PRIN.OF CORPORATE FINANCE

13th Edition

ISBN: 9781260013900

Author: BREALEY

Publisher: RENT MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 5, Problem 1PS

Payback*

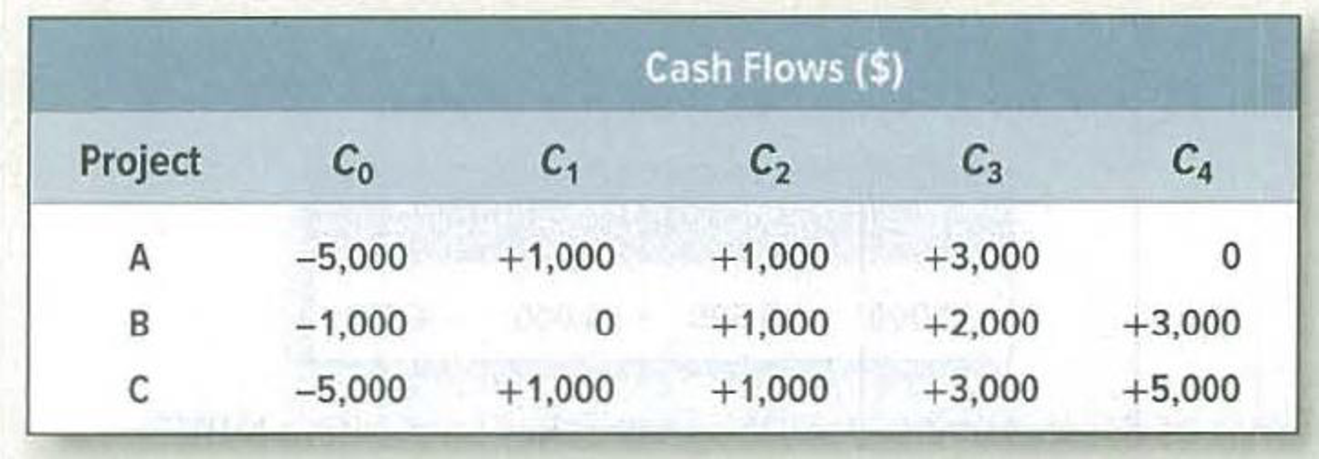

- a. What is the payback period on each of the following projects?

- b. Given that you wish to use the payback rule with a cutoff period of two years, which projects would you accept?

- c. If you use a cutoff period of three years, which projects would you accept?

- d. If the

opportunity cost of capital is 10%, which projects have positive NPVs? - e. “If a firm uses a single cutoff period for all projects, it is likely to accept too many short-lived projects.” True or false?

- f. If the firm uses the discounted-payback rule, will it accept any negative-

NPV projects? Will it turn down any positive-NPV projects?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

A firm evaluates a project with the following cash flows. The firm has a 2 year payback period

criteria and a required return of 11 percent.

Year

Cash flow

(OMR)

-24,000

17,000

12,000

9,000

-8,000

11,000

1

3

4

11. What is the net present value for the project?

12. What is the payback period for the project?

13. What is the discounted payback period for the project?

14. What is the profitability index for the project?

15. Given your analysis, should the fim accept or reject the project?

A firm evaluates a project with the following cash flows. The firm has a 2 year payback period criteria and a required return of 16 percent. Year Cash flow (OMR) 0 -35,000 1 15,000 2 17,000 3 15,000 4 -13,000 5 11,000 11. What is the net present value for the project? 12. What is the payback period for the project? 13. What is the discounted payback period for the project? 14. What is the profitability index for the project? 15. Given your analysis, should the firm accept or reject the project?

Please answer the following questions in detail, provide examples whenever applicable, provide in-text citations.

(TABLE IMAGE ATTACHED)

What is the payback period on each of the above projects?

Given that you wish to use the payback rule with a cutoff period of two years, which projects would you accept?

If you use a cutoff period of three years, which projects would you accept?

If the opportunity cost of capital is 10%, which projects have positive NPVs?

If a firm uses a single cutoff period for all projects, it is likely to accept too many short-lived projects.” True or false?

If the firm uses the discounted-payback rule, will it accept any negative-NPV projects? Will it turn down any positive NPV projects?

Chapter 5 Solutions

PRIN.OF CORPORATE FINANCE

Ch. 5 - (IRR) Check the IRRs for project F in Section 5-3.Ch. 5 - (IRR) What is the IRR of a project with the...Ch. 5 - (XIRR) What is the IRR of a project with the...Ch. 5 - Payback a. What is the payback period on each of...Ch. 5 - Payback Consider the following projects: a. If the...Ch. 5 - Prob. 3PSCh. 5 - IRR Write down the equation defining a projects...Ch. 5 - Prob. 5PSCh. 5 - IRR Calculate the IRR (or IRRs) for the following...Ch. 5 - IRR rule You have the chance to participate in a...

