FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

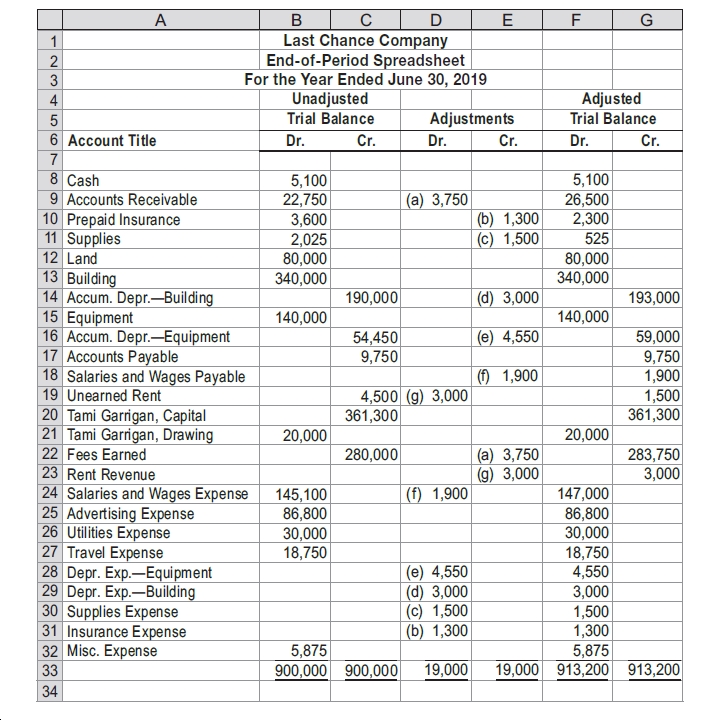

Last Chance Company offers legal consulting advice to prison inmates. Last Chance Company prepared the end-of-period spreadsheet shown at the top of the following page at June 30, 2019, the end of the fiscal year.

Instructions

1. Prepare an income statement for the year ended June 30.

2. Prepare a statement of owner’s equity for the year ended June 30. No additional investments were made during the year.

3. Prepare a

4. On the basis of the end-of-period spreadsheet, journalize the closing entries.

5. Prepare a post-closing

Transcribed Image Text:в с

Last Chance Company

End-of-Period Spreadsheet

For the Year Ended June 30, 2019

Unadjusted

Trial Balance

G

3

Adjusted

Trial Balance

Adjustments

6 Account Title

Cr.

Dr.

Dr.

Cr.

Dr.

Cr.

