Concept explainers

Ledger accounts,

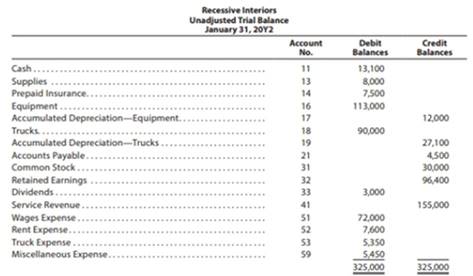

The unadjusted trill balance of Recessive Interior, at January 31, 20Y2, the end of the year, follows:

The data needed to determine year-end adjustments are as follows:

(a) Supplies on hand at January 31 are $2,850

(b) Insurance premium» expired during the year are $3,150.

(c)

(d) Depreciation of trucks during the year is $4,000.

(e) Wages accrued but not paid at January 31 are $900.

Instructions

1. For each account listed in the unadjusted

2. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. Add the accounts listed in part (3) as needed.

3. Journalize and post the adjusting entries, inserting balances in the accounts affected. Record the adjusting entries on Page 26 of the journal. The following additional accounts from Recessive Interiors’ chart if accounts should be used: Wages Payable, 22; Depreciation Expense—Equipment, 54; Supplies Expense. 55; Depreciation Expense—Trucks. 56; Insurance Expense, 57.

4. Prepare an adjusted trial balance.

5. Prepare an income statement, a statement of stockholders’ equity, and a

6. Journalize and

7. Prepare a post-closing trial balance.

1, 3, and 6:

To prepare: The T-accounts.

Explanation of Solution

T-Accounts:

T-accounts are referred as T-account because its format represents the letter “T”. The T-accounts consists of the following:

The title of accounts.

The title of accounts. The debit side (Dr) and,

The debit side (Dr) and, The credit side (Cr).

The credit side (Cr).

Record the transactions directly in their respective T-accounts, and determine their balances.

| Account: Cash Account no. 11 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y2 | |||||||

| January | 31 | Balance | ✓ | 13,100 | |||

| Account: Supplies Account no. 13 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y2 | |||||||

| January | 31 | Balance | ✓ | 8,000 | |||

| 31 | Adjusting | 26 | 5,150 | 2,850 | |||

| Account: Prepaid Insurance Account no. 14 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y2 | |||||||

| January | 31 | Balance | ✓ | 7,500 | |||

| 31 | Adjusting | 26 | 3,150 | 4,350 | |||

| Account: Equipment Account no. 16 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y2 | |||||||

| January | 31 | Balance | ✓ | 113,000 | |||

| Account: Accumulated Depreciation-Office equipment Account no. 17 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y2 | |||||||

| January | 31 | Balance | ✓ | 12,000 | |||

| 31 | Adjusting | 26 | 5,250 | 17,250 | |||

| Account: Trucks Account no. 18 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y2 | |||||||

| January | 31 | Balance | ✓ | 90,000 | |||

| Account: Accumulated Depreciation- Truck Account no. 19 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y2 | |||||||

| January | 31 | Balance | ✓ | 27,100 | |||

| 31 | Adjusting | 26 | 4,000 | 31,100 | |||

| Account: Accounts Payable Account no. 21 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y2 | |||||||

| January | 31 | Balance | ✓ | 4,500 | |||

| Account: Wages Payable Account no. 22 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y2 | |||||||

| January | 31 | Adjusting | 26 | 900 | 900 | ||

| Account: Common Stock Account no. 31 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y2 | |||||||

| January | 31 | Balance | ✓ | 900 | 30,000 | ||

| Account: Retained Earnings Account no. 32 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y2 | |||||||

| January | 31 | Balance |

| 96,400 | |||

| 31 | Closing | 27 | 46,150 | 142,550 | |||

| 31 | Closing | 27 | 3,000 | 139,550 | |||

| Account: Dividends Account no. 33 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y2 | |||||||

| January | 31 | Balance | ✓ | 3,000 | |||

| 31 | Closing | 27 | 3,000 | ||||

| Account: Income Summary Account no. 34 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y2 | |||||||

| January | 31 | Closing | 27 | 155,000 | 155,000 | ||

| 31 | Closing | 27 | 108,850 | 46,150 | |||

| 31 | Closing | 27 | 46,150 | ||||

| Account: Service revenue Account no. 41 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y2 | |||||||

| January | 31 | Balance | ✓ | 155,000 | |||

| 31 | Closing | 27 | 155,000 | ||||

| Account: Wages expense Account no. 51 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y2 | |||||||