Ch. 5 - IRR rule Consider a project with the following...Ch. 5 - IRR rule Consider projects Alpha and Beta: The...Ch. 5 - IRR rule Consider the following two mutually...Ch. 5 - IRR rule Mr. Cyrus Clops, the president of Giant...Ch. 5 - Prob. 12PSCh. 5 - Investment criteria Consider the following two...Ch. 5 - Profitability index Look again at projects D and E...Ch. 5 - Capital rationing Suppose you have the following...Ch. 5 - Prob. 17PSCh. 5 - Prob. 18PS

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- a) Calculate the payback period for each project. The maximum allowable payback period setby the company for all projects is 3 years. b) Calculate the net present value (NPV) for each project c) Calculate the profitability index (PI) for each project d) Calculate the internal rate of return (IRR) for each project. e) Based on the answer in (a) – (d), explain briefly which project should be accepted. f) If the project is independent project, how would your answer change in part (e) Note: 1. I need only e,f no question answer. only e and f 2. No need excel formulaarrow_forwarda) Calculate the payback period for each project. The maximum allowable payback period setby the company for all projects is 3 years. b) Calculate the net present value (NPV) for each project c) Calculate the profitability index (PI) for each project d) Calculate the internal rate of return (IRR) for each project. e) Based on the answer in (a) – (d), explain briefly which project should be accepted. f) If the project is independent project, how would your answer change in part (e) Note: I need only e,f no question answer. only e and farrow_forwardes Lopez Company is considering three alternative investment projects below: Project 1 5.2 years $ 26,700 Project 2 5.7 Years $ 33,700 14.2% 13.1% Payback period Net present value Internal rate of return a. Payback period b. Net present value c. Internal rate of return. Which project is preferred if management makes its decision based on (a) payback period, (b) net present value, and (c) internal rate of return? Preferred Investment Project 3 4.9 Years Reason $19,700 12.5%arrow_forward

- Please help me with this question (picture below) 1. Calculate the payback period, accounting rate of return, net present value of each project. Based on your calculations, discuss whether the projects should go ahead. Assume that the target value for payback is 3 years for project A and 2 years for project B.2. List advantages and disadvantages of payback period, accounting rate of return, net present value of each project.arrow_forwardRefer to the problem given in answering the following questions:(a) How long does it take to recover the investment?(b) If the firm's interest rate is 15%, what would be the discounted-paybackperiod for this project?arrow_forwardAnswer the following: 1 What is the payback period on each of the above projects? 2 Given that you wish to use the payback rule with a cutoff period of two years, which projects would you accept? Why? 3 If you use a cutoff period of three years, which projects would you accept? Why?arrow_forward

- Suppose your firm is considering two mutually exclusive, required projects with the cash flows shown below. The required rate of return on projects of both of their risk class is 8 percent, and that the maximum allowable payback and discounted payback statistic for the projects are 2 and 3 years, respectively. Time Project A Cash Flow Project B Cash Flow Use the payback decision rule to evaluate these projects, which one(s) should it be accepted or rejected? Multiple Choice 0 -35,000 -45,000 1 25,000 25,000 2 45,000 5,000 3 16,000 65,000arrow_forwardCompute the payback statistic for Project Y and recommend whether the firm should accept or reject the project with the cash flows shown as follows if the appropriate cost of capital is 11 percent and the maximum allowable payback is one year. Time: 0 1 2 3 4 5 Cash flow: −100 75 100 300 75 200arrow_forwardSuppose a project with a 6% discount rate yields R5000 for the next three years. Annual operating costs amount to R1000 for each year, and the one time initial investment cost is R8000. a. Calculate the Net Present Value (NPV) of this project.b. Calculate the cost-benefit ratio for the project. c. Is the project acceptable? Motivate your answer.arrow_forward

- A firm evaluates all of its projects by applying the IRR rule. A project under consideration has the following cash flows: -$25,000 today (t=0); $11,000 after one year (t=1), 17,000 after two years (t=2); and 10,000 after three years (t=3). What is the Internal Rate of Return (“IRR”) for this project?arrow_forwardA firm evaluates all of its projects by applying the IRR rule. A project under consideration has the following cash flows: Year Cash Flow 0 –$ 28,400 1 12,400 2 15,400 3 11,400 If the required return is 15 percent, what is the IRR for this project? Should the firm accept the project?arrow_forward1.Assuming you are facing with making a decision on a large capital investment proposal. the capital investment amount is $ Estimated the study period is years .The annual revenue at the end of each year is $ and the estimated annual year-end expense is $ starting in year Assuming a market value at the end year is $ and the benchmark rate is 10%, please answer the following questions: 1.Please design this investment project to fill the proper number in blank space to let the project is feasible in economics( 2.To give the cash flow chart of the project(arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License