Concept explainers

Integration of financial statements; Chapters 3 and 4

• LO4–8

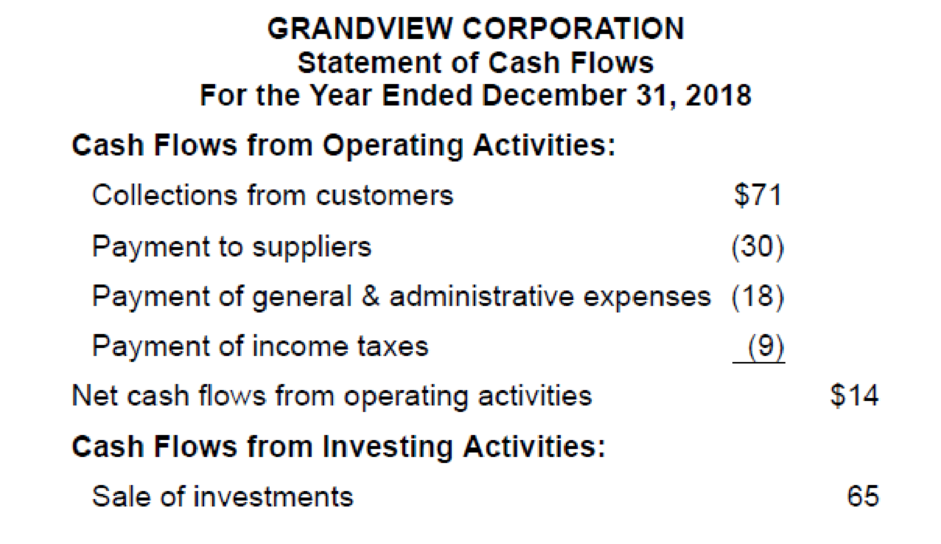

The chief accountant for Grandview Corporation provides you with the company’s 2018 statement of

Required:

1. Calculate the missing amounts.

2. Prepare the operating activities section of Grandview’s 2018 statement of cash flows using the indirect method.

(1)

Financial statement:

A financial statement is the complete record of financial transactions that take place in a company at a particular point of time. It provides important financial information regardingthe assets, liabilities, revenues and expenses of the company to its internal and external users. It helps them to know the exact financial position of the company.

To calculate: the missing amounts.

Explanation of Solution

Calculate the missing amounts.