| January | 1 | Balance | ✓ | 72,000 | |||

| 31 | Adjusting | 26 | 900 | 72,900 | |||

| 31 | Closing | 27 | 72,900 | ||||

| Account: Rent expense Account no. 52 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y2 | |||||||

| January | 31 | Balance | ✓ | 7,600 | |||

| 31 | Closing | 27 | 7,600 | ||||

| Account: Truck Expense Account no. 53 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y2 | |||||||

| January | 31 | Balance | ✓ | 5,350 | |||

| 31 | Closing | 27 | 5,350 | ||||

| Account: Depreciation Expense- Equipment Account no. 54 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y2 | |||||||

| January | 31 | Adjusting | 26 | 5,250 | 5,250 | ||

| 31 | Closing | 27 | 5,250 | ||||

| Account: Supplies Expenses Account no. 55 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y2 | |||||||

| January | 31 | Adjusting | 26 | 5,150 | 5,150 | ||

| 31 | Closing | 27 | 5,150 | ||||

| Account: Depreciation Expense- Trucks Account no. 56 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y2 | |||||||

| January | 31 | Adjusting | 26 | 4,000 | 4,000 | ||

| 31 | Closing | 27 | 4,000 | ||||

| Account: Insurance expense Account no. 57 | ||||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | |||

| Debit ($) | Credit ($) | |||||||

| 20Y2 | ||||||||

| January | 31 | Adjusting | 26 | 3,150 | 3,150 | |||

| 31 | Closing | 27 | 3,150 | |||||

| Account: Miscellaneous expense Account no. 59 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y2 | |||||||

| January | 1 | Balance | ✓ | 5,450 | |||

| 31 | Closing | 27 | 5,450 | ||||

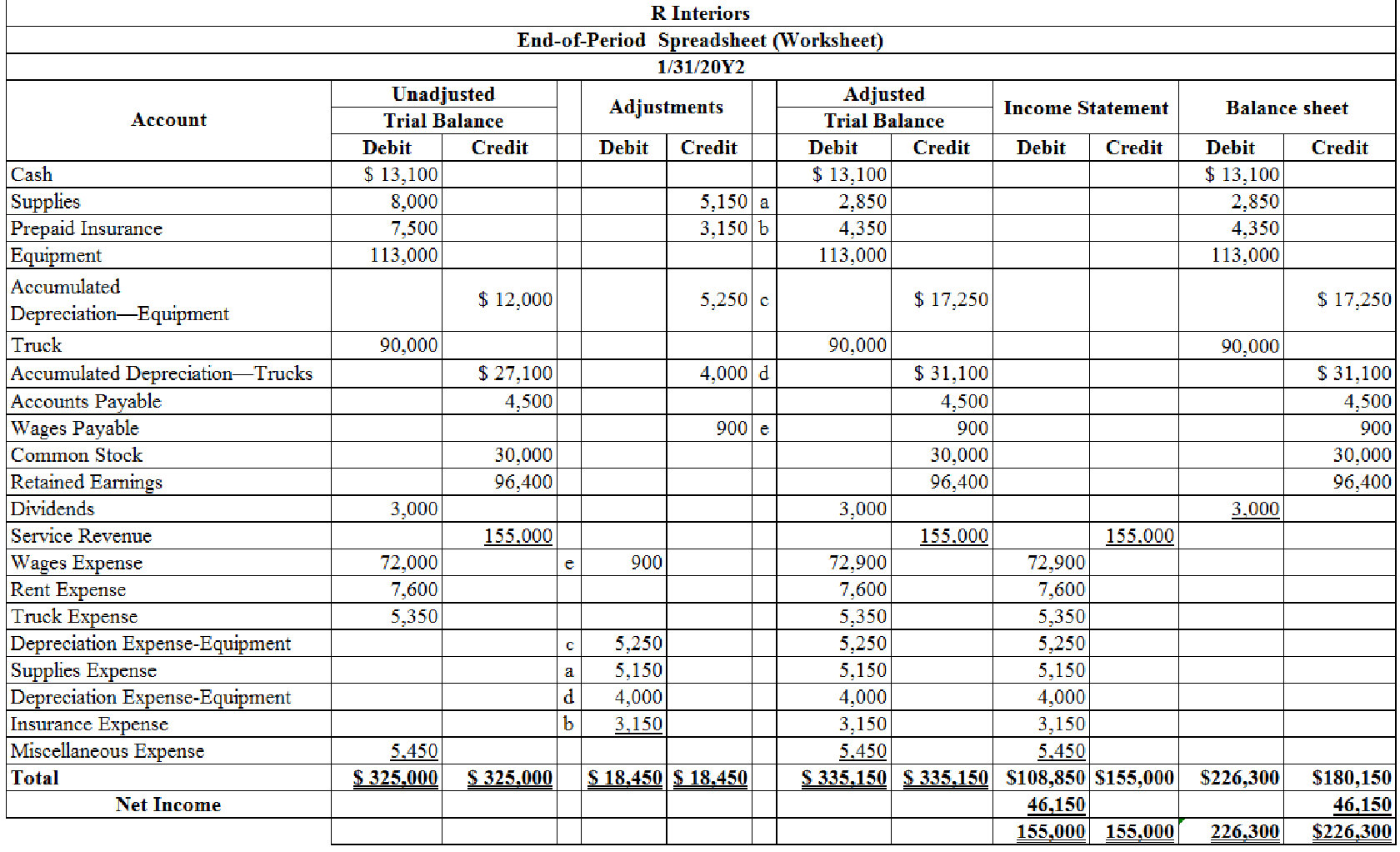

2.

To enter: The unadjusted trial balance on an end-of-period spreadsheet, and complete the spreadsheet.

Explanation of Solution

Spreadsheet:

A spreadsheet is a worksheet. It is used while preparing a financial statement. It is a type of form having multiple columns and it is used in the adjustment process. The use of a worksheet is optional for any organization. A worksheet can neither be considered as a journal nor a part of the general ledger.

The unadjusted trial balance on an end-of-period spreadsheet is prepared as follows:

Table (1)

Hence, the unadjusted trial balance on an end-of-period spreadsheet is prepared and completed.

3.

To Journalize and post: The adjusting entries.

Explanation of Solution

Adjusting entries:

An adjusting entry is prepared when the trial balance is not up-to-date, and complete, and they are usually prepared at the end of the accounting period. This adjusting entry is essential for preparing the financial statements of the business.

The adjusting entries are journalized as follows:

| Date | Description |

Post Ref. | Debit ($) | Credit ($) | |

| 20Y2 | Wages expense | 51 | 900 | ||

| January | 31 | Wages payable | 22 | 900 | |

| (To record the wages accrued) | |||||

Table (2)

Description:

- • Wages expense is an expense account, and it is increased. Hence, debit the wages expense account by $900.

- • Wages payable is a liability account, and it is increased. Hence, credit the wages payable account by $900.

| Date | Description |

Post Ref. | Debit ($) | Credit ($) | |

| 20Y2 | Depreciation expense-Equipment | 54 | 5,250 | ||

| January | 31 | Accumulated depreciation- Equipment | 17 | 5,250 | |

| (To record the equipment depreciation) | |||||

Table (3)

Description:

- • Depreciation expense is an expense account, and it is increased. Hence, debit the wages expense account by $5,250.

- • Accumulated depreciation is a contra asset account, and it is increased. Hence, credit the accumulated depreciation account by $5,250.

| Date | Description |

Post Ref. | Debit ($) | Credit ($) | |

| 20Y2 | Depreciation expense-Truck | 56 | 4,000 | ||

| January | 31 | Accumulated depreciation- Truck | 19 | 4,000 | |

| (To record the truck depreciation) | |||||

Table (4)

Description:

- • Depreciation expense is an expense account, and it is increased. Hence, debit the wages expense account by $4,000.

- • Accumulated depreciation is a contra asset account, and it is increased. Hence, credit the accumulated depreciation account by $4,000.

| Date | Description |

Post Ref. | Debit ($) | Credit ($) | |

| 20Y2 | Supplies expense | 55 | 5,150 | ||

| January | 31 | Supplies | 13 | 5,150 | |

| (To record the supplies used) | |||||

Table (5)

Description:

- • Supplies expense is an expense account, and it is increased. Hence, debit the supplies expense account by $5,150.

- • Supplies are the asset account, and it is increased. Hence, credit the supplies account by $5,150.

| Date | Description |

Post Ref. | Debit ($) | Credit ($) | |

| 20Y2 | Insurance expense | 57 | 3,150 | ||

| January | 31 | Prepaid insurance | 14 | 3,150 | |

| (To record the insurance expense) | |||||

Table (6)

Description:

- • Insurance expense is an expense account, and it is increased. Hence, debit the insurance expense account by $3,150.

- • Prepaid insurance is an asset account, and it is decreased. Hence, credit the prepaid insurance account by $3,150.

4.

To prepare: An adjusted trial balance for R interiors, as of January 31, 20Y2.

Explanation of Solution

Adjusted trial balance:

The unadjusted trial balance is the summary of all the ledger accounts that appears on the ledger accounts before making adjusting journal entries.

Prepare an adjusted trial balance for Company L, as of January 31, 20Y2.

| R interiors | |||

| Adjusted Trial Balance | |||

| January 31, 20Y2 | |||

| Accounts | Account Number | Debit Balances | Credit Balances |

| Cash | 11 | 13,100 | |

| Supplies | 13 | 2,850 | |

| Prepaid Insurance | 14 | 4,350 | |

| Equipment | 16 | 113,000 | |

| Accumulated depreciation- Equipment | 17 | 17,250 | |

| Trucks | 18 | 90,000 | |

| Accumulated depreciation- Trucks | 19 | 31,100 | |

| Accounts payable | 21 | 4,500 | |

| Wages Payable | 22 | 900 | |

| Common Stock | 31 | 30,0 00 | |

| Retained earnings | 32 | 96,400 | |

| Dividends | 33 | 3,000 | |

| Service revenue | 41 | 155,000 | |

| Wages expense | 51 | 72,900 | |

| Rent expense | 52 | 7,600 | |

| Truck Expense | 53 | 5,350 | |

| Depreciation Expense- Equipment | 54 | 5,250 | |

| Supplies expense | 55 | 5,150 | |

| Depreciation Expense- Trucks | 56 | 4,000 | |

| Insurance Expense | 57 | 3,150 | |

| Miscellaneous Expense | 59 | 5,450 | |

| 335,150 | 335,150 | ||

Table (7)

The debit column and credit column of the adjusted trial balance are agreed, both having balance of $335,150.

5.

The net income or net loss of R interiors for the month of January and prepare the statement of retained earnings and balance sheet of R interiors.

Explanation of Solution

Income statement:

An income statement is one of the financial statements which shows the revenues, and expenses of the company. The income statement is prepared to ascertain the net income/loss of the company, by deducting the expenses from the revenues.

| R interiors | ||

| Income Statement | ||

| For the year ended January 31, 20Y2 | ||

| Particulars | Amount ($) | Amount ($) |

| Revenue: | ||

| Laundry revenue | $155,000 | |

| Expenses: | ||

| Wages Expense | $72,900 | |

| Rent Expense | 7,600 | |

| Truck Expense | 5,350 | |

| Depreciation Expense-Equipment | 5,250 | |

| Supplies Expense | 5,150 | |

| Depreciation Expense-Trucks | 4,000 | |

| Insurance Expense | 3,150 | |

| Miscellaneous Expense | 5,450 | |

| Total Expenses | 108,850 | |

| Net Income | $46,150 | |

Table (8)

Statement of retained earnings: This statement reports the beginning retained earnings and all the changes which led to ending retained earnings. Net income from income statement is added to and dividends are deducted from beginning retained earnings to arrive at the end result, ending retained earnings.

The statement of retained earnings for the year ended January 31, 20Y2 is as follows:

| R interiors | ||

| Statement of Retained Earnings | ||

| For the Year Ended January 30, 20Y2 | ||

| Particulars | Amount ($) | Amount ($) |

| Balance,, February1, 20Y1 | $96,400 | |

| Net income | $46,150 | |

| Dividends | (3,000) | |

| 43,150 | ||

| Retained earnings, January 31, 20Y2 | $139,550 | |

Table (9)

Balance sheet:

A balance sheet is a financial statement consists of the assets, liabilities, and the stockholder’s equity of the company. The balance of the assets account must be equal to that of the liabilities and the stockholder’s equity account.

Prepare the balance sheet of R interiors at January 31, 20Y2.

| R interiors | |||

| Balance Sheet | |||

| For the year ended January 31, 20Y2 | |||

| Assets | |||

| Current Assets: | |||

| Cash | $13,100 | ||

| Supplies | 2,850 | ||

| Prepaid Insurance | 4,350 | ||

| Total Current Assets | $20,300 | ||

| Property, plant and equipment: | |||

| Equipment | $113,000 | ||

| Less: Accumulated Depreciation- Equipment | 17,250 | 95,750 | |

| Trucks | 90,000 | ||

| Less: Accumulated Depreciation- Trucks | 31,100 | 58,900 | |

| Total property, plant, and equipment | 154,650 | ||

| Total Assets | $174,950 | ||

| Liabilities | |||

| Current Liabilities: | |||

| Accounts Payable | $4,500 | ||

| Wages Payable | 900 | ||

| Total Liabilities | $5,400 | ||

| Stock holder’s Equity | |||

| Common Stock | 30,000 | ||

| Retained earnings | 139,550 | ||

| Total Stock holder’s Equity | 169,550 | ||

| Total Liabilities and Owners’ Equity | $174,950 | ||

Table (10)

It is one of the financial statements, which shows the assets, liabilities, and stockholders’ equity of a company at a particular point of time. It reveals the financial health of a company. Thus, this statement is also called as the Statement of Financial Position. It helps the users to know about the creditworthiness of a company as to whether the company has enough assets to pay off its liabilities.

Therefore, the net income for the year ended is $46,150, retained earnings for the year ended are $139,550, and the total assets and total liabilities plus stockholders’ equity at January 31, 20Y2 is $174,950 of R interiors.

6.

To Journalize: The closing entries for R interiors.

Answer to Problem 4.4BPR

Closing entry for revenue and expense accounts:

| Journal Page 27 | ||||

| Date | Accounts title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| January 31, 20Y2 | Service Revenue | 41 | 155,000 | |

| Wages Expense | 51 | 72,900 | ||

| Rent Expense | 52 | 7,600 | ||

| Truck Expense | 53 | 5,350 | ||

| Depreciation Expense-Equipment | 54 | 5,250 | ||

| Supplies Expense | 55 | 5,150 | ||

| Depreciation Expense-Truck | 56 | 4,000 | ||

| Insurance Expense | 57 | 3,150 | ||

| Miscellaneous Expense | 59 | 5,450 | ||

| Retained Earnings | 34 | 46,150 | ||

| (To close the revenues and expenses account. Then the balance amount are transferred to retained earnings account) | 32 | |||

| January 31, 20Y2 | Retained earnings | 32 | 3,000 | |

| Dividends | 33 | 3,000 | ||

| (To record the closure of dividend to retained earnings) | ||||

Table (11)

Explanation of Solution

Closing entries

Closing entries are recorded in order to close the temporary accounts such as incomes and expenses by transferring them to the permanent accounts such as retained earnings. It is passed at the end of the accounting period, to transfer the final balance.

Process of closing:

- • The balance of revenue and expense are transferred to retrained earnings account.

- • The balance of dividend account is transferred to retained earnings account to close the temporary accounts.

Rules of Debit and Credit:

- • Debit, the revenue account and retained earnings account balance. In addition debit retained earnings account if it suffer loss (net loss)

- • Credit, the expense account, retained earnings if it earn income (net income) and dividend account.

- • Fees earned are a revenue account. Since the amount of revenue is closed and transferred to retained earnings account. Here, AS Company earned an income of $46,150. Therefore, it is debited.

- • Wages Expense, Rent Expense, Insurance Expense, Utilities Expese, Supplies Expense, Depreciation Expense and Miscellaneous Expense are expense accounts. Since the amount of expenses are closed to Income Summary account. Therefore, it is credited.

Working Note:

Calculate net income on income summary account:

- • The Dividend is paid to the shareholders out of the Retained Earnings. Thus, Retained Earnings is debited since the earnings are decreased on payment of dividend.

- • Dividends is a component of stockholders’ equity account. It is credited because dividends are transferred to Retained Earnings account.

7.

To prepare: The post–closing trial balance of R interiors for the month ended January 31, 20Y2.

Explanation of Solution

Post-Closing Trial Balance:

After passing all the journal entries and the closing entries of the permanent accounts and then further posting them to each of the respective accounts, a post-closing trial balance is prepared which consists of a list of all the permanent accounts. A post-closing trial balance serves as an evidence to prove that the balance of the permanent accounts is equal.

Prepare a post–closing trial balance of R interiors for the month ended January 31, 20Y2 as follows:

|

R interiors Post-closing Trial Balance January 31, 20Y2 | |||

| Particulars |

Account Number | Debit $ | Credit $ |

| Cash | 11 | 13,100 | |

| Supplies | 13 | 2,850 | |

| Prepaid insurance | 14 | 4,350 | |

| Equipment | 16 | 113,000 | |

| Accumulated depreciation- Equipment | 17 | 17,250 | |

| Trucks | 18 | 90,000 | |

| Accumulated depreciation- Trucks | 19 | 31,100 | |

| Accounts payable | 21 | 4,500 | |

| Wages payable | 22 | 900 | |

| Common Stock | 31 | 30,000 | |

| Retained earnings | 32 | 139,550 | |

| Total | 223,300 | 223,300 | |

Table (12)

The debit column and credit column of the post–closing trial balance are agreed, both having balance of $223,300

Want to see more full solutions like this?

Chapter 4 Solutions

Cengagenowv2, 1 Term Printed Access Card For Warren/jones’ Corporate Financial Accounting, 15th

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,