Concept explainers

Comprehensive Problem for Chapters 1-5

Completing a Merchandiser’s Accounting Cycle

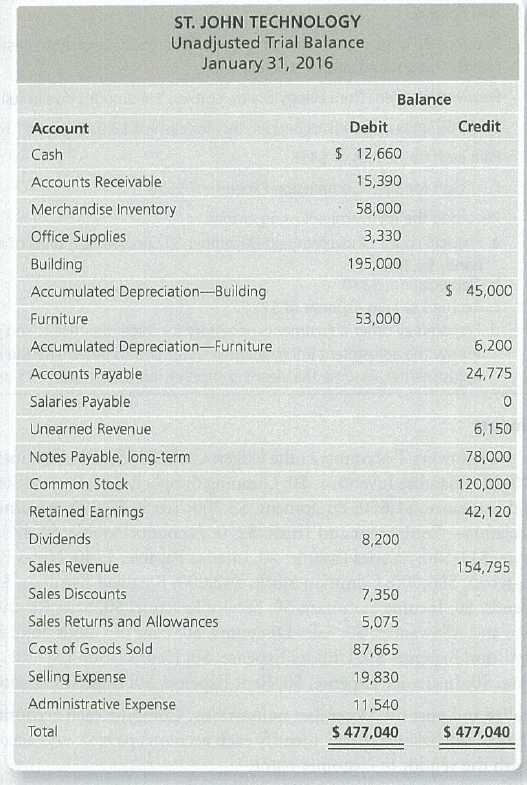

St. John Technology uses a perpetual inventory system. The end-of-month unadjusted

Additional data at January 31, 2 016:

a. Office Supplies consumed during the month, $1,780. Half is selling expense, and the other half is administrative expense.

b. Depreciation for the month: building, $4,500; furniture, $2,600 . One-fourth of depreciation is selling expense, and three-fourths is administrative expense.

c. Unearned revenue that has been earned during January, $3,825.

d. Accrued salaries, an administrative expense, $975.

e. Merchandise Inventory on hand, $55,375. St. John uses the perpetual inventory system.

Requirements

1. Using T-accounts, open the accounts listed on the trial balance, inserting their unadjusted balances. Label the balances as Bal. Al so open the Income Summary account.

2. Journalize and post the

3. Enter the unadjusted trial balance on a worksheet, and complete the worksheet for the month ended January 31, 2016. St. John Technology groups all operating expenses under two accounts, Selling Expense and Administrative Expense. Leave two blank lines under Selling Expense and three blank lines under Administrative Expense.

4. Prepare the company’s multi-step in com e statement and statement of

5. Journalize and

Want to see the full answer?

Check out a sample textbook solution

Chapter 5 Solutions

Horngren's Financial & Managerial Accounting, The Financial Chapters (Book & Access Card)

- PERPETUAL: LIFO AND MOVING-AVERAGE Kelley Company began business on January 1, 20-1. Purchases and sales during the month of January follow. REQUIRED Calculate the total amount to be assigned to cost of goods sold for January and the ending inventory on January 31, under each of the following methods: 1. Perpetual LIFO inventory method. 2. Perpetual moving-average inventory method.arrow_forwardWORK SHEET EXTENSIONS FOR MERCHANDISE INVENTORY ADJUSTMENTS: PERIODIC INVENTORY SYSTEM The following partial work sheet is taken from Nicoles Gift Shop for the year ended December 31, 20--. The ending merchandise inventory is 37,000. 1. Complete the Adjustments columns for the merchandise inventory. 2. Extend the merchandise inventory to the Adjusted Trial Balance and Balance Sheet columns. 3. Extend the remaining accounts to the Adjusted Trial Balance and Income Statement columns. 4. Prepare a cost of goods sold section from the partial work sheet.arrow_forwardWORK SHEET EXTENSIONS FOR MERCHANDISE INVENTORY ADJUSTMENTS: PERIODIC INVENTORY SYSTEM The following partial work sheet is taken from Kevins Gift Shop for the year ended December 31, 20--. The ending merchandise inventory is 50,000. 1. Complete the Adjustments columns for the merchandise inventory. 2. Extend the merchandise inventory to the Adjusted Trial Balance and Balance Sheet columns. 3. Extend the remaining accounts to the Adjusted Trial Balance and Income Statement columns. 4. Prepare a cost of goods sold section from the partial work sheet.arrow_forward

- Calculate the cost of goods sold dollar value for B65 Company for the month, considering the following transactions under three different cost allocation methods and using perpetual inventory updating. Provide calculations for first-in, first-out (FIFO).arrow_forwardSERIES B PROBLEM PERPETUAL: LIFO AND MOVING-AVERAGE Vozniak Company began business on January 1, 20-1. Purchases and sales during the month of January follow. REQUIRED Calculate the total amount to be assigned to cost of goods sold for January and the ending inventory on January 31, under each of the following methods: 1. Perpetual LIFO inventory method. 2. Perpetual moving-average inventory method.arrow_forwardCalculate the cost of goods sold dollar value for A66 Company for the month, considering the following transactions under three different cost allocation methods and using perpetual inventory updating. Provide calculations for last-in, first-out (LIFO).arrow_forward

- Selected transactions for Niles Co. during March of the current year are listed in Problem 6-1B. Instructions Journalize the entries to record the transactions of Niles Co. for March using the periodic inventory system.arrow_forwardADJUSTMENT FOR MERCHANDISE INVENTORY USING T ACCOUNTS: PERIODIC INVENTORY SYSTEM Sandra Owens owns a business called Sandras Sporting Goods. Her beginning inventory as of January 1, 20--, was 33,000, and her ending inventory as of December 31, 20--, was S36,000. Set up T accounts for Merchandise Inventory and Income Summary and perform the year-end adjustment for Merchandise Inventory.arrow_forward

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,