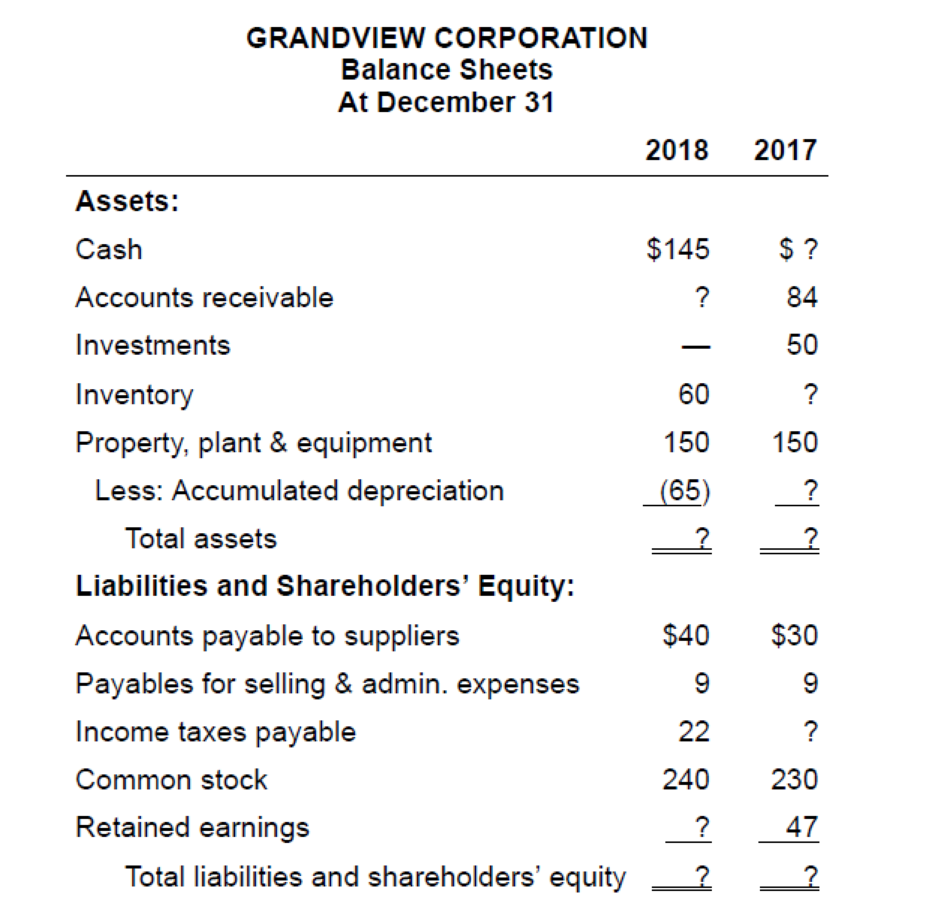

Cash Balance – 2017:

Accounts receivable-2018:

Inventory – 2018:

Calculate the purchase:

Calculate Inventory – 2017:

Accumulated Depreciation – 2017:

Calculate total assets:

| Total Assets | 2018($) | 2017($) |

| Cash | 145 | 59 |

| Accounts Receivable | 93 | 84 |

| Investments | - | 50 |

| Inventory | 60 | 52 |

| Property, plant, and equipment | 150 | 150 |

| Less: Accumulated Depreciation | (65) | (55) |

| Total Assets | $383 | $340 |

Table (1)

Calculate Income tax payable – 2017

Calculate retained earnings -2018:

Calculate total liabilities and shareholders’ equity:

| Total Liabilities and Stockholder’s Equity | 2018($) | 2017($) |

| Accounts payable to suppliers | 40 | 30 |

| Payables for selling and administrative expenses | 9 | 9 |

| Income taxes payable | 22 | 24 |

| Common stock | 240 | 230 |

| Retained earnings | 72 | 47 |

| Total Assets | $383 | $340 |

Table (2)

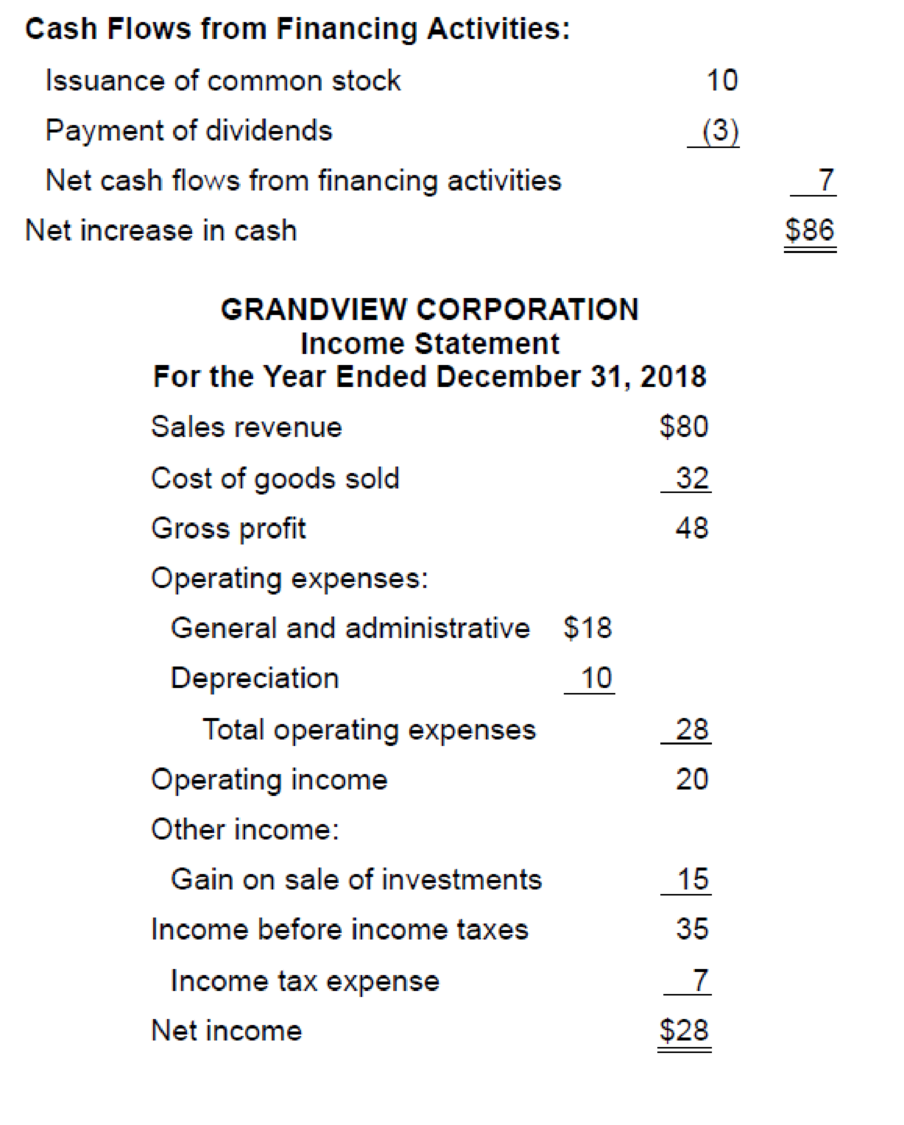

(2)

To prepare: Operating activities section of Corporation G’s cash flow statement using indirect method.

Explanation of Solution

Prepare the operating activities of Corporation G for 2018 statement of cash flows using indirect method.

| Corporation G | ||

| Statement of Cash Flows - Indirect Method (Partial) | ||

| For the Year 2018 | ||

| Particulars | Amount ($) | Amount ($) |

| Cash flows from Operating activities: | ||

| Net income | 28 | |

| Adjustments for noncash effects: | ||

| Depreciation expense | 10 | |

| Gain on sale of investments | (15) | |

| Changes in operating assets and liabilities | ||

| Increase in accounts receivable(1) | (9) | |

| Increase in inventory(2) | (8) | |

| Increase in accounts payable(3) | 10 | |

| Decrease in income taxes payable(4) | (2) | (14) |

| Net cash flows from operating activities | $14 | |

Table (3)

Working notes:

Determine changes of assets and liabilities:

Want to see more full solutions like this?

Chapter 4 Solutions

INTERMEDIATE ACCOUNTING(LL)-W/2 ACCESS

- (Appendix 21.1) Operating Cash Flows Refer to the information for Lamberson Company in P21-6. Required: 1. Using the direct method, prepare the operating activities section of the 2019 statement of cash flows for Lamberson. 2. (Optional). If you completed P21-6 earlier, prepare the remaining portion of the statement of cash flows. (A separate schedule reconciling net income to cash provided by operating activities is not necessary.)arrow_forwardRefer to the information for Cornett Company above. What amount should Cornett report on its statement of cash flows as net cash flows provided by investing activities? a. $(5,200) b. $55,200 c. $144,800 d. None of thesearrow_forwardUsing a Spreadsheet to Prepare a Statement of Cash Flows Jane Bahr, a controller of Endicott & Thurston, prepared the following balance sheets at the end of 2019 and 2018: Required: 1. Using a spreadsheet, prepare a statement of cash flows for 2019. Assume Endicott & Thurston use the indirect method. 2. CONCEPTUAL CONNECTEON Discuss whether Endicott & Thurston appear to have matched the timing of inflows and outflows of cash.arrow_forward

- [Question text] Cash management involves _________. Select one:A. maximizing the income earned on cash reservesB. determining the optimal level of liquidity that should be maintainedC. optimizing the collections and disbursements of cashD. reconciling a company's book balance with its bank balancearrow_forwardLO 7 CASH FLOW Timing and Cash Flows SE12. BUSINESS APPLICATION Use the T account for Cash below to record the por- tion of each of the following transactions, if any, that affect cash. How do these transac- tions affect the company's liquidity? Cash Jan. 2 Provided services for cash, $2,400. Paid expenses in cash, $1,400. 4 8 Provided services on credit, $2,200. 9 Incurred expenses on credit, $1,600.arrow_forwardSection V: SCF Question 3 Identify the following sections of the McDonald's SCF and record the amounts. Check the math by summing to the cash balance at end of year. Verify that the ending cash balance reported on the SCF is the same as reported on the balance sheet for the current year, Section Current Prior Year Second Prior Year Year Cash provided by operations? Click here to Click here to Click here to enter text. enter text. enter text. Cash used for investing activities? Click here to Click here to Click here to enter text. enter text. enter text. Cash used for financing activities? Click here to Click here to Click here to enter text. enter text. enter text. Cash and equivalents balance at end of year? Click here to Click here to Click here to enter text. enter text. enter text. D Focus lish (United States)arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning