 - Guardian Security Services was established on...Ch. 5 - Transactions related to revenue and cash receipts...Ch. 5 - Plumb Line Surveyors provides survey work for...Ch. 5 - Prob. 4PBCh. 5 - The transactions completed by AM Express Company...Ch. 5 - Ethics in Action Netbooks Inc. provides accounting...Ch. 5 - Prob. 3CPCh. 5 - The following conversation took place between...Ch. 5 - A subsidiary ledger is used for accounts...Ch. 5 - For the past few years, your client, Omni Care,...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY