Concept explainers

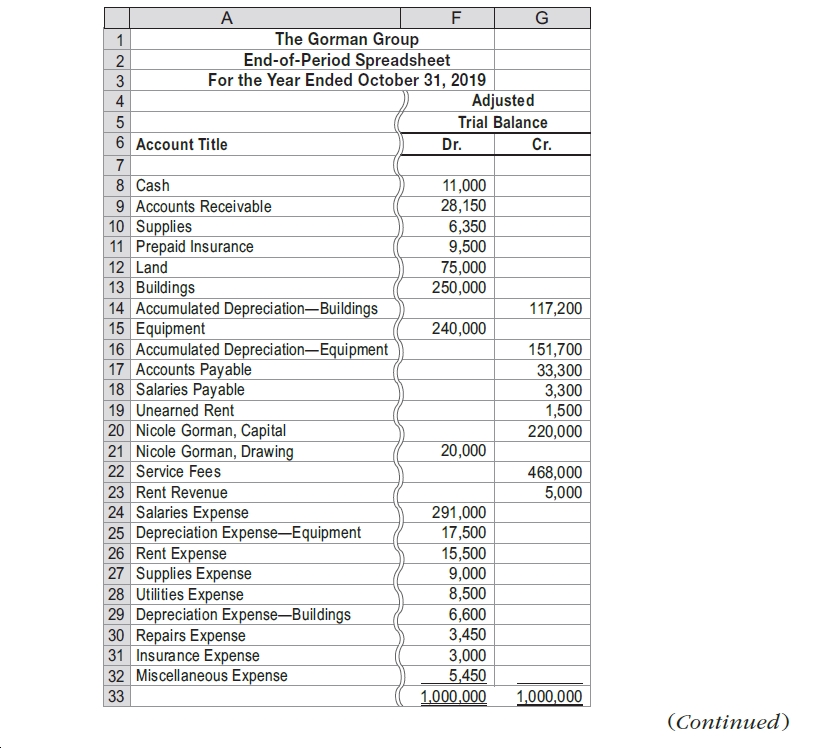

The Gorman Group is a financial planning services firm owned and operated by Nicole Gorman. As of October 31, 2019, the end of the fiscal year, the accountant for The Gorman Group prepared an end-of-period spreadsheet, part of which follows:

Instructions

1. Prepare an income statement, a statement of owner’s equity (no additional investments were made during the year), and a

2.

3. If the balance of Nicole Gorman, Capital had instead increased $115,000 after the closing entries were posted and the withdrawals remained the same, what would have been the amount of net income or net loss?

Trending nowThis is a popular solution!

Step by stepSolved in 7 steps with 5 images

If the balance of

If the balance of

- Diane, the administration manager of Jack’s Mowing collated all of the invoices raised by Jack’s Mowing during September 2022 and prepared a summary of fees charged, categorized for each client. The summary prepared by Diane is an example of: Select one : A. Business Intelligence B. Big data C. Information D. Dataarrow_forwardEpping Ltd. is a listed company based in Essex County. The company prepares its financial statements as at 31 December each year. The following trial balance is for the period ending 31 December 2019: Required: Prepare the following financial statements for Epping Ltd. for the year ended 31 December 2019 in accordance with IAS 1, Preparation of Financial Statements. Show all workings. 1)A statement of comprehensive income for the year ending 31 December 2019. 2)A statement of changes in equity for the year ending 31 December 2019. 3)A statement of financial position as at 31 December 2019.arrow_forwardsarrow_forward

- On January 2, 2019, Quo Inc. hired Reed as its controller. During the year, Reed, working closely with Quo’s president and ottside accountants, made changes in accounting policies, corrected several errors dating from 2018 and before, and instituted new accounting policies. Quo's 2019 financial statements will be presented in comparative form with its 2018 financial statements. Items a through i represent Quo’s transactions. 1. Indicate how Quo should classify each transaction. 2. Indicate the proper accounting treatment ( retrospective adjustment, prior period adjustment, prospective) for each transaction.arrow_forwardPlease prepare journal entries for the following statements. You will also need to prepare the related T-accounts for each journal entry. Then you should prepare the trial balance, the adjusting entries, the financial statements and the closing entries. Additionally, for each account that you use in the journal entries, please indicate which component of the Accounting Equation this account belongs in (if this is unclear, please ask). 9/1/21 – Mary decides to open a new business. She has $20,000 to invest in the company, and she buys all 100 shares of stock. 9/1/21 – Mary borrows $90,000 from Suntrust Bank. This loan will be repaid in 3 years and will charge interest at 4% semi-annually. She will pay $3,600 per year. 9/1/21 – Mary hires an accountant and financial advisor to help manage her business and her money. She will pay her accountant an hourly rate of $90 per hour. 9/1/21 – Mary signs a contract to provide services to a local school district. She will provide services…arrow_forwardThe first project for the semester will involve the following items to turn in: 1) Journal entries for financial transactions I will provide you. 2) An adjusted trial balance. 3) An Income statement. 1) On December 1 of 2019 Harold Hammer deposited $ 15,100 in a bank account in the name of Huaning Corporation in exchange for shares of common stock in the corporation. 2) On December 1 of 2019 Huaning Corporation purchased supplies on account for $ 226 . 3) On December 4 of 2019 Huaning Corporation received cash of $ 384 for product sold to the customer. 4) On December 5 of 2019 Huaning Corporation paid the vendor for the December 1st purchase of supplies. 5) On December 6 of 2019 Huaning Corporation purchases supplies on account for $ 469 .6) On December 8 of 2019 Huaning Corporation sells product for $ 445 on account to a customer.7) On December 9 of 2019 Huaning Corporation sells product for $ 462 on account to a customer. 8) On December 10 of 2019 Huaning Corporation paid, in…arrow_forward

- Entries into The simplest form of an account.T Accounts and A summary listing of the titles and balances of accounts in the ledger.Trial Balance Connie Young, an architect, opened an office on October 1, 2019. During the month, she completed the following transactions connected with her professional practice: Transferred cash from a personal bank An accounting form that is used to record the increases and decreases in each financial statement item.account to an account to be used for the business, $60,400. Paid October rent for office and workroom, $6,000. Purchased used automobile for $39,000, paying $9,100 cash and giving a note payable for the remainder. Purchased office and computer equipment on account, $12,100. Paid cash for supplies, $2,900. Paid cash for annual insurance policies, $4,000. Received cash from client for plans delivered, $15,100. Paid cash for miscellaneous expenses, $1,630. Paid cash to creditors on account, $3,500. Paid $480 on note payable. Received invoice…arrow_forwardPitman Company is a small editorial services company owned and operated by Jan Pitman. On October 31, 2019 the end of the current year, Pitman Company’s accounting clerk prepared the following unadjusted trial balance:Pitman CompanyUNADJUSTED TRIAL BALANCEOctober 31, 2019ACCOUNT TITLE DEBIT CREDIT1Cash7,710.002Accounts Receivable37,935.003Prepaid Insurance7,070.004Supplies2,125.005Land108,400.006Building145,300.007Accumulated Depreciation-Building85,610.008Equipment134,800.009Accumulated Depreciation-Equipment96,100.0010Accounts Payable12,625.0011Unearned Rent6,340.0012Jan Pitman, Capital219,690.0013Jan Pitman, Drawing15,120.0014Fees Earned323,700.0015Salaries and Wages Expense196,770.0016Utilities Expense42,265.0017Advertising Expense23,135.0018Repairs Expense17,195.0019Miscellaneous Expense6,240.0020Totals744,065.00744,065.00The data needed to determine year-end adjustments are as follows:a. Unexpired insurance at October 31, $6,105.b. Supplies on hand at October 31, $485.c.…arrow_forwardDavidson Company was started on May 1, 2021 by Jane Davidson. Using the adjustedaccount balances below, prepare IN GOOD FORM the Income Statement, Owner’s EquityStatement and Balance Sheet for the month completed May 31, 2021.***Be very careful with the information, as the accounts are provided in alphabetical order. You must prepare the Financial Statements with the appropriate accounts, in the appropriate order. Advertising Expense 6,000 Accounts Payable 9,000 Accounts Receivable 15,400 Accumulated Depreciation: Equipment 8,000 Cash 10,300 Commissions Revenue 12,000 Depreciation Expense 14,000 Equipment 36,000 Insurance Expense 3,200 Interest Expense 2,800 Interest Payable 1,000 Notes Payable 12,000 Prepaid Insurance 2,600 Rent Expense 3,000 Salaries Expense 39,000 Salaries Payable 7,500 Service Revenue 78,000 Owner’s Capital 20,000 Owner’s Drawing 10,000 Supplies 2,500 Supplies Expense 5,700 Unearned Revenue 5,000 Utilities Expense 2,000arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education