PRIN.OF CORPORATE FINANCE

13th Edition

ISBN: 9781260013900

Author: BREALEY

Publisher: RENT MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 5, Problem 14PS

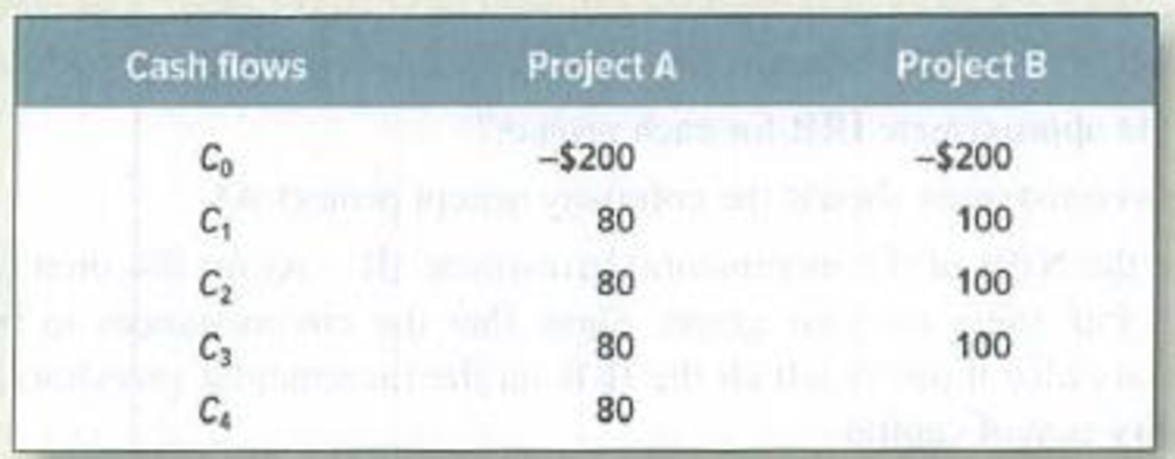

Investment criteria Consider the following two projects:

- a. If the opportunity cost of capital is 11%, which of these two projects would you accept (A, B, or both)?

- b. Suppose that you can choose only one of these two projects. Which would you choose? The discount rate is still 11%.

- c. Which one would you choose if the cost of capital is 16%?

- d. What is the payback period of each project?

- e. Is the project with the shortest payback period also the one with the highest

NPV ? - f. What are the

internal rates of return on the two projects? - g. Does the IRR rule in this case give the same answer as NPV?

- h. If the opportunity cost of capital is 11%, what is the profitability index for each project? Is the project with the highest profitability index also the one with the highest NPV? Which measure should you use to choose between the projects?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

What are the internal rates of return (IRR) on the three projects? Does the IRR rule in this case give the same decision as NPV? How do you know?

If the opportunity cost of capital is 11%, what is the profitability index for each project? Please analyze if, in general, decisions based on profitability index are consistent with decisions based on NPV.

What is the most generally accepted measure to choose between the projects? Please justify your answer.

Using image:

a-1. What is the payback period for each project

a-2. If you apply the payback criterion, which investment will you choose?

b-1. What is the discounted payback period for each project?

b-2. If you apply the discounted payback criterion, which investment will you choose?

c-1. What is the NPV for each project?

c-2. If you apply the NPV criterion, which investment will you choose?

d-1. What is the IRR for each project?

d-2. If you apply the IRR criterion, which investment will you choose?

e-1. What is the profitability index for each project?

e-2. If you apply the profitability index criterion, which investment will you choose?

f. Based on your answers in (a) through (e), which project will you finally choose?

Consider the following two mutually exclusive projects (W and Z).

-The table-

Whichever project you choose, if any, you require a 12 percent return on your investment.(a) Calculate the payback period for each project.(b) Calculate the net present value (NPV) of each project(c) Based on your answers in (a) and (b), which project will you finally choose? Explain.

Chapter 5 Solutions

PRIN.OF CORPORATE FINANCE

Ch. 5 - (IRR) Check the IRRs for project F in Section 5-3.Ch. 5 - (IRR) What is the IRR of a project with the...Ch. 5 - (XIRR) What is the IRR of a project with the...Ch. 5 - Payback a. What is the payback period on each of...Ch. 5 - Payback Consider the following projects: a. If the...Ch. 5 - Prob. 3PSCh. 5 - IRR Write down the equation defining a projects...Ch. 5 - Prob. 5PSCh. 5 - IRR Calculate the IRR (or IRRs) for the following...Ch. 5 - IRR rule You have the chance to participate in a...

Ch. 5 - IRR rule Consider a project with the following...Ch. 5 - IRR rule Consider projects Alpha and Beta: The...Ch. 5 - IRR rule Consider the following two mutually...Ch. 5 - IRR rule Mr. Cyrus Clops, the president of Giant...Ch. 5 - Prob. 12PSCh. 5 - Investment criteria Consider the following two...Ch. 5 - Profitability index Look again at projects D and E...Ch. 5 - Capital rationing Suppose you have the following...Ch. 5 - Prob. 17PSCh. 5 - Prob. 18PS

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 3) could you use the Figure below that shows the net present value profile of two projects Y and W to answer the following questions: What is the internal rate of return on project Y? Determine the “approximate” discount rate at which you would be indifferent between the two projects Find the “approximate” net present value of project W when the discount rate is 4%.arrow_forwardA. Calculate the profitability index for project X. B. Calculate the profitability for project Y C. Using the NPV method combined with the PI aporoach, which project would you select? Use a discount rate of 13 percentarrow_forward1. Calculate the net present value for each project. 2. Calculate the simple rate of return for each product.3. Which of the two projects (if either) would you recommend that Batelco Inc. accept? Why?arrow_forward

- Assume that you have two investment alternatives: the first project produces $125 for sure, and the second project produces $150 with probability 2/5. You can borrow $110 from your financial institution for one project (investment) if you show an asset as a collateral. Suppose that you maximize your expected profit, what would be the minimum level of collateral that make you select the safe project?arrow_forwardConsider the following two investment alternatives: The firm's MARR is known to be 15%.(a) Compute the IRR of Project B.(b) Compute the PW of Project A. (c) Suppose that Projects A and B are mutually exclusive. Using the IRR, whichproject would you select?arrow_forwardData table (Click on the following icon in order to copy its contents into a spreadsheet.) Cash Flow Today ($ millions) Project A -6 B с 2 25 L Cash Flow in One Year ($ millions) 22 5 - 8 <arrow_forward

- Consider the following two projects: (a) Calculate the profitability index for A1 and A2 at an interest rate of 6%.(b) Determine which project(s) you should accept (1) if you have enough money to undertake both and (2) if you could take only one due to a budget limit.arrow_forwardUse the information provided to answer the questions Calculate the Accounting Rate of Return (on average investment) of Project B (expressed to twodecimal places).Calculate the Net Present Value of each project (with amounts rounded off to the nearest Rand). Use your answers from previous question to recommend the project that should be chosen. Motivateyour choice.arrow_forwardIf the opportunity cost of capital is 11%, and you have unlimited access to the capital, which one(s) would you accept? Why did you answer the way you did? Would your response change if the cost of capital is 16%? Why or why not? Suppose that you have limited access to the capital and you need to choose only one project. Which one would you choose and why? The discount rate is still 11%. What is the payback period of each project? Please analyze if, in general, a decision based on payback is consistent with a decision based on NPV. What are the internal rates of return (IRR) on the three projects? Does the IRR rule in this case give the same decision as NPV? How do you know? If the opportunity cost of capital is 11%, what is the profitability index for each project? Please analyze if, in general, decisions based on the profitability index are consistent with decisions based on NPV. What is the most generally accepted measure to choose between the projects? Please justify your…arrow_forward

- Find the external rate of return (ERR) for the following project when the external reinvestment rate is $ = 10% (equal to the MARR). Is this an acceptable project?arrow_forwardConsider the following two mutually exclusive projects: (a) Which project has the higher profitability index at i = 7%?(b) Which project would you choose if you can raise an unlimited amount offunds in financing either project at 7%? Use the profitability index rule.arrow_forwardWallace Company is considering two projects. Their required rate of return is 10%. Which of the two projects, A or B, is better in terms of internal rate of return?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License