Concept explainers

Purchases and cash payments journals; accounts payable subsidiary and general ledgers

AquaFresh Water Testing Service was established on April 16, 2016. AquaFresh uses field equipment and field supplies (chemicals and other supplies) to analyze water for unsafe contaminants in streams, lakes, and ponds. Transactions related to purchases and cash payments during the remainder of April are as follows:

April 16. Issued Check No. 1 in payment of rent for the remainder of April, $3,500.

16. Purchased field supplies on account from Hydro Supply Co., $5,340.

16. Purchased field equipment on account from Pure Equipment Co., $21,450.

17. Purchased office supplies on account from Best Office Supply Co., $510.

19. Issued Check No. 2 in payment of field supplies, $3,340, and office supplies, $400.

Post the journals to the accounts payable subsidiary ledger.

23. Purchased office supplies on account from Best Office Supply Co., $660.

23. Issued Check No. 3 to purchase land, $140,000.

24. Issued Check No. 4 to Hydro Supply Co. in payment of April 16 invoice, $5,340.

26. Issued Check No. 5 to Pure Equipment Co. in payment of April 16 invoice, $21,450.

Post the journals to the accounts payable subsidiary ledger.

30. Acquired land in exchange for field equipment having a cost of $12,000.

30. Purchased field supplies on account from Hydro Supply Co., $7,650.

30. Issued Check No. 6 to Best Office Supply Co. in payment of April 17 invoice, $510.

30. Purchased the following from Pure Equipment Co. on account: field supplies, $1,340, and field equipment, $4,700.

30. Issued Check No. 7 in payment of salaries, $29,400.

Post the journals to the accounts pay able subsidiary ledger.

Instructions

1. Journalize the transactions for April. Use a purchases journal and a cash payments journal, similar to those illustrated in this chapter, and a two-column general journal. Use debit columns for Field Supplies, Office Supplies, and Other Accounts in the purchases journal. Refer to the following partial chart of accounts:

| 11 Cash | 19 Land |

| 14 Field Supplies | 21 Accounts Payable |

| 15 Office Supplies | 61 Salary Expense |

| 17 Field Equipment | 71 Rent Expense |

At the points indicated in the narrative of transactions, post to the following accounts in the accounts payable subsidiary ledger:

Best Office Supply Co.

Hydro Supply Co.

Pure Equipment Co.

2.

3. Total each of the columns of the purchases journal and the cash payments journal, and post the appropriate totals to the general ledger. (Because the problem does not include transactions related to cash receipts, the cash account in the ledger will have a credit balance.)

4. Prepare a schedule of the accounts payable creditor balances.

5. Why might AquaFresh consider using a subsidiary ledger for the field equipment?

1.

General Ledger

General ledger refers to the ledger that records all the transactions of the business related to the company’s assets, liabilities, owners’ equities, revenues, and expenses. Each subsidiary ledger is represented in the general ledger by summarizing the account.

Accounts payable control account and subsidiary ledger:

Accounts payable account and subsidiary ledger is the ledger which is used to post the creditors transaction in one particular ledger account. It helps the business to locate the error in the creditor ledger balance. After all transactions of creditor accounts are posted, the balances in the accounts payable subsidiary ledger should be totaled, and compare with the balance in the general ledger of accounts payable. If both the balance does not agree, the error has been located and corrected.

Purchase journal:

Purchase journal refers to the journal that is used to record all purchases on account. In the purchase journal, all purchase transactions are recorded only when the business purchased the goods on account. For example, the business purchased cleaning supplies on account.

Cash payments journal:

Cash payments journal refers to the journal that is used to record all transaction which involves the cash payments. For example, the business paid cash to employees (salary paid to employees).

To Prepare: A single column revenue journal and cash receipt journal, and post the accounts in the accounts payable subsidiary ledger.

Explanation of Solution

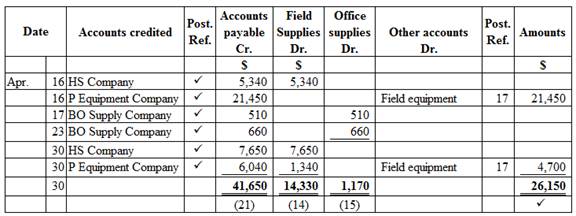

Purchase journal

Purchase journal of Company AF in the month of April, 2016 is as follows:

Figure (1)

Cash payment journal

Cash payment journal of Company AF in the month of April is as follows:

Cash payment journal

| Date | Check No. | Account debited | Post Ref. | Other accounts Dr. | Accounts payable Dr. | Cash Dr. | |

| 2016 | |||||||

| Apr. | 16 | 1 | Rent expense | 71 | 3,500 | 3,500 | |

| 19 | 2 | Field supplies | 14 | 3,340 | 3,340 | ||

| Office supplies | 15 | 400 | 400 | ||||

| 23 | 3 | Land | 19 | 140,000 | 140,000 | ||

| 24 | 4 |

|

✓ | 5,340 | 5,340 | ||

| 26 | 5 |

|

✓ | 21,450 | 21,450 | ||

| 30 | 6 |

|

✓ | 510 | 510 | ||

| 30 | 7 | Salary expense | 61 | 29,400 | 29,400 | ||

| 30 | 176,640 | 27,300 | 203,940 | ||||

| ✓ | (21) | (11) | |||||

Table (1)

Accounts payable subsidiary ledger

| Name: BO Supply Company | ||||||

| Date | Item | Post. Ref | Debit ($) |

Credit ($) | Balance ($) | |

| 2016 | ||||||

| April | 17 | P1 | 510 | 510 | ||

| 23 | P1 | 660 | 1,170 | |||

| 30 | CP1 | 510 | 660 | |||

Table (2)

| Name: HS Company | ||||||

| Date | Item | Post. Ref | Debit ($) |

Credit ($) | Balance ($) | |

| 2016 | ||||||

| April | 16 | P1 | 5,340 | 5,340 | ||

| 24 | CP1 | 5,340 | - | |||

| 30 | P1 | 7,650 | 7,650 | |||

Table (3)

| Name: P Equipment Company | ||||||

| Date | Item | Post. Ref | Debit ($) |

Credit ($) | Balance ($) | |

| 2016 | ||||||

| April | 16 | P1 | 21,450 | 21,450 | ||

| 26 | CP1 | 21,450 | - | |||

| 30 | P1 | 6,040 | 6,040 | |||

Table (4)

2. and 3.

To post: The individual entries to the appropriate general ledger accounts.

Explanation of Solution

Prepare the general ledger for given accounts as follows:

| Account: Cash Account no. 11 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| April | 30 | CP1 | 203,940 | 203,940 | |||

Table (5)

| Account: Field supplies Account no. 14 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| April | 19 | CP1 | 3,340 | 3,340 | |||

| 30 | P1 | 14,330 | 17,670 | ||||

Table (6)

| Account: Office supplies Account no. 15 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| April | 19 | CP1 | 400 | 400 | |||

| 30 | P1 | 1,170 | 1,570 | ||||

Table (7)

| Account: Field equipment Account no. 17 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| April | 16 | P1 | 21,450 | 21,450 | |||

| 30 | P1 | 4,700 | 26,150 | ||||

| 30 | J1 | 12,000 | 14,150 | ||||

Table (8)

| Account: Land Account no. 19 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| April | 23 | CP1 | 140,000 | 140,000 | |||

| 30 | J1 | 12,000 | 152,000 | ||||

Table (9)

| Account: Accounts payable Account no. 21 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| April | 30 | P1 | 41,650 | 41,650 | |||

| 30 | CP1 | 27,300 | 14,350 | ||||

Table (10)

| Account: Salary expense Account no. 61 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| April | 30 | CP1 | 29,400 | 29,400 | |||

Table (11)

| Account: Rent expense Account no. 71 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| April | 16 | CP1 | 3,500 | 3,500 | |||

Table (12)

| Journal Page 01 | |||||

| Date | Description | Post. Ref | Debit ($) | Credit ($) | |

| April | 30 | Land | 19 | 12,000 | |

| Field equipment | 17 | 12,000 | |||

| (To record the acquisition of land in exchange for field equipment) | |||||

Table (13)

4.

To prepare: The accounts payable creditor balances.

Explanation of Solution

Accounts payable creditor balance

Accounts payable creditor balance is as follows:

| Company AF | |

| Accounts payable creditor balances | |

| April 30 | |

| Amount ($) | |

| BO Supply Company | 660 |

| HS Company | 7,650 |

| P Equipment Company | 6,040 |

| Total accounts receivable | 14,350 |

Table (14)

Accounts payable controlling account

Ending balance of accounts payable controlling account is as follows:

| Company AF | |

| Accounts payable (Controlling account) | |

| April 30 | |

| Amount ($) | |

| Opening balance | 0 |

| Add: | |

| Total credits (from purchase journal) | 41,650 |

| Less: | |

| Total debits (from cash payment journal) | (27,300) |

| Total accounts payable | 14,350 |

Table (15)

In this case, accounts payable subsidiary ledger is used to identify, and locate the error by way of cross check the creditor balance and accounts payable controlling account. From the above calculation, we can understand that the both balance of accounts payable is agree, hence there is no error in the recording and posing of transactions.

5.

To discuss: The reason for using subsidary ledger for the field equipment.

Explanation of Solution

A subsidiary ledger for the field equipment helps the company to track the cost of each piece of equipment, location, useful life, and other necessary data. This information is useful for safeguarding the equipment, and determining depreciation of equipment.

Want to see more full solutions like this?

Chapter 5 Solutions

Custom Bundle: Accounting, Loose-leaf Version, 26th + Working Papers, Chapters 1-17, 26th Edition

- Transactions related to purchases and cash payments completed by Wisk Away Cleaning Services Inc. during the month of May 20Y5 are as follows: Prepare a purchases journal and a cash payments journal to record these transactions. The forms of the journals are similar to those illustrated in the text. Place a check mark () in the Post. Ref. column to indicate when the accounts payable subsidiary ledger should be posted. Wisk Away Cleaning Services Inc. uses the following accounts:arrow_forwardThe cash payments and purchases journals for Outdoor Artisan Landscaping follow. The accounts payable control account has a June 1, 20Y1, balance of 2,230, consisting of an amount owed to Augusta Sod Co. Prepare a schedule of the accounts payable creditor balances and determine that the total agrees with the ending balance of the accounts payable controlling account.arrow_forwardCatherines Cookies has a beginning balance in the Accounts Payable control total account of $8,200. In the cash disbursements journal, the Accounts Payable column has total debits of $6,800 for November. The Accounts Payable credit column in the purchases journal reveals a total of $10,500 for the current month. Based on this information, what is the ending balance in the Accounts Payable account in the general ledger?arrow_forward

- Purchases and Cash Payments Journals Transactions related to purchases and cash payments completed by Wisk Away Cleaning Services Inc. during the month of May 20Y5 are as follows: May 1. Issued Check No. 57 to Bio Safe Supplies Inc. in payment of account, $360. 3. Purchased cleaning supplies on account from Brite N' Shine Products Inc., $220. 8. Issued Check No. 58 to purchase equipment from Carson Equipment Sales, $3,680. 12. Purchased cleaning supplies on account from Porter Products Inc., $310. 15. Issued Check No. 59 to Bowman Electrical Service in payment of account, $180. 18. Purchased supplies on account from Bio Safe Supplies Inc., $410. 20. Purchased electrical repair services from Bowman Electrical Service on account, $150. 26. Issued Check No. 60 to Brite N’ Shine Products Inc. in payment of May 3 invoice. 31. Issued Check No. 61 in payment of salaries, $7,050. Wisk Away Cleaning Services Inc. uses the following accounts: Cash 11…arrow_forwardPurchases and Cash Payments Journals Transactions related to purchases and cash payments completed by Wisk Away Cleaning Services Inc. during the month of May 20Y5 are as follows: May 1. Issued Check No. 57 to Bio Safe Supplies Inc. in payment of account, $345. May 3. Purchased cleaning supplies on account from Brite N’ Shine Products Inc., $200. May 8. Issued Check No. 58 to purchase equipment from Carson Equipment Sales, $2,860. May 12. Purchased cleaning supplies on account from Porter Products Inc., $360. May 15. Issued Check No. 59 to Bowman Electrical Service in payment of account, $145. May 18. Purchased supplies on account from Bio Safe Supplies Inc., $240. May 20. Purchased electrical repair services from Bowman Electrical Service on account, $110. May 26. Issued Check No. 60 to Brite N’ Shine Products Inc. in payment of May 3 invoice. May 31. Issued Check No. 61 in payment of salaries, $5,600. Wisk Away Cleaning Services Inc. uses the…arrow_forwardTransactions for petty cash, cash short and overCedar Springs Company completed the following selected transactiduring June 20Y3: InstructionsJournalize the transactions.arrow_forward

- Transactions for petty cash, cash short and overWyoming Restoration Company completed the following selectedtransactions during July 20Y1: Instructions Journalize the transactionsarrow_forwardT. L. Jones Trucking Services establishes a petty cash fund on April 3 for $200. By the end of April, the fund has a cash balance of $97. The company has also issued a credit card and authorized its office manager to make purchases. Expenditures for the month include the following items: Utilities (credit card) Entertainment (petty cash) Stamps (petty cash) Plumbing repair services (credit card) $ 435 44 59 630 Required: Record the establishment of the petty cash fund on April 3, all expenditures made during the month, and the replenishment of the petty cash fund on April 30. The credit card balance is paid in full on April 30. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)arrow_forwardTransactions related to revenue and cash receipts completed by Sycamore Inc. during the month of March 20Y8 are as follows: Prepare a single-column revenue journal and a cash receipts journal to record these transactions. Use the following column headings for the cash receipts journal: Fees Earned Cr., Accounts Receivable Cr., and Cash Dr. Place a check mark () in the Post. Ref. column to indicate when the accounts receivable subsidiary ledger should be posted.arrow_forward

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning  Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning