Survey of Accounting (Accounting I)

8th Edition

ISBN: 9781305961883

Author: Carl Warren

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 4, Problem 4.5.2MBA

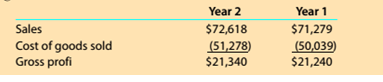

Gross margin percent and markup percent

Target Corp. (TGT) operates retail stores throughout the United States and is a major competitor of Wal-Mart. The following data (in millions) were adapted from recent financial statements of Target.

Compute the average markup percent for Years 1 and 2. Round to one decimal place.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Compare Income Statements and Balance Sheets of Competitorsa. Following are selected income statement data from two European grocery chain companies: Tesco PLC (UK) and Ahold (the Netherlands). Prepare a common‑size income statement. To do this, express each income statement amount as a percent of sales.Note: Round percentage to one decimal point (for example, round 18.566% to 18.6%).

Income Statements

Tesco

Carrefour Group

For Fiscal Year Ended

February 24, 2019

December 31, 2018

(£ millions)

(€ millions)

Sales

£57,520

Answer

€70,125

Answer

Cost of goods sold

53,790

Answer

54,765

Answer

Gross profit

3,730

Answer

15,360

Answer

Total expenses

2,542

Answer

15,670

Answer

Net income

£1,188

Answer

€(310)

Answer

b. Following are selected balance sheet data from two European grocery chain companies: Tesco PLC (UK) and Ahold (the Netherlands). Prepare a common‑size balance sheet. To do this, express each…

Adams Company reported the following operating results for two consecutive years:

Required

Compute each income statement component for each of the two years as a percent of sales.

Note: Percentages may not add exactly due to rounding. Round your answers to 1 decimal place. (i.e., .234 should be entered as

23.4).

Sales

Cost of goods sold

Gross margin on sales

Operating expenses

Income before taxes

Income taxes

Net income

ADAMS COMPANY

Vertical Analysis of Income Statements

Year 4

Percentage of

Sales for Year 4

100.0

%

$

$

X Answer is not complete.

999,500

549,725

449,775

129,400

320,375

81,000

239,375

%

$

$

Year 3

1,081,500

598,400

483,100

152,000

331,100

80,400

250,700

Percentage of

Sales for Year 3

100.0 %

%

Vertical Analysis of Income Statement

Revenue and expense data for Innovation Quarter Inc. for two recent years are as follows:

Current Year

Previous Year

Sales

Cost of merchandise sold

Selling expenses

Administrative expenses

Income tax expense

Sales

a. Prepare an income statement in comparative form, stating each item for both years as a percent of sales. If required, round percentages to one decimal place. Enter all amounts as positive numbers.

Innovation Quarter Inc.

Comparative Income Statement

For the Years Ended December 31

Current year Amount Current year Percent

$388,000 100

248,320

Cost of merchandise sold

Gross profit

Selling expenses

Administrative expenses

Total operating expenses

Income from operations

Income tax expense

$388,000

248,320

54,320

62,080

7,760

Net income

$353,000

208,270

56,480

52,950

14,120

$

54,320

62,080

7,760

%

%

%

%

%

%

%

%

%

Previous year Amount Previous year Percent

$353,000 100 ✓ %

208,270

$

56,480

52,950

14,120

%

%

%

%

%

%

%

%

Chapter 4 Solutions

Survey of Accounting (Accounting I)

Ch. 4 - If merchandise purchased on account is returned,...Ch. 4 - Prob. 2SEQCh. 4 - Prob. 3SEQCh. 4 - On a multiple-step income statement, the excess of...Ch. 4 - As of December 31, 20Y4, Ames Corporation's...Ch. 4 - What distinguishes a retail business from a...Ch. 4 - Prob. 2CDQCh. 4 - Prob. 3CDQCh. 4 - Prob. 4CDQCh. 4 - Prob. 5CDQ

Ch. 4 - When you purchase a new car, the “sticker price”...Ch. 4 - Prob. 7CDQCh. 4 - Differentiate between the multiple and single-step...Ch. 4 - Prob. 9CDQCh. 4 - Can a business earn a gross profit but incur a net...Ch. 4 - Prob. 11CDQCh. 4 - Prob. 12CDQCh. 4 - Determining gross profit During the current year,...Ch. 4 - Determining cost of goods sold For a recent year,...Ch. 4 - Purchase-related transaction Burr Company...Ch. 4 - Purchase-related transactions A retailer Is...Ch. 4 - Prob. 4.5ECh. 4 - Prob. 4.6ECh. 4 - Determining amounts to be paid on invoices...Ch. 4 - Prob. 4.8ECh. 4 - Sales-related transactions After the amount due on...Ch. 4 - Sales-related transactions Merchandise is sold on...Ch. 4 - Prob. 4.11ECh. 4 - Prob. 4.12ECh. 4 - Prob. 4.13ECh. 4 - Prob. 4.14ECh. 4 - Adjustment for merchandise inventory shrinkage...Ch. 4 - Adjustment for Customer Refunds and Returns Assume...Ch. 4 - Prob. 4.17ECh. 4 - Multiple-step income statement On March 31, 20Y5,...Ch. 4 - Single-step income statement Summary operating...Ch. 4 - Multiple-step income statement Identify the enurs...Ch. 4 - Purchase-related transactions The following...Ch. 4 - Sales-related transactions The- following selected...Ch. 4 - Prob. 4.3PCh. 4 - Multiple-step income statement and report form of...Ch. 4 - Multiple-step income statement and report form of...Ch. 4 - Multiple-step income statement and report form of...Ch. 4 - Multiple-step income statement and report form of...Ch. 4 - Single-step income statement Selected accounts and...Ch. 4 - Prob. 4.5.2PCh. 4 - Prob. 4.6.1PCh. 4 - Prob. 4.6.2PCh. 4 - Prob. 4.1MBACh. 4 - Sales transactions Using transactions listed in...Ch. 4 - Prob. 4.3MBACh. 4 - Prob. 4.4MBACh. 4 - Prob. 4.5.1MBACh. 4 - Gross margin percent and markup percent Target...Ch. 4 - Gross margin percent and markup percent Target...Ch. 4 - Prob. 4.6MBACh. 4 - Gross profit percent and markup percent Deere &...Ch. 4 - Prob. 4.7.2MBACh. 4 - Gross profit percent and markup percent Deere &...Ch. 4 - Gross profit percent and markup percent...Ch. 4 - Gross profit percent and markup percent...Ch. 4 - Gross profit percent and markup percent...Ch. 4 - Prob. 4.9MBACh. 4 - Prob. 4.10.1MBACh. 4 - Gross profit percent and markup percent Companies...Ch. 4 - Prob. 4.10.3MBACh. 4 - Prob. 4.1CCh. 4 - Prob. 4.2CCh. 4 - Prob. 4.3.1CCh. 4 - Determining cost of purchase The following is an...Ch. 4 - Prob. 4.4.1CCh. 4 - Prob. 4.4.2CCh. 4 - Prob. 4.4.3CCh. 4 - Prob. 4.5C

Additional Business Textbook Solutions

Find more solutions based on key concepts

This year, Prewer Inc. received a 160,000 dividend on its investment consisting of 16 percent of the outstandin...

PRINCIPLES OF TAXATION F/BUS.+INVEST.

Determine the estimated cost of the work performed each week given the tasks—with their associated costs and sc...

Construction Accounting And Financial Management (4th Edition)

Adjusting Journal Entries; Adjusted Trial Balance. Magic Cleaning Services (MCS) has a fiscal year-end of Decem...

Intermediate Accounting (2nd Edition)

Based on your answers to the above questions, should Lockwood invest in the machinery?

Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

18. What is the calculation for return on assets (ROA)? Explain what ROA measures.

Horngren's Financial & Managerial Accounting, The Financial Chapters (6th Edition)

List five asset accounts, three liability accounts, and five expense accounts included in the acquisition and p...

Auditing and Assurance Services (16th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Sundahl Companys income statements for the past 2 years are as follows: Refer to the information for Sundahl Company above. Required: 1. Prepare a common-size income statement for Year 1 by expressing each line item as a percentage of sales revenue. (Note: Round percentages to the nearest tenth of a percent.) 2. Prepare a common-size income statement for Year 2 by expressing each line item as a percentage of sales revenue. (Note: Round percentages to the nearest tenth of a percent.)arrow_forwardCuneo Companys income statements for the last 3 years are as follows: Refer to the information for Cuneo Company above. Required: 1. Prepare a common-size income statement for Year 1 by expressing each line item as a percentage of sales revenue. (Note: Round percentages to the nearest tenth of a percent.) 2. Prepare a common-size income statement for Year 2 by expressing each line item as a percentage of sales revenue. (Note: Round percentages to the nearest tenth of a percent.) 3. Prepare a common-size income statement for Year 3 by expressing each line item as a percentage of sales revenue. (Note: Round percentages to the nearest tenth of a percent.)arrow_forwardCuneo Companys income statements for the last 3 years are as follows: Refer to the information for Cuneo Company above. Required: 1. Prepare a common-size income statement for Year 2 by expressing each line item for Year 2 as a percentage of that same line item from Year 1. (Note: Round percentages to the nearest tenth of a percent.) 2. Prepare a common-size income statement for Year 3 by expressing each line item for Year 3 as a percentage of that same line item from Year 1. (Note: Round percentages to the nearest tenth of a percent.)arrow_forward

- The following selected information is taken from the financial statements of Arnn Company for its most recent year of operations: During the year, Arnn had net sales of 2.45 million. The cost of goods sold was 1.3 million. Required: Note: Round all answers to two decimal places. 1. Compute the current ratio. 2. Compute the quick or acid-test ratio. 3. Compute the accounts receivable turnover ratio. 4. Compute the accounts receivable turnover in days. 5. Compute the inventory turnover ratio. 6. Compute the inventory turnover in days.arrow_forwardSundahl Companys income statements for the past 2 years are as follows: Refer to the information for Sundahl Company above. Required: Prepare a common-size income statement for Year 2 by expressing each line item for Year 2 as a percentage of that same line item from Year 1. (Note: Round percentages to the nearest tenth of a percent.)arrow_forwardGrammatico Company has just completed its third year of operations. The income statement is as follows: Selected information from the balance sheet is as follows: Required: Note: Round answers to two decimal places. 1. Compute the times-interest-earned ratio. 2. Compute the debt ratio. 3. CONCEPTUAL CONNECTION Assume that the lower quartile, median, and upper quartile values for debt and times-interest-earned ratios in Grammaticos industry are as follows: How does Grammatico compare with the industrial norms? Does it have too much debt?arrow_forward

- The condensed income statements through income from operations for Dell Inc. and Apple Inc. for recent fiscal years follow (numbers in millions of dollars): Prepare comparative common-sized statements, rounding percents to one decimal place. Interpret the analyses.arrow_forwardVertical Analysis of Income Statement Revenue and expense data for Innovation Quarter Inc. for two recent years are as follows: Previous Year Sales Cost of goods sold Selling expenses Administrative expenses Income tax expense Current Year $447,000 272,670 71,520 71,520 13,410 $384,000 215,040 69,120 57,600 15,360arrow_forwardRefer to the information for Sundahl Company on the previous page.Required:1. Prepare a common-size income statement for Year 1 by expressing each line item as apercentage of sales revenue. (Note: Round percentages to the nearest tenth of a percent.)2. Prepare a common-size income statement for Year 2 by expressing each line item as apercentage of sales revenue. (Note: Round percentages to the nearest tenth of a percent.)arrow_forward

- The condensed income statements through income from operations for Amazon.com, Inc., Best Buy, Inc., and Wal-Mart Stores, Inc. for a recent fiscal year follow (in millions): Please see the attachment for details: 1. Prepare comparative common-sized income statements for each company. Round percentages to one decimal place.2. Use the common-sized analysis to compare the financial performance ofthe three companies.arrow_forwardComparative income statements for Pearle Company are provided: Required: Perform a horizontal analysis of Pearle Company's income statement by computing horizontal percentages for each item. Note: Round your answers to 1 decimal place. Sales Less cost of goods sold Gross margin Less operating expenses Income before taxes Income taxes Net income Pearle Company Comparitive Income Statement Years Ended December 31, Year 2 Year 1 $ 600,000 $ 539,700 388,700 361,650 $ 211,300 113,950 97,350 42,440 54,910 $ 178,050 103,770 74,280 33,412 40,868 Percentage Change 90.0 % % % % % % %arrow_forwardRevenue and expense data for Innovation Quarter Inc. for two recent years are as follows: Current Year Previous Year Sales $488,000 $415,000 Cost of goods sold 312,320 232,400 Selling expenses 68,320 74,700 Administrative expenses 78,080 62,250 Income tax expense 9,760 16,600 a. Prepare an income statement in comparative form, stating each item for both years as a percent of sales. If required, round percentages to one decimal place. Enter all amounts as positive numbers.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License