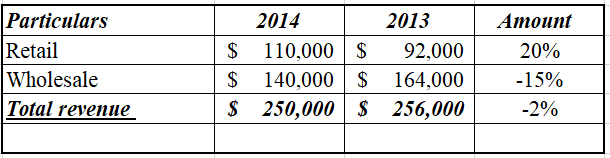

Otley Company does business in two customer segments, Retail and Wholesale. The following annual revenue information was determined from the accounting system’s invoice information:

……………………………………2014…………………2013

Retail…………………………$110,000…………….$ 92,000

Wholesale………………………140,000……………..164,000

Total revenue…………………$250,000……………$256,000

Prepare a horizontal and vertical analysis of the segments. Round to one decimal place.

View Solution:

Otley Company does business in two customer segments Retail and

Comparative analysis: It can be defined as the technique of analyzing the financial performance of the company via comparing the statements of different accounting periods.

Presentation of the horizontal analysis as follows:

Result of the above:

Step by stepSolved in 3 steps with 4 images

- The following data were taken from the financial statements of Tokyo Corporation: Annual Sales - P1,250,666, Cost of Goods Sold - P1,014,540, Inventory - P250,000, Accounts Receivable - P300,000 and Accounts Payable - P150,000. Compute for the Inventory Conversion Period. ______ days. Use whole number, no peso sign.arrow_forwardDengerarrow_forwardA company reports the following amounts at the end of the year: Total sales revenue = $560,000; sales discounts = $17,000; sales returns = $34,000; sales allowances = $20,000. Compute net revenues. Net revenuesarrow_forward

- The Peter Company's Unadjusted Trial Balance shows the following balances: Accounts Receivable ....................................................... $600,000. (dr.) Allowance for Uncollectible Accounts ...............................$13,000. (dr.) Net Sales ...................................................................... $4,000,000. (cr.) 4.Assume that Peter Company’s aging schedule indicates that 4% of the December 31 receivables will become uncollectible. What amount of bad debt expense will Peter Company report in its income statement? a.$ 9,000. b.$13,000. c.$24,000. d.$37,000. 5.Assume that Peter Company estimates its bad debts expense to be 1% of Net Sales. After the adjustment is made to record bad debts expense, what will be the net carrying value of the accounts receivable in Peter Company's Balance Sheet? a.$600,000. b.$573,000. c.$560,000. d.$547,000.arrow_forwardA company reports the following: Cost of merchandise sold $3,120,750Average merchandise inventory 182,500 Determine (a) the inventory turnover and (b) the number of days' sales in inventory. Assume a 365-day year. Round your answers to one decimal place.arrow_forwardThe income statement of Metallic Item Inc., is as follows: Metallic Item Income Statement For the Month Ended April 30, 2014 Revenue Service Revenue............................................................................ $9,500 Expenses Salaries and Wages Expense......................................................... $4,200 Depreciation Expense..................................................................... 350 Utilities Expense............................................................................. 400 Rent Expense................................................................................. 600 Supplies Expense........................................................................... 1,050 Total Expenses........................................................................…arrow_forward

- Jaded Corporation has the following account balances for the year-ended December 31, 2024. K In addition, the 12/31/23 balances for Accounts Receivable and Inventory are $45,000 and $95,000, respectively. dr Accounts Receivable Inventory Purchases Freight-In Purchases Discount Purchases Returns Purchase Allowances 32,000 20,000 480,000 5,000 Sales Revenue Interest Revenue Sales Returns & Allowances Sales Discounts Selling Expenses General & Administrative Exp 15,000 30,000 Other Operating Expenses Freight-Out 9,000 Interest Expense 2,000 Loss on Sale of Truck 5,000 What is the operating income for the period? OA. $1,146,000 OB. $1,167,000 OC. $1,156,000 O D. $1,176,000 $8,000 50,000 10,000 cr $ 4,000 3,000 1,000 1,850,000 1,000arrow_forwardDetermining Gross Profit During the current year, merchandise is sold for $45,870,000. The cost of the merchandise sold is $33,026,400. a. What is the amount of the gross profit? 12,843,600 b. Compute the gross profit percentage (gross profit divided by sales). % c. When will the income statement necessarily report a net income?arrow_forwardAt December 31, Rolison Consulting’s financial records show the following selected account information. Service revenue..................... $90,000Rent expense......................... $25,000Salaries expense.................... $54,000Supplies expense..................... $3,000Depreciation expense............... $6,000Retained earnings.................. $52,000 (credit balance)Contributed Capital................. $10,000 (credit balance) After all closing entries are recorded and posted, what is the balance of the contributed capital account?arrow_forward

- 1. During December, A Company started doing business and had gross credit trade sales of $800,000, terms 2/10 Net 30. The cost of goods sold of $480,000, selling general administration costs of $100,000, Interest Expense of $10,000; and an income tax rate of 30%. a. Prepare an income statement b. Prepare journal entries Assuming gross method and all payments for the trade sales were made within 10 days.arrow_forwardWhat is the amount of gross sales for the current year?arrow_forwardHoyt Company provides this information for the month of November, 2022: sales on credit $170,000; cash sales $70,000; sales discounts $2,000; and sales returns and allowances $9,000. Prepare the sales revenues section of the income statement based on this information. V: HOYT COMPANY Income Statement (Partial) $ 4arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education