5,100

26,500

2,300

8 Cash

9 Accounts Receivable

10 Prepaid Insurance

11 Supplies

12 Land

13 Building

14 Accum. Depr.-Building

15 Equipment

|16 Accum. Depr.–Equipment

17 Accounts Payable

18 Salaries and Wages Payable

19 Unearned Rent

20 Tami Garrigan, Capital

21 Tami Garrigan, Drawing

22 Fees Earned

23 Rent Revenue

| 24 Salaries and Wages Expense

25 Advertising Expense

26 Utilities Expense

27 Travel Expense

28 Depr. Exp.-Equipment

29 Depr. Exp.–Building

30 Supplies Expense

31 Insurance Expense

32 Misc. Expense

33

5,100

22,750

(a) 3,750

(b) 1,300

(c) 1,500

3,600

2,025

80,000

525

80,000

340,000

340,000

190,000

(d) 3,000

193,000

140,000

140,000

54,450

9,750

59,000

9,750

1,900

1,500

361,300

(e) 4,550

(f) 1,900

4,500 (g) 3,000

361,300

20,000

20,000

280,000

283,750

3,000

(a) 3,750

(g) 3,000

147,000

86,800

30,000

18,750

4,550

(f) 1,900

145,100

86,800

30,000

18,750

(e) 4,550

(d) 3,000

(c) 1,500

(b) 1,300

3,000

1,500

1,300

5,875

5,875

19,000 913,200 913,200

900,000 900,000

19,000

34

-NM 45 O70OO

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Number 101 Cash 106 Accounts receivable 126 Computer supplies Prepaid insurance Prepaid rent office equipment 128 131 163 164 Accumulated depreciation-office equipment Computer equipment 167 168 Accumulated depreciation-Computer equipment 201 Accounts payable 210 236 301 302 403 612 613 623 637 Account Title 640 652 655 676 677 684 901 Wages payable Unearned computer services revenue S. Rey, Capital S. Rey, Withdrawals Computer services revenue Depreciation expense-office equipment Depreciation expense-Computer equipment Wages expense Insurance expense Rent expense Computer supplies expense Advertising expense Mileage expense Miscellaneous expenses Repairs expense-Computer Income summary Totals Debit $ 51,334 6,268 670 1,485 805 8,200 20,000 7,200 410 1,250 3,775 495 2,415 3,275 2,598 839 170 1,185 $ 112,374 Credit $ 410 1,250 1,300 480 2,400 71,000 35,534 $ 112,374 Required: 1. Prepare an Income statement for the three months ended December 31, 2021. 2. Prepare a statement of owner's…arrow_forwardSelect all that apply Vance Co. allows employees to take a two week vacation each year. To account for the two weeks off each year, Dante will record an adjusting entry to which of the following accounts? Multiple select question. Credit to Salaries and Wages Payable. Credit to Cash. Debit to Cash. Credit to Vacation Benefits Payable. Debit to Vacation Benefits Expense. Debit to Salaries and Wages Expense.arrow_forwardPitman Company is a small editorial services company owned and operated by Jan Pitman. On October 31, 2019 the end of the current year, Pitman Company’s accounting clerk prepared the following unadjusted trial balance:Pitman CompanyUNADJUSTED TRIAL BALANCEOctober 31, 2019ACCOUNT TITLE DEBIT CREDIT1Cash7,710.002Accounts Receivable37,935.003Prepaid Insurance7,070.004Supplies2,125.005Land108,400.006Building145,300.007Accumulated Depreciation-Building85,610.008Equipment134,800.009Accumulated Depreciation-Equipment96,100.0010Accounts Payable12,625.0011Unearned Rent6,340.0012Jan Pitman, Capital219,690.0013Jan Pitman, Drawing15,120.0014Fees Earned323,700.0015Salaries and Wages Expense196,770.0016Utilities Expense42,265.0017Advertising Expense23,135.0018Repairs Expense17,195.0019Miscellaneous Expense6,240.0020Totals744,065.00744,065.00The data needed to determine year-end adjustments are as follows:a. Unexpired insurance at October 31, $6,105.b. Supplies on hand at October 31, $485.c.…arrow_forward

- Davidson Company was started on May 1, 2021 by Jane Davidson. Using the adjustedaccount balances below, prepare IN GOOD FORM the Income Statement, Owner’s EquityStatement and Balance Sheet for the month completed May 31, 2021.***Be very careful with the information, as the accounts are provided in alphabetical order. You must prepare the Financial Statements with the appropriate accounts, in the appropriate order. Advertising Expense 6,000 Accounts Payable 9,000 Accounts Receivable 15,400 Accumulated Depreciation: Equipment 8,000 Cash 10,300 Commissions Revenue 12,000 Depreciation Expense 14,000 Equipment 36,000 Insurance Expense 3,200 Interest Expense 2,800 Interest Payable 1,000 Notes Payable 12,000 Prepaid Insurance 2,600 Rent Expense 3,000 Salaries Expense 39,000 Salaries Payable 7,500 Service Revenue 78,000 Owner’s Capital 20,000 Owner’s Drawing 10,000 Supplies 2,500 Supplies Expense 5,700 Unearned Revenue 5,000 Utilities Expense 2,000arrow_forwardThe following transactions occur for the Panther Detective Agency during the month of July: Purchase a truck and sign a note payable, $13,800. Purchase office supplies for cash, $480. Pay $680 in rent for the current month. Record the transactions. The company uses the following accounts: Cash, Supplies, Equipment (for the truck), Notes Payable, and Rent Expense. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.)arrow_forwardMarsteller Properties Inc. owns apartments that it rents to university students. At December 31,2019, the following unadjusted account balances were available: The following information is available for adjusting entries:a. An analysis of apartment rental contracts indicates that $3,800 of apartment rent is unbilledand unrecorded at year end.b. A physical count of supplies reveals that $1,400 of supplies are on hand at December 31, 2019.c. Annual depreciation on the buildings is $204,250.d. An examination of insurance policies indicates that $12,000 of the prepaid insurance applies to coverage for 2019.e. Six months’ interest at 9% is unrecorded and unpaid on the notes payable. f. Wages in the amount of $6,100 are unpaid and unrecorded at December 31.g. Utilities costs of $300 are unrecorded and unpaid at December 31.h. Income taxes of $5,738 are unrecorded…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education