Corporate Finance

12th Edition

ISBN: 9781259918940

Author: Ross, Stephen A.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 5, Problem 16QAP

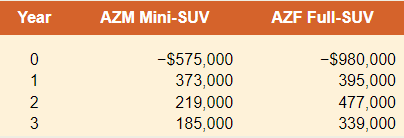

Comparing Investment Criteria Consider the following cash flows of two mutually exclusive projects for AZ-Motorcars. Assume the discount rate for both projects is 10 percent.

a. Based on the payback period, which project should be accepted?

b. Based on the

c. Based on the

d. Based on this analysis, is incremental IRR analysis necessary? If yes, please conduct the analysis.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Use the information provided to answer the questions

Calculate the Accounting Rate of Return (on average investment) of Project B (expressed to twodecimal places).Calculate the Net Present Value of each project (with amounts rounded off to the nearest Rand). Use your answers from previous question to recommend the project that should be chosen. Motivateyour choice.

A company is considering three alternative Investment projects with different net cash flows. The present value of net cash flows is

calculated using Excel and the results follow.

Potential Projects

Present value of net cash flows (excluding initial investment)

Initial investment

Complete this question by entering your answers in the tabs below.

a. Compute the net present value of each project.

b. If the company accepts all positive net present value projects, which of these will It accept?

c. If the company can choose only one project, which will it choose on the basis of net present value?

Required A Required B

Compute the net present value of each project.

Potential Projects

Project A

Present value of net cash flows

Initial investment

Net present value

Required C

Project E

Project C

$10,685

(10,000)

Consider the following cash flows, for four different projects: (given)

(a) Calculate the conventional payback period for each project.(b) Determine whether it is meaningful to caJculate a payback period for Project D.(c) Assuming i = I 0% calculate the discounted-payback period for each project.

Chapter 5 Solutions

Corporate Finance

Ch. 5 - Payback Period and Net Present Value If a project...Ch. 5 - Net Present Value Suppose a project has...Ch. 5 - Comparing Investment Criteria Define each of the...Ch. 5 - Payback and Internal Rate of Return A project has...Ch. 5 - Prob. 5CQCh. 5 - Capital Budgeting Problems What are some of the...Ch. 5 - Prob. 7CQCh. 5 - Prob. 8CQCh. 5 - Net Present Value versus Profitability Index...Ch. 5 - Internal Rate of Return Projects A and B have the...

Ch. 5 - Net Present Value You are evaluating Project A and...Ch. 5 - Modified Internal Rate of Return One of the less...Ch. 5 - Net Present Value It is sometimes stated that the...Ch. 5 - Prob. 14CQCh. 5 - Prob. 1QAPCh. 5 - Prob. 2QAPCh. 5 - Prob. 3QAPCh. 5 - Prob. 4QAPCh. 5 - Prob. 5QAPCh. 5 - Prob. 6QAPCh. 5 - Prob. 7QAPCh. 5 - Prob. 8QAPCh. 5 - Prob. 9QAPCh. 5 - Prob. 10QAPCh. 5 - NPV versus IRR Consider the following cash flows...Ch. 5 - Prob. 12QAPCh. 5 - Prob. 13QAPCh. 5 - Prob. 14QAPCh. 5 - Prob. 15QAPCh. 5 - Comparing Investment Criteria Consider the...Ch. 5 - Prob. 17QAPCh. 5 - Comparing Investment Criteria Consider the...Ch. 5 - Prob. 19QAPCh. 5 - Prob. 20QAPCh. 5 - MIRR Suppose the company in the previous problem...Ch. 5 - Prob. 22QAPCh. 5 - Prob. 23QAPCh. 5 - Prob. 24QAPCh. 5 - Prob. 25QAPCh. 5 - Prob. 26QAPCh. 5 - Prob. 27QAPCh. 5 - Prob. 28QAPCh. 5 - Prob. 29QAPCh. 5 - Prob. 30QAPCh. 5 - Construct a spreadsheet to calculate the payback...Ch. 5 - Based on your analysis, should the company open...Ch. 5 - Prob. 3MC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 3) could you use the Figure below that shows the net present value profile of two projects Y and W to answer the following questions: What is the internal rate of return on project Y? Determine the “approximate” discount rate at which you would be indifferent between the two projects Find the “approximate” net present value of project W when the discount rate is 4%.arrow_forwardWhich of the following statements is CORRECT? Assume that the project being considered has normal cash flows, with one outflow followed by a series of inflows. O A project's regular IRR is found by compounding the initial cost at the WACC to find the terminal value (TV), then discounting the TV at the WACC. A project's IRR is the discount rate that causes the PV of the inflows to equal the project's cost. O If a project's IRR is smaller than the WACC, then its NPV will be positive. O A project's regular IRR is found by compounding the cash inflows at the WACC to find the present value (PV), then discounting the TV to find the IRR.arrow_forwardProject Analysis. Assume that you are evaluating the following three mutually exclusive projects: A. Complete the following analyses. (For the last two lines, Terminal Value, please write in the dollar amount of the terminal value.) B. Compare and explain the conflicting rankings of the NPVs and TRRs versus the IRRs. C. Using different discount rates, is it possible to get different rankings within the NPV calculation? Why or why not? D. If 10 percent is the required return, which project is preferred? E. Which is the fairer representation of these two projects, TRR or IRR? Why?arrow_forward

- Consider the two mutually exclusive investment projects given in the table below for which MARR = 12%. On the basis of the IRR criterion, which project would be selected under an infinite planning horizon with project repeatability likely? Click the icon to view the cash flows for the investment projects. The rate of return on the incremental investment is 42.3 %. (Round to one decimal place.) Which project would be selected on the basis of the IRR criterion? Choose the correct answer below. Project B Project A More Info (Click on the following icon in order to copy its contents into a spreadsheet.) Net Cash Flow Project A - $4,000 n 0 1 2 3 IRR 2,500 4,000 4,000 62.18% Project B - $10,500 9,500 9,500 50.57% Xarrow_forwardConsider two investments with the following sequences of cash flows: (a) Compute the IRR for each investment.(b) At MARR = 10%, determine the acceptability of each project.(c) If A and B are mutually exclusive projects, which project would you selecton the basis of the rate of return on incremental investment?arrow_forwardConsider two investments with the following sequences of cash flows: (a) Compute the i* for each investment.(b) Plot the present-worth curve for each project on the same chart and find the interest rate that makes the two projects equivalent.(c) If A and B are mutually exclusive investment projects, which project is more economically desirable at MARR of 15%?arrow_forward

- Calculate the payback period, net present value, and internal rate of return for Project A. Assume a discount rate of 10%. Should the firm accept or reject Project A? Explain. If Project A and Project B are mutually exclusive, which is the better choice? Explain. What are “non-conventional” cash flows? What issues arise when evaluating projects with “non-conventional” cash flows? Project A Project B Year Cash Flow Year Cash Flow 0 -$100,000 0 -$1 1 $70,000 1 $0 2 $0 2 $0 3 $50,000 3 $10arrow_forwardConsider the following sets of investment projects: (a) Classify each project as either simple or nonsimple.(b) Compute the i* for Project A, using the quadratic equation.(c) Obtain the rate(s) of return for each project by plotting the PW as a function of interest rate.arrow_forwardSuppose that, for a certain potential investment project, the optimistic, most likely, and pessimistic estimates are as shown in the accompanying table. Solve, a. What is the AW for each of the three estimation conditions? b. It is thought that the most critical factors are useful life and net annual cash flow. Develop a table showing the net AW for all combinations of the estimates forthese two factors, assuming all other factors to be at their most likely values.arrow_forward

- What are the internal rates of return (IRR) on the three projects? Does the IRR rule in this case give the same decision as NPV? How do you know? If the opportunity cost of capital is 11%, what is the profitability index for each project? Please analyze if, in general, decisions based on the profitability index are consistent with decisions based on NPV. What is the most generally accepted measure to choose between the projects? Please justify your answer. Project A -5000 +1000 +1000 +3000 0 B -1000 0 +1000 +2000 +3000 C -5000 +1000 +1000 +3000 +5000 I will need full analysis (qualitative examples and references citations and examples of relative current investments of big companies.arrow_forwardConsider the following cash flows of two mutually exclusive projects for Dubai Company. Assume the discount rate for Dubai Company is 10 percent. Required: Based on the payback period, which project should be taken? Based on the NPV, which project should be taken? Based on the IRR, which project should be taken? Based on this analysis, is incremental IRR analysis necessary? If yes, conduct the analysis.arrow_forwardCalculate internal Rate of Return of the project. Should the project be accepted? If reinvestment rate assumption of IRR is changed to cost of capital 11% , what should the modified rate of return ( MIRR)?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Financial Risks - Part 1; Author: KnowledgEquity - Support for CPA;https://www.youtube.com/watch?v=mFjSYlBS-VE;License: Standard youtube license